It appears the VirtualScopics Inc. (NASDAQ:VSCP) is in the midst of restructuring efforts that began roughly two years ago to put the company back on a path to profitability. Dating back to 2007, VSCP has lost money since Q2 2013 and only has achieved annual profitably in one year (2011). Despite its history of losing money, we believe there are reasons to track the story. Recent financial results and bullish commentary from management lead us to believe the company’s restructuring efforts are beginning to bear fruit. When we first brought this story to our members’ attention on January 28, the stock was trading at $3.05. It subsequently reached $4.18 before retracing to current levels at around $3.55.

It appears the VirtualScopics Inc. (NASDAQ:VSCP) is in the midst of restructuring efforts that began roughly two years ago to put the company back on a path to profitability. Dating back to 2007, VSCP has lost money since Q2 2013 and only has achieved annual profitably in one year (2011). Despite its history of losing money, we believe there are reasons to track the story. Recent financial results and bullish commentary from management lead us to believe the company’s restructuring efforts are beginning to bear fruit. When we first brought this story to our members’ attention on January 28, the stock was trading at $3.05. It subsequently reached $4.18 before retracing to current levels at around $3.55.

The company offers a suite of image analysis software tools and applications, which are used in detecting and measuring specific anatomical structures and metabolic activity using medical images. Its proprietary software and algorithms provide measurement capabilities designed to improve clinical research and development.

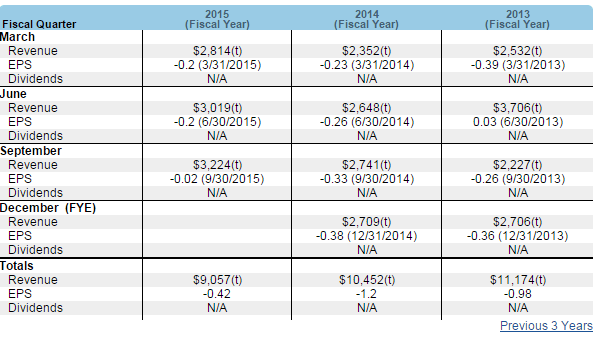

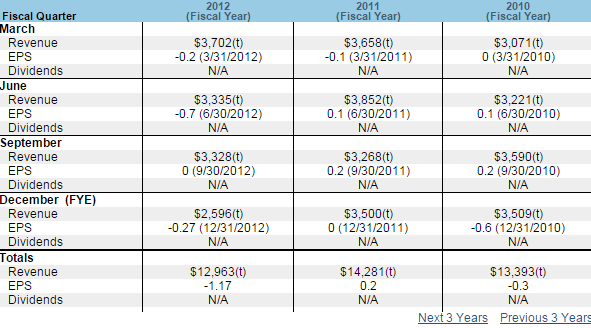

The last time VSCP was profitable was back in 2011.

Source: Nasdaq.com

Although we are usually skeptical of companies that have a recurring problem of reporting profitable bottom line results, we have our reasons to continue to track VSCP.

VirtualScopics – From Cash Burn to Cash Generation

The company’s restructuring efforts have taken it from a cash burn to a potential cash generator on a quarterly basis. The efforts include:

- A focus on core customer base to improve customer relationships. The company is active in engaging and educating its current customer base.

- Promote better work environment for employees

- Focus on higher margin projects

Strong Q3 2015 results

- Revenues for the third quarter of 2015 increased 18% to $3,224,407 compared to $2,741,241 for the third quarter of 2014.

- VSCP reported a net loss for the third quarter of 2015 of $24,779, or $0.02 loss per share, representing a 97% improvement from a net loss of $955,523, or $0.33 loss per share, reported in the third quarter of 2014.

- The company reported positive Adjusted EBITDA in the third quarter of 2015 of $132,101 as compared to negative Adjusted EBITDA of $842,772 in the third quarter of 2014.

- Bullish commentary regarding outlook indicates that the company is on a path to achieve profitability for the first time since Q2 2013:

“We are very pleased with the company’s strong performance during the third quarter of 2015,” said Eric T. Converse, president and chief executive officer of VirtualScopics. “This quarter is the first time the company has achieved positive Adjusted EBITDA since the second quarter of 2013 , a trend we believe will continue to improve for the remainder of this year and beyond. I am very proud of the entire VirtualScopics team.”

- Margins are improving, quotes from management:

“We are pleased to have achieved strong margins for both 2015 reporting periods over the prior year’s periods,” said Jim Groff, VirtualScopics’ chief financial officer. “In the third quarter of 2015, margins improved to 42% as compared to 34% in the third quarter of 2014. For the first nine months of 2015 margins improved to 37% as compared to 34% achieved last year. The margin improvement thus far in 2015 reflects the increase in the startup of new projects, which yield higher margins during their startup phase, along with a continued focus on our core offerings and investment in our infrastructure and people.”

- Bullish on the backlog:

“the backlog has grown to $31.9 million and we believe it will continue to grow. Our decision to focus on our core competencies has proven to be the right decision as we continue to strengthen our relationships with large pharma and develop new relationships with biotechs. This year we were chosen to be the sole imaging provider for several of our customers and most recently we were awarded a phase III oncology trial from yet another large pharma company.

But I do want to mention this, because our bookings and awards this year are $24 million, with over $16 million of that already booked and the reason why I’m sharing this with you is we’re on the verge of two consecutive years with bookings over $20 million. Just to give you a perspective on that, before last year, we had not had bookings over $20 million since 2009 and that was the only time it happened in the history of this company.

Now, we’re looking at two years in a row with these booking numbers. This will definitely help increase our backlog and we believe continue to help our revenue grow. This organic growth is promising. However, I will continue to speak to industry people and explore how we can obtain a greater backlog more rapidly than just organic growth. I have nothing more to offer on this subject, but want to be clear that I’m looking to overcome this challenge in the shortest timeframe possible.”

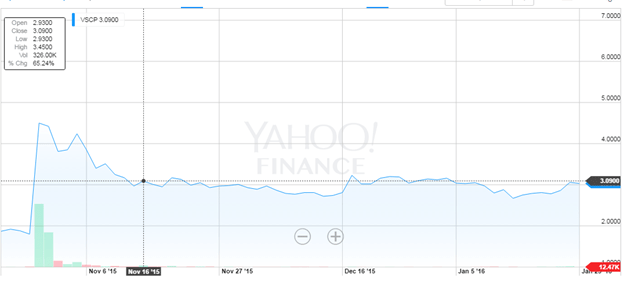

- Shares rocketed higher on Q3 results reaching a high of $6.65, a 269% rise from the prior day close of $1.80. Shares settled at $4.50 by the close of that trading day and have since retraced to current levels of $3.00.

- Flat line chart

Disclosure: No Position a time of update

We suggest investors read the Q3 2015 conference call transcript for a better understanding of the story.

Caveats

- We cannot find a comparable backlog figure to compare to the Company’s current backlog. We will also like to learn how long it takes the company to fill its backlog.

- Unsure how profitable the company will be without any specific guidance

- Quote from the Q3 conference call:

“ I do want to remind you that we are always at risk of changes in trials we win. This risk is inherent in our business. I would also like to advise you that the greater our backlog becomes the lessened the risk becomes. The progress we’re making as a team gives me great confidence in our future .”