About Fullshare Holdings Ltd. (607.HK)

Contributed by FG Alpha Management with GeoInvesting, LLC

Summary

- We were concluding months of on-the-ground research into Fullshare Holdings (607.HK) while Glaucus Research Group (“Glaucus”) issued its own scathing report calling the company a “stock manipulation scheme”

- The Glaucus Research Group report focused heavily on numerous related party transactions Fullshare has made; we push the case forward and offer newly revealed exclusive findings on numerous other transactions

- Newly revealed Chinese regulatory filings and the investigation we performed confirms the case that the company is self-dealing to undisclosed related parties and creating an accounting scheme that’s bound to eventually implode

- Newly revealed share pledges of Fullshare stock for bank loans, combined with suspicious end of day trading is reminiscent of Tech Pro Technology, another FG Alpha Management short that is down over 90% in the last 12 months

(Editor’s note: For clarification, GeoInvesting and or F.G. Alpha Management have never had any affiliation or “research cooperation” with Glaucus Research. To put it plainly, as with last year’s Tech Pro Technologies report, we had no knowledge, conversations, or correspondence either direct or indirect with Glaucus related to Fullshare.)

Today, FG Alpha Management will release the details of our newly revealed on-the-ground due diligence that supports our conclusion that Fullshare Holdings (HK:607) (“Fullshare”) is a completely uninvestable stock and likely an accounting scheme that will eventually implode, costing shareholders most, or all, of their invested capital.

On April 24, 2017, Glaucus Research Group released a report on Fullshare, claiming that the 2013 reverse merger is one of the largest stock manipulation schemes ever to trade on any exchange. The report goes into detail regarding questionable trading in Fullshare stock, as well as numerous transactions of subsidiaries and private companies between Fullshare and entities that we also found to be undisclosed related parties. At the time this report was released, FG Alpha, in conjunction with GeoInvesting, was putting the final touches on months of on-the-ground due diligence that we were performing to try and address similar concerns about Fullshare.

On May 2, 2017, Fullshare issued an official response to the Glaucus Research report. We believe that Fullshare’s response is nothing more than the obligatory “runaround” for investors, analysts and regulators. After reviewing Fullshare’s response, we continue to concur with Glaucus Research’s findings. Today we will release our own findings, which we believe will corroborate the Glaucus report and reiterate to investors, auditors and regulators that Fullshare needs to be viewed with significant scrutiny going forward and we believe the company to be uninvestable.

Our Findings

1. Jiasheng Construction Group Co., Ltd. is a related party of Fullshare

We concur with Glaucus’ findings that Jiasheng Construction Group Co., Ltd. (“JCC”) is a related party of Fullshare. Based on our new evidence, JCC is in fact a related party of Fullshare controlled by Ji Changqun, Fullshare’s chairman. Along with other disputed related parties, we believe that Fullshare simply used different “strawmen” to hide the fact that these disputed parties are, in fact, real related parties. For instance, we believe Nanjing Shanbao Investment Management Limited, Nanjing Fullshare Leisure Agricultural Development Co., Ltd. and others are also undisclosed related parties of the company that utilize different “strawmen”, as the Glaucus report alleged.

2. Fullshare’s disclosure about the Nanjing Tianyun “strawman” transaction raises more questions than it answers

Based on our research, we believe Fullshare concealed the fact that the purchase of Nanjing Tianyun was a related party transaction. It seems to us that Fullshare simply paid the money in question to Nanjing Jiangong using Nanjing Tonglu as an intermediary. Based on Fullshare’s own explanation of events, we can draw a clear conclusion that Nanjing Changfa/Nanjing Tonglu paid an unknown amount of money to Nanjing Jiangong. One month later, Fullshare paid HK $631M to Nanjing Tonglu and even booked a RMB 238M gain for the Nanjing Tianyun transaction.

3. Fullshare claimed to sell Jurong Dasheng/Dingsheng to an undisclosed related party called Nanjing Dongzhou, but new on the ground interviews with local employees at Jurong Dasheng/Dingsheng insisted that they are still managed by Fullshare

In addition to the fact that Nanjing Huigu is a related party, our new on-the-ground due diligence clearly shows that subsidiaries that were claimed to be sold by Fullshare, Jurong Dingsheng/Dasheng, are still managed and controlled by Fullshare.

On 20 January 2015, Fullshare entered into an agreement with an “independent” third party, Nanjing Huigu, to acquire all of the equity in Jiangsu Anjiali. Fullshare turned around and sold Jurong Dasheng/Dingsheng, subsidiaries of Jiangsu Anjiali for a cash consideration of RMB 269,104,000 and RMB 254,496,000 to an undisclosed related party, Nanjing Dongzhou.

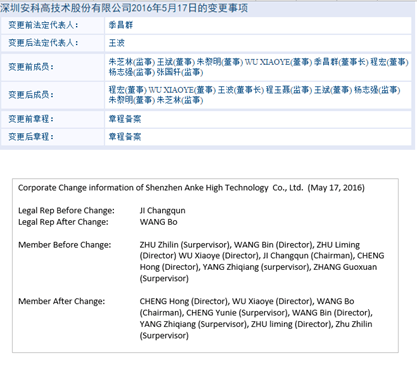

4. RMB 140M Shenzhen Anke High Technology Co., Ltd. transaction may not have ever closed according to newly disclosed SAIC information, which indicates to us a gross lack of internal controls or at worst perhaps an intentional omission.

Based on our examination of SAIC filings, the ownership transfer in the case of an acquisition of Shenzhen Anke was not completed. We believe the lack of perfection of ownership with SAIC, if the deal did in fact close, is either gross incompetence or, like in the case of Puda Coal, perhaps an intentional omission so that the equity of Shenzhen Anke may be used as collateral without proper disclosure.

On February 3, 2016, Fullshare announced a disclosed related party transaction with Fullshare Holding and Mr. Ji Changqun to acquire 72.19% of Shenzhen Anke High Technology Co., Ltd.(“Shenzhen Anke”) When we looked at the SAIC records for Shenzhen Anke, we discovered that this deal may not have ever closed. Based on current SAIC information, Shenzhen Anke is still owned by Fullshare Holding Group (a private company) and other companies, but not the publicly traded Fullshare and/or its subsidiaries. The last shareholder change for Shenzhen Anke was back on October 24th, 2013, when its current shareholders acquired Shenzhen Anke from other parties.

5. Newly revealed on-the-ground interview at Zhenjiang Youshan Meidi Garden contradicts the terms of a disclosed real estate acquisition claimed by Fullshare. We question whether Fullshare acquired the Zhenjiang Youshan Meidi Garden project’s commercial property.

Our on the ground due diligence led us to question whether or not Fullshare acquired more than 10,000 sq. meters of commercial property at the Zhenjiang Youshan Meidi Garden Project. Further, we are also skeptical that transactions involving the Nantong Huitong Building Project (汇通大厦) and the Huilong New Town (汇隆新城) project in Nantong City ever took place.

A subsidiary of Fullshare entered into agreements to purchase several commercial properties in July of 2016. The three commercial properties to be acquired were all in Jiangsu province and ranged between 10,085 and 24,848 sq. meters each. We interviewed sales representatives from Zhenjiang Youshan Meidi Garden, who told us that the commercial property was divided into smaller units of 100-200 sq. meters each. The sales representatives stated that the biggest buyer involved in the project may have only bought several units, totaling less than 2000 sq. meters. This interview leaves us little choice but to call into question whether Fullshare really acquired the claimed 10,085 sq. meter commercial property or not.

6. New interviews with Zall employee’s reveal that the purported transaction with Zall Group & a mysterious BVI company raises further questions about the relationship between Zall Group and Fullshare.

We believe transactions invovling Zall Group, Fullshare and a mysterious BVI company may have been a front for the purpose of Fullshare issuing shares to Zall Group via an arm’s length transaction between Zall Group and Fullshare. In June of 2015, Fullshare bought a 90% equity interest in Zall Xiaogan and Zall Shenyang for a total consideration of RMB 736M by way of issuing 681,480,000 shares. Five months later, Fullshare turned around and entered into two agreements to sell Zall Shenyang (“Active Mind Group”) and Zall Xiaogan (“Advance Goal Group”) to Sun Field Property Holdings Limited, a BVI company that lacks a disclosed beneficial owner. We visited both Zall Xiaogan and Zall Shenyang. It was reported to us by employees of Zall that both Zall Xiaogan and Zall Shenyang are still managed and controlled by Zall Group, rather than by Fullshare or any other third party.

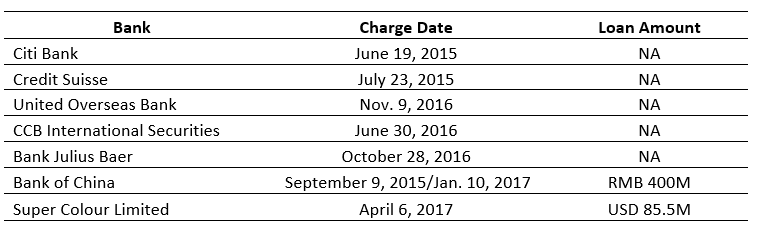

7. New evidence revealed that Fullshare stock is being pledged by its controlling shareholder for millions, if not billions, in at least seven different bank loans, reminiscent of Tech Pro and Huishan Dairy

As Tech-Pro and Huishan Dairy did, Fullshare’s controlling shareholder pledged its owned shares to third party banks without disclosing it. Based on the information we pulled from the BVI corporate registry, Fullshare’s controlling shareholder, Magnolia Wealth International Limited, pledged shares of Fullshare it held to at least seven different banks, including Citi Bank, Credit Suisse, CCB International Securities, Julius Baer, Bank of China, United Overseas Bank and Super Colour Limited (China Huarong).

Details of Our Findings

1. Related Party Transactions & Jiasheng Construction Group Co., Ltd.

We concur with Glaucus’ findings that Jiasheng Construction Group Co., Ltd. (“JCC”) is a related party of Fullshare. Despite the company citing Hong Kong law as a reason for this not being possible, our independent research makes it clear to us that JCC is, in fact, a related party controlled by Fullshare’s Chairman.

In Fullshare’s response to the Glaucus report, it denied that it had engaged in related party transactions with parties alleged by Glaucus, such as Jiasheng Construction Group Co., Ltd., Nanjing Shanbao Investment Management Limited (“Nanjing Shanbao”), Nanjing Dongzhou Property Development Limited (“Nanjing Dongzhou”), Nanjing Fullshare Leisure Agricultural Development Co., Ltd. (“Fullshare Leisure”) and others. In Fullshare’s response, it claimed there was no way it could be a related party simply based upon Chapter 14 of the Listing Rules or Hong Kong Accounting Standard 24 (Revised) Related Party Disclosures.

Regarding JCC, we obtained new evidence in the form a document titled “Dongtai Real Estate Trust Fund Prospectus”, which states:

季昌群对旗下南京丰盛集团、南京建工和嘉盛建设集团有限公司的资金采取集中管理的模式,若旗下某企业遇到流动性问题需向另外一家企业调度资金,经季昌群审批通过即可执行。该笔借款无需支付利息,但借款企业在资金宽裕后需及时归还。南京丰盛控股的兜底能力需通过上述三家公司的综合实力进行评判。

Our paraphrase: Ji Changqun jointly and collectively manages the cash flow of Nanjing Fullshare Group, Nanjing Jiangong and Jiasheng Construction Group. In the event that any subsidiary has cash flow liquidity, upon the approval of Ji Changchun, the subsidiary can allocate cash flow from another subsidiary. This inter-subsidiary loan shall not incur relevant interest but shall be paid back when the borrowing subsidiary has enough cash flow.

Nanjing Fullshare Holding’s guarantee capability shall be appraised upon joint financial capability of these three companies.

Based on its content, we believe the date of this prospectus to be from the second half of 2015. As we can see above, along with Fullshare Group, Nanjing Jiangong and JCC were also collectively managed by Mr. Ji Changqun, Fullshare’s chairman in the second half of 2015. Following the transactions with Fullshare, we believe that JCC is still controlled by Mr. Ji Changqun.

Based on JCC’s current shareholder structure, JCC is beneficially owned by a group of unknown individuals. JI Changbing and JI Changrong, brothers of Mr. JI Changqun, both divested of their shares in JCC at the end of 2016, at which point someone named “JI Xueshan” became a 31.1% beneficial owner of JCC. We know he has the same last name as the chairman and we also know, based on a 2016 Fullshare Group Bond Prospectus, that he was formerly a shareholder of Fullshare Group.

Besides the Fengsheng Green Building transaction, Fullshare also has participated in several other transactions with JCC, which acquired Guangzhou Fullshare Healthcare Management Co., Ltd. (“Fullshare Healthcare”) from Fullshare in December 2016. The disclosure states:

In December 2016, Fullshare completed the disposal of 51% equity interest of Fudaksu Pte. Limited and its subsidiaries at a consideration of approximately RMB120,340,000 and recorded a gain before tax of approximately RMB64,124,000. In December 2016, the Group completed the disposal of 100% equity interest of Guangzhou Fullshare Healthcare Management Co., Ltd.*(廣州豐盛健康管理有限公司)(“Guangzhou Fullshare Healthcare”) and its subsidiaries at a consideration of RMB55,000,000 and recorded a gain before tax of approximately RMB45,460,000.

We searched the corporate history of Guangzhou Fullshare Healthcare and found out that this is a company which was only established on April 25, 2016 by Fullshare about seven months prior to its divestment. Fullshare buried the only disclosure of this sale in the 2016 annual report, failing to disclose it individually (anywhere we could find) when the sale purportedly took place. The timing of the transaction leaves us no choice but to be skeptical.

We found out that JCC paid RMB 55 M for Guangzhou Fullshare Healthcare – more than 10 times the investment Fullshare made in it slightly more than half year prior. Based on JCC’s introduction, JCC is not involved in the healthcare business, making it difficult to understand the motivation behind this acquisition at all. Fullshare Healthcare’s SAIC record states:

Fullshare may continue to dispute the fact that JCC is a related party, but from what the Glaucus’ report states, combined with what we are presenting today, we can reasonably conclude that JCC was/is a related party of Fullshare controlled by Ji Changqun.

2. The Nanjing Tianyun Transaction

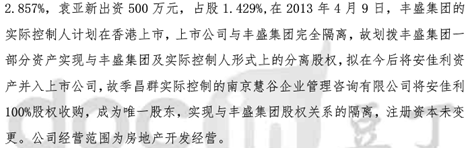

Fullshare stated that Nanjing Tonglu is not a related party in its response to the Glaucus Research report. Based on our independent research, however, we believe that Nanjing Tonglu is related to Fullshare. We arrived at this conclusion by examining the company’s SAIC filings.

It is noted in regulatory filings that Mr. QIN Dong, the legal representative for Nanjing Tonglu, also serves as the supervisor of Jiangsu Fullshare Construction Design Institute Co., Ltd. This is yet another entity that, according to our extensive due diligence, appears to be a related party of Fullshare.

One month before the Tianyun acquisition was made by Fullshare, Nanjing Jiangong Group Co., Ltd. (“Nanjing Jiangong”), a disclosed related party, sold its ownership interest in Nanjing Tianyun to Nanjing Tonglu on July 28, 2014, according to Tianyun’s SAIC file. We believe this to simply be a “strawman” setup, wherein the company used Nanjing Tonglu as an intermediary between two related parties to absolve themselves of the appearance of impropriety. Fullshare offered this response:

As far as the Company is aware, Nanjing Jiangong and Nanjing Changfa has a long history of business relationship in their ordinary and usual course of business. The shareholding changes in Nanjing Tianyun between Nanjing Changfa and Nanjing Jiangong were mainly due to the financing arrangement for a loan which was unrelated to the subject acquisition. After the repayment of the loan, the 95% shareholding in Nanjing Tianyun was transferred back to Nanjing Changfa’s wholly-owned subsidiary Tonglu. Due to further capital needs of Nanjing Changfa, it then sold 80% shareholding in Nanjing Tianyun to the Company at a consideration which was below the net asset value of Nanjing Tianyun, and the remaining 20% shareholding in Nanjing Tianyun was still held by Nanjing Changfa directly and indirectly through Tonglu.

We do not know what “financing arrangement for a loan” means to Fullshare and it’s tough for anyone to make sense of that phrase without further explanation/disclosure. Based on Fullshare’s own explanation, we can draw a clear conclusion that Nanjing Changfa/Nanjing Tonglu paid some unknown amount of money to Nanjing Jiangong. Whether it was a repayment of a loan or not remains to be seen, as it was not disclosed. One month later, Fullshare paid HK $631M to Nanjing Tonglu and even booked a RMB 238M gain in 2014. It seems to us that Fullshare simply paid the money in question to Nanjing Jiangong using Nanjing Tonglu as an intermediary.

On January 2017, Fullshare announced that its Chairman, in conjunction with his relatives, jointly purchased real estate from Nanjing Tianyun in the amount of RMB 78M. Fullshare booked a RMB 28.45M gain from the sale to Mr. Ji and his relatives. We were able to find out that Mr. Ji Changqun and his relatives started to acquire these real estate properties in September 2016, five months prior the official announcement. We find it extremely suspicious that this January 2017 announcement came out after a possible internal audit may have caught the related party transaction by Mr. Ji Chuangqun and his relatives.

3. The Jiangsu Anjiali and Jurong Dingsheng/Dasheng Transaction

We were told by employees that Jurong Dingsheng/Dasheng are, and have been, managed and controlled by Fullshare. This leads us to also question whether or not the divestment of Jurong Dingsheng/Dasheng closed.

On January 20, 2015, Fullshare entered into an agreement with an “independent” third party, Nanjing Huigu Enterprise Management Consulting Co., Ltd. (“Nanjing Huigu”), to acquire all of the equity in Jiangsu Anjiali, a company engaged in property development in the PRC, for a cash consideration of approximately RMB 438,000,000. The acquisition was completed on February 12, 2015.

Nanjing Huigu, the original seller of Jiangsu Anjiali, is owned by two individuals named Zheng Xingdong and Wei Zhuqin. Based on our due diligence, Nanjing Huigu is just another company controlled by Mr. Ji Changqun, Fullshare’s chairman. We were able to find a due diligence report (Sichuan Trust: South Garden Project Structuralized Fund Trust Plan) that clearly lists the corporate history of Jiangsu Anjiali, Fullshare and Mr. Ji Changqun:

Paraphrased: On April 9, 2013, the controlling personal of Fullshare Group plans to list its company in Hong Kong and the list company and the group shall be separated. Therefore, from the outlook, a part of Fullshare Group’s assets is separated from Fullshare Group and its beneficial owners. Anjiali’s assets was planned to be acquired by the list company. Therefore, Nanjing Huigu Enterprise Management Consulting Co., Ltd. (“Nanjing Huigu”), which is essentially controlled by Mr. Ji Changqun, acquired 100% equity of Anjiali and became its sole shareholder. Accordingly, Anjiali is separated from Fullshare Group for ownership relationship and Anjiali’s registered capital is the same as before. Anjiali’s business scope is real estate development.

We consider this document to be important due to its context regarding the company’s corporate history. This document clearly states that Nanjing Huigu is controlled by Mr. Ji Changqun. The only reason that Nanjing Huigu became Jiangsu Anjiali’s shareholder is to facially separate Jiangsu Anjiali and Fullshare as a “strawman”. Fullshare may have concealed the fact that this is a well designed related party transaction, similar to other disputed related party transactions Fullshare talked about in its May 2, 2017 response.

Several months after Fullshare acquired Jiangsu Anjiali, on 9 November 2015, Fullshare entered into two sale and purchase agreements with Nanjing Dongzhou Property Development Limited*(南京東洲房地產開發有限公司)(“Nanjing Dongzhou”), an independent third party, for the disposal of its entire equity interest in Jurong Dasheng and Jurong Dingsheng (subsidiaries of Jiangsu Anjiali) for a cash consideration of RMB 269,104,000 and RMB 254,496,000, respectively. The transactions were completed on 27 November 2015.

To verify our findings, we visited these two project companies, Jurong Dasheng/Dingsheng, in April 2017. On two separate trips, local employees told our investigators that both project companies have always been managed and controlled by Fullshare. When our investigator asked a sales representative additional questions about these “projects”, the sales representative clearly stated that Jurong Dasheng/Dingsheng are still managed by Fullshare and dispelled rumors to the contrary. Here are our pictures of Jurong Dasheng/Dingsheng:

In addition, we took video of our conversation with a sales representative at Jurong Dasheng/Dingsheng. Below is a screenshot of our video and the transcript of our conversation is included in Appendix A of this report. We will provide a full copy of our video to Hong Kong regulators.

4. Shenzhen Anke Transaction

In Fullshare’s response, one specific paragraph caught our attention:

“The Company considers that such transactions with Mr. Ji and/or his associates are fair and reasonable and in the interests of shareholders as a whole, and certain transactions such as the acquisitions of the Shenzhen Anke High-Tech Company Limited*(深圳安科高技術股份有限公司)and its subsidiaries (the “Anke Group”) and Nanjing Fullshare Dazu Technology Co., Ltd.*(南京豐盛大族科技股份有限公司) (“Nanjing Fullshare Technology”) have contributed positive profit after tax to the owners of the parent as set out below”

The company seems to think that these transactions are “fair and reasonable and in the interests of shareholders”, despite the fact that the transaction has not been reflected in the company’s SAIC filings. We are left to ponder whether this lack of shareholder change is simply gross incompetence or, like the in case of Puda Coal, perhaps an intentional omission so that property may be used as collateral by more than one entity without proper disclosure.

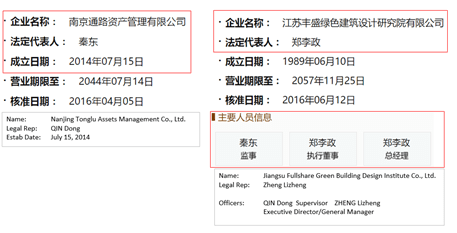

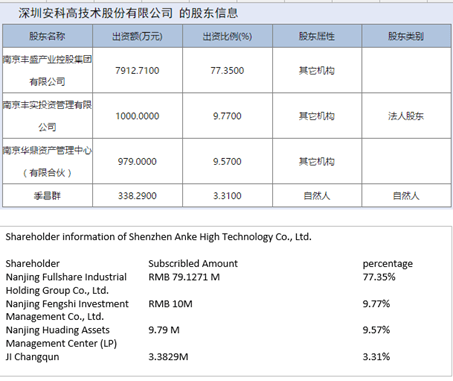

On February 3, 2016, Fullshare announced a related party transaction with Fullshare Holding and Mr. Ji Changqun to acquire 72.19% of Shenzhen Anke High Technology Co., Ltd. (“Shenzhen Anke”) for RMB 140M. On May 17, 2016, Fullshare announced that this deal had closed and that Fullshare owned 72.19% of Shenzhen Anke. Based on this announcement, Nanjing Fullshare Assets Management Co., Ltd. (“Nanjing Fullshare”) now directly owns 72.19% of Shenzhen Anke after May 17, 2016.

SAIC records were not updated to reflect the closing and did not indicate to us that the deal had closed. Based on current SAIC information, Shenzhen Anke is still owned by Fullshare Holding Group, a private company, Mr. Ji Changqun and other companies, but not by Fullshare and/or its subsidiary. The last shareholder change for Shenzhen Anke was all the way back on October 24th 2013. The current shareholders of Shenzhen Anke, as of May 4, 2017, are still as follows:

On May 17, 2016, Shenzhen Anke had additional corporate changes to its legal representative, director, supervisor and its Articles of Associations, but not to its shareholders. We believe the lack of perfection of ownership with SAIC is either an indication of the company’s weak internal controls or, even worse, an intentional omission for potentially nefarious purposes. Without proof of perfection of ownership, we also have to question whether Shenzhen Anke should be consolidated financially by Fullshare.

Here is the information from the corporate change that took place on May 17, 2016:

5. Commercial Real Estate Acquisition Transactions

Our on the ground due diligence led us to question whether or not Fullshare acquired more than 10,000 sq. meters of commercial property at the Zhenjiang Youshan Meidi Garden Project. Further, we are also skeptical that transactions involving the Nantong Huitong Building Project (汇通大厦) and the Huilong New Town (汇隆新城) project in Nantong City ever took place.

On 20 July 2016, an indirect wholly-owned subsidiary of Fullshare entered into formal agreements (the “Formal Agreements”) in relation to the acquisition of certain Target Properties, which consist of (i) the Huitong Building Project*(匯通大廈項目)located at No.89 Zhongxiu Road, Nantong, Jiangsu Province, the PRC with areas of approximately 20,461.22 sq. meters in total; (ii) the Nantong Youshan Meidi Garden Project*(南通優山美地花園項目)located at No.1888 Xinghu Avenue, Nantong, Jiangsu Province, the PRC with areas of approximately 24,847.53 sq. meters in total; and (iii) the commercial properties in Zhenjiang Youshan Meidi Garden Project*(鎮江優山美地花園項目) located at the cross of Guyang North Road and Yushan North Road, Jingkou District, Zhenjiang, Jiangsu Province, the PRC with areas of approximately 10,085 sq. meters in total (the “Properties”). Each of the vendors of the Properties and their ultimate beneficial owners are third parties that are claimed to be independent of the Company and related parties.

We visited the Zhenjiang Youshan Meidi Garden Project twice in April 2017. The sales representative we spoke to told us that there was no such large investor for the entire 10,085 sq. meters of property. We were told that the commercial properties at Zhenjiang Youshan Meidi Garden Project were divided into different units (the size of each unit being around 100-200 sq. meters) and that the biggest commercial property buyer of this project only bought several units adding up to 2000 sq. meters total. When we asked whether or not there was a company called Fullshare who purchased more than 10,000 sq. meters, the sales representative denied knowing about any such purchase, telling us the largest purchase had only been for several units totaling about 2000 sq. meters total.

Here are two pictures of our visit to the Zhenjiang Youshan Meidi Garden Project:

Additionally, here is a screenshot from the video with a sales representative. The transcript of the video is available in Appendix B to this report. We will provide the full video to Hong Kong regulators.

Because of what we learned about the Zhenjiang Youshan Meidi Garden transaction during our on the ground due diligence, we are also skeptical that the Nantong Huitong Building Project (汇通大厦) and Huilong New Town (汇隆新城) project in Nantong City ever took place. We strongly recommend investors, Fullshare’s auditor and regulators visit these real estate projects to better understand the realities of these transactions.

6. Zall Shenyang and Zall Xiaogan Transactions

We believe transactions involving Zall Shenyang and Zall Xiaogan may be nothing more than a sham set up for the purpose of Fullshare issuing shares to Zall Group through a disingenuous arm’s length transaction.

On 26 June 2015, Fullshare completed the acquisition of a 90% equity interest in Zall Development (Shenyang) Limited*(卓爾發展(沈陽)有限公司), Zall Trading Development (Xiaogan) Limited(卓爾商貿發展(考感)有 限公司)and its wholly-owned subsidiary, Zall Development (Xiaogan) Limited*(卓爾發展(孝感)有限公司)for a total consideration of RMB 736,000,000, by way of issuing 681,480,000 shares.

Several months later, On 6 November 2015, Fullshare entered into two sales and purchase agreements with Sun Field Property Holdings Limited (the “Sun Field”), an independent third party, for the disposal of its entire equity interests in Active Mind Group (“Zall Shenyang”) and Advance Goal Group (“Zall Xiaogan”) for a cash consideration of RMB 685,270,000 and RMB 173,944,000, respectively.

Within five months of flipping Zall Shenyang and Zall Xiaogan, Fullshare booked a net gain of RMB 123M on its financial statements for 2015. Sun Field, the supposed independent third party final purchaser of Zall Shenyang and Zall Xiaoyang, is a BVI company that has not disclosed its beneficial owner.

We noticed in the SAIC database that Active Mind and Advance Goal only became shareholders of Zall Shenyang and Zall Xiaogan on Nov. 3 2015 and Nov. 5 2015 — between 1 and 3 days before Fullshare sold them to Sun Field, an unknown BVI company. You can see this in the SAIC file data below:

To understand the nature of the Zall transaction, we also visited Zall Xiaogan to try and understand its business. We found out that the entire real estate construction project has been idled. Local employees told us that Zall Xiaogan is owned and operated by Zall Group, which would indicate that the transaction never actually took place. Here are some pictures of Zall Xiaogan:

On April 5, 2016, a half year after Fullshare’s sale to Sun Field, the local government issued an online response regarding the lack of progress at the project which still stated that Zall Group was the owner and operator of the project. We question what kind of motives may have been at play to make Sun Field, an unknown BVI company, pay RMB 174M for an idle project We find it even more suspicious that Fullshare only acquired this project three days prior, based on SAIC records.

We also visited the Zall Shenyang project, which is still wholly managed by Zall Group. We were unable to find any signals that Fullshare and/or any third party was/is the owner of Zall Shenyang. Here are our pictures of Zall Shenyang:

We believe that before Active Mind and Advance Goal became Zall Shenyang and Zall Xiaogan shareholders, Fullshare had already issued shares to Zall Group. We believe this could even be a sham transaction simply for the purpose of Fullshare issuing more shares to Zall Group via an arm’s length transaction between the two companies. We suspect that the final beneficial owner of Sun Field, the unknown BVI company, is likely a person or persons close to Zall Group or Fullshare.

Interestingly, on May 2, 2017, the same day that Fullshare issued its response, Zall Group also announced the release of a share pledge in shares of Fullshare Holding Limited. We believe these are shares that Zall Group obtained in the Zall Shenyang and Zall Xiaogan transaction. Zall Group announced that on May 2, 2017, it had fully repaid the corresponding bank loan which was secured by, among other things, the pledged Fullshare shares.

7. Share Pledges

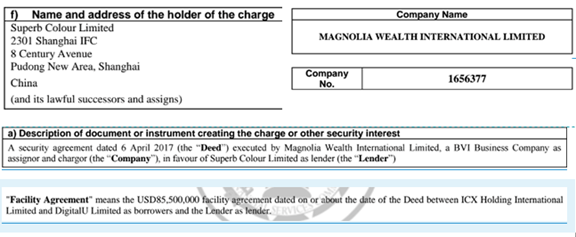

Based on information we pulled from the BVI corporate registry, Fullshare’s controlling shareholder, Magnolia Wealth International Limited pledged shares of Fullshare it held to different banks, including, but not limited to:

Attached is a copy of a pledge to Super Colour Limited, a subsidiary of China Huarong, the biggest institutional holder of Fullshare:

Attached is a copy of a pledge to Super Colour Limited, a subsidiary of China Huarong, the biggest institutional holder of Fullshare:

We are working on collecting more share pledge information from the BVI corporate registry in order to document any further pledges.

Based on the loan information we already have, the Bank of China RMB 400 million loan and the Super Colour Limited USD 85.5 million loan total up to around HK$ 1.12 billion. If we assume that the average share price used for the pledge was HK $3 per share with a 50% pledge rate, Magnolia Wealth International Limited would have needed 746 million shares of Fullshare, or 3.7% of Fullshare’s total shares, to pledge for these two loans.

Considering the fact that there are five other bank loans we found and potentially more loans that we have not yet found, it is reasonable to believe that Magnolia Wealth International Limited may have pledged more than 5% of Fullshare’s total outstanding shares for loans. We did not see any announcement regarding these share pledges from Fullshare and/or Magnolia Wealth International Limited.

Along the lines of what happened with Tech-Pro Technologies and Huishan Dairy, we believe these share pledges for loans continue to put Fullshare and its stockholders in an extremely precarious and dangerous position.

Conclusion: Fullshare is Uninvestable

In full view of the results of our on the ground due diligence, we drew the conclusion that Fullshare is an accounting scheme, manipulated through the acquisition and sale of related party assets that continue to grow in size.

Due to the nature of the company’s undisclosed related party transactions, we simply believe Fullshare to be uninvestable. Fullshare’s internal controls appear to be so bad that we don’t know whether the company’s cash flow is real or not. As a reminder, the aforementioned Chinese trust fund prospectus stated:

季昌群对旗下南京丰盛集团、南京建工和嘉盛建设集团有限公司的资金采取集中管理的模式,若旗下某企业遇到流动性问题需向另外一家企业调度资金,经季昌群审批通过即可执行。该笔借款无需支付利息,但借款企业在资金宽裕后需及时归还。

Our paraphrase: Ji Changqun jointly and collectively manage the cash flow of Nanjing Fullshare Group, Nanjing Jiangong and Jiasheng Construction Group. In the event that any subsidiary has cash flow liquidity, upon the approval of Ji Changchun, the subsidiary can allocate cash flow from another subsidiary. This inter-subsidiary loan shall not incur relevant interest but shall be paid back when the borrowing subsidiary has enough cash flow.

Based on our investigation, we found that Fullshare had several transactions with Nanjing Jiangong (which is disclosed as a related party) and JCC (which is not disclosed as a related party). As we show in several examples, we found that Fullshare acquired and divested different entities to “unrelated” third parties so as to avoid blatantly making related party transactions.

Because of the Chinese trust fund prospectus language, it’s difficult for us to understand whether these transactions with Nanjing Jiangong and JCC were only for cash flow allocation purposes. Isn’t it then possible Fullshare is just moving cash around from various subsidiaries to simulate the appearance of cash flow? Because Nanjing Jiangong and JCC are not public companies, we don’t know their internal financial status, which could be an invisible liability to Fullshare’s financial stability.

As we already stated, we question whether or not several transactions made by Fullshare are even real. For example, why would local employees claim that Fullshare still controls and manages Jurong Dasheng/Dingsheng after Fullshare claimed to sell it Nanjing Dongzhou? Why would sales representatives at Zhenjiang Youshan Meidi Garden tell us that the biggest buyer of its commercial property only bought several units, well under the 10,000 sq. meters claimed to be purchased by Fullshare? Why does it seem that Zall Group still controls and manages both Zall Shenyang and Zall XIaogan, even though Fullshare claimed to acquire these entities and then sell them to an unknown BVI company?

Fullshare’s response did not address all issues raised by Glaucus. Independent of Glaucus, we ask that Fullshare address these issues further with regard to the findings we highlight in this report. We strongly believe our findings to further the obvious case that Fullshare is totally uninvestable and warrants scrutiny by its auditor Ernest & Young, as well as HK regulators.

Disclosure: Short 607.HK

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here –https://geoinvesting.com

Appendix A

Jurong Interview – (note that all English translations are paraphrased)

S: sales woman; I: Investigator – Transcript starts from 04:54 to 07:32 of the video:

I: ……起码你们开发商比较大,丰盛的吗?

At least, your developer is very big, Fullshare, right?

S: 恩,丰盛的,对,南京丰盛的。

Yes, Fullshare, Nanjing Fullshare.

I: 但是我听其他楼盘的人说,你们项目是不是被其他的收购了?

But based on what people from other projects said, we learned that your projects were acquired by someone else?

S: 其他的,每个项目都会,就是,怎么说呢…我能跟你说的是,至少现在还是丰盛的领导在做主。

Other? Every project may, well, how can I explain this. I shall tell you this, till now, Fullshare’s boss still manages this project.

I: 但是有其他的公司在…

But other company?

S: 没有

No.

I: 没有?

No?

S: 对

Right.

I: 但是我在网上,还是其他渠道,因为我家里面有公积金的人,听说是,有个叫什么,南京东洲的吧?

From online source and other channels, as my family member have public reserve fund, heard that, there is a company called Nanjing Dongzhou?

S: 恩,对,是有这种传言。因为之前是这样子的。但是目前为止我能告诉你的就是,现在所有的领导还是丰盛的。就所有的决策东西,包括什么东西, 全都是丰盛的。还没有实施的话,基本上…

Yes, there was a rumor about it. It is a while ago. However, till now, I can tell you, all managers are still from Fullshare. All decision makings are done by Fullshare, including everything. There is no such as, basically.

I: 跟东洲啊什么没有关系?

No relationship with Dongzhou?

S: 没有关系

No relationship.

I: 据你们了解是?

Based on your understanding?

S: 嗯。但至少它现在还是丰盛的人。只有丰盛的员工过来买房才有员工价。东洲的人过来买房是没有的。

Yeah. At least now all managers are still from Fullshare. Only Fullshare’s employees can enjoy employee discount. Dongzhou’s employees cannot.

I: 员工价多少?

What’s the employee price?

S: 员工价也就…但后期有没有就不知道了。反正前期的话…

Employee price is. But we don’t know employees can enjoy this discount on later phase projects or not. At the beginning, it is…

I: 一期多少?

How much for Phase I?

S: 就5个点,不多。

Only 5% discount. Not too much.

I: 5个点。

5%.

S: 就丰盛集团内部下面的啊。

Only for Fullshare Group’s employees.

I: 因为我就是怕什么呢,其他公司来了之后,比如后期的物业啊什么的,二期的话,一期是丰盛的,搞得很好,物业搞得很好,二期的话,比如说之前你说的那样,不是你说的,外面传闻的东洲啊什么的,进来其他公司进来的话,很多东西都不一样的。品质上没有保证的。反正据你们了解是没有这个…

I am afraid of…if other company joins in the project, such as property management, in the phase II. Fullshare is in Phase I and did a good job on the property management. In the phase II, as you said, no, not what your said, it is a rumor from outside, other company like Dongzhou joins in, all things may change and the quality is not guaranteed too. At all, based on your understanding, there is no?

S: 据我们了解,现在我们二期做的,还是丰盛的在这边做,至少领导还是丰盛的。

Based on my understanding, we are now in Phase II, and Fullshare is still control and manage here. At least, all managers are still from Fullshare.

I: 一期也是?

The same in Phase I?

S: 对,一期也是。

Yes. Same in Phase I.

I: 没有听说什么其他公司入伙啊怎么样?

You did not hear that any other company joins the project?

S: 其实这个听说我们在一期的时候早就听说过了,但其实,但至少,可能刚开始还在卖前面多层的时候,我们就听说过了。不是我们没听说过,我们也听说过。但至少到现在还是丰盛的领导。

In fact, when we sold phase I, we heard of this. But, actually, at least, when we started to sell those multi-levels in Phase I, we heard it. It is not the fact that we did not hear this. We did hear this. However, till now, all managers are still from Fullshare.

I: 就是说…

It is to say…

S: 说实话,现在的话,行情这么好,是吧?它也不可能说怎么样子。因为丰盛的话,因为它的产业比较多嘛,房地产业不是它最主要的。

Actually, now, the market is very good, right? Everything shall be all right. As to Fullshare, it has lots of different businesses, real estate is not its main business.

I: 哦。就是说跟东洲啊什么的没关系的是吗现在?

Oh. It is to say that there is no relationship with Dongzhou as of now?

S: 对。反正据我们了解现在是没有关系的。

Yes. Based on our understanding, there is no relationship.

I: 好的。主要是这个限购……

Ok. The problem is the purchase restriction.

Appendix B

Zhenjiang Youshan Meidi Garden Interview – (note that all English translations are paraphrased)

S: Sales woman; I: Investigator – Transcript starts from 06:40 to 12:50 of the video

I: …这边的话都有什么业态卖掉了?

What are sold in here?

S: 还不清楚呢,因为都是自己过来买的。我同事他有一个客户直接把这个全买掉了,要做会所。

I am not clear, because they come here to buy. One client of my colleague bought this , and then make it as club.

I: 这块多少?

How many are this part?

S: 6套

6 units

I: 6套?

6 units?

S: 买了6套,全部用来做会所。

Bought 6 units, and all are used as club.

I: 会所

Club.

S: 我们也不太懂他要做什么,反正他要做生意。

We don’t know what he is going to do, but he wants to do business.

I: 6套有多少平方?

How many square meters are for these 6 units?

S: 6套,不清楚,反正把这一段全买掉了,到这头全买了。

6 units, not clear, anyway this whole part was bought.

I: 这边也是100和155的?

In here there are also 100 and 155 square meters’?

S: 对对对。面积都差不多。因为我们这次做的相对面积都比较偏大,因为之前人家都觉得小了。

Yes. The area is about the same. Because this time the area we made is relatively large, people think they are too small before.

I: 那将近买了差不多1000个平方?

Then [that person] bought almost 1,000 square meters?

S: 恩,差不多。

Yes, almost.

I: 是不是你们这里最大的客户了,差不多?

Is that your biggest client in here?

S: 不是,还有一个人。

No, there is another one.

I: 还有一个?

Another one?

S: 还有一个,他/她买了14套。

There is another one. He/she bought 14 units.

I: 14套?

14 units?

S: 恩。9套住宅。然后剩下的全部是商铺买的。

Yes. 9 units are residential, and the rest are commercial.

I: 就是买了14套商铺?

Bought 14 commercial units?

S: 买了14套住宅+商铺。

Bought 14 units of residential and commercial.

I: 那商铺他/她买了多少?

How many commercial units did he/she buy?

S: 9套住宅,剩下的就是商铺。应该是…6…应该是…

9 units of residential, and the rest is commercial. Should be…6…should be…

I: 5套

5 units.

S: 5套,5套。

5 units, 5 units.

I: 那也不算。他做什么的?

That is not too much. What does he/she do?

S: 投资。

Investment.

I: 投资。

Investment.

S: 他/她投资的。

He/she does investment.

I: 个人的?

Is it individual?

S: 个人的,就是个人的。家里有钱,我们小区业主。(下一句不清楚)

Individual, it’s individual. Family is rich, [he/she is] resident in our community. (not clear for next sentence)

I: 我听说…这里面现在就是说,依你了解的话,是没有做餐饮的?

I heard…so based on your knowledge, right now in here there is no one doing restaurant business?

S: 没有做餐饮的。没有做的,没有人做餐饮。你看,我们这个里面做餐饮的很少,就几家,里面。里面就一个卖面条的,两个餐馆,没了,全是超市,药店,洗衣房。

There is no one doing restaurant business. No, there is no one. You see, we have rare restaurant business in here, only a few, in there. In there there is one selling noodles, two restaurants, then no others, they are all supermarket, drug store, and laundry.

I: 那你们现在就是里面的话全部都是小的?

Then inside you only have small ones?

S: 小的。是115,155。就这3套。

Small ones. It’s 115 and 155 [square meters]. Just these 3 units.

I: 我怎么听说有一个,因为我过来就是…

I heard there is one, because I come here that…

S: 有小的

There are small units

I: 不是,怕有那种大型的那种餐饮竞争。我听说有一个公司,但是我不知道它是做什么的,买了一万多平,是不是?

No. [I am afraid] there is competition from that kind of big restaurant. I heard there is one company, but I don’t know what it does, bought 10,000 square meters, is that right?

S: 没有啊,你说的是yueronghe吧?yueronghe现在已经关掉了。它已经关掉了。

No. Are you talking about yueronghe? Yueronghe has already shut down. It already closed down.

I: 叫什么?

What’s it called?

S: yueronghe

Yueronghe

I: yueronghe?

Yueronghe?

S: 啊,已经关掉了。

Ah, [it] already closed down.

I: 它是,它是干什么的?

It is…what does it do?

S: 它是做私人会所,餐饮的,现在关掉了。酒楼开到changjiang dian去了(不清楚)。

It was doing the private club, restaurant, now it is closed. The restaurant was opened at changjiang dian (not clear).

I: 哦,关掉了

Oh, closed.

S: 就是整个关掉了。你去门口看,就在我们前面,出了会所左拐就能看到它了。牌子还在呢。

It closed as a whole. You can take a look at the gate, just in front of us. You will see it by making a left turn after getting out of the club. The sign is still there.

I: 它是什么公司的?

What company is it?

S: 它不是公司,它是私人自己开的一个酒楼。做那种私人的,菜还比较贵的。然后一般吧。

It’s not a company. It’s a restaurant opened by individual. Doing that kind of private, and the food is relatively expensive. It’s just so so.

I: 卖吃的?

Selling food?

S: 我同事有去吃过。不是特别好吃,然后比较贵。

Our colleagues went there to eat before. It’s not very good, and expensive.

I: 那它那个…

Then it…

S: 现在这是最大的,没有那么大的像它那种酒楼了。没有了。

Now this is the biggest, there is no restaurant as big as it, no.

I: 你们这边一共的面积是多少来着?

What’s your total area?

S: 一共2.5万方

25,000 square meters in total.

I: 2.5万方

25,000 square meters in total.

S: 这个还没卖,卖的是这个

This one is not sold yet, selling this one.

I: 对啊

Yes.

S: 其实一样啦,因为都靠马路边上。比在小区里面要好一点。而且旁边也有小区,因为这边有门的,预留的。预留入口的,你看,都预留入口的。然后后面有个6 II 期。6 II期的业主肯定也只会在这边买东西,不可能跑到你那里去买。

Actually it is the same, because they are all beside the road. It is better than within the community, and there is community beside, because there is gate in here, pre-saved. Pre-saved entrance, you see, the entrance is pre-saved. And there is the second stage of phase 6 in the back. The residents in the second stage of phase 6 would only buy things in this side, they won’t go to your side to buy things.

I: 他那个会所的话,是哪种会所,带不带餐饮?

The club, which kind of club is it? Is it with foods service?

S: 不带餐饮。就是做那种…

No food service. Just that kind of…

I: 我现在就是怕竞争,因为这边的话,人流量,说实话,很那个什么,但是我就是怕那种竞争。因为有些会所它带餐饮的话冲击很厉害的。

Right now I am afraid of competition, because here, the flow of people, to be honest, very…, but I am just afraid of that kind of competition. Because the competition is strong if some clubs have food services.

S: 它做那种,那种不是餐饮的会所。做那种美容之类的。

It does the kind of club without food services. It does kind of beauty services.

I: 美容之类的哦?

Beauty services?

S: 恩

Yes.

I: 我好像听说,是不是…

I kind of heard, is it…

S: 因为我们这边现在没有什么大型的餐饮。

Because right now we don’t have big scale restaurant.

I: 因为我在网,前阵子我来之前在网上找了下资料。我看了一下是不是那个叫什么,有一个,我想一下,说是买了很多,将近1万方,丰盛。

Because I was on the internet, I searched some material on the internet before I come here. I looked, there is some one, let me think, it says it bought a lot, almost 10,000 square meters, Fullshare.

S: 不在我们这个地方(不清楚)我们这还没有人买1万个方的.

Not in our place (not clear). We don’t have some one who purchased 10,000 square meters.

I: 一个叫丰盛的公司,南京丰盛,是吧?听说过没?

A company named Fullshare, Nanjing Fullshare, right? Did you hear about it before?

S: 我不知道,反正这边商铺的话,就是我同事卖的,他一个客户买了6套,就把前面这个全包了。然后还有另外一个买了5套。就是说我们现在商铺也不多了。而且那个买5套的女孩子,她是做投资的,家里也满有生意的,做这行生意的,家里做投资的。

I don’t know. The commercial units here, my colleague sold, one client of his/hers bought 6 units, just bought them all in here. And there is another one who bought 5 units. We don’t have many commercial units now. And the girl who bought 5 units, she is doing investment, her family has business, doing business in this area, family does investment business.

I: 没听说过丰盛过来买?

Did not hear Fullshare come here to buy?

S: 没听说过。可能买的不是我们这吧,可能买的是那个zhong gang lan wan (不清楚)吧?

Never heard it before. Maybe did not buy from us, maybe bought from that zhong gang lan wan (not clear)?

I: zhong gang lan wan?

Zhong Gang Lan Wan?

S: 就是lan wan也有商铺卖。

Lan Wan also has commercial units to be sold.

I: 哦

Oh.

S: 它的商铺比较小,就是四五十平米大的格子铺。以后去做的话只能做奶茶店或者做卖衣服的店,做不了大的餐饮。面店老馆都开不下来(不清楚),太小了。你想,四五十个平方,就算你得毛率(不清楚)高一点吧,你可能也就三四十个平方。

Its commercial unit is small, about 40 to 50 square meters. It can only be used as bubble tea shop or cloth shop, can’t do big scale restaurant. Noddle shop will not fit (not clear), it’s too small. Think about it, 40 to 50 square meters, even if the ratio is higher (not clear), you might have 30 to 40 square meters.

I: 这边物业费怎么算?

How is the property management fee?

S: 物业费我要问一下他。

The management fee I will need to ask him/her.

I: 还有那个空调是中央空调还是什么?

And that air condition, is that central or what?

S: 好。所有中央空调(不清楚)。物业费两块。

Ok. All are central air condition (not clear). Management fee is 2 RMB.

I: 物业费两块。前面停车怎么样?

Management fee is 2 RMB. How about the parking?

S: 停车正常前面可以停啊。它现在在修呢,你可以去外面逛一圈,你去看一下。因为其实我觉得这边位置比较好,又属于待开发的。因为买商铺的话,我们就相当于带一些风险性投资吧。自己要有电,自己要带(不清楚)。因为我原来在bao luo卖商铺的,我们那边比这边还要荒呢。这边还算好啦,前面都有学校,哪边都有人。我们那个时候,开荒的时候,啥都没有。那的商铺还卖得不便宜。零几年,我那个时候是15年去的,他们那还卖到1万2一平方。

Normally you can park in the front. Right now it is under construction. You can go out and have a tour, you can go to take a look. Because actually I think the location in here is good, and it’s also pending development. Because purchasing the commercial unit, we are like doing some risking investment. We need to have electricity, self …(not clear). Because I originally was selling commercial unit in bao luo, and that is even more deserted than here. Here is ok, there is school in front, and people are everywhere. When we were there, there is nothing. And the commercial unit is selling not at a cheap price. I went there in 2015, they were selling at 12,000 RMB per square meter.

I: 那现在就是有一个,买了6套的,最大了,做会所。还有一个买了…

Now there is one person bought 6 units, the biggest buyer, making as a club. There is another one bought…

S: 5套的,做投资。

5 units, for investment.

I: 5套的,做投资。

5 units, for investment.

S: 没了。

Nothing more.

I: 剩下全是小的。

All the others are small purchase.

S: 自己买的。现在商铺就3套了。就刚好就是102,103…

All bought by themselves. There are only 3 commercial units left. They are just 102, 103…

I: 只有100…100…100…

Only 100…100…100…

S: 115的和155的,这两种户型,然后是上下两层的。我们现在做的yanjiu(不清楚)商铺都是上下两层。

115 and 155 square meters, respectively, these two types, and two floors with upstairs and downstairs. The commercial units we are doing are all two floors, upstairs and downstairs.

I: 现在只剩这两套了是吧?

There are only 2 units left?

S: 对。

Yes.

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions