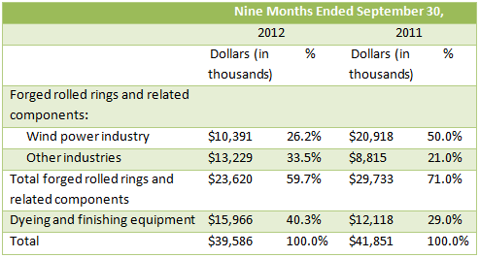

Cleantech Solutions Internation (NASDAQ:CLNT) wowed investors with what appeared to be home run financial results for its third quarter ending September 30, 2012. Reported sales increased 48.5% to $17.3 million and EPS increased 91% to $0.88. CLNT attracted our attention after a bearish November 21, 2012 article was published on Seeking Alpha titled “A Troubling Visit to Cleantech Solutions.”

Following these developments and dramatic volatility in CLNT’s shares, we decided to visit CLNT for a firsthand glimpse of the company’s operations. While we cannot attest to how CLNT has used capital it has been able to raise in the U.S. or to the claims it has made in all of its prior disclosures, we have been able to cross check some of the company’s recent claims. Our initial due diligence confirms that a good deal of information disclosed to U.S investors, as well as recent financials presented in CLNT’s SEC filings, may hold some credence.

As CLNT introduced new types of dyeing equipment, its dyeing and finishing equipment business appears to be significantly growing and may more than offset the decreasing performance of its wind power industry business.

The information we have gathered and confirmed may give investors enough confidence to assign a conservative short-term price target for CLNT of $9.00 per share, which is a meager 5 times trailing EPS and more than double its current level of around $4.40 per share. As we will discuss, we believe there could be significant upside to this target, especially if the company takes steps to increase the transparency of its operations.

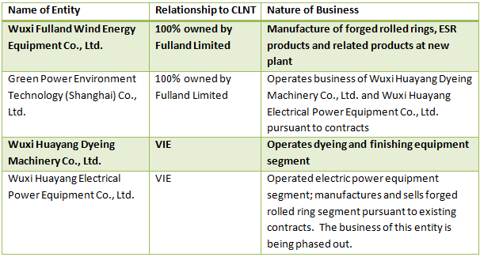

It appears that the company’s legacy dyeing and finishing equipment business is thriving, a segment that comprised around 40% of sales through the first nine months of 2012. And although CLNT’s forged rolled rings business serving the wind power industry appears to be on the downswing, this same forged rolled ring business serving other industries such as solar energy is picking up and represents around 34% of sales through the first nine months of 2012.

This is a testament to how the stabilization in China’s solar energy industry can fuel substantial growth for CLNT’s forged rolled rings business serving industries other than wind power. Due to Chinese government subsidies for solar energy, it is possible that CLNT can continue to grow its forged rolled rings business serving this and possibly other industries as well. Thus, 2 out of 3 market segments that CLNT serves, currently comprising around 75% of revenues, appear to be running on all cylinders.

The following is a summary of findings from our visit to CLNT operations between November 23 and 26, 2012.

- The employee count was largely in line with CLNT’s claims.

- CLNT’s legacy dyeing and finishing business seems to be growing and even thriving. However, its wind power business (forged rolled rings for the wind power industry) is dwindling. This change in direction should not come as a surprise to investors since CLNT had disclosed this trend in recent filings, beginning on August 8, 2012. CLNT’s forged rolled ring business for their non-wind power customers continues to be substantial.

- The lack of activity at CLNT’s ESR (“electro-slag re-melted”) production facilities referenced in the November 21, 2012 Seeking Alpha report can be explained by company disclosures that these facilities were non-operational at that time and is currently non-operational as well.

- Employees stated that CLNT has received big orders for its new type of dyeing equipment.

- CLNT is currently in an aggressive hiring mode, recruiting electric welders for its dyeing and finishing business and forged rolled rings business.

- Techprecision Corporation (OTCQB:TPCS), a publicly traded U.S. company, has a business relationship with CLNT and rented a small office in the company’s facility. TPCS’s website contains information that indicates it is involved in the Cleantech sector.

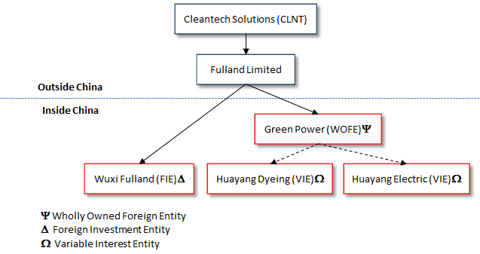

Furthermore, we also pulled the SAIC files for all of CLNT’s Chinese subsidiaries and confirmed CLNT’s corporate structure as disclosed in these filings.

CLNT basically has two ongoing businesses through its subsidiaries.

The corporate chart of CLNT is as follows:

The following table sets forth information on the revenue of CLNT’s “forged rolled rings and related components” industry, as well as the “dyeing and finishing equipment” segment, in dollars and as a percent of revenue:

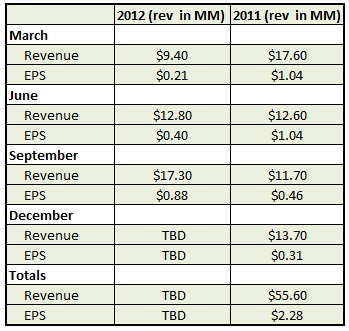

Our investigator visited CLNT from Nov. 23 to Nov. 26, 2012 in Qianzhou Township Huishan District, Wuxi City, Jiangsu province. The following satellite map is marked with CLNT’s two facilities that we had a chance to visit – one for dyeing and a finishing equipment facility (old plant) and one for forged rolled rings and related components (new plant).

We talked to several of CLNT’s employees without disclosing our identity. After cross-checking the information we gleaned from these employees, it was overall in line with company disclosures. The following points are what we gathered from our conversations, corroborated with information from company disclosures and our own observations.

- Currently, CLNT’s manufacturing staff in these two plants amounts to around 180 people, not including executives, administrative staff and sales representatives.CLNT Disclosure in its 2011 10K:

“As of March 22, 2012, we had 233 employees, including 168 full time employees and 65 part time employees. Of these, 120 employees are in the dyeing and finishing segment (six executives, managers and administrative staff, two accounting staff, three quantity control staff, three engineers and technicians, four marketing and salespeople, three purchasing staff and 99 manufacturing staff) and 113 employees are with our forged rolled rings and related products segment (six executive, managers and administrative staff, three accounting staff, three salespeople, and 90 manufacturing staff, and 11 quality control and engineers/technicians).”

We assume that CLNT kept a similar employee count from March 22, 2012 to Nov. 2012.

- In the last three months, CLNT has decreased production of forged rolled rings for the wind power industry. Currently, CLNT appears to have few substantial orders from the wind power industry.CLNT’s Disclosure:

“For nine months/three months ended September 30, 2012, revenue from forged rolled rings and related components for wind power industry decreased to USD 10.3 million/3.2 million, decreased from USD 20.9 million/4.5 million for the same period of 2011.”

Based on our on-the-ground due diligence, revenue from forged rolled rings and related components for the wind power industry during the period from Q3 to Q4 in 2012 may continue to see a decrease in revenues.

- Employees who used to work with the forged rolled rings (for wind power) were transferred to work in the plant for either the dyeing equipment business or forged rolling business serving other industries.CLNT disclosure:

There was no disclosure regarding this issue. However, CLNT reported a substantial revenue decrease for forged rolled rings and related projects serving the wind power industry and reported a substantial revenue increase for the dyeing and finishing equipment business. CLNT’s manufacturing staff numbers did not substantially change from March 2012 to November 2012. Therefore, it is reasonable to believe that CLNT transferred some manufacturing staff from wind power to dyeing and finishing.

- The manufacturing staff estimated the workload distribution between the dyeing and finishing business vs. forge rolled rings business to be around 60% vs. 40%, respectively. (As this is only an observational estimation from the staff, we have to be open to the possibility that this distribution may not reflect the real revenue ratio between the forged rolled rings business and dyeing and finishing equipment business).CLNT’s disclosure:

“For three months ended September 30, 2012, the revenue for dyeing and finishing equipment is USD 7.5 million and total forged rolled rings business is USD 9.8 million, including wind power industry revenue USD 3.2 million and other industries revenue USD 6.6 million.”

Considering…

- The wind power industry revenue (which is part of the forged rolled business) may continue to decrease in Q4 and

- The increase in new dyeing and finishing equipment orders

… the financial disclosures do match CLNT’s real business performance for Q3 of 2012

- Recently, CLNT introduced a new type of dyeing machine. Employees stated that CLNT received big orders for this new type of dyeing equipment. CLNT also started to use the forged rolled rings facility for the dyeing equipment business. Our investigator observed dyeing equipment laid out in the yard of the forged rolled rings plant.

CLNT disclosure:

CLNT disclosure:

From this August 2012 press release, CLNT reported several big orders for its new dyeing machines. We believe that our on-the-ground due diligence confirmed the existence of new orders leading to a possible increase in revenue from dyeing and finishing equipment.

- Because of the recent boom in its dyeing business, CLNT is recruiting electric welders. With the newly reported dyeing machines order, along with CLNT’s non-wind power forged rolled rings business, it is reasonable that CLNT will need to recruit more manufacturing staff for these new orders.

- Wuxi Critical Mechanical Components Co., Ltd. (“WCMC”), a Chinese subsidiary of U.S. based Techprecision Corporation, has an office in CLNT’s facility as disclosed in TPCS’s 10K:

“On November 15, 2010, WCMC leased approximately 1,000 sq. ft. of office space from an affiliate of Cleantech Solutions International (“CSI”) to serve as its primary corporate offices in Wuxi, China. The lease has an initial two-year term and rent under the lease with the CSI affiliate is approximately $17,000 on an annual basis. In addition to leasing property from an affiliate of CSI, the Company subcontracts fabrication and machining services from CSI through their manufacturing facility in Wuxi, China, and such subcontracted services are overseen by the Company personnel co-located at CSI in Wuxi, China … Of those employees, 8 employees are located in China at Wuxi Critical Mechanical Components Co., Ltd. (WCMC).”

During his visit, our investigator found WCMC’s sign on CLNT’s facility wall:

We also pulled WCMC’s SAIC file and confirmed that it is a TPCS subsidiary.

We also pulled WCMC’s SAIC file and confirmed that it is a TPCS subsidiary.

Troubled Electro Slag Remelt (“ESR”) Business

The aforementioned bearish Seeking Alpha article made the following statements regarding CLNT’s ESR business:

“I showed up at Cleantech on a Tuesday, prepared for a full day tour of the facilities and interview with management. Management had been informed about my visit some weeks before and I was told that they planned on putting on quite a show of how their business was booming. However, the entire tour of the facilities took less than 30 minutes because the operations were conducted in a single, small open air warehouse.

The part that was intended to be so visually impressive was the ESR (“electro-slag re-melted”) production facilities and this was also said to be the key driver of CLNT’s huge future revenue potential. However, apparently the ESR line takes time to heat up and start production, and it wasn’t running at all on the day I visited.

Instead what I saw was quite literally fewer than 10 employees (in total) engaged in very low-end metal stamping of forged rings which are used in windmills.”

Regarding the ESR business, CLNT made a clear disclosure that the business was shut down since the end of 2011. The relevant disclosures were made in the company’s SEC documents:

“In October 2009, we ordered machinery to expand our completed state-of-the-art forged product facility with a new production line, enabling us to manufacture ESR forged products for the high performance components market for various industries. We delivered the initial units from this production line in July 2010 to one customer, which has been our only ESR customer through December 31, 2011. For fiscal 2011, we generated revenue of $1,687,756 from the sale of ESR forged products as compared to $7,568,774 for fiscal 2010. This customer is using our ESR products primarily in the steel manufacturing equipment and accordingly revenues from the sale of ESR products are included in forged rolled rings – other industries. The contract with this customer has expired and we have no new orders for ESR products as of the date of this report.”

“During the nine months ended September 30, 2012, we recorded depreciation expense related to ESR production equipment in operating expenses since we did not perform any production for ESR products and we did not use the equipment in this period. During the first quarter of 2011, we recorded depreciation expense related to ESR production equipment in inventories and cost of revenues since we generated production activities for ESR products in the first quarter of 2011. Accordingly, for the nine months ended September 30, 2012, depreciation included in operating expenses increased by approximately $618,000 as compared to the comparable period in 2011.”

2011 SEC filings confirm that the ESR business was essentially non-existent after the second quarter of 2011. Regardless, the ESR business was never a significant revenue generating operation for the business.

In light of the above excerpts, we can say that it appears that CLNT did not make any false statements regarding its ESR business. However, there is a very real possibility the CLNT may have to write off around USD 9 million related to the ESR business due to annual audit requirements. But we only view this as a worst case scenario and a one-time non-cash event.

Valuation

CLNT reported strong 2012 third quarter results. During this quarter, the company’s top and bottom-line numbers made significant strides compared to the past several quarters.

CLNT’s trailing fully taxed non-GAAP EPS is $1.80 and at the stock’s current price of around $4.40 per share, it is selling at a trailing P/E multiple of 2.4. This leads us to believe that investors have likely baked a brazen fraud scenario into the number, which appears unwarranted in light of our due diligence findings.

Given our findings, we think that investors may at the very minimum bid CLNT shares upwards to trade at a trailing P/E of 5 as they begin to give CLNT the benefit of the doubt that they may be telling the truth to U.S. investors about its operations. This would lead to an eventual short-term price target of $9.00. Keep in mind that based on CLNT’s 2012 third quarter results, the company’s forward 12 months fully taxed non-GAAP EPS is tracking at about $3.50 if at least $0.88 is attained for the next three quarters, which could lead to significant upside to our price target.

Having said that, the absence of seasonality disclosures and lack of forward-looking sales/income guidance could add a few caveats to our casual EPS estimate. We would like the company to be more transparent with the street to give it the ammo necessary to calculate a forward calculation with confidence. Regarding seasonality, from what we have seen in the industry CLNT is involved with, it has not been an issue.

While we can’t yet comment on whether 2012 third quarter revenue levels have set a new high water mark, we believe that our OTGDD, the industry outlook as well as management’s comments in the third quarter press release indicate that sales momentum can continue. Furthermore, management believes that margin expansion is in the cards:

“Growth of our forged products for non-wind applications has been very strong, and we are exploring additional markets, including petroleum and petrochemical industries. We are also excited about the new opportunities presented in China’s solar industry, which is expected to undergo some major change following recent supportive government policies, and we are also expanding our range to include high performance components for production equipment targeting smart phones and LED lighting. In the dyeing and finishing equipment segment, we are benefiting from a major upgrade cycle, as manufacturers embrace our more energy efficient and environmentally friendly technology. We anticipate strong growth potential in 2013 with the expected launch of our new after-treatment equipment, which is in the late stages of research and development.

Thanks to improving volumes and strong expense controls, our margins improved dramatically in the third quarter. In the next few quarters, we continue to foresee a slight increase in our margins, as raw material costs are not expected to have great fluctuations given the general weak economy. We have been generating positive cash flow from operations and believe they are sufficient to fund our new product development initiatives,” Mr. Wu concluded.

Further P/E Expansion Could Result:

- If CLNT takes steps to build legitimacy, allow for verification of SAT documents and grows operations without tapping the equity markets. In fact, since the first quarter of 2011, the company has stated it does not need to raise equity to finance growth. Here is a quote from its 2012 third quarter 10Q:

“Our capital requirements for the next twelve months relate to purchasing machinery for the manufacture of products for the solar industry as well as additional investment in our forged rolled rings division. We also expect to incur modest expenses in maintaining our dyeing business. We believe that our cash flow from operations will be sufficient to meet our anticipated cash requirements for the next twelve months.”

- If investors are convinced that China’s economy has bottomed and is about to resume growth trends seen in the past.

- If the company upgrades its auditor from the highly controversial Sherb & Co. to a top tier auditor with more credibility. We have said in the past that we have no faith in Sherb, so any U.S listed Chinese company, in our opinion, should not use Sherb for its audits.

Also keep in mind that CLNT is selling well below its tangible book value per share of $25 after we totally write off USD 9 million for the ESR business.

Conclusion

CLNT has two businesses of significance – one is in dyeing equipment and the other one is in forged rolled rings. Based on our on-the-ground due diligence, its forged rolled rings business for the wind power industry continues to decrease. Its forged rolled rings business serving other industries continues to have substantial orders.

As CLNT introduced new types of dyeing equipment, its dyeing and finishing equipment business appears to be significantly growing and may somewhat counter-balance the decrease in wind power industry business.

CLNT disclosed in its files that its ESR business did not generate any new orders in 2012 and recorded a depreciation expense related to ESR production equipment.

We do acknowledge that our on-the-ground due diligence may not be enough to confirm all of CLNT’s financial information, including revenue, gross margin, net margin and/or total equity. However, from our research, we did not find substantial information which may contradict CLNT’s disclosure and/or its financial information.

Disclosure: Long CLNT at time of article