We all have our ways of defining the characteristics of special situation investing scenarios. Microcap and nanocap stocks present an endless number of special situations. You can look for them to gain an edge in your investment strategy.

We all have our ways of defining the characteristics of special situation investing scenarios. Microcap and nanocap stocks present an endless number of special situations. You can look for them to gain an edge in your investment strategy.

When I participated in a newsletter panel (April 29 through April 31) at the Planet Microcap Showcase Conference in Las Vegas, Nevada, moderator Brian Balbirnie of Issuer Direct (NYSE MKT:ISDR) asked me to talk about the type of infection points and catalysts I look for when I am hunting for stocks to buy. You can view the panel conversation here.

Typically, I am looking for Growth + Value + Information Arbitrage situations that will improve the growth and/or risk profile of a company. This can lead to a permanent or temporary expansion in valuation multiples. I particularly enjoy spending a lot of time exploring the “risk profile” part of this equation.

Valuation And Discounted Cash Flow

I am not a huge fan of strictly adhering to valuation models as a holy grail to determine what the fair value of stock prices should be. They require forecasting a set of assumptions that are unknown or will change over time.

This tweet by @JSiegel88 sums this up:

“DCF to us is sort of like Hubble telescope – you turn it fraction of inch & you’re in differnt galaxy”

Third Ave. CIO & PM, Curtis Jensem

– Jay Siegel (@JSiegel88) December 4, 2014

But formulas are logical in their construction and useful in seeing how changes in the inputs can impact stock prices.

The assumed risk premium assumption embedded in the interest rate or cost of capital inputs is one of the key factors in discounted cash flow (DCF) analysis and stock pricing models like the Gordon Model.

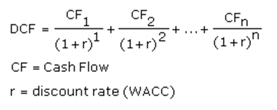

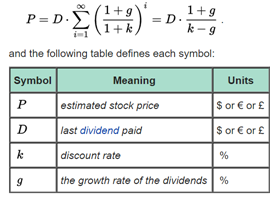

Here is a look at a standard Discounted Cash Flow Model and the Gordon Model:

DCF Model Equation

Gordon Model

The “r” and “k” in these formulas are going to incorporate the risk free rate of return PLUS risk premium assumptions. Thus, simple math tells us that if the denominator of the equation decreases through a decrease of “r” or “k”, the price or cash flows will move higher if we keep all other inputs constant.

Return On Invested Capital

Value investors like Warren Buffett and Chuck Akres point to high ROIC as being the single most important factor that multi-baggers share. As risk comes down a company will be in a greater position to earn a higher return on its invested capital (ROIC).

ROIC is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. Return on invested capital gives a sense of how well a company is using its money to generate returns. Comparing a company’s return on capital (ROIC) with its weighted average cost of capital (WACC) reveals whether invested capital is being used effectively.

The WAAC (cost to access capital) will come down for a company as its risk profile comes down (thus reducing the denominator).

But you don’t need to visit these concepts to understand the role risk plays in valuation analysis. It’s just logical to assume that as a business becomes less risky there is a good chance that the market will place a higher value on its cash flows and that it will be less expensive for the management to grow the business.

The Valuation Facade And Special Situation Investing

I love special situation investing plays that look expensive on a price to earnings (P/E) basis, even more so if the company is losing money, making the P/E irrelevant. Growth at A Reasonable Price (GARP) Investors will ignore extremes as they look for undervalued companies. For example, they want stocks that are growing, but not too much such that growth will not be sustainable. Also, they don’t want P/Es that are too low (signifying that there could be unknown risks) or too high (sometimes implying that investor expectations are set too high). But these are the pockets where special situations can live. Your job as an investor is not to assume that the market is efficient.

A low P/E situation is great in that it could mean the stock is already cheap relative to its cash flows. If you can identify that the reason for the low P/E is due to some risk factors and then deduce that management will successfully address them you could see a swift and violent increase in the P/E ratio when risks are removed or reduced.

When P/Es are high or not material due to low earnings levels or losses, I like to reference the price to sales, enterprise to sales and price to tangible book multiples. If these multiples are low, it could mean some major risks exist in the company. If resolved, you could see these multiples expand. The EV/EBITDA is a nice way to search for companies that have high debt burdens, but are on the cusp of reducing debt. With the elimination or reduction of interest expense, the hidden value is more evident in earnings per share and P/Es.

Microcap Investors Can Shine

This is where microcap investors shine since other investors ignore these stocks when they just look at trailing P/Es. In fact, in his famous book, “Intelligent Investors”, Ben Graham advocates for using normalized P/E ratios so as to not put too much weight on the most recent results. I recommend that investors should try to develop special situation investing skills to eye up “troubled” companies where future cash flow will increase substantially.

Listen closely to what value investing advocates like Peter Lynch and Warren Buffett have preached over the years. The value of the stock is the total value of its future earnings discounted back to the present —to reiterate, the FUTURE earnings!

In part two of this special situation investing topic I will present different types of de-risking scenarios I look for to help me build wealth over time.