Yesterday, while reviewing my book notes on value investing , I came across an interesting passage from a classic investment book, “Security Analysis” by Graham and Dodd.

Yesterday, while reviewing my book notes on value investing , I came across an interesting passage from a classic investment book, “Security Analysis” by Graham and Dodd.

“Security Analysis” is considered by many to be the more technical version of Benjamin Graham’s famous book “The Intelligent Investor”, which has been notably praised by Warren Buffett as one of the best books of all time in the genre of value investing. Graham was Buffett’s professor and mentor at Columbia Business School. Despite being originally published in 1934, the book offers timeless wisdom on value investing.

Value Investing Using Adjustments

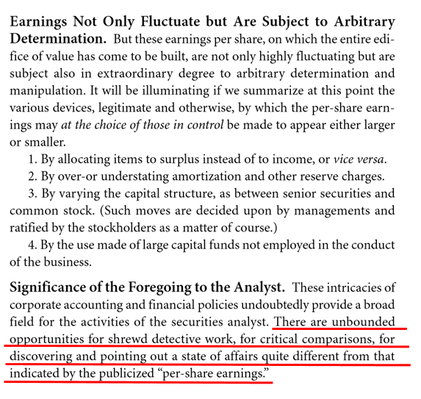

The following passage struck me as quite relevant as it summarizes much of the work we do at GeoInvesting.

At GeoInvesting, we are obsessed with digging through financial filings to figure out if company financials are truly indicative of future performance. We pride ourselves with being the best research outlet for deciphering adjusted earnings in the micro-cap space.

It is always encouraging to hear someone who is smart and respected agree with you, especially if it happens to be an investment legend.

If you are an investor and agree with Graham on the importance of adjusted earnings and deep dive research in financial filings, GeoInvesting could be an indispensable tool for you. Subscribe now to our premium service and get the best earnings research there is in the micro-cap space.

A Picture Is Worth A Thousand Words

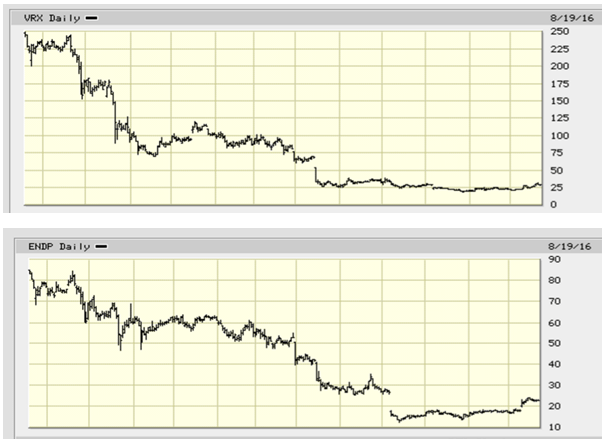

Putting forth the effort to go beyond the numbers provided by companies can protect your portfolio and even pay you back for your time. The adjusted earnings vs. non-adjusted earnings debate was in full bloom in 2015 and 2016 when shares of pharmaceutical giants Valeant Pharmaceuticals (NYSE:VRX) and Endo International (NMS:ENDP) plummeted. These were two companies that sported a combined $5 billion in annual revenue and combined market caps in the tens of billions.

Over the years, both companies grew their enterprises through an aggressive acquisition strategy and were adding back “one time” expenses as adjustments related to acquisitions to boost earnings per share (EPS). Eventually, it became evident that these expenses should be treated as recurring in nature, and not as one-time events.

Here is a look at the charts of ENDP and VRX as the market caught on to what many would consider accounting gimmicks.

On the flip side, we find plenty of hidden bullish scenarios when management teams report what initially looks like lousy financial results, but adjustments could work to the advantage of the investor by clarifying expenses that truly will be non-recurring, or one-time, in nature.

Our advantage is that we know how to assess conservative decisions by management not to adjust EPS for certain non-recurring expenses. The often-ignored microcap universe is where much of this value can be discovered and ultimately unlocked.

During earnings seasons, our team opens up every microcap earnings release to analyze the numbers and search for these potential gems. With Q1 2017 earnings season about to go live, now could be a great time for you to witness how we execute this process.

This passage was written by Siegfried Eggert, GeoInvesting Special Situations Analyst