While awaiting a market correction, I like to read quotes of legendary investors to help me get through mentally taxing environments. This is one of my favorites:

While awaiting a market correction, I like to read quotes of legendary investors to help me get through mentally taxing environments. This is one of my favorites:

“To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.”

–Sir John Templeton, “greatest stock picker of the century” by Money magazine

A month ago we stated that in the midst the of turmoil in the U.S. stock market we were focusing on stocks that have recently reported bullish news, only to be ignored or driven down with the overall bearish sentiment. We mentioned that we felt 4 stocks with recent positive catalysts that suffered sharp declines in prices could experience quicker and more meaningful bounce backs than the broader market during a market correction.

Market Correction – 7% So Far

The market has bounced 7% off its bottom. Even though this is not a full market correction, we wanted to provide an update on the share performance of the 4 stocks and let you know that we have uncovered another ignored stock that we think could potentially rise by 25% after it reports its financial report on March 10th. The company is benefiting from an increased amount of projects to improve roads, bridges and the energy infrastructure in the United States. It’s a company we are very familiar with and was one of our best performers in 2015, more than doubling. Shares are slowly recovering from a sharp pullback from their highs. The market’s muted reaction to a recent accretive acquisition has rekindled our interest in the company, especially since analysts have not accounted for the acquisition in their estimates.

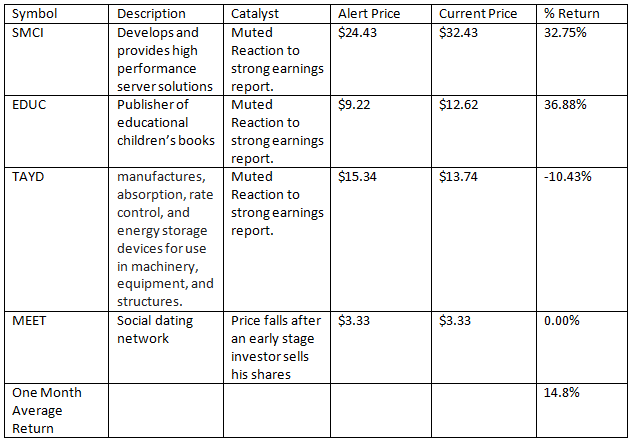

See our original 4 stock report here – 4 Names We’re Watching for Post-Crash Bounces, and below is the subsequent performance.

*Prices as of yesterday close

Notes:

- Super Micro Computer Inc. (SMCI) – Shares have quickly recovered. At current levels, we feel SMCI’s snap-back rally has been fulfilled.

- Educational Development Corp. (EDUC) — Despite the strong move in EDUC shares, we feel there is still room in EDUC’s recovery rally.

- Taylor devices, (TAYD) – We are still optimistic that shares of TAYD will eventually enjoy a snap-back rally in the near future.

- MeetMe, Inc. (MEET) – We still view MEET as the wildcard of the pack, but feel shares could snap back if market conditions improve.