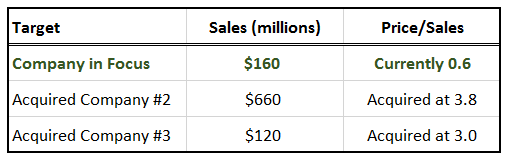

On the heels of a new relationship with IBM (NYSE:IBM), we found a stock that we think has a great chance of being acquired for a price 400% to 500% above its current price. We wanted to hold off on buying shares until we secured a management interview. But the stock started moving. So, in the meantime, we thought that the story, as presented in SEC filings, press releases and CC transcripts was good enough to get some exposure, just in case the stock runs. The target company is one of the top 3 leading companies in an industry that is protecting its customers from breaches in security. Here is a table that illustrates this fact:

On the heels of a new relationship with IBM (NYSE:IBM), we found a stock that we think has a great chance of being acquired for a price 400% to 500% above its current price. We wanted to hold off on buying shares until we secured a management interview. But the stock started moving. So, in the meantime, we thought that the story, as presented in SEC filings, press releases and CC transcripts was good enough to get some exposure, just in case the stock runs. The target company is one of the top 3 leading companies in an industry that is protecting its customers from breaches in security. Here is a table that illustrates this fact:

If you are new to GeoInvesting you might find it interesting that since we launched Geo 10 years ago, over 40 stocks we brought to the community have been acquired. Sometimes, we came right out and stated that our bullish theses were based on the target company potentially being an acquisition candidate. At other times, acquisitions were just a byproduct of investing in management teams building great businesses. Our last bullish acquisition call was in June 2016 when we presented our thoughts on why Golden (old symbol GLDC) could be a great acquisition target. Less than a month later, GLDC’s Board of Directors accepted an offer to be acquired by Utz Quality Foods at $12.00 per share, or 100% higher from our disclosure that we were going long. Now we are hot on the trail of a new acquisition candidate.

|

Asset Class – Common equity |

|

Industry – Security

|

|

Catalysts – Completes last asset sale; Earnings swings to profit; Acquisition thesis becomes more apparent; New relationship with IBM |

|

Market Cap – Microcap with liquidity |

Elevator Pitch On Our Next Acquisition Play

We are very excited about our next acquisition call. But the good news, is that on its own merits, this 17-year-old company has done some great things to put itself in a great position to grow sales and earnings. After 3 years of under-performance, resulting from the company losing focus on its bread and butter business, a new CEO has come in to recapture this focus. He is in the last innings of shedding money draining assets and in the early innings of redeploying capital into R&D and marketing.

Automated stock screens are probably not going to find this stock because on a trailing basis, the company is hemorrhaging money. But moving forward, the business is meaningfully profitable, something we are banking on investors eventually discovering.

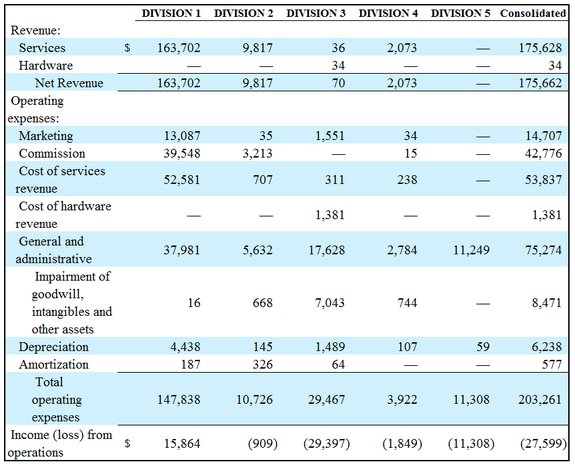

Assets that are now being shed were contributing just shy of 7% to total revenue, but 22% to total operating expenses. Eliminating non-core assets takes the company from a business posting an annual operating loss of $30 million per year to being $16 million in the positive.

Note: Division 1 is the main business going forward.

…

Log in below with your Premium Account to learn more about what this company does and to stay up to date about any conclusions we have drawn from our interview with management, once complete.

Log in below with your Premium Account for the full content.

Last Updated 5/7/2017