If you are a premium member make sure you sign in to see All the exclusive content In This Issue.

Welcome to this week’s Microcap Information Arbitrage Weekly Wrap.

I was able to sneak away from a Mother’s Day Smorgasbord to put the finishing touches on this weekly wrap-up after chowing down on food from some of the finest chefs in town…

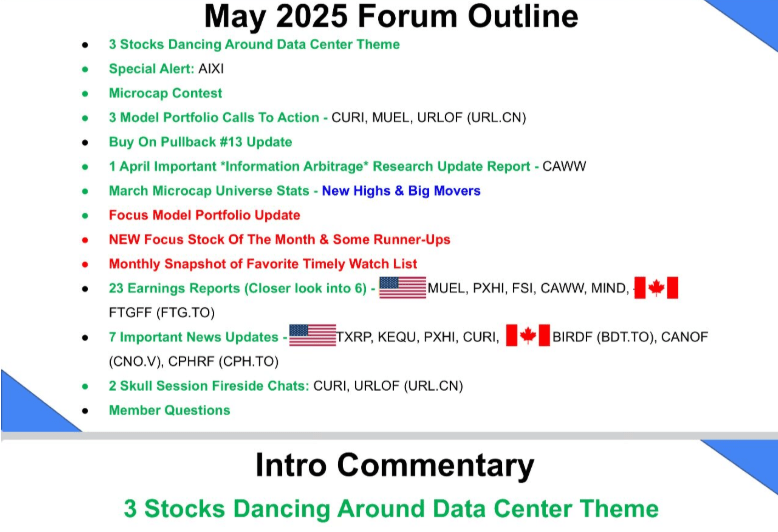

This past Wednesday, we hosted our May 2025 Live Open Forum.

In case you missed it, here is the outline of what we discussed:

Maybe it’s just me, but the abundance of misconstrued news these days seems to be accelerating – from data center growth FUD (fear, uncertainty and doubt), to how Trump’s new policies “will” negatively impact certain industries.

We have already addressed data center growth skeptics and set the story straight on how we think the U.S. Department of Government Efficiency’s (DOGE) budget cuts won’t hurt a favorite lab equipment stock of ours that’s fallen sharply on panic selling. You can read about these in past Weekly Wrap-Ups:

- Insights from Sterling Infrastructure’s Earnings Conference Call Signals Bullish Future For Data Center Industry

- A New Twist on a Familiar Industry: Why This Lab-Focused Microcap Could Be a Hidden Gem

- Data Center Uncertainty Amid FUD

There is incredible alpha to be generated in the microcap universe by zeroing in on what’s real—and what’s fluff.

While acknowledging that going against the crowd can sometimes be risky, it’s easily one of my favorite investing strategies.

And “Trump & Co.” are giving us plenty of opportunities with their soundbites.

So, we kept our “FUD-buster” mantra going during last week’s May 2025 Live Open Forum.

Although I continued to share my thoughts on the market’s waning excitement around sustainability of data center growth, our focus shifted to FDA 2.0—separating fact from fiction regarding this new policy mission to discourage the use of animals in biotech research and encourage more modern research tools, such as AI, which could reshape the fortunes of certain biotech players.

My latest PodClip covered why it’s possible that a stock falling due to FDA 2.0 should actually be rising.

Continuing along the speculative narrative, I also discussed why the flow of facts could improve $AIXA odds of winning its ongoing $1.4 billion patent infringement lawsuit against Apple Inc. (NASDAQ:AAPL), especially in lieu of some nice information arbitrage out of China that seems to give the edge to AIXI!

It’s still a high risk gamble, but I am going to keep dreaming!

Our most recent article on AIXI vs. AAPL outlines the chain of events.

From there, we shifted gears to remind everyone about MS Cliff Notes’ FREE to enter microcap stock-picking contest that GeoInvesting is sponsoring (6 months contest).

I can’t wait to see the picks made by our community, which will hopefully flush out a few new multibaggers. As a reminder, $15,000 is up for grabs.

Even though the deadline to join the contest has passed, we’re thinking of ways to still allow our community to have some fun around the contest and win some prizes over the next six months. Stay tuned.

We also reviewed our recent Model Portfolio Additions, including Curiositystream Inc. (NASDAQ:CURI)’s 100% move since we added it to our Model Porfolios on April 7, 2025, fueled by strong first quarter 2025 results, a 100% increase in its quarterly dividend, and a special dividend.

We took a bow for Brett Maas from Haydin IR, who pounded the table that we should bring CURI management onto GeoInvesting for a Fireside Chat Skull Session in early April.

As far as other stocks go, we reviewed why we added a data center play as our next focus stock of the month, and elaborated on a Buffett style stock we just added to our Model Portfolios, the subject of last Sunday’s Weekly Wrap-UP: “If Warren Buffett Invested In Microcaps, This Would Be The One.”

Other names like Avita Medical, Inc. (NASDAQ:RCEL) (wound care) and Lakeland Industries, Inc. (NASDAQ:LAKE) (personal protective apparel) warranted discussions around execution risk and what management has to accomplish to reverse downtrends in these stocks.

As usual, this past week we also sent out a few morning emails covering earnings releases and news related to companies in our model portfolios and microcap coverage universe of over 1,500 stocks.

You can review those emails here, which included PSIX, MITK, AATC, CURI, CCEL, FSI, ACFN, KRMD, CRAWA, FALC, RCMT, MOJO, EBS, VMD, CCRD, QBAK, LFVN, FACO, CXDO, FTK, AVNW, AMNF, IPI, GLDD, XPEL, MUEL, TGEN, BURCA, CSBR, BLMWF (BLM.V)

Please enjoy the related clips from our May 2025 Live Open Forum below, after which the rest of the post includes summary recaps on three stocks from the above list that we covered in one of our morning emails—CSBR, BURCA, BLMWF (BLM.V).

——

Sorry, the full post is only available for paying subscribers. If you are already a paying subscriber, please make sure you are logged in. To become a paying subscriber please click on the link below

(We also offer a new very popular monthly subscription option).

gain Exposure to our expanded coverage on Our 1500+ Microcap Universe, Subscribe below.

200+ multibaggers and counting

——

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)