Summary

- Almost all of Raven Industries’ (NMS:RAVN) products are tied to the price of commodities — both hard and soft — all of which have been sharply lower across the board for the last two years with no signs of stabilizing

- This has led to enormous downward pressure and momentum in Raven’s earnings and sales, both of which have deteriorated significantly over the last few fiscal years

- The company’s sole organic growth wild card is the dubious “Project Loon” — a speculative experimental stage project with Google that’s trying to offer Wi-Fi using stratospheric balloons

- In addition to commodity pressure, Raven faces broader market headwinds as all of the major indices show signs of slipping into a bear market heading into the middle of the year

- The company’s only financial backstop is in its assets, which give it a book value that’s ~45% less than current prices; we believe shares should trade around $8

Introduction

Deep within the roots of any good investment thesis, there should be a foundation of common sense. While there are no sure things in the market, investing with a modicum of common sense can lead to situations where it appears rather obvious that equities will move in one direction or another. Of course, that intuition must also be backed up by research in order to arrive at a cogent investment thesis.

Such was the case when we began to look at Raven Industries (RAVN) (hereinafter “Raven”, “RAVN” or “the company”). Raven Industries, founded in 1956 and headquartered in South Dakota, is a company that has been around for 60 years and has been through thick and thin.

Raven is not a company we expect to go bankrupt.

Raven is, we believe, an easily analyzed predictable business that appears to be forecasting further significant downside in its stock based on readily available commodity information and the application of common sense with regard to the company’s only organic growth project. The company, on March 10, offered a dark outlook for its future after posting results that continue to show the company swinging to a wider loss.

Raven “provides various products to customers in the industrial, agricultural, energy, construction, and military/aerospace markets worldwide.” The company operates in three segments — two of which tied tightly to commodity prices – which we will break down and review at length.

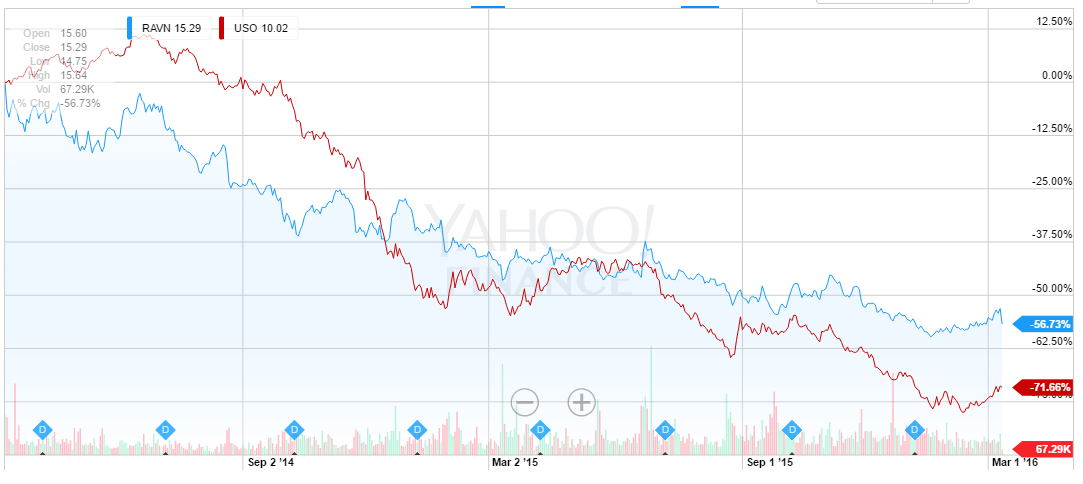

Shares of RAVN have been destroyed just as commodity prices have moved lower over the course of the last year. Here’s what it looks like when compared to the U.S. Oil Fund (USO) over the course of the last two years.

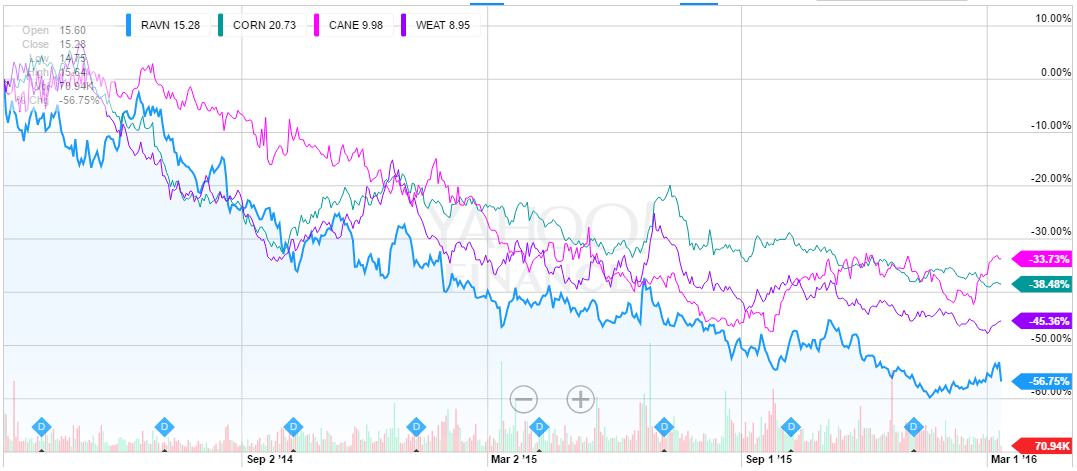

Because so much of RAVN’s business relies on the price of both hard and soft commodities, the company has experienced terrible earnings declines over the previous few quarters that we think are likely to continue, as commodity prices show no signs of once again turning upward. Here are three popular commodity ETFs showing corn, wheat and sugar prices over the course of the last five years. Corn, the commodity with one of the strongest ties to RAVN, is in the bold blue.

Corn, Wheat and Sugar – 5 Year Chart

In addition, the company has been buying back stock at prices that are far higher than its current share price, adding insult to injury by poor use of capital as the company’s declining share price makes this cash invested worth less and less as time progresses.

All the while, bulls of the company continue to put renewed faith in an extremely speculative, experimental stage project that the company is working with Google on, but as we will show, this project looks to be far more likely to dissolve than to move forward in any robust fashion.

In this article, we are going to break down the three segments that the company reports on, review their operating history and more importantly, talk about the ties to certain commodities that each segment has.

Commodities are Crushing Raven Industries

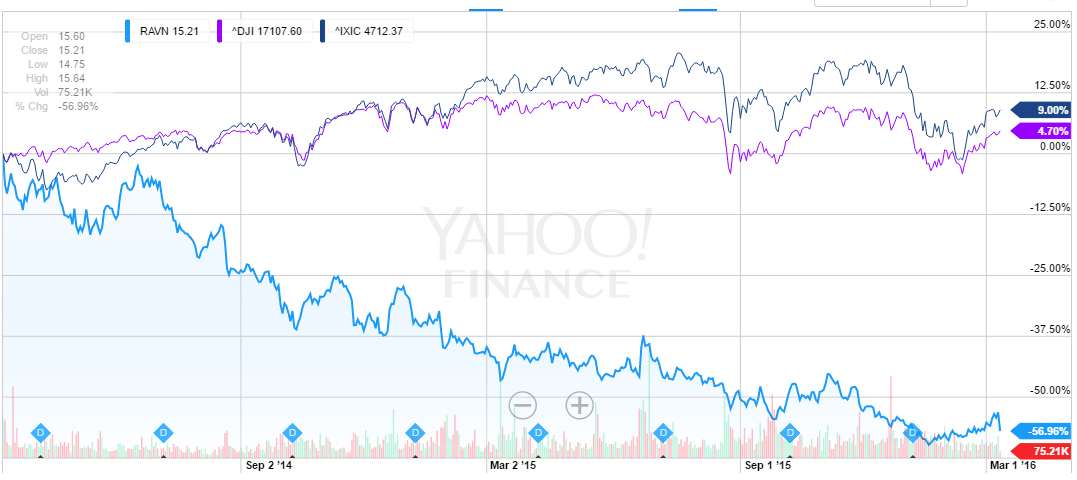

Just like in the oil industry, commodity prices are in full control of the direction of RAVN’s stock. Over the last two years, the company has begun to seriously diverge from the market, leading us to believe that if the broader market turns lower in a signficant way moving forward, that RAVN may take on far more damage before hitting its only firm financial backstop in its hard assets.

RAVN Market Divergence

The stock move has been commensurate with all three of RAVN’s segments being in serious decline.

Raven Industries operates in the following three segments:

- Applied Technology – this segment designs, manufactures, sells, and services precision agriculture products and information management tools that enable growers to enhance farm yields. Its products include field computers, application controls, GPS-guidance and assisted-steering systems, automatic boom controls, yield monitoring planter controls, seeder and harvest controls, and motor controls, as well as Slingshot, an integrated RTK and information platform. This segment sells its products to original equipment manufacturers and through aftermarket distribution.

- Engineered Films — this segment produces plastic films and sheeting for energy, agricultural, construction, geomembrane, and industrial applications. This segment sells plastic sheeting to independent third-party distributors.

- Aerostar — this segment designs and manufactures high-altitude balloons, tethered aerostats, and radar processing systems to provide research, communications, and situational awareness to government and commercial customers. This segment also sells military parachutes, uniforms, and protective wear, as well as provides electronics manufacturing services to aerospace and situational awareness markets.

We will show, citing the company’s financials that all three segments are in decline. In fact, the company tells us in their own words that the market conditions for all three segments are moving in the wrong direction. Here’s the company’s most recent comments on the market conditions of its three segments, with our emphasis:

[Applied Technologies] Market conditions. Deteriorating conditions in the agriculture market put pressure on Applied Technology during the first nine months of fiscal 2016. End-market demand has deteriorated from the beginning of the year and the Company believes these conditions will continue through our fiscal year 2016, and may persist into next year. Corn prices have stabilized since the beginning of the year. Farmer sentiment is weak and productivity investments are being delayed. With the world’s population growing toward nine billion and income growth in emerging economies, greater demand for food will ultimately support healthy growth.

[Engineered Films] Market conditions. The fiscal 2015 acquisition of Integra better positioned Engineered Films to adapt to sales channel changes and customers’ complex conversion needs emerging in the energy market. However, challenging end-market conditions have persisted in Engineered Films’ energy market. The decline in oil prices has resulted in land-based rig counts decreasing more than 60% year-over-year, significantly decreasing demand for films in the energy market. While the decline in oil prices has reduced demand for products in the energy market, it has also led to favorable raw material cost comparisons versus the prior year. Despite the overall contraction in demand in the agricultural equipment market served by Applied Technology, demand has continued to strengthen for both Engineered Films’ agricultural barrier films used in high-value crop production and grain and silage covers used to protect grain and feed.

[Aerostar] Market conditions. Aerostar’s growth strategy emphasizes proprietary products and its focus is on proprietary technology including stratospheric balloons, advanced radar systems, and sales of aerostats in international markets. Certain of Aerostar’s markets are subject to significant variability due to government spending. Uncertain demand in these markets continues in fiscal 2016. Aerostar continues to pursue substantial targeted international opportunities but the conflicts plaguing the Middle East North Africa region makes these opportunities and their timing less certain. As part of its strategy to sell proprietary products into new markets, Aerostar is pioneering leading-edge applications of its high-altitude balloons in collaboration with Google on Project Loon. Project Loon is a program to provide high-speed wireless Internet accessibility and telecommunications to rural, remote, and under-served areas of the world

It is abundantly clear from the company’s own admissions in its latest 10-Q filing that the market outlook for all three of its segments is very bleak, and that the company expects this weakness to continue into next year. The only new organic growth driving prospect that the company has on the horizon that does not have immediate ties to commodity prices is “Project Loon”, a speculative experimental stage project with Google that involves offering Wi-Fi to various global locations using stratospheric balloons.

Project Loon rounds out the company’s Aerostar segment. Project Loon is one of Alphabet’s many speculative projects that it likely includes in its “Other Bets” segment that it recently reported for the first time as a separate entity from Google’s operations. Needless to say, we believe Project Loon will likely go the way of many other money-losing experimental “Other Bets”, and eventually be defunded and wound down. Further, of Google’s “Other Bets”, Project Loon was offered nary a mention on Google’s Conference Call and appears just once in the company’s 100 page 10-K filing. As Engadget said after Google’s last earnings report,

To sum it up, Google is making money and Other Bets are not. In 2015 as a whole, Google earned $74.5 billion in revenue with $23.4 billion of operating income, both up over the year before. But “Other Bets” was a money-loser: the “Other Bets” companies made $448 million in revenue over the course of the year but failed to turn a profit. Those companies lost $3.6 billion in 2015. Alphabet CFO Ruth Porat said on today’s earnings call that the majority of the revenue pulled in by Other Bets came from Nest, Google Fiber and Verily (formerly known as Google Life Sciences).

Bulls are betting that Project Loon makes a full scale run out of “Other Bets” and onto its own, hypothesizing that 1,000’s of balloons could be on order from Google in that case.

We look at this project with significant skepticism – not only due to the speculative nature in which it’s being developed, but because in an age of drones, it just doesn’t seem to make sense. Balloons seem a little arcane, especially when compared to what companies like Facebook Inc. (NMS:FB) are doing — stratospheric drones:

Facebook has built the first of what it hopes will be a large fleet of solar-powered drones to bring Internet connectivity to hundreds of millions of people beyond the reach of today’s telecommunications infrastructure.

Facebook designed and built this carbon-fiber drone, called Aquila, to bring Internet connectivity not served by today’s communications infrastructure.

Aquila, as the V-shaped carbon fiber craft is known, is powered by two propellers and has a wingspan of about 42 meters, roughly equivalent to a Boeing 737 airliner. When covered in solar panels and loaded with communications gear needed to beam down wireless Internet connectivity, it should weigh only a little over 400 kilograms (about 900 pounds), roughly one-third of a Toyota Prius.

Facebook has not yet flown the recently completed craft but has been testing one-tenth scale versions over the U.K. since March. The full-size Aquila is undergoing structural tests and should begin flight tests before the end of this year.

We’re betting on common sense. These balloons need to be serviced every 60-100 days and there have been reports — in fact, just days ago — that they have crashed in Sri Lanka, an area the company is testing.

A Google balloon, part of the company’s high-speed Internet service known as “Project Loon”, crashed in a Sri Lankan tea plantation during its maiden test flight, local police said Thursday. Villages found the deflated balloon with its electronic equipment in the island’s central tea-growing region of Gampola on Wednesday night, an officer told AFP:

“Tea plantation workers found it crashed in the plantation. They picked up the pieces and brought it to the station,” the officer, who is not authorised to speak with media, told AFP by phone.

Bulls assume thousands of these balloons will be on order someday. We believe reality is that this is one of many projects for Google that they expect to lose money on, and ultimately decide not to pursue.

With this one potential growth prospect looking doubtful to us, we believe that much of RAVN’s future as a public company continues to hinge on commodity prices which, as we will show, have had a materially negative impact on the business.

The Financial Impact

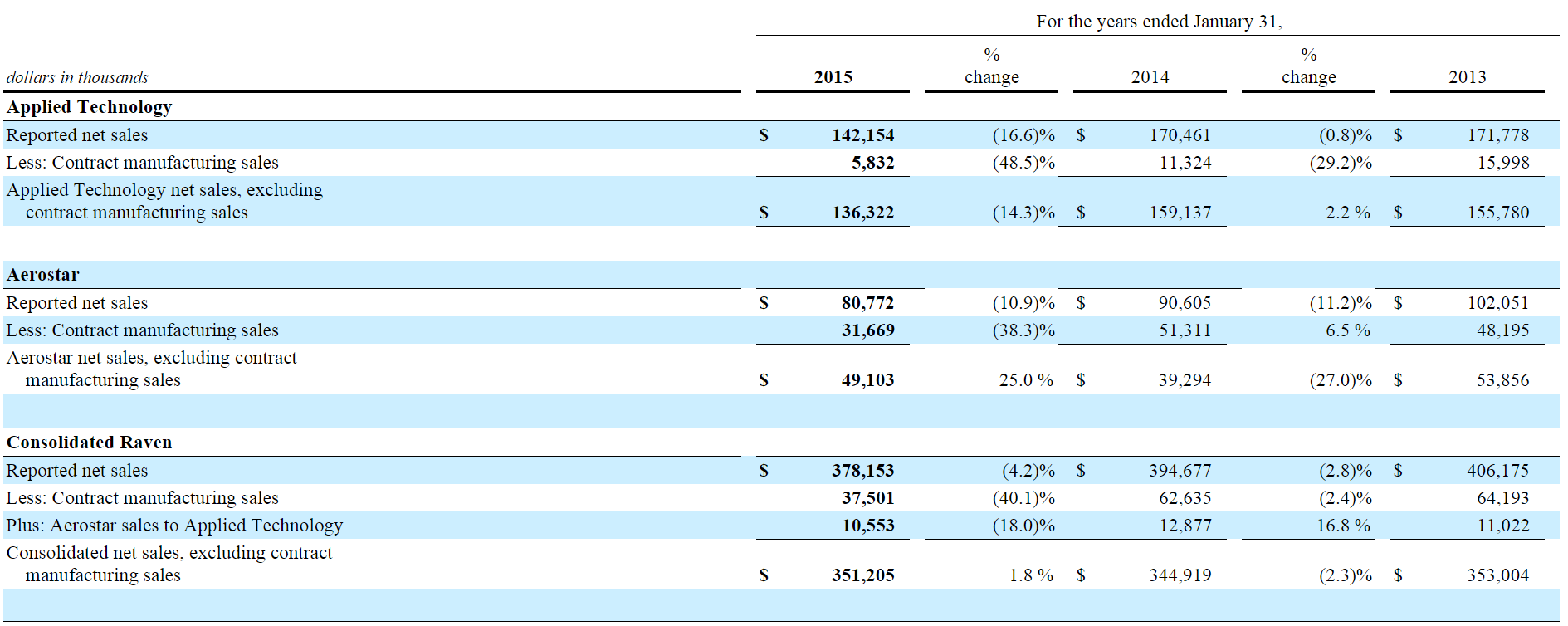

When you look at the commodity space and see the resultant pressure that falling prices have put on Raven Industries (among other companies), it is nowhere clearer than in the company’s financial reports. Here is a look at all three operating segments and their financial performance leading up to last year’s 10-K filing, which was filed in May 2015. Year over year, the results are extremely troublesome.

As you can see, by segment, things continue to look dark heading through FY 2016 and into FY 2017 for the company.

The company’s report on March 10th showed us that the business continues to move in the wrong direction. Not only did the company miss estimates on both lines, reporting EPS of $0.03 versus estimates of $0.11 and revenue of $52.83M versus estimates of $62.80M, the company’s commentary was equally as dark looking into the rest of 2016. The company’s first guidance for the year started with:

“As we begin fiscal year 2017, the markets served by our core businesses remain very challenging,” said Rykhus. “The precision agriculture market is expected to decline for the third straight year, oil and gas prices are suppressing drilling activity, and defense spending continues to be curtailed. This is not the ideal backdrop for a business with our end market exposures…”

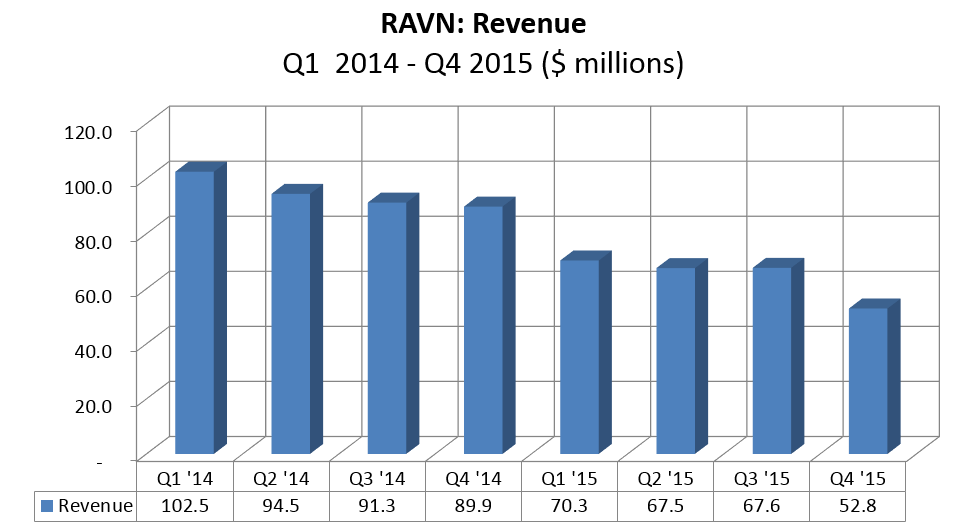

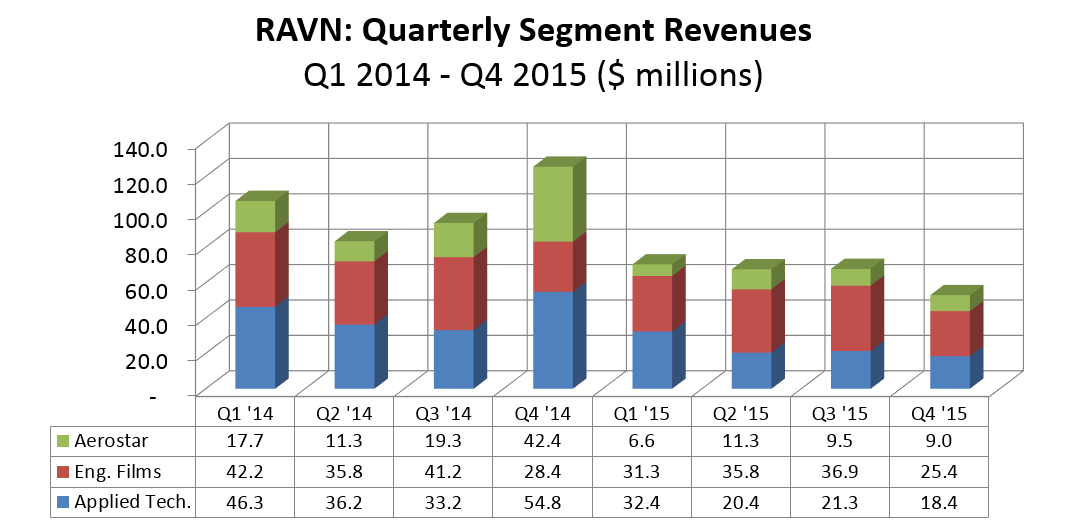

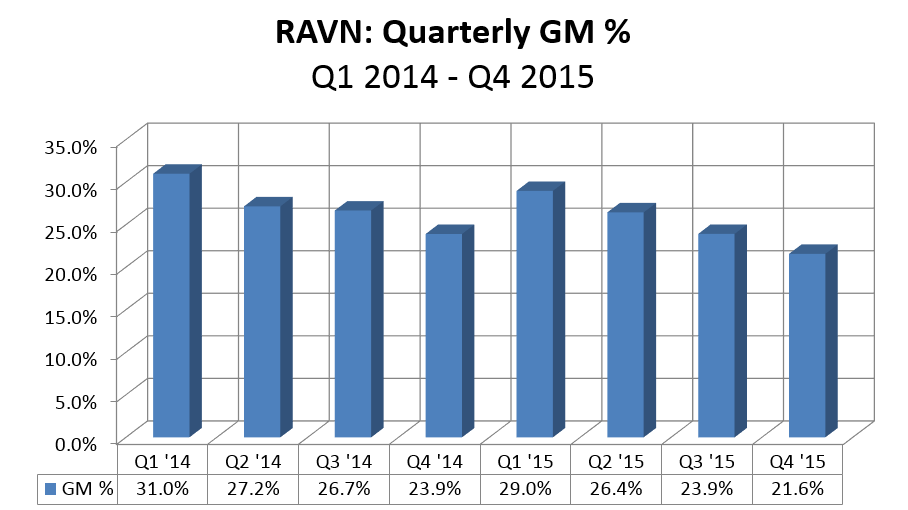

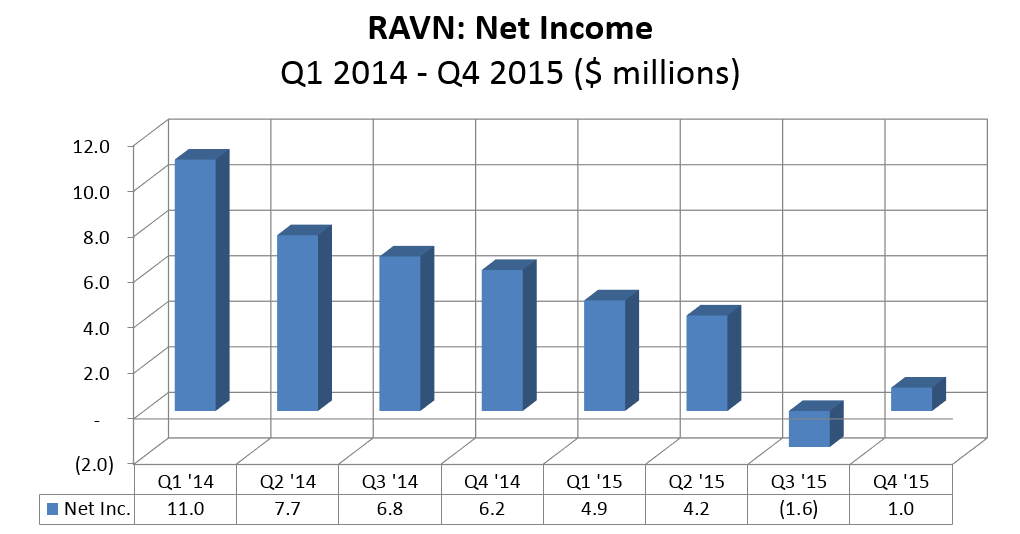

This is a snapshot of some of the company’s key metrics have looked like over the last 8 quarters. Most of these metrics are in disturbing downtrends. With the company toying with posting losses continually, and momentum showing no signs of slowing down, we believe the worst could still be on its way for the company’s financials.

The company’s revenue continues to trend lower:

Weakness in both the Aerostar and Applied Tech. segments have contributed to revenue declines.

Gross margin continues to slide:

The company is now toying with posting losses:

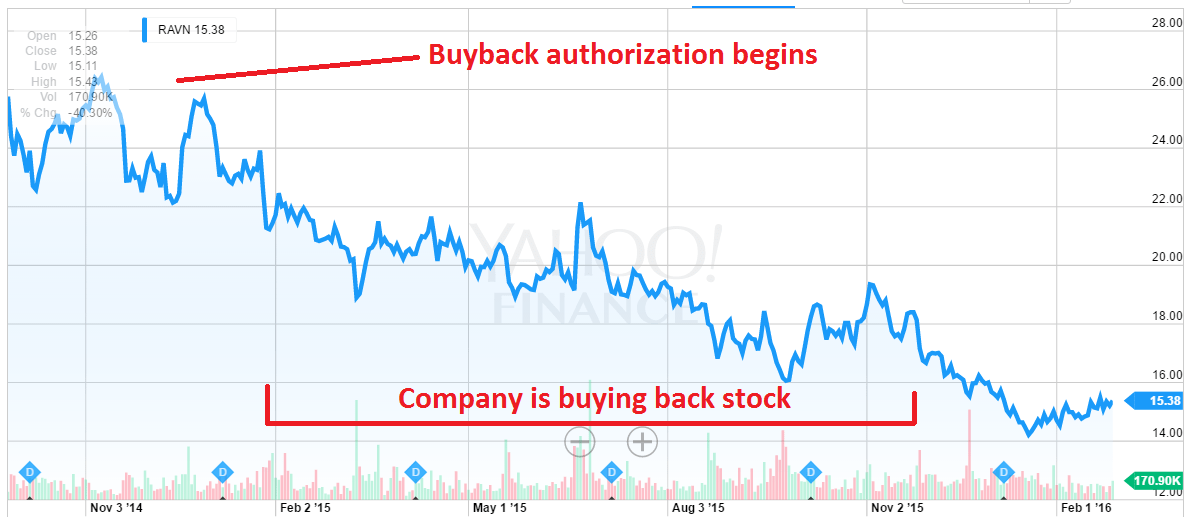

Another problem is the company’s use of capital. Buying back stock while it tanks is the company literally catching its own falling knife. For instance, this is from the company’s last 10-Q:

On November 30, 2014 the Company announced that its Board of Directors had authorized a $40,000 stock buyback program. The Company repurchased 1,052,587 and 1,602,545 shares in the three- and nine-month periods ended October 31, 2015, respectively. These purchases totaled $18,513 and $29,338, respectively. The remaining dollar value that may be purchased under the plan at October 31, 2015 is $10,662.

And here is how the stock has performed over that time period.

Caveats

Of course, there are caveats to being short RAVN.

If commodity prices stabilize or turn around, the company may be able to stop its bleeding. However, it would likely take several quarters for a swing in commodity prices to even make their way through the agriculture system to the farmers at such a rate where they would need to place further orders with Raven Industries for equipment.

The biggest caveat is the company’s best attribute: its fantastic balance sheet and asset heavy equity base, which gives the company significant leverage in the event that they would need to fund operations moving forward to weather the storm. Like many oil companies now, the company is playing a little bit of “fight the clock”.

Valuation

RAVN’s operating results disappointed in fiscal Q4 (February) 2016. Analysts’ estimates assumed Q4 revenues of $62.8 million and EPS of $.11. Actual results fell well short of estimates with actual Q4 revenues of $52.8 million and EPS $.03. For the year, the company generated $258.2 million revenue and GAAP net income of $8.5 million or $0.23 per share. The company reported adjusted net income of $14.9 million or $0.40 after adding back a $7.4 million goodwill impairment charge of $7.4 million and other adjustments. Given the non-recurring nature of the adjustments we view $0.40 as a better benchmark for EPS.

Management offered little encouragement that fiscal 2017 revenue would be better than flat vs. 2016. The Q4 revenue run rate was only $212 million and there appears to be little seasonality in RAVN’s quarterly revenue data. We therefore expect 2017 to fall short of the $258 million posted for 2016 even if the business begins to improve somewhat later in the year. If we assume 2017 revenue of $250 million, gross margins of 25%, a 12% decline in R&D and SG&A costs (on the heels of a 20% decline in fiscal 2016 from 2015), and an effective tax rate of 22%, RAVN should be able to generate net income of around $14.3 million. If our net income estimate is in the ballpark, 2017 EPS should be around $0.40.

If we apply a 20X forward EPS multiple to $0.40, the implied share price would be $8.00 or 42% less than its recent trading price of $13.80.

Disclosure: Short RAVN