The GeoTeam is continually looking in places where others fear to tread, like the OTC Markets. The OTC Markets have a well-deserved reputation for hosting more than their share of questionable companies. However, on rare occasions legitimate OTC gems fly under the radar largely ignored by Wall Street. If you can identify such companies before the Street, you have a good chance to realize outsized gains. Finding “under the radar” investments necessitates the need to perform extensive due diligence. Often, the adage, “if it seems too good to be true, it probably is” comes into play with lesser known stocks on the OTC that look good at first glance.

The GeoTeam has identified a number of outstanding OTC investments for our premium members including Costar Tech Inc (OOTC:CSTI) and Pacific Health Ca (OOTC:PFHO), up over 200% and 1100%, respectively, since we identified them. It’s an added plus when we find management teams with pedigree and proven track records that put the maximization of shareholder value as a top priority. Considering these criteria, we believe we have found another Pink Sheet gem in ALJ Regional Holdings, Inc. (PINK:ALJJ).

ALJ’s management team has a proven track record of acquiring undervalued assets, turning businesses around and growing shareholder value. The company has grown from virtually nothing in 2002 to a powerhouse that could generate $175 million in revenues and $25 million EBITDA in the next 12 months. Ultimately, we think the stock is on its way to trading north of $7.50.

Acquisition and Sale of Kentucky Electric Steel, LLC

ALJJ’s journey, as well as the promise it offers to investors, effectively began in September 2003 when it invested $125,000 to acquire a 1.00% membership interest in KES Holdings, LLC, which was formed to acquire certain assets of Kentucky Electric Steel, Inc. (“KES”), consisting of a steel mini-mill located in Ashland, Kentucky (the “Mill”). The Mill had been in operation for nearly 40 years, but under previous ownership and after several years of financial difficulties, the company ceased production in December 2002. Its owners filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in February 2003. In September 2003, KES acquired the Mill’s assets for around $2.7 million. Following the acquisition and under new management, the Mill was refurbished and operations were restarted in January 2004. The Mill was soon profitable and operating at 101% of its capacity of 200,000 short-tons per year.

ALJ increased its stake in the Mill to 80% in March 2005 for consideration that included $40 million in promissory notes and non-convertible preferred stock with a liquidation value of $25 million. Management steadily grew the Mill’s business and, in the fiscal year ended September 30, 2012, it generated around $160 million revenue and over $13.3 million net income.

ALJ’s management has a simple philosophy regarding once undervalued assets that somebody else wants to buy: everything is for sale at the right price.In the fall of 2012, ALJ received an unsolicited offer to sell the Mill. ALJ’s management set the right price at which they were willing to sell and the buyer, Optima Specialty Steel, Inc., eventually met that price.

In February, 2013, the Mill was sold to Optima for $114.4 million. As a result of the transaction, ALJ recorded a gain on the sale of KES of $76.8 millionand a further gain on the settlement of minority interest of $10 million. After satisfying all liabilities related to KES, ALJ increased the cash on its balance sheet in February 2013 to approximately $52.6 million.

Shareholder Friendly Management

The GeoTeam is drawn to management teams that allocate capital to shareholders by executing share buybacks, paying dividends or by other means. Within weeks of selling the Mill, ALJ started putting its cash hoard to work for its shareholders. The Company repurchased 30 million shares of its common stock in a modified “Dutch auction” tender offer at $0.84 per share, about a 100% premium to the then current share price, for a total consideration of $25.2 million, leaving $27.4 million cash and short term investments at March 31, 2013.

As astute of an acquisition and sale of the Mill was, management’s repurchasing 50% of ALJJ’s outstanding shares was also a great move for shareholders, since the shares have recently traded at $3.50 only 18 months after the transaction. And, management recently announced another share buyback program that will be executed as market conditions and working capital allow.

Management’s track record of maximizing shareholder value gives us confidence that they will keep dilution to a minimum, while executing an accretive acquisition strategy.

When Opportunity Knocks, ALJ Answers

ALJ is industry agnostic in executing its opportunistic M&A driven growth strategy. Following the sale of the steel mill and share buyback, ALJ management continued to execute its strategy perfectly by acquiring two undervalued and promising businesses:

Acquisition of Faneuil, Inc.

In October 2013, ALJ acquired 96.43% of the capital stock of Faneuil, Inc. (3.57% acquired by Faneuil’s CEO) from Harland Clarke Holdings Corp. for aggregate consideration of $53.0 million, consisting of $25.0 million in cash, a contribution of $500,000 in cash for working capital purposes, 3,000,000 shares of ALJ common stock valued at $2.5 million (now worth around $10 million) and a seller note for $25.0 million.

Faneuil is a leading provider of outsourcing and co-sourced services to both commercial and government entities in the healthcare, utility, toll and transportation industries. At the time of the acquisition, Faneuil was generating around $110 million annual revenue and $10 million EBITDA. One of the considerations in acquiring Faneuil is that ALJ’s management felt they had a more focused perspective for executing a controlled growth strategy over time, rather than being unduly influenced by quarter to quarter performance.

Adding intrigue to the ALJ story is billionaire investor Ronald Perelman’s involvement. Harland Clarke is a wholly owned subsidiary of MacAndrews & Forbes Holdings Inc. MacAndrews & Forbes is a diversified holding company that’s wholly owned by Ronald Perelman. The company holds interests in both public and private companies, and serves as Mr. Perelman’s primary investment vehicle. Mr. Perelman did not just sell Faneuil and walk away – he specifically wanted a piece of ALJ and ended up with 10% of the company. He also obtained the right to designate one of his representatives as a member of ALJ’s board of directors. His 3 million shares of ALJJ are now worth over $10 million, which is certainly worthy of his attention. In fact, we understand that Mr. Perelman provides input and counsel to ALJ’s board of directors on a regular basis.

Acquisition of Carpets N More

Continuing to demonstrate that ALJ is indeed industry agnostic, effective April 1, 2014, ALJ acquired all of the equity interests of Floors-N-More, LLC, dba, Carpets N’ More (“Carpets”) for around $5.25 million plus $240,000 invested. Carpets is one of the largest floor covering retailers in Las Vegas and a provider of multiple products for the commercial, retail and home builder markets, including: all types of flooring, countertops, cabinets, window coverings and garage/closet organizers. The company has five retail locations, as well as a stone and solid surface fabrication facility.

Carpets was a $100 million revenue business before the Las Vegas real estate crash around 2008. The company’s management proved itself to be flexible and adaptable, growing market share during the downturn by shifting to more commercial business. Although Carpets is not near $100 million in revenue now, this remains an opportunity for the company going forward, since the current annual run rate is only about $35 million. Since the acquisition, two of four stores have been upgraded to a more upscale look and premium offering. Two other stores are currently being updated.

It’s Not Too Late…

The Market is following ALJ’s lead

As the ALJ story has developed during the past two years, ALJJ’s share price has followed in stair-step fashion, as indicated by the below chart. The following events have driven the value of ALJ’s shares higher:

If you look in the rearview mirror, it could appear that ALJJ’s share price has already “made its move.” That perspective, however, misses what we believe to be a significant opportunity moving forward. We are focused on what ALJ is today, and where we think it is going next. We believe ALJ’s share price could increase over 100% from current levels, to around $7.50 in the near team. In short, we think ALJ’s growth is only just beginning.

ALJ’s Current Business Segments

ALJ has organized its business along two reportable segments together with a corporate group for certain support services. The current segments, as we described above, are Faneuil and Carpets N’ More.

Faneuil’s Business

Faneuil provides multi-channel customer contact center solutions focusing on high profile, highly regulated clients. Utilizing advanced applications and a workforce of approximately 3,000 service professionals, the company manages more than 425 million customer interactions a year. As disclosed in ALJ’s public filings the products and services offered by Faneuil are:

- Contact Center Operations: Faneuil operates multi-channel customer care centers staffed by 50 to 500 employees in several states. Contact center clients include several toll authorities, a health benefit exchange, a multi-state utility, municipalities, an agency that operates two major airports serving the Washington, D.C. area and several other government and commercial entities. Toll collection services and health benefit exchange represent the majority of these services:

- Toll Collection Services: Faneuil provides manual and electronic toll operations services to many state and municipal state transportation authorities. The company’s services go beyond traditional call center capabilities with expertise in violation processing, violation court support, fulfillment, front counter support and transponder sales and inventory. Faneuil offers both turn-key operations in which it assumes complete responsibility for every aspect to targeted applications to supplement the client’s operations. The company is the largest outsource provider of manual toll collection in the US.

- Health Benefit Exchange: Faneuil supports the Washington State Health Benefit Exchange by providing contact center services and CRM development. The operation was opened in September 2013 and includes a dedicated operation in Spokane, Washington and overflow operations in a multi-client site in Virginia. The company was also selected by the State of Tennessee in October 2013 to operate its TennCare member services center.

The nature of Faneuil’s business requires a protracted selling process (six months to a year or more) to win new clients, but once established, the relationships tend to be very “sticky”. For that reason, the company generates a solid and reliable revenue stream that should grow consistently over time. According to management, Faneuil has a longstanding reputation for, and record of excellence in, meeting its clients’ needs. As such, it has an almost perfect track record for client retention.

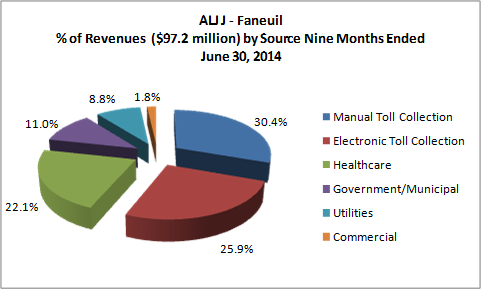

The following chart shows the percentage of revenues by source that Faneuil generated in the nine months ended June 30, 2014:

Note that toll collections and related services accounted for over 56% of Faneuil’s revenue during the nine months ended June 30, 2014. We referenced nine months of financials because the company has only provided preliminary Q4 guidance. The fact that nearly half of the company’s toll collections revenue comes from electronic toll collections speaks to management’s ability to adapt to an ever changing business environment including more traffic utilizing E-Z Pass and other similar services.

Faneuil’s website describes its electronic toll operations as follows:

As the introduction of technological advances has continued within the toll industry, we have expanded our proficiencies to include electronic collections as more tolling authorities have invested in the required infrastructure. Faneuil’s full complement of automated services is all-inclusive — from turn-key operations in which we assume complete responsibility for every aspect, including management, staffing, systems, customer care, and transponder sales and distribution, to targeted applications in which we supply specific components to supplement a client’s own operation.

And though automated collections are by nature transacted without direct human interaction, we are no less attentive to service quality, particularly when we have opportunities to provide one-on-one assistance to customers who may be purchasing transponders or replenishing their account balances, for example.

For two consecutive years, our SunPass prepaid electronic toll system, which we operate in partnership with the Florida Department of Transportation to serve travelers along the state’s turnpikes, was honored by national research giant J.D. Power and Associates for service excellence, based on consumer satisfaction and quality ratings.

Faneuil has plenty of room to grow. The company’s growth opportunities come through seven different verticals that the sales force is focused on. Currently, the company provides toll collection services in 10 states, with Florida as its largest account. We believe success in those states will inevitably lead to opportunities to offer toll collection services in other states. On the healthcare side of the business, Faneuil provides health benefits exchange services in Washington and TennCare member services in Tennessee. Those success stories are referenceable accounts that will help sell similar services to other states.

As you can see from the above pie chart, the company’s exposure to commercial opportunities is minimal, leaving a lot of room for growth. Additionally, many companies that previously outsourced customer services offshore are now moving those operations back onshore.

ALJ is an active owner/operator of its businesses. It supports Faneuil’s growth initiatives in positive and meaningful ways:

- ALJ staff has regularly scheduled meetings with Faneuil’s senior management for strategic planning and growth strategy sessions.

- Time and resources have been invested in the sales force.

- The implementation team has doubled since the acquisition. Being nimble and having the ability to quickly respond to client needs is one of Faneuil’s competitive edges. The company is able to set up call center operations in half the time it takes competitors like Xerox, IBM and Cubic.

- ALJ refinanced debt and secured a credit facility to provide capital to support future expansion.

In addition to benefiting from ALJ’s guidance and support, Faneuil is also getting a tailwind from a number of key macro industry trends, including the fact that more companies are outsourcing call center operations. Although the majority (78%) of the $300 billion spent each year on call center operations in the US each year is handled in-house, 22% of $66 billion is spent on outsourced customer service solutions. In addition, those outsourced operations are not just being placed offshore anymore. Growth of onshore outsourcing of call center operations in the US has averaged around 10% for the last four years. According to the Information Services Group, there are five drivers behind the shift in spending patterns to more outsourcing:

- Performance improvement by service providers

- Significant cost reduction potential

- Growing executive-level acceptance of outsourcing as a business practice

- Declining in-house capabilities

- Rising customer demand for multiple support channels

All of these factors should favorably impact Faneuil for years to come.

Carpets N’ More

ALJ began including the results of Carpets N’ More (“Carpets”) in its operating results effective April 1, 2014. We have very limited operating history for Carpets but we know that the macro trends, particularly real estate in Las Vegas, will most likely provide a tailwind for the company’s carpets and flooring business. The flooring industry is driven by a combination of renovation and repair as well as new installations. Renovations, repairs and new installations are heavily impacted by real estate sales and the real estate market in Las Vegas has recovered from the 2008 crash to reach a level of normalcy. Recently, there have been fewer cash purchases of investors turning the homes into rentals and more by owner occupiers. These trends bode well for the carpet and flooring business in the Las Vegas area.

Assuming a stable real estate market in Las Vegas (the third best real estate market in the US last year), Carpets should make steady progress, especially with ALJ’s management and resources involved. ALJ has only had control of the business since April 1, 2014, and it has already upgraded two of five stores, and two more are currently being updated. Recall that the steel mill ALJ management acquired out of bankruptcy was back online, generating revenues and profits in less than six months after it assumed control of the business. Expect them to also put their stamp on Carpets as well, resulting in marked improvement in both top and bottom line performance.

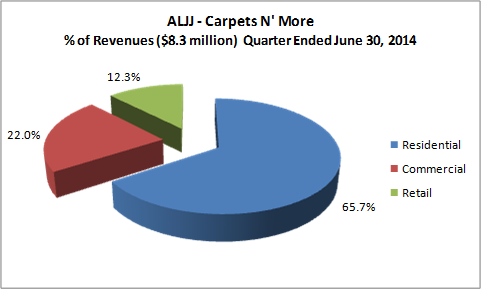

Investors should note that unlike the steel mill, Carpets is not starting from a distressed state. In fiscal QIII ended June 30, 2014, the only period for which we have full operating results, the company generated $8.3 million revenue (followed by $8.1 million to $8.5 million revenue guidance for fiscal QIV), $665,000 EBITDA and $563,000 operating profit. The following chart shows the sources of Carpets’ revenues. Note that Commercial accounted for 22% of revenues. That is an area Carpets’ management grew during the real estate recession that began in 2008. The value of the market share gained during the recession will be amplified as the economy and housing market in Las Vegas improves.

New M&T Bank credit facilities provide growth capital and reduced interest costs

On October 2, 2014, ALJ announced the refinancing of its debts and revolving credit facilities with M&T Bank. We believe the combination of the refinancing and paying down debt will reduce annual interest expense costs by up to $1 million from where they otherwise would have been. The key components of the new financing arrangement are:

- $25 million note payable to Harland Clarke, Inc.: When ALJ acquired Faneuil Inc.; part of the consideration was a $25 million note payable to the seller, Harland Clarke. The note was scheduled to accrue interest at 7.5% and was due in full in October 2015. Under the new financing arrangement with M&T, the loan amortizes over 60 months and accrues interest at Libor (recent 1-year Libor .57%) plus 3.75% (around 4.3%) declining to Libor plus 2.5% upon meeting certain ratios. Investors should note that at the time of the refinancing the balance due on the note was $21.6 million and ALJ paid that balance down by another $2.6 million to $19 million with cash on hand. That means in the year since the acquisition of Faneuil in October 2013, cash flows from operations allowed ALJ to reduce the note balance by $6 million. We estimate the combination of reduced principal and the lower interest rate on the loan will reduce annual interest costs by around $1.0 million. Also, amortization of the loan over 60 months avoids a balloon payment in October 2015 giving ALJ more financial flexibility and growth capital.

- Revolving lines of credit for Faneuil and Carpets: Faneuil refinanced its $5 million Senior Credit Facility and Carpets executed a $3 million facility with M&T. The “revolver” credit facilities will provide working capital as needed from time to time for the businesses.

- $2 million term loan due to Libra Securities: ALJ refinanced its related party note due to Libra Securities with M&T. The new loan amortizes over 30 months plus accrued interest of Libor plus 3.75%. The original note accrued interest at 10% and was due in full in April 2019.

The consolidated financing arrangements with M&T Bank lend credibility to the ALJ story. Clearly, M&T would have done extensive due diligence before offering such financing under favorable terms. ALJ management is smart, prudent and conservative. Management acquires businesses at bargain prices, turnaround and grow the businesses and put them on solid financial footing. Given management’s track record we believe the consolidation of financing with M&T puts ALJ in a strong position as management grows and leverages the Faneuil and Carpets businesses likely leading to future acquisitions of other businesses at deeply discounted prices.

Net Operating Loss (“NOL”) Carryforward

ALJ has a net operating loss (“NOL”) of $80 million that will cover the income tax liability on the next $180 million of taxable income. The company had a $300 million plus NOL from the steel mill and has realized $220 million of that benefit. The remaining NOL should cover profits for at least the next several years giving the company the ability to accumulate and deploy substantially more capital than otherwise would have been available if income was fully taxed.

Caveats

With every investment opportunity there are both potential rewards and risks. In ALJ’s case there are indeed risks or caveats but there are also mitigating circumstances, including independent due diligence by a major bank and investor (Ron Perelman’s holding company), and a concentration of share ownership with key players that gives us comfort.

- Lack of current and historic financial statements: We based our annualized projections on the financial results reported for Faneuil and Carpets for fiscal QIII ended June 30, 2014. We used these because QIII is the only period for which we have full operating results for both companies at the same time. Revenue guidance has been given for fiscal QIV but full operating results will not be available until the end of December, when the company is expected to file its annual report. Further, we do not have historic operating results for Faneuil prior to its acquisition in October 2013 or for Carpets prior to its acquisition in April 2014. Our projections, therefore, do not reflect the historic or possible seasonal patterns or past aberrations in the performances of Faneuil and Carpets, although we believe our assumptions are conservative and reasonable.

- Concentration of business: One or a few customers have in past contributed a significant portion of revenue to both Faneuil and Carpets.

- Faneuil has long standing relationships with many of its significant customers. Customers generally contract with it for specific projects or programs with a specific durations (typically 3-5 years). The loss or reduction of any significant contracts would have a material adverse impact on revenue and cash flows if the business is not otherwise replaced. During the nine months ended June 30, 2014, the Florida Department of Transportation accounted for approximately 38% of net revenue, of which $4.1 million was included in accounts receivable.With respect to Florida, Faneuil has three contracts with the Florida Department of Transportation. The smallest of three contracts will eventually be lost once a protest filed over the award of a customer service system that will process electronic toll transactions in much of FL is resolved. A judge s ruling against the protest could arguably seal its fate. We do not see this as a material loss for Faneuil, since we believe ongoing growth of its sales verticals will pick up the slack. Additionally, they both work and compete with the industry’s top players, including Xerox, IBM and Cubic. The contracts Faneuil has with the Florida Department of Transportation are not impacted by the contract award to Xerox. Those contracts are up for renewal in 2015, but regardless, we’re not overly concerned about the segment’s ability to grow business.

- Carpets has four customers that account for approximately 25%, 17%, 17% and 10% of net revenue.

Putting the Pieces Together, Summary & Investment Thesis

We used the operating results from fiscal QIII and revenue guidance for fiscal QIV as the basis for making initial projections for the combined businesses and deriving a range of reasonable valuations for ALJJ. It is clear just from examining the operating results for the three months ended June 30 that the market is not paying attention to the value ALJ management is creating; therein lies the opportunity for investors to start accumulating shares as this undervalued stock continues to fly under the radar.

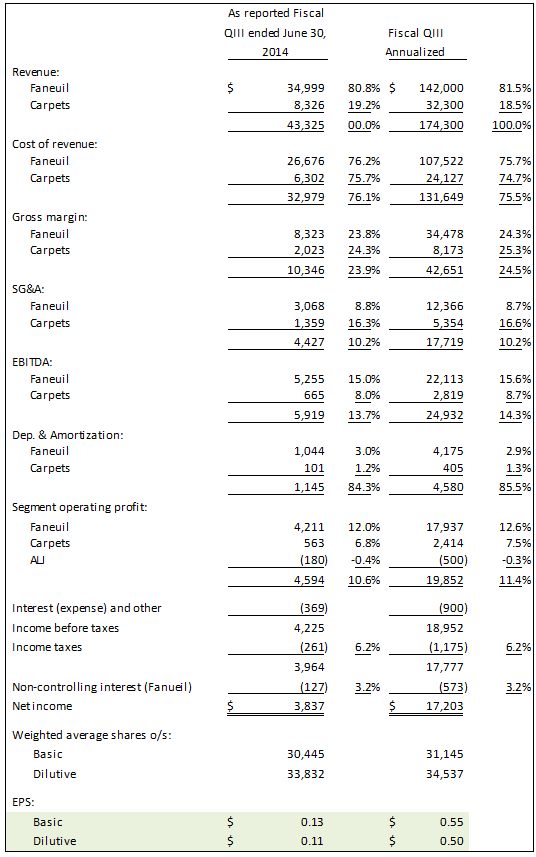

Noteworthy data points for ALJ’s fiscal QIII ended June 30, 2014 operating results include:

- Revenues: $43.3 million including $35 million Faneuil and $8.3 million Carpets

- EBITDA: $5.9 million, $5.3 million Faneuil and $665,000 Carpets

- Operating Profit: $4.6 million, $4.2 million Faneuil, $563,000 Carpets, ($180,000) ALJ Corp.

- Net Income: $3.8 million

- EPS: $o.13 basic, $0.11 dilutive

Revenue guidance for fiscal Q IV ended September 30, 2014:

- Revenues: $42.4 million to $44.6 million including $34.3 million to $36.1 million for Faneuil and $8.1 million to $8.5 million Carpets.

We projected the next year based on QIII June 30 operating results with the following assumptions:

- Next four quarters’ revenue would conservatively be in line with QIII.

- Cost of revenues would decline by 0.5% for Faneuil and 1% for Carpets

- The run rate for SG&A would increase by 1% for Faneuil and decrease by 2% for Carpets

- Depreciation and amortization, and interest expense would continue at the same run rate as QIII

- Tax provision would remain at 6%+. ALJ has an $80 million NOL.

Our annualized projections for the next four quarters indicate:

- Revenues: $174 million including $142 million Faneuil and $32 million Carpets

- EBITDA: $24.9 million, $22.1 million Faneuil and $2.8 million Carpets

- Operating Profit: $19.9 million, $18.0 million Faneuil, $2.4 million Carpets, ($500,000) ALJ Corp.

- Net Income: $17.2 million

- EPS: $0.55 basic (31.1 million shares) , $0.50 dilutive (34.5 million shares)

If our projections are in the ballpark, ALJJ at its recent price of $3.50 would be trading at 6.3X forward fully diluted EPS, 4.4X EBITDA and 0.63X Revenue. We consider that to be undervalued by any measure especially for growing businesses, in promising industries that have new owners who are willing to invest in and fully support operations.

Following are our initial financial projections for Faneuil, Carpets and ALJ for the 12 months beginning July 1, 2014.

Financial Projections for Faneuil, Carpets and ALJ

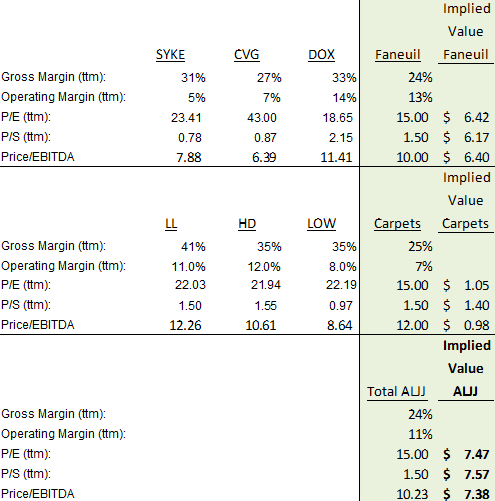

Deriving segment values by applying comparables to Faneuil and Carpets

We believe that, based on current operations, ALJJ would be fairly valued at around $7.50, or 115% more than its recent trading price of $3.50. That valuation is based on Faneuil’s and Carpet’s annualized operating results with the previously discussed modest allowancesfor sequential revenue growth, improved margins and operating and cost efficiencies. The following chart details our valuation assumptions and the comparables used as benchmarks. It was difficult to find direct comparables to Faneuil and Carpets in terms of size and expected growth trajectory but we identified substantially larger companies that compete in the same or similar markets so we have reasonable benchmarks for valuation purposes. Note that while both Faneuil and Carpets have relatively low gross margins, they also have low SG&A costs. Thus, their operating margins are in line with others in similar industries.

Industry Peer Margin Comps

Conclusion

Despite the dramatic upward movements in ALJJ’s share price in the past 18 months, investors should not be distracted or think that they have missed the boat. We believe the ALJ story is only at the “end of the beginning,” and that there are many more chapters to be written. In a sense, ALJ Holdings could be a baby Berkshire Hathaway (BRK.A NYSE), in that it is acquiring disparate and undervalued businesses and building shareholder value over time. Based on what we know about Faneuil and Carpets, we believe a price target of $7.50 is reasonable as the market begins to digest the opportunity ALJJ is offering investors.

Disclosure: Long ALJJ