In the investment world, it shouldn’t be a “One Size Fits All” approach, especially when we look at the microcap world that represents the largest segment of the equity market in terms of sheer number of choices. As a regular educational feature, we at GeoInvesting will explore the approaches commonly seen within the microcap space and discuss how we have applied that particular approach in the past. Let’s start with special situation investing.

Special Situation Investing

According to Investopedia “A special situation refers to particular circumstances involving a security that would compel investors to trade the security based on special situation investing principles, rather than the underlying fundamentals of the security or some other investment rationale. An investment made due to a special situation is typically an attempt to profit from a change in valuation as a result of the special situation, and is generally not a long-term investment.”

First off, guess Investopedia never paid attention in class where you can’t define a word using itself. But if we say “unusual circumstances”, the above works nicely for us. Secondly note that there is a temporary disparity between the value of the stock and the price, whether positive or negative. And thirdly, that delta of value will disappear as the market adjusts to the information. All of this means that “special situation” is a time sensitive short term approach to grabbing profits when the opportunities arise.

Let’s explore some examples. The most extreme of the past two decades is the attack on 9/11/2001. Totally exogenic, a shock to the entire system. Some companies that were to present that day in Manhattan disappeared because of this “black swan” event. Many other companies had their stock price plummet due to the chaos of the ensuing days and weeks, often presenting opportunities to pick up fundamentally strong stocks that were on sale through no fault of their management. Let’s hope we never see an event like that again. But Warren Buffet made a ton of money by using his cash on hand to extend loans to General Electric Company (NYSE:GE) and other firms that were caught in the credit crunch that arose. You must be ready to move and move quickly when a special situation opportunity arises, because the old adage “you snooze, you lose” is accurate.

On a more “normal” scale, special situations can cover anything from a one-time charge for an acquisition (both completed and failed mind you) to a lump sum life insurance payment from a key-person policy (a non-recurring revenue issue that can create change of control situation and forced sale of stock) to a regulatory issue creating doubt. Let’s explore an example from GeoInvesting’s own research to see the opportunity for profit from a special situation.

Blue Bird – A Special Situation Investing Gem

You probably recognize Blue Bird if you have kids, because they make school buses. They have been doing so since the 1930’s, so you probably have ridden in their product at some point. They are listed on the NASDAQ as Blue Bird Corporation (NASDAQ:BLBD) since 2015 when Cerberus Capital took them public while retaining a majority stake.

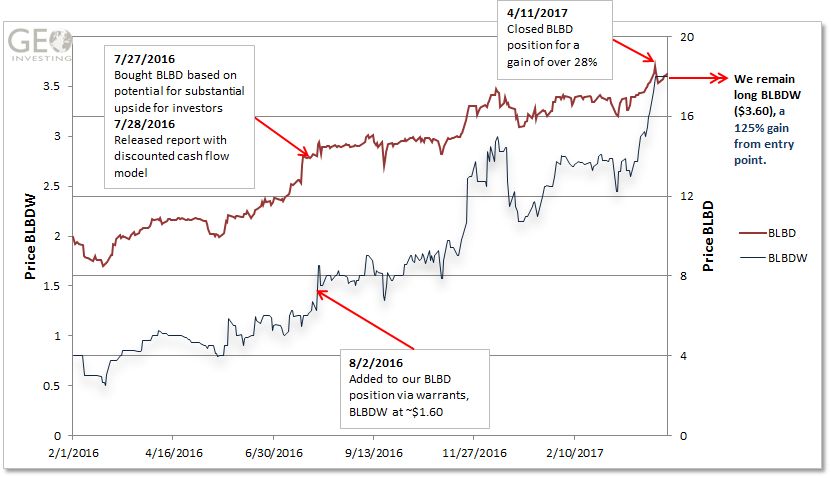

We at Geo began following Blue Bird in 2016, and on July 27, 2016 published a post as to why we did not think the takeover offer at $13 per share from American Security would close. We were right, and on September 8 we re-iterated why we felt this. In August our analysis was featured in Barron’s because we were spot on. As the takeover fell apart, BLBD shares fell further, making it even more attractive.

Fast forward to 2017. In January Blue Bird announced it would develop a Zero Emission Vehicle supported by $4.4mm grant from the US Department of Energy (itself a special situation for the company) with other entities assisting for a total of $9mm+ of funds. Later Geo closed out its long position on the stock but remained long on the warrants. In late April we discussed the fight in an article about shareholder activism and that month’s newsletter listed it as a STUD as we were up 35+% on the stock. Overall we are up over 125% on this special situation investing scenario, and the returns speak for themselves. We were well paid for our research and patience.

How Do We Find Special Situation Investments?

So how do we find Special Situations? It’s not like they are advertised on the six o’clock news. Well, actually they sometimes can be, if you happen to glean a piece of information that is valuable, but that is extremely rare.

More likely you can find a special situation investing opportunity the way that we do at Geo, with hard work. Reading the reports, listening to interviews with management, digging through all the stuff to find the things that are overlooked like liabilities coming off the books or new funding avenues. Or you can become a GeoInvesting Member and trade a few dollars for time and use our research. We spend hundreds of hours a week doing it, so we have a bit of an advantage in finding the limited time Special Situations and bringing them to our Members so they can take advantage of it before the window slams shut.

Either way, being opportunistic and research driven will allow you to make some great profits if you keep your eyes and ears open. The old adage “fortune favors the bold” applies to special situation investing like no other. Maybe now would be a good time to be bold and seize the day and the situation.

Thank you.