California-based company Zogenix (NASDAQ:ZGNX) observed the drug fenfluramine, which had problematic side effects in obesity, and demonstrated it could work to prevent seizures. At a time when GW Pharmaceuticals (GWPH) and Insys Therapeutics (INSY) were advancing cannabidiol (CBD)-based drugs to treat childhood epilepsy, Zogenix launched a 5-year study of fenfluramine, also known as ZX008. The study goal was to reduce the frequency of seizures in childhood epilepsy. Like GW, Zogenix narrowed the patient pool by testing fenfluramine only in patients with either Dravet syndrome or Lennox Gastauts syndrome. ZX008, with a different mechanism of action, subsequently outperformed the GW drug, Epidiolex.

California-based company Zogenix (NASDAQ:ZGNX) observed the drug fenfluramine, which had problematic side effects in obesity, and demonstrated it could work to prevent seizures. At a time when GW Pharmaceuticals (GWPH) and Insys Therapeutics (INSY) were advancing cannabidiol (CBD)-based drugs to treat childhood epilepsy, Zogenix launched a 5-year study of fenfluramine, also known as ZX008. The study goal was to reduce the frequency of seizures in childhood epilepsy. Like GW, Zogenix narrowed the patient pool by testing fenfluramine only in patients with either Dravet syndrome or Lennox Gastauts syndrome. ZX008, with a different mechanism of action, subsequently outperformed the GW drug, Epidiolex.

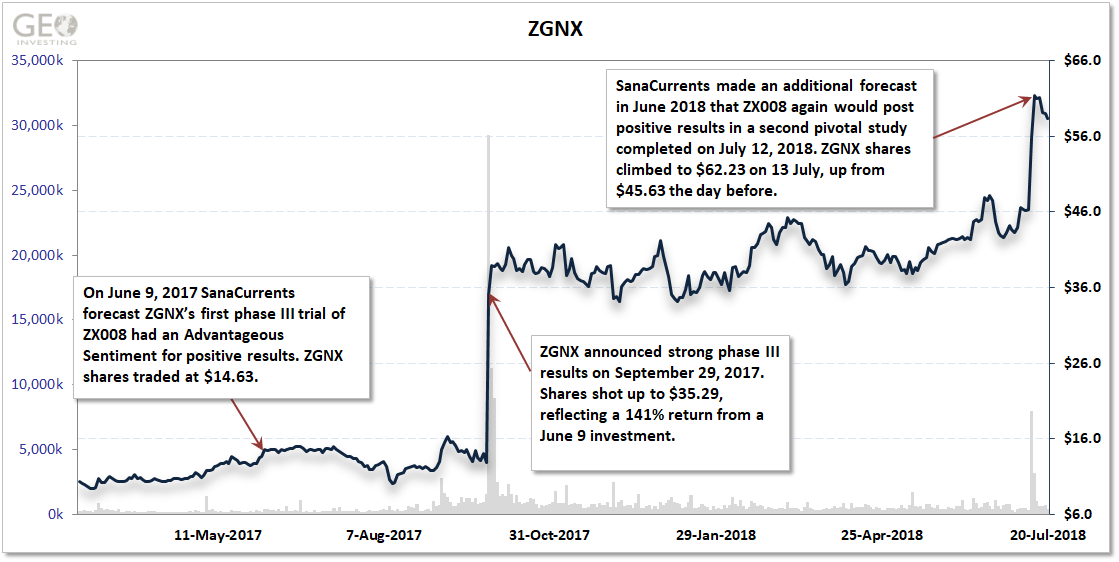

SanaCurrents evaluated previous fenfluramine studies early last year through its analytics platform. On June 9, 2017, SanaCurrents forecast ZGNX’s first phase III trial of ZX008 had a high probability for positive results. ZGNX shares traded at $14.63 on June 9.

When ZGNX announced strong phase III results on September 29, 2017, its shares shot up to $35.29, reflecting a 141% return from a June 9 investment. SanaCurrents made an additional forecast in June this year that ZX008 again would post positive results in a second pivotal study completed on 12 July, 2018. ZGNX shares climbed to $62.23 on 13 July, up from $45.63 the day before.

In June 2018, the FDA approved GWPH’s Epidiolex as a treatment for childhood epilepsy. Zogenix operated under the radar as GW and Inysys gained headlines for its novel cannabidiol approach, but the ZGNX study results validated the company’s drug and yielded high returns – for the investor who “removed the blindfold” in 2017. GWPH now has a $4.2 billion market cap, while ZGNX owns a $2.15 billion market cap. As ZX008 moves closer to approval and market launch, expect ZGNX to narrow the gap.

What exactly did this mean for investors in ZGNX shares? In 13 months, they netted $32,000 on a mere $10,000 investment after SanaCurrents’ initial forecast.