We learned today (after last night’s market close in Asia) that a discounted rights offering proposed by Sino Grandness Food Industry Group (T4B.SI) (OTCBB: SFOOF) has been reduced in price significantly, to the tune of 32%, furthering a case that we made in October that the company may have seen its Hong Kong IPO of its beverage business hit a wall — and that the company may be more in need of capital than it has let on. We believe that shares will continue to drift lower, eventually to the S$0.21 per share rights price that the company is offering, an additional 28.8% downside from current market price.

We learned today (after last night’s market close in Asia) that a discounted rights offering proposed by Sino Grandness Food Industry Group (T4B.SI) (OTCBB: SFOOF) has been reduced in price significantly, to the tune of 32%, furthering a case that we made in October that the company may have seen its Hong Kong IPO of its beverage business hit a wall — and that the company may be more in need of capital than it has let on. We believe that shares will continue to drift lower, eventually to the S$0.21 per share rights price that the company is offering, an additional 28.8% downside from current market price.

Recall on October 25, 2016, we issued a critical report asking whether Sino Grandness Food Industry Group was “rotten at its core”. In the report we provided our findings from our on the ground due diligence at Sino Grandness facilities and drew the conclusion that the company should be looked at through a very critical eye. Subsequently, the company issued a response on October 30, which we responded to in an October 31 article available on our website. The company then issued a follow up on November 1, 2016, which we commented on the morning of November 3, 2016.

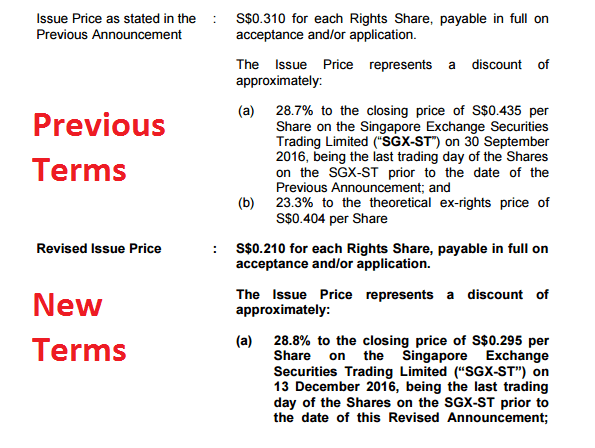

In our original report, we questioned the company’s need to perform a proposed rights offering in Singapore to sell new shares to existing stockholders at a 28.7% discount to the stock’s price at the time. We stated:

“We believe that this could mean that the company’s plan of raising capital through a Hong Kong IPO of its beverage business may have hit a wall, and the issuance of shares through the rights offering in Singapore tells us that the company is currently in need of capital.”

We continued:

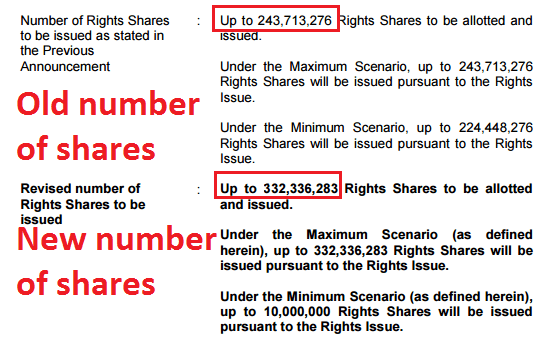

“To us it seems strange that the company is proposing this rights offering at a 28.7% discount to its recent market price, despite reporting more than RMB500 million in cash and cash equivalents on its balance sheet while its net profit reportedly grows at a very high rate. This issuance will increase the company’s total share count by up to 33%. We believe this action could indicate that the company’s real financial condition may not be what has been reported. We also think this could mean that the company needs a capital injection in order to sustain its business operations, especially if it isn’t going to be able to raise capital from an IPO of its beverage business.”

In today’s revised announcement, the company stated it will now be offering shares at S$0.21 per each rights share, versus a previous price of S$0.31 per each rights share.

While this price remains only a 28.8% discount to the current market price — a discount we still find to be disturbing — it is a whopping 51.7% lower than the stock price when the original rights offering was proposed.

This action should be yet another red flag for Sino Grandness shareholders and, equally, it reiterates to us that our concerns about the company’s access to capital may be warranted. We continue to monitor Sino Grandness and will update our members, as well as the public, with new developments should they occur.

Disclosure: No Position in SGX:T4B at time of this writing

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy/