In our February 9, 2016 email we stated we were working on financial modeling for BG Staffing Inc Common Stock (AMEX:BGSF) ($12.50), taking into account the company’s last earnings report and the full impact of the company’s recent acquisition of D&W (February 27, 2015) and VTS (September 28, 2015) . Our analysis, after factoring in these acquisitions and management’s growth assumptions, lead us to believe that pro-forma 2016 sales and EPS could exceed analyst estimates. In this update, our model confirms that analyst estimates will likely need to be increased for 2016. Current estimates for 2016 sales and EPS are for $249.0 million and $1.05 EPS respectively. Our estimates for sales and EPS in 2016 are $260.5 million and $1.26 respectively compared to 2015 GAAP results of $217.5 million in sales and EPS of $0.70.

A Message from Maj Soueidan, Co-Founder of GeoInvestingIn our more recent articles, we are taking more of a focus on our in-house financial modeling. The GeoTeam performs this task on companies that have announced contracts, acquisitions or other developments. We try to provide investors with a glimpse of how such events will impact sales and earnings going forward before the rest of the market/analysts digest them. This often gives us a chance to make a buy or sell decision in advance of the “crowd,” decisions we alert our members to. We have provided financial models over the last few months with greater frequency than we have in the past. Today, with continued focus on our financial modeling, we are releasing a complementary internal financial model to the public on BGSF, a staffing company that made two acquisitions in 2015, where analysts still have not baked in their positive impact to sales and earnings per share. If you have stocks that you would like us to model for you or if you want to receive all of our financial modeling alerts, I encourage you to subscribe for your membership here. If you are not ready to subscribe, feel free to learn more about how I believe GeoInvesting can enhance your investment returns and reduce the time it takes you to perform stock research by Opting in to our Newsletter Here, (you can opt out anytime). |

BG Staffing Financial Analysis

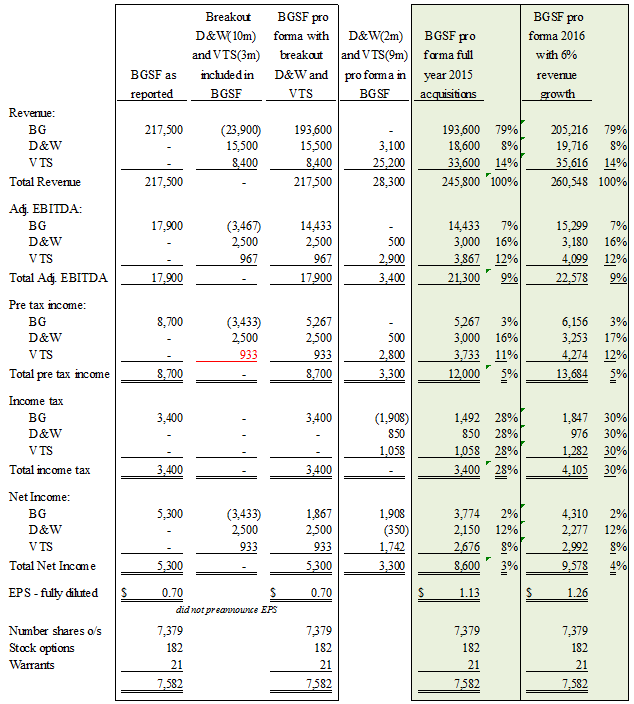

The following chart reflects BG, as pre-announced for fiscal 2015 (column 1) together with an estimated breakout (column 2) of D&W (10 months) and VTS (three months) for results recorded during the year after the acquisitions. The impact of the pro forma contributions of D&W and VTS during 2015 prior to the acquisitions is reflected in column 4 with pro forma combined results for 2015 in column 5. Estimated results for fiscal 2016 using the company’s assumed revenue growth rate of 6% and estimated EBITDA and net income ratios based on 2015 results. Note, we used an effective tax rate in line with the pro forma combined data provided by the company for 2015.

In BGSF’s February 1, 2016 press release that pre announced unaudited financial results for the fiscal year ended December 27, 2015, the company included combined results that included two companies acquired during 2015; D&W (February 27, 2015) and VTS (September 28, 2015). The release also included pro forma combined results for 2015 and 2014 for BG with separate breakouts of results for D&W (2 months) and VTS (9 months) that took place in 2015 prior to the acquisitions. The financial data provided by the company included revenue and a reconciliation of pro forma Net Income to EBITDA. The reconciliation included an income tax provision for BG but not for D&W and VTS. We therefore allocated the tax provision pro rata to the three companies based on their respective revenues.

Although the company did not pre announce 2015 EPS, using BG net income included in the data provided in its pro forma combined presentation of $5.3 million and the shares outstanding in Q3, we derived 2015 EPS of $0.70. On a pro forma combined basis, we estimate EPS would have been $1.13 had the acquisitions of D&W and VTS taken place effective at the beginning of fiscal 2015. Finally, if revenues grow at 6% in 2016 and the 2015 ratios of EBITDA, effective income tax rate and net income are consistent with 2015’s performance, the company should generate around $1.26 EPS in fiscal 2016.