On April 27, 2016 we stated we were interviewing Cematrix Corp (CVX.V) ($0.45), a manufacturer and supplier of technologically advanced cellular concrete products. Overall, we think CVX.V is presented with some great long-term trends to fuel growth. The commitment by Canadian and U.S governments for infrastructure rebuild is very strong. The Company has projected sales of $18 million for 2016 but then $25 to $30 million for 2017 (fiscal 2015 was $15.3 million).

CVX.V ($0.45) is a manufacturer and supplier of technologically advanced cellular concrete products.

CEMATRIX provides cellular concrete product for many applications in

- Oilsands,

- Oil and Gas facilities, and

- Infrastructure projects throughout North America by utilizing CEMATRIX’s production units.

Cellular concrete is a cement slurry based product that is combined with air to result in a very lightweight, foamed concrete-like material that has thermal insulating qualities with moderate structural strength. It is generally lighter than water and is used as a replacement for rigid and other types of insulation and as a lightweight fill or a void fill, which includes tunnel grouting.

The Company has a dry and wet mix production offering.

- Dry mix production equipment is fully automated and the cement slurry mixing process is done directly from cement and other dry powders, onsite. This equipment permits the production of high hourly volumes. The dry mix system enables the Company to improve the quality of its end product, while reducing its unit cost by up to 20% as compared to the wet mix process. However, the dry mix process is typically not suitable for small to medium sized projects because of the higher costs associated with mobilization together with the onsite space required for set up;

- Wet mix production equipment is partially automated and the pre-designed cement slurry required is delivered by a ready mix provider; this equipment has lower hourly production capability and is suitable for small volume projects or projects where there is no space for the larger dry mix units.

We recently had a call with management. Here is a summary of our call and our reasons for tracking.

[hide]

- Like many companies, CVX.V was crippled by the great recession of 2008. The Company was generating 95% of its sales from the oil sand and refinery industry in Alberta, Canada. They had $13 million in contracts on the books heading into 2009, but lost all of them when the crash happened in the fall of 2008. The Company had to start from scratch and slowly rebuild the oil sand business and also began to apply for approvals to work in the Canadian infrastructure build out. (for infrastructure work, each company needs approvals in each Province, which could take up to 5 to 10 years to gain approval). The lengthy approval process gives the company a competitive advantage. In fact, management claims it has little to no competitors in Canada.

- The Company began to gain approvals for infrastructure work in 2014 and is really just beginning to gain traction now.

- Similar to the recent passage of the $305 billion house bill to fund highways and mass-transit projects in the U.S., the Canadian Government passed a $120 billion infrastructure bill covering the next decade. According to management, and unlike the U.S., there are little to no bureaucratic hurdles when it comes to federal spending in Canada.

- 94% of the Company’s $99 million current pipeline of work is from infrastructure vs oil sands. This ratio used to be reversed, with most work coming from oil sands.

- While there is plenty of opportunity in Canada, the Company is also looking to penetrate the U.S market. They have had some small projects but are looking to expand its U.S footprint.

- The Company believes it can grow from cash flows, therefore likely eliminating the need to raise capital.

- On February 29, 2016 the Company announced a new $2 million bank loan which will be used to repay a mezzanine loan with a rate of 16.5% significantly lowering the Company’s interest expense and will also provide the capital necessary to support growth in 2016.

- The Company’s current production capacity allows for up to $88 million in sales compared to $15 million it reported in 2015, providing a great runway for sustained growth.

- The Company has projected sales of $18 million for 2016 but then $25 to $30 million for 2017 (fiscal 2015 was $15.3 million)

- Overall, we think CVX.V is presented with some great long-term trends to fuel growth. The rebuilding of the U.S. infrastructure is a theme we have been on of for some time. So it makes sense that we follow CVX.V. The company’s products last longer than competitors. For example, the Company’s product usually replaces Styrofoam, management stated its cellular concrete product is more durable, cheaper and easier to use than Styrofoam, which is the common alternative.

Caveat:

- We are new to the Canadian space and missed an initial run. The stock is up ~50% since it reported its fiscal 2015 results in January. However, while the pace of growth in 2016 may slow down, if the Company’s positive momentum continues investors may start valuing the Company on its 2017 growth potential. Furthermore, the company has some projects in the pipeline that could help provide some upside to 2016.

- The company reported a small loss in Q1 2016.

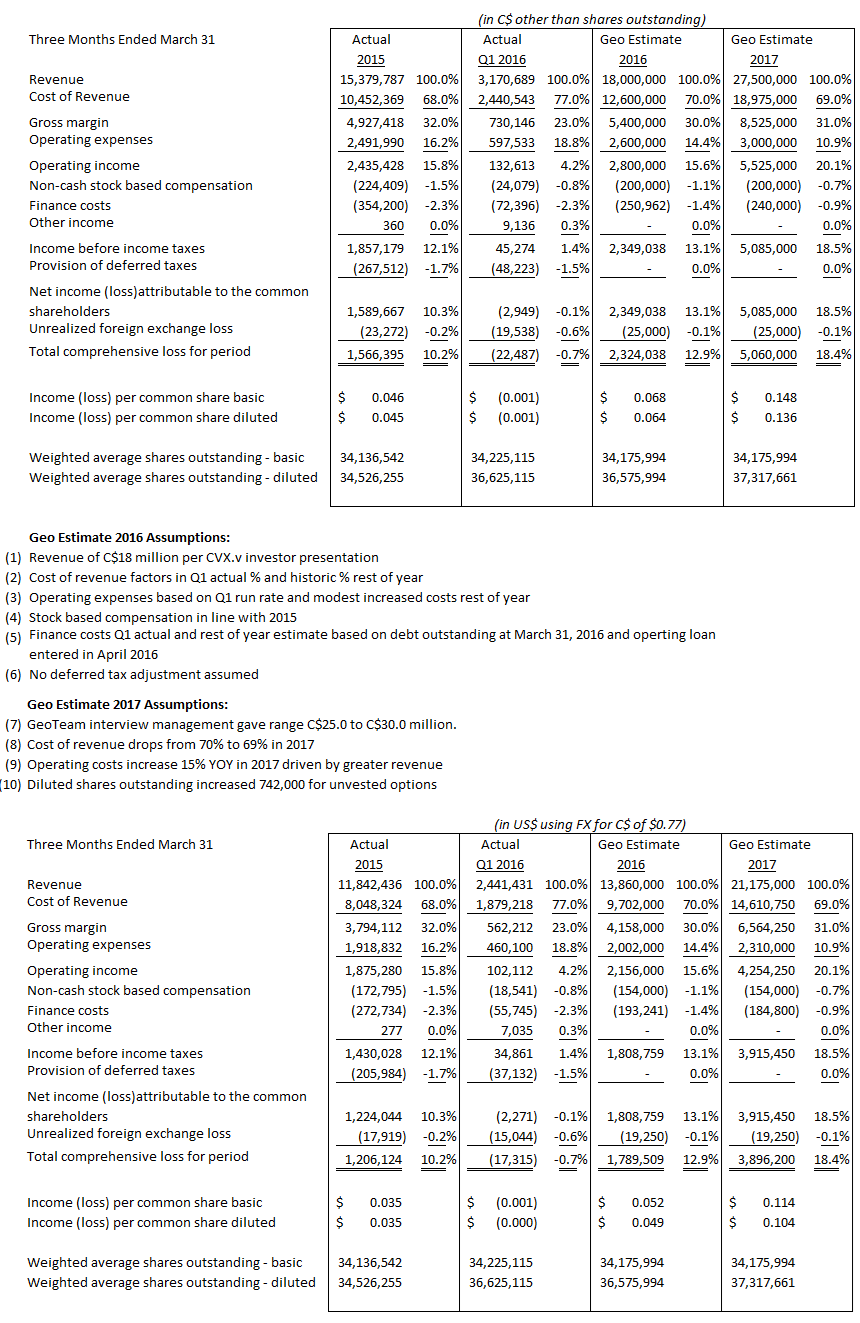

Below are our estimates based on management’s sales guidance for 2016 and 2017

Below are our estimates based on management’s sales guidance for 2016 and 2017

[/hide]