FAB Universal (FU) has completely failed to address in any substantive way a growing series of reports that challenge the core of FAB’s business and expose an almost complete lack fiduciary responsibility and corporate governance by FAB’s U.S. management:

- September 26 and October 1, 2013: Two articles discuss massive dilution and insider selling issues, while also beginning to question FAB’s Chinese 5C Media Kiosk operation.

- November 14, 2013: Alfred Little put out a scathing report concluding that FAB Universal is a fraud. He found FAB guilty of rampant piracy, back-end deals with franchisees that offered FU stock and guarantee returns, and of inflating its kiosk count by as much as 10 times.

- November 18, 2013: GeoInvesting reported evidence from three independent sources confirming that FAB had failed to disclose a 100 million RMB ($16.4 million) Chinese bond issuance by its VIE subsidiary.

- November 19, 2013: Alfred Little announced he had caught FAB management red-handed covering up piracy following the publication of his original report.

In today’s report, we present new evidence that proves FAB’s Chinese VIE subsidiary secretly issued 100 million RMB ($16.4 million) in bonds.

On November 19, 2013, GeoInvesting obtained a final draft of the 113-page 12 FAB Bond prospectus dated April 2013 from the underwriter, Industrial Securities, detailing the private offering of 100 million RMB of 11% corporate bonds by FAB Digital (bond ticker SZ118089, short name: “12 FAB Bond”). Note: Similar to SEC filings, final executed copies of the privately issued 12 FAB Bond prospectus are not publicly available.

The information in the prospectus reveals:

- FAB’s Chinese VIE subsidiary, FAB Digital, was in fact the issuer of the bonds.

- How risky VIE agreements can be for U.S. shareholders’ ownership interest assumptions.The 12 FAB Bond prospectus omits any discussion of the VIE agreements and the U.S. shareholder’s interests as portrayed in SEC documents.Issuing the bonds without the WFOE’s approval was a clear violation of the VIE agreements disclosed in SEC filings.In order to execute the bond offering, the Chairman may have pledged his FU shares as collateral.

- A Serious undisclosed related party relationship between FAB and Huzhong, the operator of the kiosks.

- FAB’s Chinese auditor for its 12 FAB Bond issuance, Zhonglei CPA, had its license to audit securities issuers revoked by the CSRC after a failed audit of a fraudulent Chinese company. (Engaging in improper behavior in terms of obtaining audit trails and forming audit opinions that resulted in the issuance of falsified statements in the auditor’s report).

Further confirmation that this bond offering occurred is through a recorded conversation we had with Daton Securities, one of the buyers of 12 FAB Bond, that confirmed Daton Securities knew nothing about FAB Digital being controlled by a US listed company.

The following are the detailed findings in the prospectus:

1. FAB’s Chinese VIE “FAB Digital” was the issuer of the bonds.

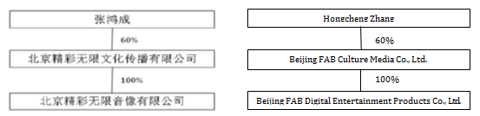

Page 64 of the prospectus shows that the bond issuer, Beijing FAB Digital Entertainment Products Co., Ltd (“FAB Digital”), was 100% owned by Beijing FAB Culture Media Co., Ltd (“FAB Media”). This is identical to the organizational structure FAB presents in its 2012 10-K filed on 3/18/13. The prospectus confirms that the legal representative of FAB Digital is Jiliang Ma, consistent with FAB’s June 1, 2012 proxy. The descriptions of FAB’s business, including wholesale, retail, and network of approximately 15,000 5C kiosks are nearly identical to those described in FAB’s SEC filings. Most importantly, on page 80 of the prospectus, FAB Chairman Hongcheng Zhang is listed as a director of the issuer (FAB Digital) and a registered 60% shareholder of the issuer’s parent company, FAB Media, matching FAB’s disclosure in the VIE contracts annexed to the proxy.

FAB Digital’s prior ownership structure was disclosed in the March 15, 2012 VIE agreements annexed to the proxy as follows:

“As of the date of this Agreement, Wang Gang and Zhang Hongcheng are the registered shareholders of FAB Digital, legally holding all equity interests of FAB Digital, of which Wang Gang holding 35% interest, Zhang Hongcheng holding 65%.”

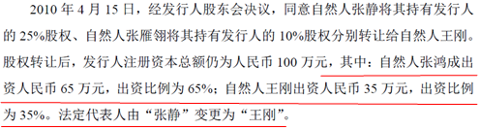

The 12 FAB Bond prospectus outlines the series of changes to the ownership structure of FAB Digital that precisely match up with the ownership disclosures in FAB’s proxy filing:

April 15, 2010, …Hongcheng Zhang contributes RMB 650,000, 65%, Gang Wang contributes 350,000, 35%. Legal representative is changed from Jing Zhang to Gang Wang.

March 3, 2012, based upon issuer’s Shareholder’s Meeting decision, the legal representative is changed from Gang Wang to Jiliang Ma.

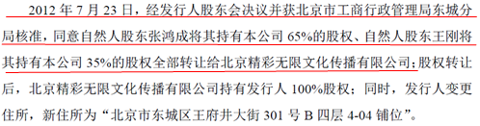

July 23, 2012, based upon issuer’s Shareholder’s Meeting decision and approved by Dongcheng AIC Branch of Beijing AIC, Hongcheng Zhang transferred his 65% and Gang Wang transferred his 35% of FAB Digital to FAB Media.

All of the above unquestionably confirms that FAB’s consolidated VIE, FAB Digital, was indeed the issuer of the 12 FAB Bond. FAB’s Chinese Chairman, U.S. CEO, and CFO concealed and then vehemently denied the existence of this bond offering in violation of multiple securities laws:

- Section 17(a) of the Securities Act for making untrue statements of material fact and engaging in transactions that deceived purchasers of FAB common stock.

- Section 13(a) and 10(b) of the Exchange Act for filing inaccurate quarterly reports and failing to disclose indebtedness.

- Section 13(b) of the Exchange Act for failure to keep accurate books and records.

- Section 13(b)(5) and Rule 13b2-2 of the Exchange Act for knowingly falsifying books and records and making materially false and misleading statements.

- SOX Section 302 for principal officers falsely certifying the integrity of financial reports.

- SOX Section 906 for falsely certifying that financial reports were accurate and reflected the true financial condition of the issuer.

2. FAB’s WFOE’s VIE management agreements and US investors’ interests are totally ignored in the 12 FAB Bond prospectus.

The 12 FAB Bond prospectus totally ignores the contractual rights of control that FAB’s VIE’s granted to FAB’s wholly foreign owned enterprise (“WFOE”) via management agreements (the “VIE agreements”). The complete disregard of U.S. investors is immediately obvious in the corporate structure presented in the 12 FAB Bond prospectus as follows:

Missing from the diagram is Beijing Dingtai Guanqun Culture Co., Ltd. (the “WFOE”), that through VIE agreements should have complete control of FAB Media and FAB Digital. The US investors’ interests (contractually exerted by the WFOE) are totally ignored in the 12 FAB Bond prospectus.

As a result of the lack of disclosure, Chinese purchasers of the 12 FAB Bond are unaware that FU investors, through the WFOE, control and are entitled to 100% of profits of FAB Media and FAB Digital through the VIE agreements. Our recorded conversation with Daton Securities, one of the buyers of 12 FAB Bond, confirmed that Daton Securities knew nothing about FAB Digital being controlled by a US listed company.

Most importantly, the issuance of the 12 FAB Bond without the approval of the WFOE is a violation of the VIE agreements. According to Article 2.4 of “The Exclusive Service Agreement” annexed to the proxy, the WFOE shall be in charge of FAB Digital’s and FAB Media’s funds and contract execution, including approval of the issuance of corporate bonds (among numerous other rights set forth in the agreement to protect investors).

To summarize in plain English: FAB Digital needed to get the WFOE’s approval to issue the bonds, but the prospectus hid this requirement from the Chinese bond buyers.

3. The prospectus reveals an astonishingly undisclosed related party relationship between FAB and Beijing Huzhong Culture Co., Ltd.

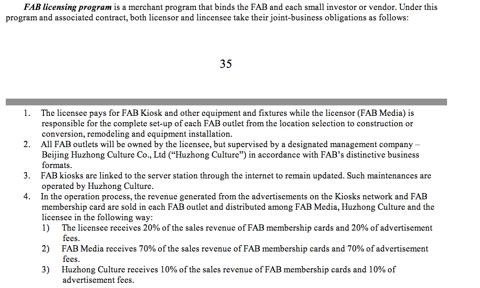

On page 35 of FAB’s June 1, 2012 proxy, FAB disclosed the operational management and revenue sharing arrangement of its 5C kiosks business as follows,

According to FAB, Beijing Huzhong Culture Co Ltd (“Huzhong Culture”) is responsible for operating and maintaining its 5C kiosks network entitling Huzhong Culture to a share of the kiosks’ advertising and membership sales. FAB provides no further details regarding Huzhong Culture, despite its very central and key role in FAB’s kiosk operation.

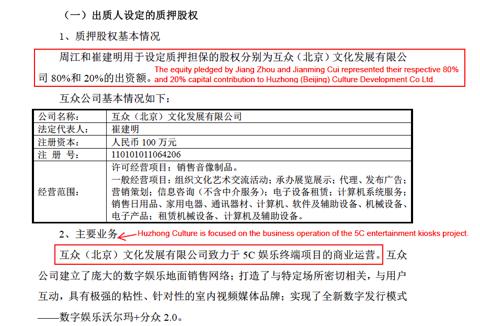

According to page 32 (shown below) of the 12 FAB Bond prospectus, Huzhong (Beijing) Culture Development Co Ltd (互众(北京)文化å‘展有é™å…¬å¸) pledged its owner’s equity as collateral for the 12 FAB Bond. According to the prospectus, the owners of Huzhong Culture are and Jiang Zhou (80%) and Jianming Cui (20%). Huzhong Culture’s business is described as “focusing on the business operation of 5C entertainment kiosks.”

Why would Huzhong Culture, a supposedly unrelated company to FAB, pledge its assets to secure the 12 FAB Bond?

The answer is revealed on page 39 (shown below) of the prospectus:

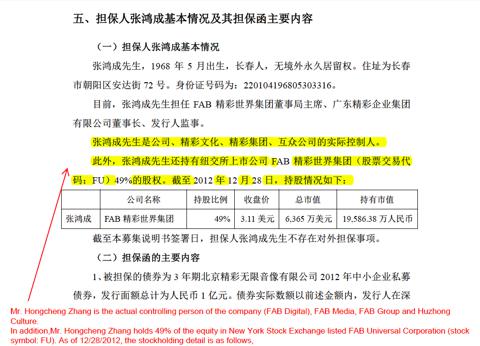

“Mr. Hongcheng Zhang is the actual controlling person of the Company (FAB Digital), FAB Media, FAB Group and Huzhong Culture.” [emphasis added]

Based on this statement in the prospectus, FAB failed to disclose in its SEC filings countless related party transactions between its subsidiaries, franchisees, and Huzhong Culture (the operator of the kiosks). Such widespread hidden related party transactions call into question the true role of Huzhong Culture, which may be simply to help FAB cook its books, further calling into question the revenues and profitability of FAB’s entire kiosk operation.

4. FAB Chairman Hongcheng Zhang may have pledged his FU shares to secure the bonds.

According page 39 (shown above) of the prospectus, Zhang personally guarantees the 12 FAB Bond. The prospectus specifically cites Zhang’s 49% ownership in the NYSE listed FAB Universal as proof of Zhang’s ability to pay. We can’t tell from the prospectus, but Zhang may have pledged his FU shares to secure the bonds.

5. FAB’s Chinese auditor for its 12 FAB Bond issuance, Zhonglei CPA, had its license to audit securities issuers revoked

Zhonglei CPA Co., Ltd. (ä¸ç£Šä¼šè®¡å¸ˆäº‹åŠ¡æ‰€) was the Chinese auditor of FAB Digital’s financials, according to page 15 of the prospectus. After Zhonglei’s client, WanFuShengKe (SZ300268), was determined to be a fraud by the Chinese Securities Regulatory Commission (“CSRC”), Zhonglei’s license to audit securities issuers was revoked after Zhonglei was found negligent by the CSRC for:

a). Failing to perform proper audit procedures on Wang Fu Sheng Ke’s IPO and 2011 financials;

b). Engaging in improper behavior in terms of obtaining audit trails and forming audit opinions that resulted in the issuance of falsified statements in the auditor’s report.

All of Zhonglei’s ongoing securities-related audit projects were suspended. Zhonglei clients were forced to switch to other firms. Kaisong Huang, the CPA who audited the FAB financials presented in the bond prospectus, moved to DaXin CPA LLP.

6.The Longyuan Building FAB is considering buying appears to have been pledged as collateral to secure the 12 FAB Bond. Why would the owner of the Longyuang Building agree to secure the 12 FAB Bond?

FAB stated on page 21 of its 2013 Q2 10-Q that:

“In order to expand our business of media entertainment and copyright transaction, in June 2013 we made approximately a $13 million dollar refundable deposit to purchase the Longyuan Building in Miyun, Beijing… The building is 95,000 square feet…

Should the board approval purchase of the Longyuan Building in Miyum, Beijing, we will be obligated to make two remaining payment installments prior to transfer of the building, the first not later than November 2013 in the approximate amount of $13 million and the second not later than March 2014 in the approximate amount of $6.5 million.”

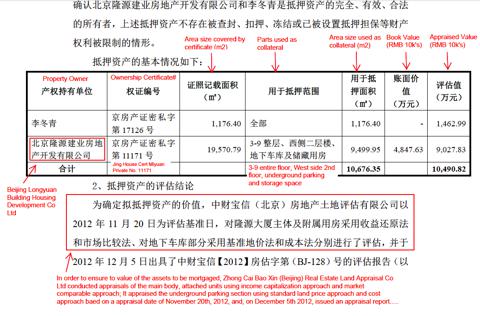

As shown in the following screenshot of page 28 of the prospectus, “the entire 3rd to 9th floor, 2nd floor of the building’s west side, underground parking space and storage” of the Longyuan Building (隆æºå¤§åŽ¦) totaling 9,499.95 square meters will be formally pledged as the first collateral for the 12 FAB Bond. (1 square meter = 10.8 square feet.)

The pledged portion of the Longyuan Building was appraised at RMB 90.28 million (USD $14.8 million). The current owner of Longyuan Building, according to the prospectus, is Beijing Longyuan Building Housing Development Co., Ltd.

What was FAB really doing by depositing $13 million in June 2013 to acquire the Longyuan Building that was pledged in April 2013 by its current owner to secure FAB Digital’s $16.4 million 12 FAB Bond offering?

FAB’s Bold Response

In response to our report revealing FAB’s undisclosed debt, on November 20th, 2013, FAB issued a press release repeating its vehement denial of the recent allegations. FAB therefore certainly appears to be denying that FAB Digital ever issued the 12 FAB Bond.

In addition to the numerous Chinese websites that confirm this bond issuance, on 10/25/13 the Daton Tri-Stone #2 asset management fund published its Q3 2013 fund management report that disclosed that the fund continued to hold 20 million RMB of 12 FAB Bonds.

Investors can download the report direct from Daton’s website (the 6th item from the top):

Furthermore, GeoInvesting recorded a call to the Daton fund manager who acknowledged the fund’s holdings of the 12 FAB Bond as of 9/30/2013.

How can FAB possibly continue to deny the existence of these bonds secretly issued by FAB Digital?

Conclusion

It’s been one week since the allegations of fraud and misrepresentation have first been reported. FAB management has made breezy blanket statements defending their innocence rather than even attempting to refute a single allegation with any detail. FAB has yet to appoint an independent committee to examine our findings. Our question today is simple and applies to both the US management of FAB as well as the auditor, Friedman LLP. Do you deny that the 12 FAB Bond is in fact a bond issued by your VIE subsidiary to investors in China? Answer this simple question. If you deny it then please explain how all this evidence could possibly be wrong! The most important question to be answered: Is anyone on FAB’s US management team willing to step up to protect US investors?