Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

June 1, 2020 marked the highest price that Zynex Inc. (NASDAQ:ZYXI) traded in the past 19 months, $27.03. It was shortly thereafter, on June 11, 2020, that Night Market Research (@NMRtweet) saw what likely appeared to them as an opportunity to strike when they released a critical report on the company titled, “Zynex: Deteriorating Fundamentals and Signs of Reimbursement Pressure.” The short seller contended that ZYXI had deteriorating profitability, looming insurance reimbursement pressure, alleged poor efficacy of its products, deductible woes and violations, investigations levied against them, and analyst estimates unrepresentative of real world circumstances facing the company.

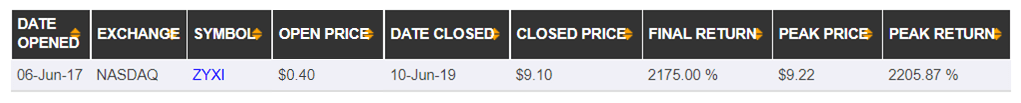

If you rewind a little further back in time, ZYXI, specializing in pain management medical devices, was a stock that sat in our Long Disclosures Model Portfolio from June 6, 2017 to June 10, 2019, netting us a 2,175% return.

Our coverage was ironically born from a speculative turnaround scenario in which, as is often the case, we were interested in tracking the company’s return to profitability and improved balance sheet, but had yet to do further diligence.

The stock continued its ascent to its June 2020 high, without us, but we were of the opinion that it surely got way ahead of itself and were a bit uncertain of the efficacy of the company’s products, so we were happy with our returns.

The 2-year duration of ZYXI’s tenure in our Model Portfolio saw the company markedly improve its financials. Analyst price targets gradually increased as the company posted improved qoq comps and increased order flow. As we neared the closing of our coverage, we noted:

“After holding for just over two years and reaping 2000%+ gains, we have closed out our long position in Zynex, Inc.(OOTC:ZYXI) ($8.43; $273.0M market cap). We first highlighted ZYXI on June 6, 2017 when shares were trading at $0.36, disclosing our long position and adding it to our “Run to One” portfolio the same day, while the stock was trading at $0.40. The stock has had an amazing run, but at current levels we can no longer justify the valuation. We have closed out our long position and will remove the stock from all of our portfolio screens.”

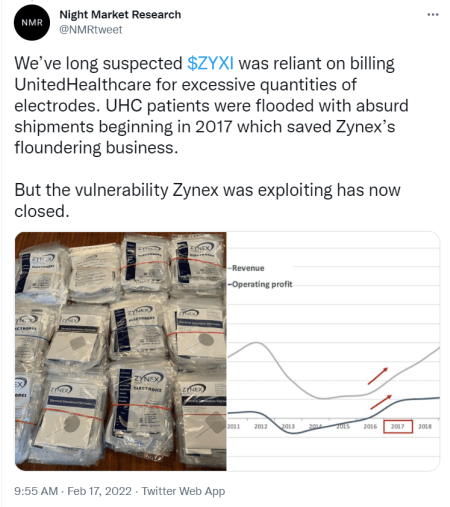

Today’s analyst estimates of $20.47 (Sentieo) are more than 185% higher than ZYXI’s current price of $7.00, a price that we think might represent a “coming back down to earth” scenario, where valuation should be reassessed, even in light of a new February 17, 2022 report by Night Market Research on the company titled, “Zynex: UnitedHealthcare Terminating Contract – An Undisclosed Loss That Accounts For 50%+ EBITDA.” This time, the activist firm noted that:

“We’ve long suspected Zynex was reliant on billing UnitedHealthcare (NYSE: UNH) for excessive quantities of electrodes. When UHC recently introduced a new TENS coverage policy it appeared the insurer finally detected the impropriety but might continue to pay Zynex claims if at reduced rates. However, it appears UHC has taken decisive action to put an end to Zynex’s abusive tactics.”

Noted in a letter observed by Night Market Research, “Zynex Medical will no longer be a part of the UnitedHealthcare Network”.

On the seemingly positive side, the company also just acquired Kestrel Labs and is seeking FDA approval for CM-1600, ZYXI’s next generation fluid monitoring system and a follow-up to its already FDA cleared CM-1500 Fluid Monitoring System:

“I am thrilled to announce that we have submitted a 510(k) premarket notification to the FDA for our CM-1600. We have worked diligently at adding key enhancements to our FDA-cleared CM-1500 Fluid Monitoring System, including wireless connectivity to the non-invasive wrist wearable,” said Thomas Sandgaard, CEO. “This 510(k) submission is an important step in the evolution of our fluid monitoring system, which we believe will become a vital tool to ensure optimal fluid management and quality care for patients at risk for hemorrhagic events.”

Given the tug of war between the positive and negative, should we view the continued coverage by Night Market Research as worrisome, especially that this a material event was allegedly undisclosed to investors?

Alas, they feel that their original research was vindicated:

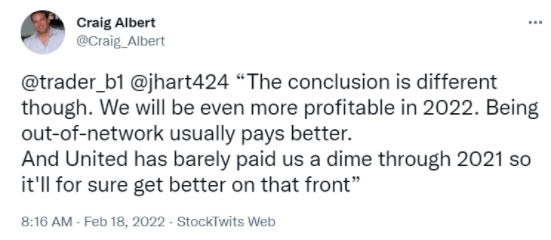

However, Zynex claims that there will be no material change in terms of profitability as they will just process the claims as they usually do through out-of-network claims, something they will talk about in a webcast on February 24, 2022.

After all, some investors are still bullish, especially due to other products.

You might be asking, where are we going with this? Please sign in to read on

Frankly, given the stock’s pullback, we are intrigued again, so Zynex is back on our radar so we can monitor how the company’s management handles adversity and to see if their lack of concern of losing an insurance carrier partner is warranted

Let’s get this straight, this does not mean we are putting the stock on any of our Model Portfolios, nor would we even consider this idea generation in a classic sense. This is us observing the potential for a company to address skeptics in a responsible and transparent manner. Given our past in dealing with companies who are in the crosshairs of scandals, and at times being the quarterback spearheading investigations into malfeasance, we feel we are in a unique position to call it as it is.

The stock did so well for us in the past, and we want to see if there is another window of opportunity should ZYXI successfully dispel the concerns that the loss of the major partner will cripple its ability to mitigate this loss of revenue through other channels, as they claim they’ll be able to do.

Analyst price targets call for ZYXI to report EPS of $0.59 in 2022, $1.17 2023 and $1.89 in 2024 vs. $0.42 in 2021 (Source: Sentieo). So the stock is trading at a meager P/Es of 11.86 on 2022, 5.89 on 2023, and 3.70 on 2024 estimates. Likewise, revenue is expected to grow 63.83% to 131.26M in 2022 and then 32.32% to 173.68M in 2023, putting the 2023 P/S at only 1.08. (Source: Sentieo)

Night Market Research thinks that guidance will need to be dropped, but is this really the case? Will the UnitedHealthcare Network want to get back money for which they were supposedly overbilled, or will they have already lost their leverage and window of opportunity, being that they were originally part of Zynex’s network? Will the new acquisition dilute shareholders since more than half of it was stock-based, and how accretive will it be? How will this affect estimates?

We’ll likely have more to say as the situation unfolds, and especially after the webcast ZYXI is holding in a few days.

~Thank you

–

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

xxx

Notable Tweets

Featured Video

xxx

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.