By Maj Soueidan, Co-founder GeoInvesting

In 2015 to 2016, we published premium coverage on infrastructure company Smith Midland (SMID). Their primary operations consist of making precast concrete products for the construction, transportation, and utilities industries

It was a microcap we thought to be on the cusp of growth, so we added it to our Model Portfolio in the $2 to $3 range. Shares just hit an all time high of $40.87.

Because we were so intrigued by the company amid news that U.S. infrastructure spending could be ramping up, pending the passage of bills to support that spending, we decided to pay SMID’s headquarters a visit and take our recorded findings back to our Premium subscriber base.

Some people have this idea that microcaps are all tiny development stage companies with little revenues. However, that is not the case. SMID generates annual revenue of about $50 million, employs a staff of 178 full time employees, and has large manufacturing and logistics facilities.

The on-the-ground visit left us bullish for the long term. We didn’t hold the stock for as long as we should have, which is a regret and a story for another day.

What I really wanted to hit on is that looking back, we were basically providing a Wall Street Service at a Retail Price. (WSaaRP, if you will).

I hate to so unabashedly throw a truth bomb out there, but I’m not sure that you’ll find any non-investment bank, or non-Wall Street firm research service provider that will go to these lengths to vetting a potential investment.

You won’t get this anywhere else…well, unless you deposit a cool million into a Goldman Sachs brokerage account.

Looking at SMID’s price today, we really did discover a diamond in the rough, and a true BigCapMicro.

The stock’s 8-year journey from $2 to $40 is pretty impressive, and just like the beginning of every new year, it’s our intention to find at least 5 more stocks in 2024 that can similarly multibag over the long term. In fact, since we published our first research report in 2009, we’re averaging over 13 multibagger discoveries per year.

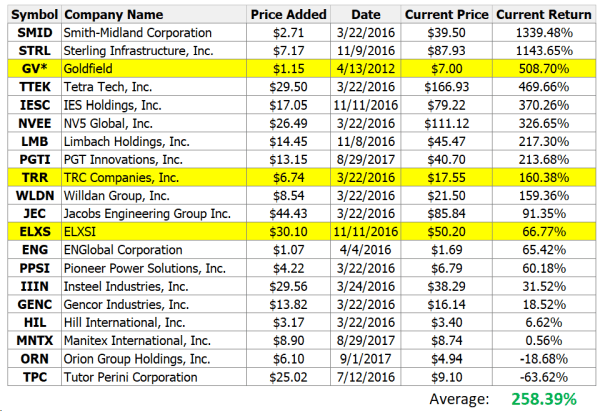

And one more fact, around the time we were researching SMID, we published a 20-stock infrastructure model portfolio screen on Geo.

The returns have been pretty amazing, with 10 of them multibagging (over 100%) at an average return of 490.91%. 17 out of 20 are in positive territory, and the overall average return of the 20 stocks is an impressive 258.39%. We’d also like to note that 3 of the companies were acquired at premiums (yellow highlights), and 2 are achieving returns of over 1000%.

- Note: The symbol GV was claimed by another company after it was acquired.

We are on the cusp of releasing BOP #12, which you can get early access to by joining GeoInvesting today.

In fact, we’ve already identified 1 stock that has fallen sharply that we think has 56% upside.