We believe short sellers have the winning position in AmTrust Financial Services (AFSI). Owners of AFSI should take careful note of the discussions of consolidation of earnings and valuation of assets that could result in large losses and regulatory scrutiny for the company.

AFSI is a multinational insurance company headquartered in New York City that provides specialty property and casualty insurance to small and medium businesses. AFSI’s primary business lines include worker’s compensation, commercial automobile, general liability, extended warranty, UK legal expense and Italian medical malpractice coverage. The company also invests in life settlement contracts (“LSCs”).

It seems suspicious that a company could take on so many different types of risk while beating consensus estimates for 14 consecutive quarters. We find it difficult to believe that AFSI could quickly enter areas where they had no previous experience and at such a pace without ever missing a step. This has led us to take a deeper look into AFSI’s books and accounting. The SEC has been very active in investigating LSC investments (GWG Holdings is now under investigation), and we think they will be very interested in AFSI’s valuation of LSCs and the reported profits from the LSC portfolio.

In addition to LSC-related mark to market gains, it appears that management is ceding/sending losses to offshore captive reinsurance companies it has purchased since 2009, but not disclosing these losses in SEC financial statements as required.

We will show that AFSI appears to be inflating earnings/net equity via offshore entities, making it difficult for regulators to see the complete picture and/or get accurate information. We think that AFSI could be next in line to face regulatory scrutiny.

Summary of Findings

- A cross section of public documents (AFSI SEC filings, Statutory financial filings by AFSI subsidiaries and Credit Rating information) shows that AFSI appears to be excluding losses of wholly-owned subsidiaries in its SEC filings

- From 2009 to 2012 we believe that AFSI has not disclosed a total of $276.9 million in losses ceded to Luxembourg subsidiaries.

- AFSI seems to be mismarking its LSCs by using egregiously aggressive assumptions relative to peers despite lawsuit documents showing AFSI holds many policies which are probably worthless.

- Applying industry standard discount rates would result in an impairment/markdown of $90-$135 million in AFSI LSCs.

- These findings regarding AFSI’s LCSs are especially troublesome since more than half of the policies held by AFSI are of contracts where Phoenix Life Insurance, (PNX) (see footnote 1) is the issuing carrier / counterparty. Since PNX and/or its subsidiaries are faced with possible bankruptcy, its ability to honor the payout on these policies could be diminished and AFSI’s expected collection on these contracts would be even less than other comparable policies.

- Press releases contain different accounts than those reported in SEC filings, leading us to question the company’s internal controls over financial reporting.

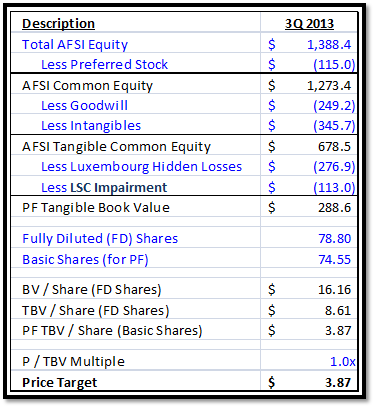

- We conclude that AFSI is worth between $3.87 and $13.00 per share.

Additionally, AFSI CFO Ronald Pipoly & COO Michael Saxon were executive officers at Credit General (“CGI”), a P&C insurance company that was liquidated in 2001 by the Ohio insurance regulator after it was revealed that the CEO, Robert Lucia, had committed fraud via related party offshore entities and stolen $30 million from the company.

Insurance Industry Is No Stranger to Fraud

The complexity of insurance accounting as well as the latitude management teams can use in the accounting for certain items can make it difficult to detect fraudulent or risky behavior. Mutual Benefit (private), EEA Life settlements Fund (private), Absolute Life Solutions (once a public company), and Life Partners Holdings Inc (LPHI) are examples of companies that had their feet in the toxic life settlement insurance sector and whose accounting tricks eventually were detected. This led to a massive destruction of investor capital.

Just recently, shares of Tower Group, Inc. (TWGP) imploded shortly before and after an August 7, 2013 announcement that the company was delaying its 10-Q to reevaluate issues related to reserves, the integration of its Canopius Bermuda merger, and its integration of goodwill and certain tax accounts. The events surrounding these issues led to over $700 million in charges incurred upon TWGP and a credit rating downgrade by insurance rating agency A.M. Best.

AFSI 101

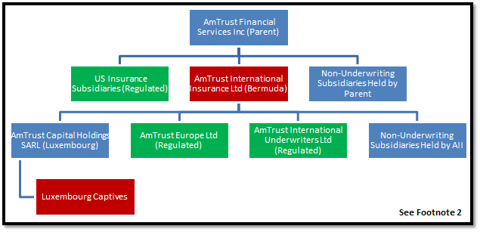

In order to understand AFSI, it’s important to comprehend its organizational structure, summarized below:

The subsidiaries (or groups of subsidiaries and parent) in blue do not directly participate in insurance underwriting. The subsidiaries (or groups of subsidiaries) in green are AFSI’s regulated insurance subsidiaries which can write policies directly. The subsidiaries (or groups of subsidiaries) in red are “captive” reinsurance subsidiaries.

Regulatory and Accounting “Arbitrage”

A captive reinsurance company is wholly owned by an affiliated entity (in AFSI’s case, the parent) to insure the risks of its other insurance subsidiaries under the same corporate umbrella. Captive reinsurance subsidiaries are used to shift profits to lower tax jurisdictions or to reduce capital requirements. By using captives, they need to have fewer reserves to pay out policy holders that need to collect, and can instead take more risk than they otherwise could if they stayed at home.

Since AFSI voluntarily gave up the tax benefits associated with this structure (see footnote 3), we guess the benefit for AFSI is capital-related. We believe AFSI is interested in Bermuda in order to shield operations from the view of investors, regulators and ratings agencies.

The Luxembourg Cookie Jar

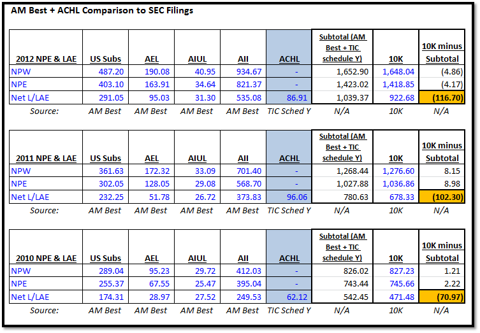

AFSI uses an offshore captive reinsurer called AmTrust International Insurance (“All”) in Bermuda to off lay of more than half of its contracts. We believe it is doing this not only lay off the risk, but to in effect hide the eventual losses from this risk. Under All sits a Luxembourgian domicile captive insurer called ACHL. We believe AFSI is using this web of subsidiaries to move bad policies and conceal losses. Here is a snapshot showing loss and premium information from 2010 through 2012 comparing AFSI SEC financial information to AM Best data and a statutory filing from (Schedule Y) of one of its wholly owned subs, Technology Insurance Company (“TIC”).

Table Items Defined:

NPW = Net Premiums Written

NPE = Net Premiums Earned

Net L/LAE = Net Loss/Loss Adjusted Expense

AEL = AFSI’s UK subsidiary

AIUL = AFSI’s Irish subsidiary

AII = AFSI’s Bermuda subsidiary

ACHL = AFSI’s Luxembourg subsidiary

TIC = One of AFSI’s U.S. subsidiaries

Referencing the last column of the table above, we can see that AFSI is not consolidating the losses ceded to ACHL (see footnote 4), but appears to be recognizing premiums associated with those policies. As you can see, the 10-K reconciles when it comes to premiums. But when it comes to recognizing losses, those do not appear to be present in the 10-K. The mismatch approximates the losses being sent to Luxembourg, so it would appear to us that AFSI is not recognizing certain losses in its SEC filings.

AIUL’s 2009 AM Best report is not available, so we’re unable to perform the same exercise for 2009. We will revisit this table later in our report and also present evidence that AFSI also did not consolidate losses into ACHL in 2009.

GAAP Accounting Shenanigans

We believe that AFSI is inappropriately taking advantage of differences between U.S. GAAP and Luxembourg GAAP to create a cookie jar for earnings. In brief, AFSI’s Bermuda subsidiary (“AII Bermuda”) “stuffs” losses into “ACHL”, yet keeps the premiums.

Let’s look at the clear evidence that has led us to conclude that AII Bermuda is ceding losses to ACHL, and that the results reported to investors do not accurately portray this fact.

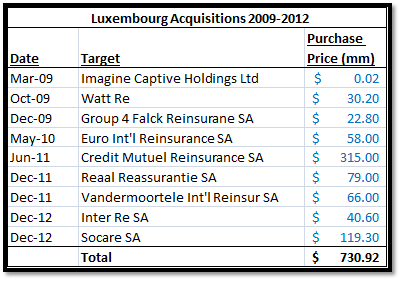

In simple terms, we believe AFSI acquires shell companies that have built up “equalization” balances for smoothing future earnings that are recognized in Luxembourg GAAP, but not US GAAP (see footnote 5). Then AFSI appears to inappropriately incorporate the results of Luxembourg entities under Luxembourg GAAP (which allows the use of these smoothing balances) instead of what the results would have been under U.S. GAAP (which does not allow the use of smoothing balances). Basically, Luxembourg GAAP allows these smoothing balances to offset future losses vs. U.S. GAAP that prohibits this practice specifically because these balances allow companies to avoid reporting losses on financial statements. Thus, real losses AFSI is sending/”smoothing out” in Luxembourg are not being reported in the results AFSI reports in its SEC filings. We believe this is why AFSI has spent $730.9 million buying Luxembourg captives – it is the key to being able to report steady profit growth.

Origin Luxembourg “Equalization” Balances

AFSI did not incur the equalization balances. Instead, they purchased entities that already had the balances built up.

This all started in 2009 when AFSI bought Imagine Captive Holdings Limited (subsequently renamed AmTrust Capital Holdings Limited or “ACHL”), a Luxembourg holding company which owned three Luxembourg-domiciled captive insurance companies (“Luxembourg Captives”). They proceeded to purchase another 8 entities through 2012. The full list is below:

In total, AFSI paid $730.92 million to buy Luxembourg-domiciled entities that had approximately $688 million (see footnote 6) of “equalization” balances.

We have no problem with AFSI’s purchase of the entities as long as the parent company is properly recognizing subsequent intra-company transactions appropriately under US GAAP. However, we believe AFSI is not recognizing these intra-company losses correctly — most likely by mixing and matching Luxembourg GAAP and US GAAP.

In the following two sections we will show that magnitude of losses (that ACHL is absorbing and clearly not disclosing) by comparing its financial statements presented in SEC filings with the public filings of its subsidiaries. We will also show that ACHL is receiving no premiums.

Proof That ACHL Received Zero Premiums

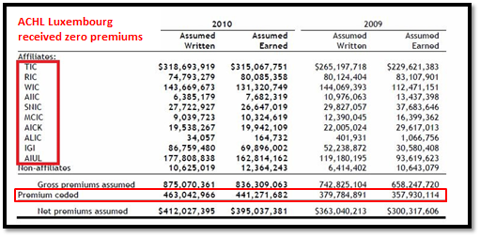

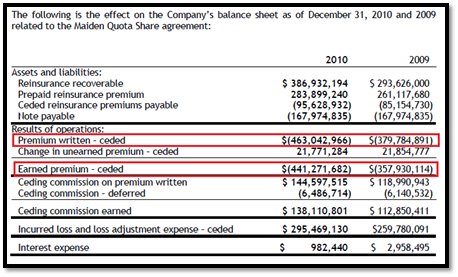

AII Bermuda’s 2010 financial statements break out premiums assumed and premiums ceded for 2009/2010, which we show below.

Source: AII Bermuda’s 2010 Audit

Notice that ACHL is not presented in this table provided by AII Bermuda. Affiliates TIC through ALIC are AFSI’s regulated US subsidiaries. IGI is the holding company for AEL, AFSI’s regulated UK subsidiary. AIUL is AFSI’s regulated Irish subsidiary. Finally, “Premiums Ceded” relate to Maiden Holdings (MHLD) and not another entity, as evidenced by AII Bermuda’s Reinsurance Footnote which we show below:

Source: AII Bermuda 2010 Audit

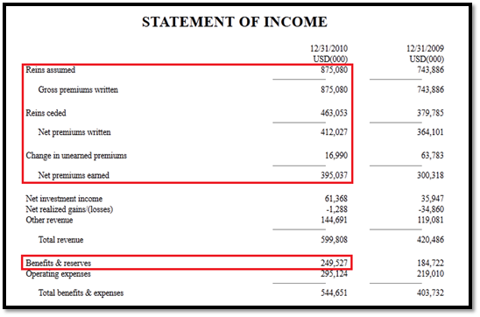

Proof That Losses Exist

Statutory filings of AII Bermuda

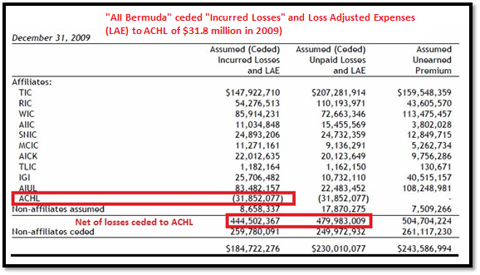

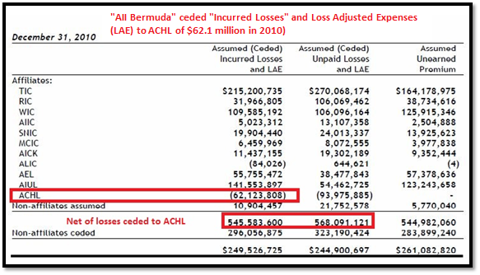

The statutory filings of AII Bermuda in 2010 (the only year they are publicly available) show a mysterious $62.1 million dollars of losses being ceded to Luxembourg in 2010 and $31.8 million in 2009. The following are pictures from AII Bermuda regulatory filings in 2009 and 2010:

Source: AII Bermuda 2010 Audit

Source: AII Bermuda 2010 Audit

Statutory filings (2010, 2011, 2012) of AFSI’s wholly-owned subsidiary, Technology Insurance Company (TIC)

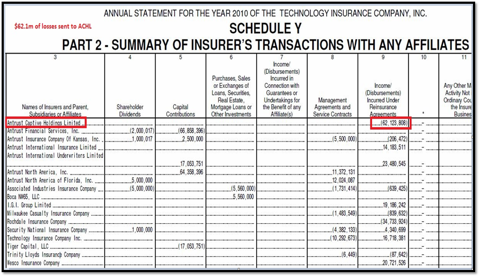

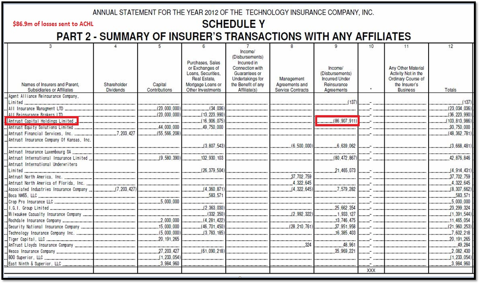

The statutory filings of AFSI’s wholly owned subsidiary, Technology Insurance Company, confirm the AII Bermuda 2010 Financials disclosure – to the dollar. Specifically, the following table shows that $62.1 million was sent to ACHL in 2010 which matches the net loss ceded figure in the above table of AII Bermuda. We then present two additional tables from TIC statutory filings showing that a total of $183 million of losses was ceded to ACHL throughout 2011 and 2012.

2010 – Amtrust Capital Holdings Limited (ACHL): $62.1 Million Of Losses Via Reinsurance Agreements

Source: TIC 2010 NAIC filing (National Association of Insurance Commissioners)

TIC’s filings in 2011 and 2012 further show how these ceded losses have likely become even bigger.

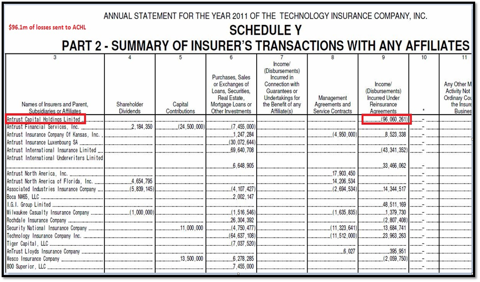

2011 – Amtrust Capital Holdings Limited (ACHL): $96.1 Million Of Losses Via Reinsurance Agreements

(click to enlarge) Source: 2011 Technology Insurance Co Statutory Filing Supplement, available via https://eapps.naic.org/insData/

Source: 2011 Technology Insurance Co Statutory Filing Supplement, available via https://eapps.naic.org/insData/

2012 – Amtrust Capital Holdings Limited (ACHL): $86.9 Million Of Losses Via Reinsurance Agreements

Source: 2012 Technology Insurance Co Statutory Filing Supplement, available via: https://eapps.naic.org/insData/

Dipping into the Cookie Jar – Unconsolidated Losses

We are willing to accept that if the losses are being ceded, this is not necessarily a big problem as long as AFSI reports those losses on the 10-K and consolidates them for US GAAP purposes. However, they do not appear to be consolidated and so net income appears to be overstated.

Not In the Net Loss Expense Line

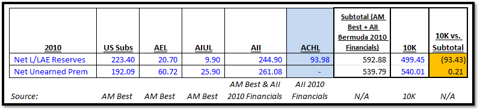

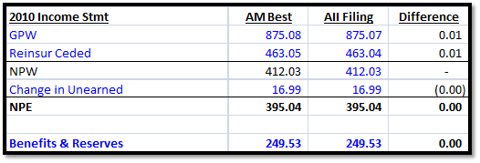

The table below compares the AII Bermuda Financial statements for 2010 to the AM Best report for AII Bermuda in 2010 and shows that AM Best is basing ratings on the AII Bermuda financial statements:

Below is an excerpt from the 2010 AM Best report, constructed from AII Bermuda income statements, showing the data points:

This confirms the validity of the AII Bermuda 2010 financial statements that show losses being ceded to ACHL from AII Bermuda as AM Best does not recognize the losses ceded to ACHL either. It also provides us with a consistent data source to compare the subsidiaries’ net earned premium and net loss and loss adjustment expense to the 10-K since AM Best reports are available for AFSI’s insurance subsidiaries (US Subsidiaries are filed as a group) with the exception of ACHL.

However, since we can derive ACHL’s results from the AII Bermuda 2010 Financial statements and Schedule Y of AFSI’s US Statutory subsidiaries’ filings, we can check to see if all net earned premiums and net loss and loss adjustment expenses are consolidated in the 10-K. If it were being consolidated properly, the losses ceded to ACHL would be present in the disclosed aggregated net loss numbers reported, yet they are not, and they appear to be off by roughly the same amounts that are being sent to Luxembourg.

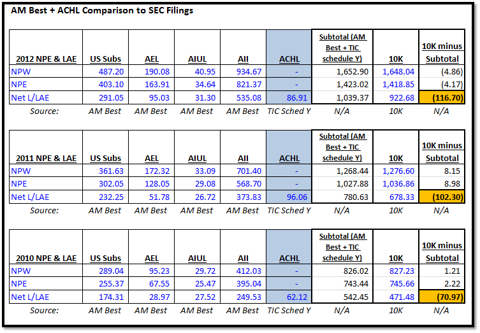

The tables below are the result of that exercise for 2010, 2011, and 2012. AIUL’s 2009 AM Best report is not available, so we’re unable to perform the same exercise for 2009. The tables clearly show that AFSI is not consolidating the losses ceded to ACHL (see footnote 7):

Table Items Defined:

NPW = Net Premiums Written

NPE = Net Premiums Earned

Net L/LAE = Net Loss/Loss Adjusted Expense

AEL = AFSI’s UK subsidiary

AIUL = AFSI’s Irish subsidiary

AII = AFSI’s Bermuda subsidiary

ACHL = AFSI’s Luxembourg subsidiary

TIC = One of AFSI’s U.S. subsidiaries

Notice that Net Premiums Written (“NPW”) , and Net Premiums Earned (“NPE”) of GroupSubs (US Subs, AEL, AIUL, AII, ACHL) for each year closely approximates the consolidated 10-K disclosures, giving us comfort that no material entities are missing when we try to back into the earned premium and loss numbers disclosed in the 10-K.

However, also note that Net loss and Loss Adjustment Expense (Net L/LAE) of the GroupSubs, is $290 million higher than what is disclosed in the AFSI’s 10-Ks, and that $245 million of this discrepancy comes from ACHL. We are not choosing to believe that AFSI got it right on premiums and wrong on losses. Thus, given the known data points, we can only assume that AFSI did not disclose $245 million of ceded losses in its SEC filed financials from 2010 to 2012.

Furthermore, adding the 2010 to 2012 ceded losses ($245 million) to ACHL (Luxembourg) referenced in the above table to the losses ceded ($31.8 million) to ACHL per AII Bermuda’s statutory filing 2009 earlier in our report works out to about $276.9 million.

This comparison clearly indicates that the results AFSI reports to investors significantly understate the loss expense (thereby significantly overstating income).

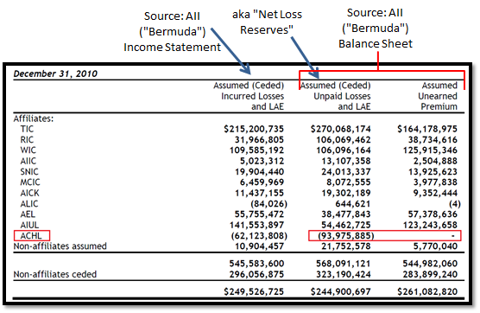

2010 Net Loss Reserves in 10-K Exclude ACHL

Thus far, we have primarily focused on income statement analysis to support our conclusions. But we can also reference balance sheet items to show that AFSI is not recognizing AII Luxembourg loss items, such as net loss reserves. Taking a look at ASFI’s 2010 10-K, we can calculate net loss reserves from page F-3 (amounts in thousands):

[Loss and loss expense reserves ($1,263,537)] + [Reinsurance payable on paid losses ($11,343)] – [Reinsurance Recoverable ($775,432)] = $499,448.

Now, it appears that ACHL’s net loss LAE reserves are not incorporated in AFSI’s 10-K, even though AII Bermuda has disclosed that ACHL has L/LAE has reserves of 93.975 in its filings.

The reported loss reserves in the 10-K ($449.448 million) are different from the sum of subsidiary loss reserves ($592.88 million) by the exact amount sitting at ACHL ($93.975 million). This is potentially a $93.43 million hole in the AFSI balance sheet. See below from AII Bermuda financial statements:

Source: 2009/2010 AFSI Financial Statements, issued by BDO, page 34

Using the same AM Best filings we have been using throughout our article, we can also show that ACHL’s net loss reserves appear to not be reflected in AFSI’s 2010 10K. As one would expect, since the premium earned ties out (as discussed earlier), unearned premiums tie out between Am Best and 10k from the above table, it is revealing that net loss reserves do not even closely match.

Information GAAP – Investors & Ratings agencies Need More Data Points to Properly Assess Luxembourg Risk

We believe that the company is not recognizing the losses to make reported earnings look better. This could also lead to downgrades from AM Best, as AM Best’s ratings assumptions use the net losses and loss adjustments that match unconsolidated financials and therefore do not include the full financial results.

AFSI should provide additional Information regarding losses ceded to Luxembourg to the public and ratings agencies. The financial data AM Best uses to assign a credit rating to AFSI match what is in AFSI’s 10-K, so it seems ACHL’s losses are not part of the ratings evaluation process (AFSI supplies AM Best with statutory filings).

Comparing the 2010 financial statements of AII Bermuda, which show ceded net losses to ACHL of $62.1 million, with the 2010 AM Best report for AII Bermuda (see previously discussed ‘AM Best + ACHL Comparison to SEC Filings‘), we see that the net loss & loss adjustment expense of $249.5 million matches. Therefore, the net loss expense shown in the AM Best report (appropriately based on their methodology) excludes the losses of AII Bermuda’s wholly owned subsidiary, ACHL, and only takes into account the reported unconsolidated numbers.

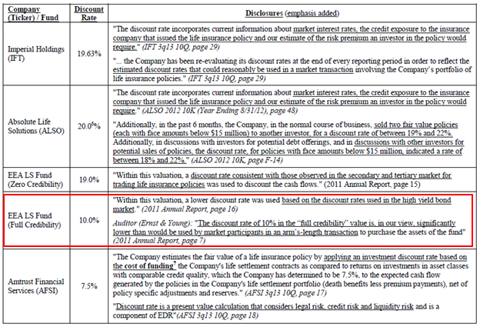

Life Settlement Mismarking

AFSI appears to be boosting earnings and tangible book value by marking up its portfolio of life settlement contracts (“LSCs”). LSC, net of non-controlling interest now represent approximately 19% of AFSI’s tangible book value. In valuing an LSC portfolio, the discount rate and life expectancy (“LE”) are the two most critical inputs. AFSI uses a 7.5% discount rate to value its LSCs while peers use a rate approximately 20%. Applying industry standard discount rates would result in a mark down of $90-135 million, or roughly 13-19% of AFSI’s tangible equity. Further, it appears that AFSI relies on internal estimates, only considering third party estimates for the LE input (See 10-Q for the period ended September 30, 2013, page 17). In contrast, best practice is to use third party estimates to determine LE estimates and weight them towards the more conservative estimate. The use of internal LE estimates has been a staple of past frauds in the LSC industry (notably, Life Partners and Mutual Benefits).

AFSI has been revising down its LE assumptions, generating gains on its LSC portfolio. Publicly traded peers are revising their LE assumptions higher (especially for the premium-financed LSC paper that AFSI holds) (see footnote 8). Simply put, peers are assuming people are living longer while AFSI assumes people are going to die sooner. We are unaware of any reason why AFSI is taking a non-consensus view on lifespans of Americans. It is possible that AFSI’s policyholders en masse have decided to take up smoking, skydiving, or ride motorcycles without their helmets, but given a diverse base of people, this seems unlikely despite what AFSI management is asking the market to believe if you accept its LSC valuations.

More than half of AFSI’s LSC portfolio consists of contracts where Phoenix Life Insurance is the issuing carrier/counterparty . Faced with possible bankruptcy, PNX has been attempting to induce holders of its LSC paper to lapse on their policies by hiking premiums & denying death benefits. Given the possibility that PNX death benefits will not be paid, when PNX paper does trade, it trades for pennies on the dollar.

For example, Fortress described the market for Phoenix policies in a complaint filed August, 2012 as follows:

“As a result of Defendants’ anticompetitive and exclusionary conduct, there are very few, if any, buyers who remain willing to purchase Phoenix life insurance policies on the secondary market. Defendants’ anticompetitive and exclusionary conduct, and the resulting uncertainty it has created, has destroyed the value of Phoenix policies and robbed policyholders of the once-precious ability to sell their policies in a competitive market. The few buyers who do remain will only buy Phoenix policies at severe discounts…”

Tiger Capital LLC, an AFSI sub, filed a lawsuit against Phoenix in 2012. In recent days, Tiger Capital’s court documents showed it held 136 Phoenix LSCs. In their third quarter 2013 10-Q, AFSI disclosed 81 of the policies it held are carried at “no value”, including those policies that have a negative NPV. This implies that a minimum 55 of the Phoenix policies (136 minus 81) have been assigned value despite there being essentially no buyers for these policies. Marking these LSCs to true market value would result in a significant impairment.

AFSI suggests that marking its LSC book at $194 million is conservative; since this represents a 17.7% IRR based on $795 million in future cash flows. But, if one were to apply the same LE standard peers use, this $795 million would be lower since longer LEs require more premiums to be paid before the death benefit is received. By shortening LE, the policy holder gets to “double dip” by using fewer years in the present value calculation and by assuming less premiums paid. The effect is not simply an adjustment based on discount rate. The true amount of future net cash flows, calculated using peer assumptions, then, would be closer to $439 million (after applying the reserves that, essentially, make AFSI’s LE methodology comparable with peers).

The peer group calculation would then be to discount the $439 million by 17.7% or more, rather than the 7.5% discount rate AFSI uses. We estimate that AFSI’s LSC would be worth $90 – $135 million less if they used the same discount rate as peers based on their disclosed sensitivity to changes in the discount rate assumption.

In fact, since Phoenix policies (they make up the policies in the LSC portfolio) trade at cents on the dollar, an appropriate discount rate is probably 50-60%.

Finally, despite claiming to set reserves based on LEs calculated by outside data providers, management does not address why its own LE assumptions have been falling (generating portfolio gains) while peers, who rely on the same data providers, are revising their LEs upward. As we said earlier, it could be that the people associated with contracts owned by AFSI are becoming riskier.

See the below chart for a display of comparable companies and the discount rates they use. Note that the one company, EEA LS Fund (Full Credibility) that uses a discount rate assumption (10.0%) closest to AFSI’s (7.5%) has been warned by its auditor Ernst & Young, that the discount rate is “significantly lower than what would be used by market participants in an arm’s-length transaction“:

We wonder what E&Y would have to say if they were to replace BDO as AFSI’s auditor?

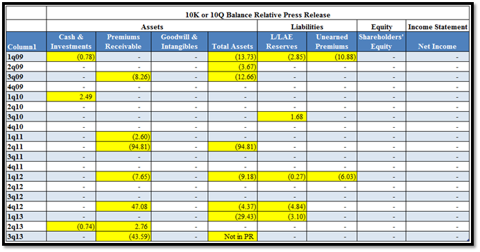

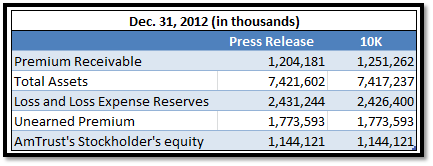

AFSI Disclosure Discrepancies

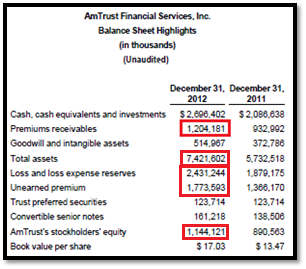

Amtrust frequently has discrepancies between the balance sheet items presented in press releases and SEC filings. However, the adjustments made to the balance sheet have not resulted in changes to Shareholders’ Equity, Goodwill & Intangibles, or the Income Statement items.

The discrepancies could have offsetting entries as appears to be the case in the first quarter of 2009 where adjustments to assets and liabilities offset. Additionally, the press release only includes certain line items, so there could be offsetting entries that we are unable to see. However, there are other quarters where the magnitude of the discrepancy is significant and likely explanations do not appear to offset the adjustment.

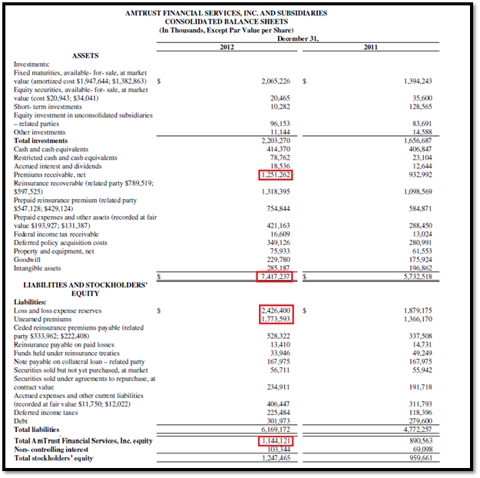

For example, in the fourth quarter of 2012 AFSI reported $47.1 million more premiums receivable in the 10-K than in the press release (excerpts below), $4.37 million fewer total assets and $4.84 million fewer loss reserves:

Sources for the three images above: Fourth quarter 2012 Press Release and 2012 10-K

An increase in premiums receivable should be offset by either:

- a reduction in cash if the premium was thought to be collected but actually was not,

- an increase in unearned premiums if additional premiums correspond to future policies, or

- a higher reported revenue.

However, none of these were the case. We question what other offsetting entry AFSI made and why it was not accompanied by an explanation in the 10-K or an 8-K to correct the press release if there was an error. How does $47 million simply appear and then disappear? AFSI management needs to explain what happened.

Interestingly, David Einhorn (Greenlight Capital) had similar questions and concerns with Lehman Brothers’ disclosures:

“As you can see, the table in the 10-Q does not match the conference call. There is no reasonable explanation as to how the numbers could move like this between the conference call and the 10-Q. The values should be the same. If there was an accounting error, I don’t see how Lehman avoided filing an 8-K announcing the mistake. Notably, the 10-Q changes somehow did not affect the income statement, as there must have been offsetting adjustments somewhere in the financials.”

Source: http://foolingsomepeople.com/main/TCF%202008%20Speech.pdf

Executive Team’s Sketchy History

Several pieces of information make it difficult to put our trust in the AFSI management Team.

Outright Fraud- Theft and Money Laundering

AFSI CFO Ronald Pipoly & COO Michael Saxon were executive officers at Credit General (“CGI”), a P&C insurance company that was liquidated in 2001 by the Ohio insurance regulator after it was revealed that the CEO Robert Lucia had stolen $30 million from the company. From Court documents:

“During this same period of time, Mr. Lucia, in breach of the duties of care and loyalty that he owed to Credit General, diverted checks belonging to Credit General into the Outside Accounts. Although the precise amounts so diverted are presently not known, Plaintiff reasonably estimates that the amount so diverted exceeded $30 million.”

Other members of the executive suite issued false financials to hide the theft. CFO Pipoly was Controller of CGI at the time, & COO Saxon was Chief Claims Officer. Both men were named as defendants in lawsuits (see here and here) brought by the Ohio Director of Insurance, alleging they were actively involved in the cover-up. Here is a quote from the relevant court filings:

“Fazekash subsequently notified Pipoly that Lucia would be wiring a substantial sum of money to CGIC and instructed Pipoly to account for the money as a reduction of CGIC’s commission expense. Pipoly understood that Lucia would be wiring the money to follow through on Lucia’s commitment to cease diverting premium payments. Pipoly also understood that an accounting entry to reduce commission expense would not be the appropriate way to account for previously unrecorded premium payments.”

In the years prior to liquidation, CGI reported incredible growth in premiums written, with a focus on small company worker’s comp (similar to AFSI). AmTrust, which entered into a management agreement with CGI in 2000, was also sued by the Ohio Director of Insurance.

Valuation/Conclusion:

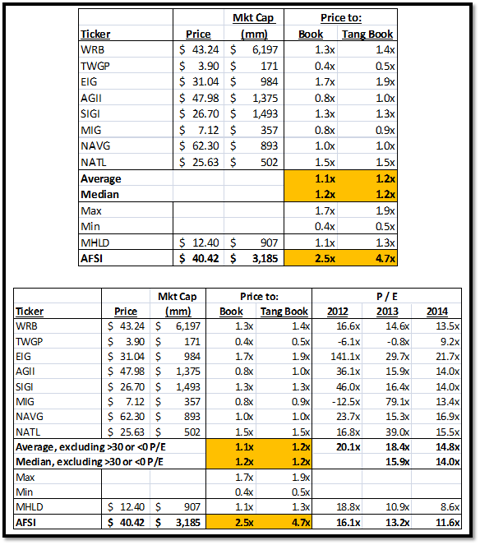

Comparable publicly traded property & casualty insurance companies currently trade between 1x to 1.5x tangible book value per share (“TBV”), yet at around $40 AFSI trades at 4.7x TBV of $8.61 on a fully diluted basis. Even barring the issues we have presented, AFSI appears massively overvalued.

The bullish investors will try to justify this premium valuation by referencing AFSI’s “impressive” reported EPS growth and a P/E that is in-line with comparables. However, once our findings become apparent the market may place little value on AFSI’s earnings and P/E and will instead focus on TBV.

Interestingly, the next highest P/TBV multiple belonged to a very good comparable to AFSI, TWGP, until it blew up as a result of under-reserving. It now trades at a discount to TBV. If we were to use a 1x to 1.5x AFSI’s current stated TBV, the stock would be $8.50 to $13 per share. If we are right about the hidden losses (a $276.9 million hit) and our LSC over valuation (a $113 million mid-point hit) conclusions, it will be worth $3.87.

Disclosure: Short AFSI

Footnotes:

1 In 3Q13, AFSI held 272 total policies. The Tiger Capital lawsuit claimed that AFSI held 138 policies issued by Phoenix. So Phoenix is 50.7% of the portfolio.

2 Derived from 2012 Technology Insurance Company Inc.’s Schedule Y, Part 1A “Detail of Insurance Holding Company System”

3 During 2012, AII made a section 953(‘d’) election which means that AII is now treated as a US corporation and included in AFSI’s consolidated US tax return. AFSI maintains other non-US subsidiaries for which profits are considered to be indefinitely invested offshore.

4 Note that net premium written and net earned premium very closely approximate the results reported in the 10-K, demonstrating that there are not any material operations that are missing other than ACHL.

5 Reference: Materials For The International Solvency And Accounting Standards Working Group, April 2013

6 Our estimate is derived from AFSI’s purchase price allocation disclosures. DTLs associated with Luxembourg acquisitions totaled $206.4m and AFSI disclosed that a 30% tax rate is applied to equalization reserves acquired ($206.4m/30%).

7 Note that net premium written and net earned premium very closely approximate the results reported in the 10-K, demonstrating that there are not any material operations that are missing other than ACHL.

8 In 2012, AFSI disclosed the average age of insured was 79 with 139 months left to live versus 2011 estimates of 155 months left to live on an age of 77.