Summary

- Please note, we were unable to find evidence that sell side analysts have identified the corporate governance red flags we were able to identify at Purple Innovation, Inc. (NASDAQ:PRPL). We are obviously not surprised.

- We are currently neither long or short PRPL but are merely attempting to offer transparency so that long and short investors in PRPL are better informed.

- The conclusion of this report includes 6 questions directed toward management that should help investors more fully understand PRPL’s growth or lack of growth opportunities.

- Purple Innovation, Inc. predominantly a mattress company, rebounded sharply after its downturn in March, has been hitting all-time highs and is now valued at almost $2 billion. This turnaround came after the release of its two record-beating quarters.

- While investors seem to think that the growth might continue, we believe shareholders should question why the company’s growth has not been even greater.

- This is because when Purple went public, they entered into a License Back agreement with EdiZONE, an entity owned by PRPL’s founders, the Pearce brothers. Under this agreement, EdiZONE is able to generate money from PRPL’s intellectual property assets without any need to reimburse the company.

- We believe that EdiZONE has successfully marketed Purple’s intellectual property to eight firms that generated combined revenues more than 16.5 times greater than Purple in 2018. We also believe that this could have resulted in tens of millions of dollars that PRPL could have received.

- Some of the sublicenses prevent PRPL from expanding into “certain” geographic regions, like Europe. Depending on the magnitude of these limitations PRPL’s stated goal to pursue international growth opportunities could be significantly constrained. Other sublicenses are direct competitors to PRPL in the US.

- We believe these circumstances have allowed insiders to benefit at expense of shareholders. In some scenarios we believe that the agreement could even be detrimental to the company’s growth and profitability.

- But it gets better: Not only have the founders sold most of their shares in PRPL to the tune of over $520m, just 2 years after going public, recently, PRPL just paid Edizone and essentially the Pearce brothers $8.4 million dollars for some of Edizone’s licensing rights.

- We question this decision of PRPL’s board which included the Pearce brothers that are enjoying royalties paid to EdiZONE for PRPL’s assets which could have been shared with shareholders.

- Finally, PRPL’s corporate governance could have been questioned from the very beginning of their going public SPAC merger process when the company went public with an Up-C structure where shareholders of PRPL did not own 100% of Purple Innovation LLC, the operating business. Recently, WeWork wanted to go public this way and was criticized for it.

- In our opinion, all this raises significant red flags regarding PRPL’s governance. Shareholders should demand increased disclosure from PRPL to determine if serious constraints to growth exist that might not justify that shares should carry a premium valuation.

Watch the short video below outlining our thesis and/or read the full report.

1. Lost revenue to Pearce Brothers

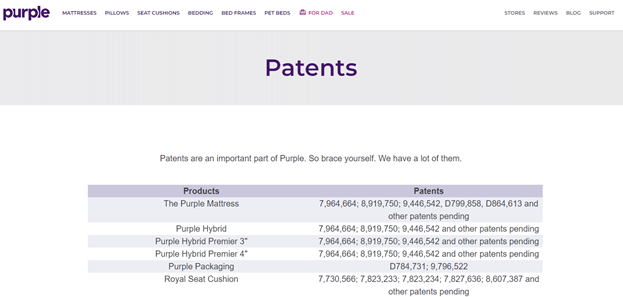

Purple Innovations, Inc. has long marketed itself as a “leading comfort technology company.” The Company claims that its “products are the result of over 30 years of innovation.” Purple has developed a substantial portfolio of intellectual property that includes dozens of patents, trade secrets, trademarks, and tradenames.

Source: Excerpt from PRPL’s website.

Most of the intellectual property comes from EdiZONE, which is an entity controlled and owned by the Pearce brothers, the innovators behind PRPL’s technology, previous members of its board of directors and significant shareholders.

When PRPL went public through being acquired by a SPAC, EdiZONE entered into an agreement with the newly formed public company. This agreement assigned most, but not all, of EdiZONE’s intellectual property to Purple Innovation LLC, the operating business in which PRPL’s shareholders currently own roughly 98.8% economic interest (as of August 26,2020).

The assignment includes some of the most crucial IP assets such as patents connected to the gels used in PRPL’s mattresses, pillows etc. Purple Innovation LLC can use these assets as they please as they are now the owners. Given this assignment of full control, the way Purple Innovation, LLC has handled this valuable property strikes us as odd.

This is because the original agreement also stipulates that all the assigned assets are immediately licensed back to EdiZONE. Moreover, as stated in the agreement the EdiZONE License is irrevocable, fully paid-up, and world-wide. This means EdiZONE can enjoy all the economic benefit of having such a license and does not need to share any of the proceeds when it itself licenses this intellectual property to other firms.

Thus, it seems that Purple shareholders are ‘lending’ their own assets to EdiZONE for free and without the need for it to ever pay back. We view this as extremely material.

First, Purple could be missing out on an unknown amount of royalties collected by EdiZONE. Royalties can be valuable for companies as they flow straight to operating income.

For example, Purple used to have their own license with EdiZONE prior to being public whereby Purple was paying EdiZONE for the use of the intellectual properties. According to PRPL’s 8-K filed in February of 2018, the company owed around $4.14 million to EdiZONE in 2016. At that time, Purple was generating $65 million in annual revenue. This specific example shows the royalty fee for EdiZONE was around 8% of the total revenue.

One can only imagine how much royalties EdiZONE is now generating from others. Shareholders of PRPL should not forget than an extra $4.14 million in what is likely 100% margin revenue would push the net income of the company up by material amounts. Prior to Q1 of this year, the company was generating a consistent loss. We do not think this would have happened if they were able to fully generate economic benefits from their own assets.

However, more importantly, as disclosed in PRPL’s filings, EdiZONE is sublicensing Purple’s assets to competitors.

2. Competitors are able to use Purple’s assets

In the license back agreement, EdiZONE agrees not to use Purple’s intellectual property in the ‘cushion field of use’. This means they are not going to actively interfere with PRPL’s business (and vice versa actually). This makes sense as PRPL’s shareholders would be mistreated even more than we believe they are now.

However, EdiZONE was able to keep its old licensing contracts with competitors of Purple. It seems that they will not enter into new agreements with entities dealing in PRPL’s market but are able to receive revenue from companies which have transacted with EdiZONE before PRPL was public. In our view, PRPL is not disclosing much information about these existing contracts EdiZONE has. The License Back agreement is not showcasing the actual competitors and there is no sense of the extent of this.

However, PRPL does disclose several footnotes in their SEC filings that we find worrisome, such as (italics are our addition for context);

One of these third parties (which has an existing contract with EdiZONE) is now a domestic competitor of ours, as it now sells mattresses through some of the same retailers through which we also sell our products. This competitor’s sales revenues are increasing, resulting in increasing royalties paid to EdiZONE from this licensee…

…One competitor, which has been a licensee of EdiZONE for over fifteen years, uses substantially similar technology to our Hyper-Elastic Polymer® material and Purple Grid in its own mattress, topper and pillow products sold through branded retail stores domestically and in Canada. This competitor has been growing its sales and now distributes its products through wholesale partners with retail locations where our mattresses are sold. This competitor may continue to increase its sales and expand into additional distribution channels which could erode our sales in those retail locations and channels. The continuing growth of this single competitor could adversely affect our business.

Source: 10K filed in March of 2019.

This means EdiZONE is able to benefit from Purple’s assets at the possible expense of the company itself. Purple does not disclose how lengthy these contracts are and how long such risk factors could be applicable to the company.

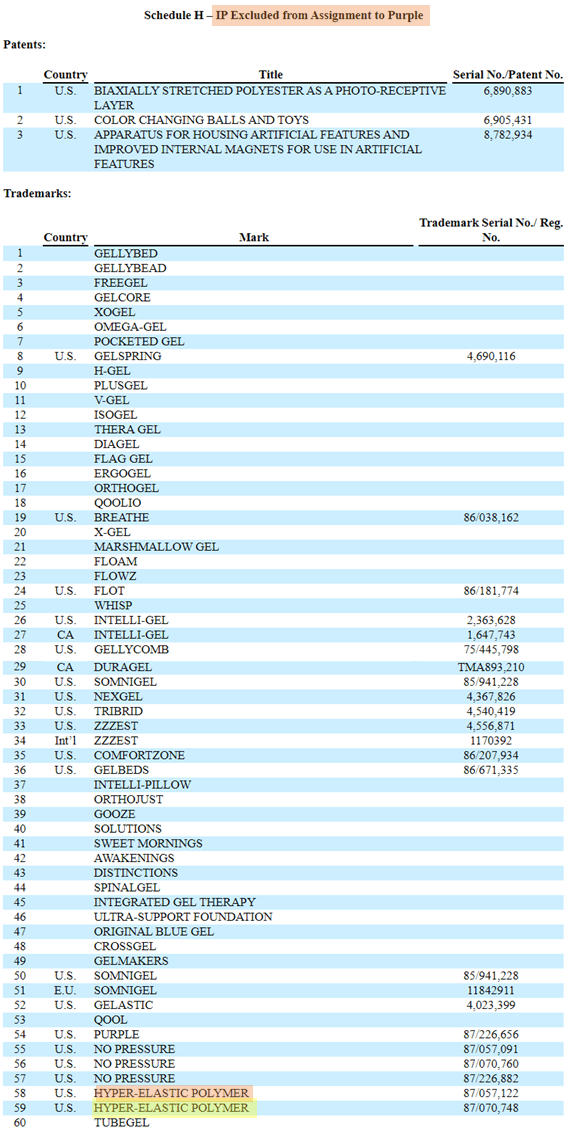

We would also note that two patents that we believe are likely connected to the mentioned Hyper-Elastic Polymer are still in possession of EdiZONE and not PRPL as per the license back agreement from March 2018 (See Appendix B).

Despite the limited disclosures, we have been able to find possible examples of competitors which have a contract with EdiZONE and should pay royalties to the entity.

Using Purple’s original License Back agreement as our starting point, we searched for mattress and bedding products that included trademarks and tradenames Purple licensed back to EdiZONE. In all, we were able to discover 45 companies that appear to have licensing agreements with EdiZONE. They all use EdiZONE trademarks or tradenames within their product description or marketing material (See Appendix A). Some of these licensees generate revenues that are comparable or even greater than what Purple itself achieves.

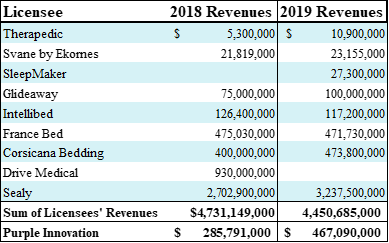

D&B Hoovers publishes revenue data for some of these licensees, shown below.

This list of EdiZONE licensees is not exhaustive, but it does demonstrate that EdiZONE has successfully marketed Purple’s intellectual property to eight firms that generated combined revenues more than 16.5 times greater than Purple in 2018.

Given the large revenue streams of the companies, shareholders could be missing out on millions of dollars of royalties now paid to EdiZONE. Again, it is also not clear how lengthy these contracts are. These could be multi-year contracts which we believe could push the lost revenue to tens of millions of dollars.

However, this is not all. Purple footnotes in its 10K filed in March of 2019 continue to highlight circumstances that could limit PRPL’s ability to grow (italics are our addition for context);

Another third-party licensee (which has an existing contract with EdiZONE) may make it difficult for us to expand into certain geographic regions, such as the European Union.

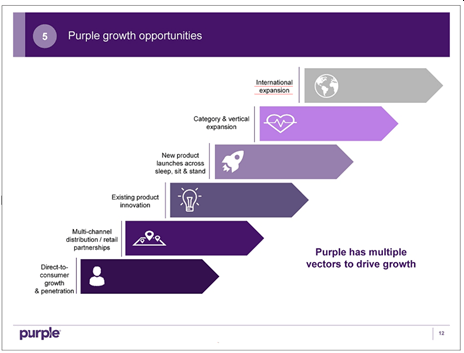

Not only that US competitors are able to use Purple’s assets at the possible expense of the company, but Purple might also have troubles expanding its business overseas. It’s also unclear what “certain geographic regions” is referring to. This is especially worrisome when the management has been talking up international expansion as an opportunity since day one.

Source: Purple’s July 27, 2017 Investor Presentation

Again, we do not believe that Purple is clear on how extensive these international restrictions are, but we believe they are certainly material.

It could be that alongside the European Union, PRPL could also face challenges entering Japan and Australia. According to the timeline provided on Purple’s website, the Pearce brothers licensed their intellectual property for use in consumer mattresses in Europe to Svane by Ekornes, in Japan to Francebed, and in Australia to Sleepmaker. We believe Purple did elude to this risk factor in its S-3 filed on February 14, 2018, p. 14. In this filing Purple discloses that,

EdiZONE, LLC, which is an entity owned by our founders, previously entered into licenses for comfort-related intellectual property with three different unrelated third-parties. These licenses may prohibit us from selling our existing mattresses in certain geographic areas, including the European Union…

We believe Svane by Ekornes, Francebed, and Sleepmaker to be the same three companies mentioned in the above filing. One reason for this conclusion is that the above S-3 identifies “three different unrelated third-parties,” and Purple’s website provides the names of “three different unrelated third-parties” that license the Pearce brothers’ technology for use in consumer mattresses. The other reason for this conclusion is that in its initial S-3, Purple mentions its licenses “may prohibit us from selling our existing mattresses in certain geographic areas, including the European Union.” Of all the licensees mentioned on Purple’s website, it only assigned specific geographic areas of operation to these three.

To conclude, it seems that Purple portrays itself as a tech company with strong proprietary technology. We believe shareholders should closely reexamine this statement. Purple seems to be lending some if their crucial intellectual property assets for free to EdiZONE which is then making money out of these assets by empowering PRPL’s competition with PRPL’s own assets. Possibly even seriously restricting PRPL’s ability to grow in certain geographical areas.

Imagine what the growth might have been if PRPL was able to receive the royalties or perhaps stifle the development of the competition around the world as well as in the US.

While the company did recently get access to part of its IP assets which were used by a competitor (as per the new license agreement) it had to pay about $8.45 million to do so. This is just showcasing how convoluted we believe that the setup has been from the very beginning. Still, we do need to point out that PRPL will finally receive royalty fees this competitor had been paying to EdiZONE:

“As a result of the Agreement the Company is now the direct licensor entitled to all royalties paid under the License Agreement. Also pursuant to the Agreement, EdiZONE assigned to the Company the trademarks GEL MATRIX and INTELLIPILLOW”

But we still have no context on how much more fees PRPL is missing out from EdiZONE’s other licensees. Furthermore, it does not appear that any competitive restrictions were lifted as part of this new agreement.

3. Who was at the negotiating table?

Purple’s shareholders may want to ask themselves, who made this deal possible? Below you can see the people that signed-off on the license back agreement in its current form.

Source: Latest iteration of the original license back agreement

In our opinion the signature of Mr. Megibow, who signed on behalf of Purple, might as well have been the signature of the Pearce brothers.

At the time of the signature, the Pearce brothers had complete control over PRPL as they had majority voting interest in the entity. They were also on PRPL’s board of directors. Terry Pearce was the Chairman of the Board and the brothers served as co-directors of R&D for PRPL.

Due to this, the Pearce brothers were effectively negotiating with themselves. They controlled both EdiZONE and Purple Innovation. They decided EdiZONE will be able to use PRPL’ assets for free and collect royalties which might even be hurting PRPL’s business prospects, both in the US and abroad.

The arrangement makes sense for the Pearce brothers. Why share the royalties with PRPL’s other shareholders when they can enjoy it just for themselves?

Even though not illegal, in our view, this constitutes a significant conflict of interest at around the time of the business combination. This conflict of interest may have then created a continuous loss of revenue for PRPL’s shareholders.

One might think PRPL’s Chief Legal Officer, Casey McGarvey, might at least voice his discontent with this deal since we believe the contract could certainly fall under his responsibility. However, perhaps without much surprise, a few months after PRPL went public, we learned Mr. McGarvey also stands to benefit from EdiZONE royalty stream. According to the 10K filed in March of 2019, Mr. McGarvey invested in EdiZONE prior to PRPL becoming public and thus is entitled to receive profits from the entity.

We would like to stress the fact that we could not identify this potential conflict of interest in the initial S-3 PRPL filed in March of 2018, but only came upon it in a proxy statement filed a month later.

To summarize, shareholders of PRPL provided capital to management that may have have resulted in a sweet deal for the benefit of PRPL’s controlling shareholders despite fiduciary duty obligations to shareholders. It seems that the Pearce brothers essentially routed part of possibly highly lucrative PRPL’s revenue to themselves.

4. Is Premiumn Valuation Warranted?

While PRPL is has been able to grow its revenues and the management is painting a rosy future, we believe shareholders should also be aware of the increasingly premium valuation of the stock.

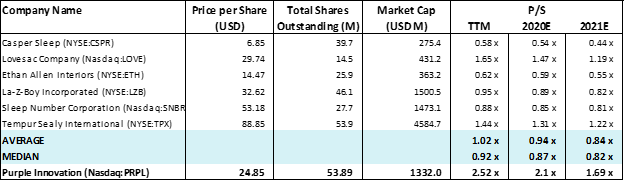

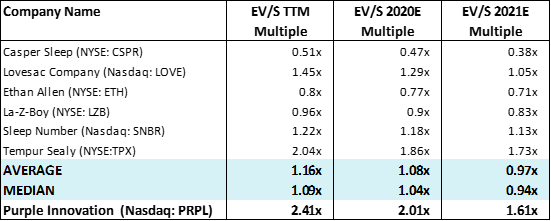

As seen below, PRPL is now trading at a substantial premium from the perspective of price to sales and enterprise to sales.

Price-to-Sales Comparison of Purple Innovation and its Competitors

Data as of market close October 6, 2020

Enterprise Value – to – Sales Comparison of Purple Innovation and its Competitors

Data as of market close October 6, 2020

We are unsure whether this is reasonable. PRPL could be missing out on a significant royalty stream which is potentially empowering its competition and makes it more challenging to enter overseas markets. While the company might able to start profiting from their growing revenue stream as they scale their production and grow both main customer channels, the valuation shows the market has increased confidence the plan will be executed well.

We believe it might be easy to question such confidence in a management team and a board of directors who we believe may have rerouted lucrative revenue streams to themselves that PRPL could have received.

Conclusion

In this report, we have not touched much on the underlying business. The growth seen by shareholders might continue, but we believe shareholders are not receiving all of it. It seems that EdiZONE and the Pearce brothers can enjoy licensing revenue from Purple’s assets without the need to ever pay it back. In fact, PRPL just paid EdidZONE $8.5 million for some of their IP assets.

Given the fact that royalties typically fall right to net income, we wonder how Purple’s income statement and cash flow would look like if this royalty stream was flowing to PRPL since the very beginning.

We also wonder how lengthy are EdiZONE’s contract with PRPL’s competitors. These could be hurting PRPL’s growth prospects internationally and in the US.

Finally, we question the whole decision-making process connected to the license-back agreement which we believe has routed the royalty stream into the hands of insiders rather than shareholders.

Thus, we urge shareholders to ask the following questions to the board and management of Purple Innovation, Inc.

- Why did Purple choose to license back to EdiZONE the intellectual property it was assigned?

- How has the License Back agreement benefited Purple and/or its shareholders excluding Pearce brothers and Mr. McGarvey?

- To how many of Purple’s competitors (both internationally and in the US) does EdiZONE currently license Purple’s intellectual property?

- What is the total revenue from royalties EdiZONE generated from Purple’s assets since the company went public?

- When do the EdiZONE’s contracts with competitors of PRPL end?

- What are all the geographic regions Purple is prohibited from selling its existing products?

We would remind shareholders that while now they might be enjoying profits, they should not forget that it seems that PRPL’s Board of Directors put the company in a position where insiders are able to benefit at the expense of shareholders.

Appendix A: Itemized List of Purple’s Intellectual Property Licensed Back to EdiZONE, and Third-Party Products Using that Intellectual Property

| Tradenames/ Trademarks | Companies Using Tradename/ Trademark |

| Awakenings | GlideAway |

| Breathe | SupportZone |

| ComfortZone | Telemade |

| Kair Medical | |

| FLoT | Keeco |

| FreeGel | Modern Sleep |

| Gelastic | Intellibed |

| GelBeds | Sealy |

| GelCore | Mlily |

| Healthy Rest | |

| GelSpring | SupportZone |

| Activize | |

| BedStory | |

| H-Gel | James & Owen |

| Synwell Sleep | |

| Intelli-Gel | Intellibed |

| IsoGel | Stryker |

| ObusForme | |

| NexGel | NexGel |

| OmegaGel | OmegaGel |

| OrthoGel | NexGel |

| Comfort Coil | |

| MLily | |

| OrthoJust | My Comfort |

| PlusGel | Eco Mattress |

| Memory Foam Mattresses | |

| Enso | |

| Mlily | |

| Protekt | |

| Pocketed Gel | Sleepeezee |

| Somnigel | Dubuque Mattress Factory |

| Comfort King | |

| King Koil | |

| Sweet Mornings | NexGel |

| TheraGel | Splendorest |

| SleepBetter | |

| TheraGel | |

| Isotonic | |

| Sheex | |

| Therapedic | |

| Blue Bird | |

| Tribrid | Natural Elements |

| Dormeo | |

| Ultra Support | Sleep Innovations |

| Sealy | |

| Corsicana Bedding | |

| Vienna | |

| V-Gel | Englander |

| Drive Medical |

Appendix B: EdiZONE INTELLECTUAL PROPERTY EXCLUDED FROM ASSIGNMENT

Taken from – AMENDED AND RESTATED CONFIDENTIAL ASSIGNMENT AND LICENSE BACK AGREEMENT released March 2018.