If you are a premium member make sure you sign in to see All the exclusive content In This Issue.

FUD in the Data Center Industry

This Weekly Wrap Up post covers earnings reports from Wendy restaurant operator Meritage Hospitality Group, Inc (OTC:MHGU) (dud of the decade), California Nanotechnologies Corp. (OOTC:CANOF) (CNO.V) (lukewarm) and Mind Technology, Inc. (NASDAQ:MIND) (mostly good).

But I really want to focus on the fear, uncertainty, and doubt (“FUD”) about the data center industry that has continued in investing circles.

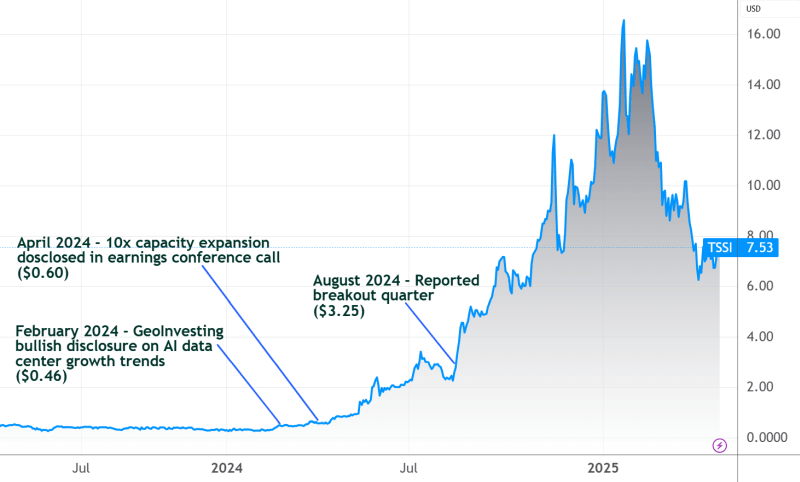

And no, this is not about Tss, Inc. (NASDAQ:TSSI)—well maybe a shameless plug on TSSI, as we are gearing up for our next favorite AI play (potentially, better than TSSI).

TSSI Multibagger Case Study

| For our premium subscribers, the full newsletter dives into these stories, unpacking earnings, management commentary, and market dynamics. If you’re not yet a premium subscriber, I invite you to join us—unlock the detailed insights that could sharpen your portfolio decisions. Read on for more highlights.

At the end of this post, you can see all of the individual emails we sent throughout the week that this todfay’s summary covers. You can also view them in individual email posts at our premium portal under the Research main menu item. And finally, it you will unlock all of our premium research and videos on all our favorite stocks, as well as our 1500 coverage universe of companies. |

I initially visited the data center FUD topic a few weeks ago in this Weekly Wrap-Up post, talking about the data center tailwinds positively impacting Sterling Infrastructure, Inc. (NASDAQ:STRL) construction operations and how management addressed the data centers growth skepticism in its Q4 2024 earnings call:

Q: “So my first question is just more of a kind of a sanity check that you’re not really seeing a change in tone from either the hyperscalers or the developers doing DC work? And then hand in hand with that, are you seeing any change in terms of the willingness of the GCs or developers to kind of accept the contractual terms Sterling typically insist on that are kind of necessary for you guys to properly manage risk?”

A: “Yes. Well, I will say we’re seeing a change in tune but it’s the opposite of what the messaging out in the world is. The change of tune is, they are more aggressive and more hungry to grow faster every time we talk to them. And I think people are confusing some of the, I’ll call it, facts in turning it into fiction.”

Regardless of what STRL thinks, The “Debbie Downer” pundits keep warning us of a data center bubble, pointing to signs like MSFT and AMZN supposedly pulling back on data center spending.

For example, a Wells Fargo analyst just reported that Amazon is pausing certain data center projects, hinting at a capex slowdown.

However, it’s crucial to cut through the noise. The FUD about MSFT cancelling leases on properties to build data centers is actually what prompted us to look at STRL.

By the way, Amazon.com, Inc. (NASDAQ:AMZN) already put the Wells Fargo debate to bed, at least for a few days. 😂😂😂 (more on this later).

Actually, I had already reached out to the CEO of an AI company who gave me further perspectives on what he thinks is going on with the “CAPEX” carousel decisions at companies like AMZN and Microsoft Corporation (NASDAQ:MSFT).

It’s all about perspective!!

I will come back to what this CEO said later in this Weekly Wrap Up post. However, it’s given me even more reason to be bullish on our next data center favorite stock that we are most likely about to add to our Focus Stock Of The Month Model Portfolio. I included some of my preliminary thoughts on this company within this post.

While FUD can cast a shadow, the certain data center trends have very real underpinnings – and our research this week uncovered more clues that the long-term growth story currently remains well intact.

Now, I am not saying that the outlook will not eventually turn sour for the data center industry. Sure, if one of Trump’s amateur poker bluffs goes haywire or we go into a major recession, things may change.

But for now, things seem well grounded for certain segments of the data center industry.

Just to be clear, I am a natural bull at heart and don’t like spending my time trying to predict the end of the world.

So take my opinion with a grain of salt.

I am not always going to be right, but the mission of a microcap bull is not to always be right with every decision.

It’s to make an absurd amount of money when you can… manage your margin responsibly… cash in some of your paper profits along the way… and keep some cash on hand, so you can take your medicine like a big boy or girl for the times when the bears finally get their chance to gloat, like once every 10 years or so.

And by gloating, I don’t mean make money, because trust me, most permabears don’t time it right, even when they’re right.

We are starting to dig deeper into a company as the next data center Company we are getting really excited about. We just Identified as to our Focus Stock of the Month. To skip right to that commentary go to the heading: Power Solutions

—–

Research via Earnings Calls – Our Approach

One way you can rise above the noise is by going straight to the source: earnings call transcripts. A good part of our research hinges on reading these transcripts to spot emerging trends and to see which companies are acting on them in real time.

More importantly, earnings calls often reveal pertinent insights that never make it into press releases or social media headlines.

By poring over what executives actually say on these calls, you can learn where industries are headed and which firms are positioning themselves early.

You can also build a mental journal of management teams that historically bullshit investors and learn how to spot the types of clues that allow you to question bullish narratives.

This “boots-on-the-ground” research approach can help you identify genuine opportunities despite the market’s mood swings and motivate you buy/sell stocks before the crowd that are making decisions based on improperly sourced headlines and social media.

Major Trend Identified: Data Center Growth Is Not A Rumor

A dominant theme that keeps appearing in our transcript readings is rampant data center growth. In fact, after reading a particular earnings call transcript, I interviewed a company this week that I’ll soon be publishing research on, due to a data center theme they are now pursuing.

Nearly every corner of the tech and infrastructure world is being touched by the need for more data center capacity – from the cloud and AI boom to increased enterprise digitalization.

Industry estimates that the global data center power market will expand significantly in the next few years, with both data center operators and utilities planning to invest “billions of dollars on infrastructure” to meet surging demand. Data centers aren’t a fad; they’re a fundamental growth engine of the digital economy.

Companies that enable or supply this expansion – especially on the power and construction side – stand to benefit from a multi-year tailwind.

Power is basically the constraint and impetus to data center growth.

Validating Trends From The Horse’s Mouth: What Leading CEOs Are Saying

To ensure we’re not chasing a false narrative, the GeoTeam cross-checks trends with what CEO narratives of larger industry players report in their earnings calls.

Now, I know some of you are saying that management teams are always optimistic on these calls, so we can’t trust them. However, although I am not blindly optimistic, I have always taken a half glass full approach to investing, not a guilty until proven innocent approach. And I do not look at earnings calls to buy a stock on management financial predictions or guidance. However, I have found that earnings calls can be a great way to glean near-term pulses on industries.

If the highlights from the STRL Q4 earnings call we summarized in our 3/2/2025 Weekly GeoWire were not enough to get you excited about flipping the finger to the data center pessimists, let’s take a look at Vertiv Holdings, Llc (NYSE:VRT)‘s fuck you to them.

Vertiv is at the heart of data center infrastructure.

Part of their business includes providing power solutions for data centers, so its perspective is especially telling.

For a multibillion dollar company, Vertiv’s Q1 2025 report was a blowout. Sales rose 24% to $2.03 billion, while EPS grew 49%.

On its earnings call, the company explicitly called out the data center FUD:

“We have heard a lot of opinions about the market. Let me be clear. Our visibility into the data center market gives us every reason to be confident, not just for 2025, but for the years beyond. Our industry is continuing to grow, particularly around AI infrastructure; and it’s moving along the market trajectory that we shared with you at our November 2024 Investor Day. Vertiv is uniquely positioned to capitalize on this trajectory.”

The Executive Chairman Dave Cote highlighted that “AI adoption is spreading globally, data center demand remains robust, and Vertiv is positioned extremely well to capitalize on these opportunities.”

Vertiv CEO Giordano Albertazzi struck a similarly optimistic tone, saying Vertiv’s visibility into the market gives “every reason to be confident, not just for 2025, but for the years beyond.”

In a 2024 interview, he even stated that

”…the digital infrastructure is a very essential element. The power and thermal really keeps the thing alive and working.”

Jumping back to the flavor of STRL’s Q4 2024 views on data center sentiment, this quote from the CEO says it:

“remain as strong or stronger than ever.”

He further said they “anticipate that the current strength in data center demand will continue for the foreseeable future.”

The company’s E-Infrastructure division (which includes data center construction) saw Q4 2024 revenue jump 8% and backlog swell to record levels, surpassing $1 billion.

Actually Sterling disclosed that data center projects now make up over 60% of its E-Infrastructure backlog, and data center-related revenue was up more than 50%, year-over-year in Q4.

In sum, both a construction firm (STRL) and now, a data center equipment supplier (VRT) are independently affirming strong, sustained growth in the data center arena.

Their “on-the-ground” results and commentary align with our beliefs: Even amid chatter of a possible slowdown, certain companies serving the right data center segments are seeing healthy demand and committing to multi-year expansions.

Are Cloud Giants Really Pumping the Brakes?

One specific point of FUD I addressed in the introduction of this Weekly Wrap-Up was the concern that hyperscale cloud companies (like Amazon’s AWS) might be tightening their purse strings on data center capex. This fear gained traction after a Wells Fargo analyst stated that Amazon is “pausing” data center leases overseas.

However, Amazon quickly downplayed that report, calling it “routine capacity management” with no fundamental change in expansion plans.

In fact, Amazon and Nvidia executives see AI data center demand accelerating, not slowing.

“We continue to see very strong demand, and we’re looking both in the next couple years as well as long term and seeing the numbers only going up,” – AMZN.”

We suspect what’s happening is a short-term digestion of past growth (and some tactical adjustments like shifting where new capacity is added), rather than an outright cutback. It’s a healthy breather, not a reversal

Actually, the second that I saw the Wells Fargo comment on AMZN, I reached out to a CEO in the data center power industry. He told me that AI play is still very strong and that, in his opinion, “lease cancellations” by hyperscalers is likely because of the long construction times. So, it’s making more sense to repurpose as much of existing data centers as well.

I think this is particularly great for power solution companies.

For stock pickers ![]() —When analyzing a company’s potential, it can sometimes be more important to track where the money is going in its industry, as opposed to tracking total industry spend.

—When analyzing a company’s potential, it can sometimes be more important to track where the money is going in its industry, as opposed to tracking total industry spend.

Bubble vs. Durable Growth

It’s true that whenever an industry runs hot, there’s the risk of a speculative bubble. We’ve seen certain data center stocks skyrocket purely on AI hype, and some froth may need to settle.

However, part of the art of investing is being able to draw distinctions between hype-driven valuation bubbles and genuine demand growth.

Parts of the data center ecosystem might get overextended, but other segments have hard multi-year demand behind them.

It’s important to understand where you’re putting your AI investment dollars. Would I want to invest in companies that are catering to bitcoin miners? I’m not sure about that.

Just make sure you understand more than just what a company you are investing in does, but who their customers are, especially if you’re planning on investing in the AI and data center themes.

Think of data center infrastructure as the pick-and-shovel play during a gold rush – even if gold prices wobble, you still need shovels if miners keep mining. Similarly, so long as global data creation and AI computing needs are rising, the demand for reliable power, cooling, and physical facilities should grow year after year.

As Sterling’s CEO put it, customers are now “focused on how to align with the right partners” to support multi-year buildouts – a sign that this is a long-haul trend, not a one-and-done spike.

As Vertiv’s and Sterling’s leadership echoed, the build-out for AI and cloud is expected to play out over many years, not quarters. Both companies are seeing orders for new data center capacity out to 2026+ and Vertiv stated customers are formulating multi-year capex plans now.

This suggests that even if stock prices swing, the underlying investment cycle in data centers (particularly power infrastructure) can continue steadily.

For a historical parallel, consider the early Internet boom and bust. In the late 1990s, internet-related stocks soared to absurd heights and then crashed spectacularly in 2000. Many investors who got burned concluded that the internet was overrated – yet, in hindsight, the underlying trend was never in doubt.

Internet adoption kept accelerating despite the bust. In 2000, roughly 52% of U.S. adults were online; by 2015, that figure had grown to 84%. The dot-com bubble was a valuation bubble, not a usage bubble.

Our strategy is to remain thoughtful and confident in the long-term trend (AI and data center infrastructure) while being selective in picking companies with solid fundamentals that can weather any interim shakeout. That’s what you pay us to do 🙂

Now, onto our new favorite Data Center stock.

——

You must Be signed in to read the remainder of this premium Post and To See Our Next Favorite Data Center Stock

gain Exposure to our expanded coverage on Our 1500+ Microcap Universe, Subscribe below.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ multibaggers and counting

——

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)