This week we are giving a shout-out to Arham Khan (@arhamgrowthcap) for his August 11, 2020 gutsy buy the dip Call to Action on Alteryx, Inc. (NYSE:AYX). On August 7, 2020 shares of AYX dropped 28% in one day to $121.51 and by August 10 the stock closed at $109.27. Arham published an article on Geoinvesting the next day, August 11, to highlight why he thought investors were overreacting to Q2 financial results that missed estimates and were weaker than expected guidance.

On October 5, 2020, the stock shot up 28% to close back to $145.96 when the company raised its sales outlook and named a new CEO. We wanted to highlight Arham’s call because it fits right in with one of our model portfolios.

The Buy On Pullback Model Portfolio series was launched in January of 2016. It generally takes advantage of:

- what we believe are overdone drops in certain stocks in our coverage universe due to market turmoil or misunderstood reactions to company news.

- situations where a stock hasn’t risen in reaction to really good news, a common theme with micro cap stocks.

The portfolio is designed to provide you with shorter to medium term opportunities. Even though we are primarily longer term investors, we don’t mind surrounding this focus with short term opportunities when they arise. We also understand that some of you may be more focused on shorter term opportunities. We believe it’s to our advantage that because we’ve been running Geoinvesting since 2007, we have a large number of tier one quality companies in our coverage universe, which can offer us a steady pipeline of stocks to include in these pullback portfolios. We believe our level of familiarity with potential inclusions in the portfolio increases the chance of success.

The returns of these model portfolios have been very favorable across the board.

- 18.88% (chart)

- 21.94% (chart)

- 132.77% (chart)

- 52.23% (chart)

- 13.04% (chart)

- 80.07% (chart)

- 31.17% (chart)

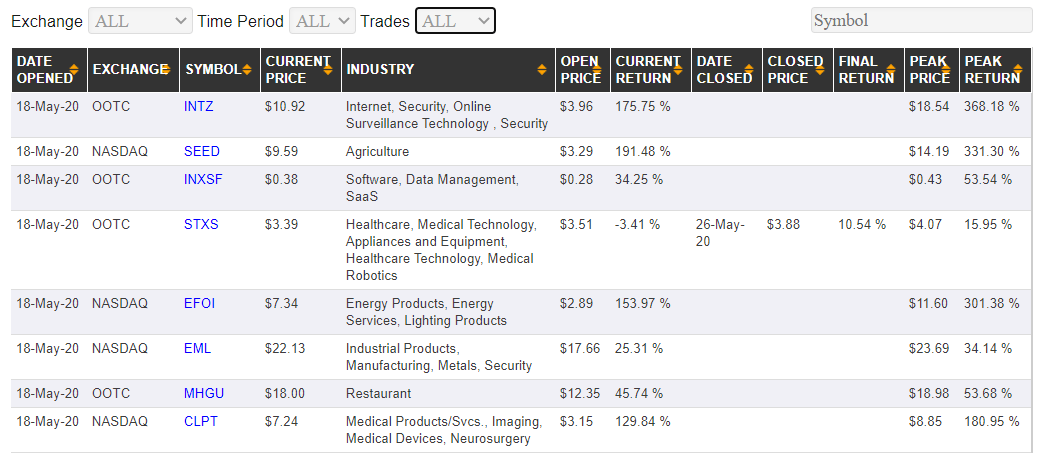

On May 18, 2020, we launched the 8th Buy On Pullback Portfolio which has performed remarkably well:

As you can see, we included a total of eight stocks in the portfolio, closing out medical device company Stereotaxis, Inc. (OOTC:STXS) on May 26, 2020 when we became annoyed that management raised money by issuing new stock… again!

The cumulative return of the seven remaining open stocks plus the closing return of STXS is currently 766.88%, for an average return of 95.68%. We are reviewing the seven open positions and the portfolio as whole to determine the next course of action: either close a few more positions or launch Buy on Pullback Portfolio #9.

GeoInvesting Weekly Premium Email and Call To Action Updates (Oct 19 – Oct 23)

Weekly Wrap Up Summary…

I also want to briefly talk about a Tier One Microcap that we have been seriously following since December 2017 that we believe is about to reach a sales and margin inflection point. The stock is also in one of our core portfolios that was home to Repro Med Systems, Inc. (NASDAQ:KRMD) (up 2583%) and many other GeoInvesting multibaggers.

To find out more about this stock and what else we covered in the past week, log in below with your Premium Account to continue reading.