We are no strangers to the DOW crashing. We look at these events as opportunities to profit from areas of the market that have a history of outperforming the market as outflows dominate the stock market at large.

Last Friday the major U.S. market indices spiraled out of control on the heels of a historic referendum vote by Britons that will lead to the U.K. to exit the Euro: Brexit (I know everyone is sick and tired of hearing the word Brexit).

- DOW: -610 points (-3.39%)

- S&P: -75.91 points (-3.99%)

- NASDAQ: -202.06 points (4.12%)

- Russell: -44.68 points (3.81%)

As today unravels in a similar fashion, it has many investors wondering if this is the start of a larger scale selloff. Although this is a possibility, it also opens the door to find opportunity where others may not be looking.

Just What the Doctor Ordered in face of DOW Crashing

Many microcap stocks we own and follow bucked the downtrend. For some time now, I have been writing articles stressing that some of the economic currents over the past year or two will revive a floundering microcap universe.

Rising rates will eventually hurt the balance sheets of bigcaps that use leverage to grow, increasing risk profiles while reducing sales and EPS growth rates.

Currency fluctuations in the China (RMB) and the UK (Pound) will hit the income statements of big caps that generate sales in these foreign currencies. This also makes the products that are exported outside the U.S. more expensive for consumers abroad. And who knows what nation will be next to exit the Euro.

Some Things Just Make Sense

Markets hate uncertainty. Investing in homegrown U.S. companies that have clean balance sheets and little exposure to foreign countries should begin to attract investor money. And the microcap universe is full of ideal candidates where multi-baggers are born. In fact, since I co-founded GeoInvesting in 2007 we have unearthed over 50 multi-baggers. With rates still at relatively low levels investors are still going to have to invest in the stock market. At some point the lack of love “bestowed” upon microcaps over the past few years will reverse. So many investors I talk to can’t stop ragging on microcaps. But these are the times when astute investors take notice. Remember, right before dotcoms turned to dotbomb and you were at a picnic and everyone was talking about how great these stocks were. Avoid the CROWD! I stand by my belief that each global shock event (provided we avoid a deep recession) will bring us closer to a logical rotation into quality mircocaps (and small-caps).

By the way, don’t worry, we also look for opportunity in larger cap names that we believe can plow through global risk factors or have no exposure to them at all, and can shrug off the DOW crashing. For example, every quarter we update our Big Cap Pull Back screen. We are looking for companies that retrace from their highs when it appears there is no reason for the drop other than weak market conditions or a misinterpretation of quarterly financial results.

In a nutshell, we are opportunistic. I am confident that if you join our growing community you will benefit from our quality research and profit alongside our team as we get ready for the revival of microcaps.

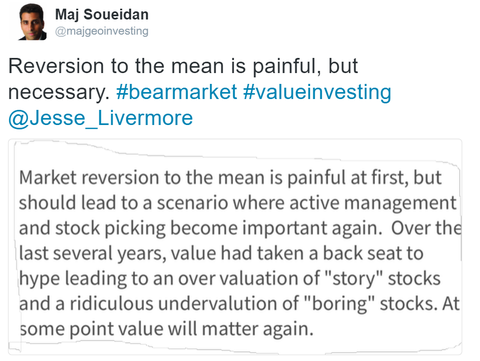

I will leave you with one of my top tweets that was well received by my followers. (You can follow me at @majgeoinvesting). It sums up why I think microcaps are a great option for investors looking for a little extra alpha in their portfolios.