By Maj Soueidan, Co-founder GeoInvesting

On March 30, 2022 Rcm Technologies, Inc. (NASDAQ:RCMT) reported great Q4 2022 financial results.

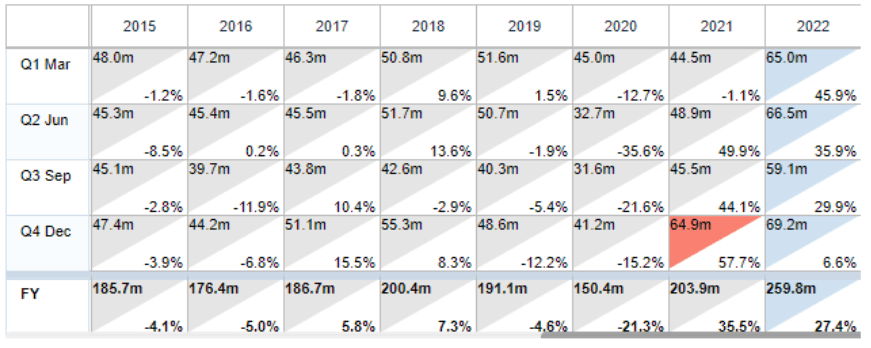

- Sales of $64.9 million vs $41.2 million in the prior year

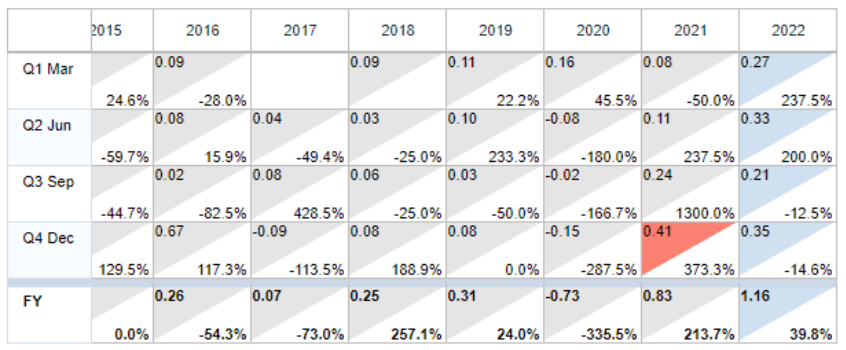

- Non-GAAP EPS of $0.34 vs $0.01 in the prior year

“Our fourth quarter results serve as a nice bookend to 2021. As I reflect on our transformation plan dating back before the pandemic, I am proud of the team’s execution. The results speak for themselves, with broad-based strength across each segment.”

One thing to notice is that RCMT is much more profitable than it was in 2018, when it reported the same level of revenue.

RCMT Revenue, USD

RCMT Diluted EPS, USD

Source: Refinitiv Sentieo

The stock has risen ~45% to $~12.50 since the release of the report.

RCMT is a stock we have followed for a while. In fact, we have archived a few pieces of research on RCMT

- December 2014 Reasons for tracking note – Stock was $3.31

- March 2015 follow up article on Activist Investor taking stake – Stock was $4.51 at the time of publication

- Turnaround stalled

- Reached a peak price of $5.45 in December 2014(closed out 11/2018 at 4.53)

- September 2019 contributor article – Stock was $2.86 when published

We certainly want to reconnect with RCMT’s management team to understand if the blowout Q4 results that crushed analyst estimates have set a new barometer for the company or will their quarterly financial performances revert back to exhibiting unpredictable and volatile results. We also want to understand why the first turnaround attempt did not occur on the timeline initially expected. The challenge with RCMT is that the company operates 3 divisions.

- Engineering – range of engineering services

- Specialty Healthcare – Focus on staffing

- Life Sciences and Information Technology – Focus on staffing

Applying a P/E of 25x to RCMT Q4 EPS run-rate would imply a price target of $34.00 and even $20.40 if we use a P/E of 15x.

A staple of our research is reviewing conference call transcripts related to quarterly earnings reports to gain more insight into company and industry trends. The Q4 RCMT CC was a clinic in the type of information we look for. We were particularly interested in learning about trends in RCMT’s outsourcing staffing business since we are currently in the process of breaking down two companies in this industry: Mastech Digital, Inc (AMEX:MHH) and Tsr, Inc. (NASDAQ:TSRI).

A key take away from the RCMT conference call is that the demand for outsourced staffing growth trends is ripping higher, particularly in the IT and pharma markets. And quite honestly, this makes perfect sense. The U.S. is sitting at its lowest unemployment rate since late 1960’s, wages are increasing, the percent of the population over 55 is growing, the work from home and GIG trends (propensity to not seek full-time employment) are changing things up, immigration to the U.S. is at a low point and the participation rate of people actually looking for jobs is rapidly falling.

For example, work for Uber or work for the boss?!

Add to that, technology is changing at a blistering pace. This all means that it’s getting harder and harder for companies to find qualified employees to fill skilled positions. To put it bluntly, it’s a total mess. So, instead of taking on the task of beefing up their own recruitment team, they are leaning on companies that are experts at finding qualified employment candidates.

So, let’s take a moment to review the bullish trends affecting the staffing industry from the point of view of RCMT’s Executive Chairman, Brad Vizi. The following passage is somewhat lengthy, but it’s worth the read and should get you excited to want to learn more about RCMT (staffing division), MHH and TSRI:

“Starting with the great talent shortage many industries are experiencing as of late. This problem is one that cannot be solved overnight. To illustrate the scale of this dilemma, consider the following: first, core demographic trends are putting tremendous strain on our clients to source talent as the baby boomer generation drops out of the workforce. This dynamic is compounded by the multi-decade decline in birth rates seen across many developed economies and the reduction in both high skill and low-scale immigration.

These trends were all accelerated by the pandemic and exacerbating labor shortages facing many companies today. There just aren’t many scalable solutions to backfill the decline in working age population demographics facing the workforce today. Adding it all up, here’s the sobering math behind this new reality. Since the start of the pandemic, labor force participation rate of workers, aged 55 and over has remained well below the pre-pandemic levels and has equated to approximately 2 million less workers today.

The overwhelming majority of this age cohort are represented by baby boomers who are retiring from the workforce altogether. Hypothetically, natural population growth and immigration would be able to backfill and offset these lost workers. But in reality, both are actually contributing to the shortage. In 2021, the U.S. population grew just 0.1%, its lowest rate since the nation’s founding with the working age population actually declining.

As it relates to immigration, there are about 2 million fewer working-age immigrants than there would have been if pre-pandemic trends continued. The takeaway is clear. As the labor market swings for abundance to scarcity, the process of sourcing, securing and retaining talent for organizations is becoming a strategic asset of the highest priority. That is where we come in. At RCM, we have the expertise and know-how to help our clients excel in all three facets.

One example can be found in our Life Sciences and Information Technology Group. Our scalable talent solutions in helping clients in mission-critical industries to meet the demands of this quickly changing and dynamic labor market. Our teams are innovating in the delivery of these services in an RPO model that is resonating with our client base. We handle the talent sourcing and recruitment efforts for our clients, so they can focus on providing value-add products and services to their end customers.

The wide-scale adoption of the RPO model represents a $5.5 billion plus market opportunity and is quickly gaining steam within a fast-changing labor market where demand for talent is outstripping supply. This model is a win-win for RCM and our partners as it represents a more holistic solution for the client and has enabled us to establish longer-duration contracts with blue chip customers across health care, pharma and life sciences.

Not only are we helping our clients address the talent shortages of today, but we are also remaining focused on cultivating the next generation of talent tomorrow. This process starts and ends with assisting our clients to address the unique problems facing our youth today. As we are all aware, the country’s social infrastructure was already under stress leading up to the pandemic, but that stress has only exacerbated as our country exits from them. The stress has been particularly acute for our youth. From learning loss to declines in social-emotional development, the direct and indirect impact the pandemic has had on children across the country is now becoming clear. Here are a few statistics that highlight the overall magnitude of the problem.

From a learning loss perspective, the average child in grades first through six are five months behind in math and four months behind in reading. If unaddressed, these learning gaps will compound through time as many parents and schools are reluctant to hold back an entire cohort of children. As children struggle in the classroom, it is no surprise this has an impact on kids social and emotional well-being.

Parents across the country are concerned for their child’s mental health as they are seeing increased rates of anxiety and depression. According to surveys, 35% of parents said they were very or extremely concerned about their child’s mental health. Unfortunately, we are also seeing an absolute uptick from pre-pandemic rates in children’s anxiety, depression, social withdrawal, and self-isolation to the tune of 5%, 6%, 8% and 7%, respectively. Meanwhile, the capacity to assess and test children for issues related to mental and behavioral health have declined by approximately 6% compared to 2019. These trends are clearly not sustainable. That’s why our health care team is leveraging their 40-plus years of experience and leading position in the education end market to help solve what I believe might be one of the least talked about crises our country faces today.

The persistent development gap our youth faces as we recover from the pandemic. We are helping parents and schools across the country on a variety of fronts to address the problems facing our youth today. First, our team has done an excellent job of keeping kids in school by scaling up their testing business by partnering with several of the largest testing companies in the country.

Second, our therapy and behavioral health programs are thriving as we ensure schools and students have the necessary skilled support to help reverse the social-emotional fallout that resulted from the pandemic.

Lastly, we are helping teachers in the classroom, address the learning gaps by providing enhanced instructional and supplemental support through the expansion of our par educators and RBTs into the classroom. Given the diversity of our solutions and capabilities, we are quickly becoming the strategic partner of choice for school districts across the country. We facilitate students being in the classroom, eight teachers and having the resources to improve students’ educational outcomes and make certain districts have the necessary behavioral and supplemental support to ensure their student population thrive in the future.”

So, it’s obvious that the demand for outsourced staffing should remain strong for years to come. However, if you are going to begin researching this industry category you need to understand that there is risk in that a huge key ingredient to the success of a staffing firm is hiring full-time recruiters to help customers find employees. And it can be expected that the cost that companies like RCMT, TSRI and MHH have to pay to hire recruiters is going up as demand for their expertise rises. Think of the problem as a supply chain risk.

And far as MHH goes, we also have some history:

- December 2012 – Added to GeoBargain list at $2.30 (prices adjusted for spec divd/splits)

- October 2015 – Added to our position based on Hudson global acquisition

- March 2017 – Closed long position, the stock had early success, more than tripling from our initial disclosure before retracing and closing out at ~50%.

- July 2017 – Acquisition of Info Trellis brings MHH back on our radar

- February 2018 – Re-established long position at ~$5.18

- March 2018 – Added stock to our Favorite Model Portfolio

- July 2019 – Removed from long disclosure screen with stock at ~$5.36, after reaching a high of $11.49 in September 2018

- April 2022 – Back in focus with strength in IT Staffing segment

On April 11, 2022, we published an updated MHH report which premium member can see here.

Now, on to TSRI. TSRI is a leading staffing company focused on recruiting Information Technology professionals for short- and long-term assignments, permanent placements, and project work.

On February 14, 2022 we mentioned that TSRI entered our high priority research funnel. The company had recently reported strong Q2 results, leading the stock to rising ~75% in 14 days to highs of $15.28.

- Q2 sales of $23.8 million vs $16.0 million in the prior year

- Q2 EPS of $0.12 vs loss of $0.13 in the prior year

However, shares quickly pulled back to low ~$9.00, prompting us to add the stock to our research funnel.

In early March I interviewed CEO Thomas Salerno and CFO John Sharkey and only now were able to get management to commit to a fireside chat to be hosted on Geo on April 20 (meeting premium calendar here).

I actually started preparing pieces of TSRI DD for an eventual article two weeks ago. Unfortunately, TSRI rose ~40% on Thursday and Friday last week, with shares hitting a new high at $15.62, before closing at $13.54. Applying a generous P/E of 25x to TSRI’s annual run-rate EPS based on Q2 results would imply a price target of $12.00 vs. its current price of $13.54.

However, we still think this fireside will be helpful for a few reasons:

- Give us additional insight to an industry we currently like

- MHH has still not run yet and RCMT could have plenty of upside left, even after the sharp rise in its share price. So, it will be helpful to gain any tidbits of information that could help us gain some insight into an industry of comps we are interested

- Maybe we will walk away from the fireside chat with a feeling that TSRI’s quarterly EPS run-rate can accelerate (we believe the chances of this are good)

- Finally, maybe TSRI will pull back again

In preparation for the upcoming TSRI fireside chat, let’s take a first look at the company, based on my cliff notes from my chat with the CEO and CFO a few weeks ago.

————————–

TSRI CEO and CFO Interview Cliff Notes are available to Premium Members here. Apart from being able to access these in-depth cliff notes