So, Donald Trump won. After investing in the market for 30 years now, I can finally say that I’ve been through a lot and have a significant amount of experience.

So, Donald Trump won. After investing in the market for 30 years now, I can finally say that I’ve been through a lot and have a significant amount of experience.

I have been through 8 election cycles and the story is the same each time: the stock market overplays both sides of the potential outcome. My goal going into this election was to identify which stocks were getting beat up with the uncertainty; which ones would perform with a Clinton win; which ones will be the beneficiaries of a Trump victory. Or does it really matter?

At GeoInvesting, we are constantly looking for changes in both the economic landscape and political landscapes so we can catalyze and bring to life potential investment ideas. In yesterday’s email to our free opt-ins, we mentioned we were looking at stocks that had fallen due to irrational fears related to the election.

While many traders and investors are already looking past November to whether or not the Federal Reserve is going to raise interest rates in December, the volatility immediately exhibited by the markets reinforced the widely accepted view that Election Day brings with it a shift in the perceived outlook of the economic landscape.

Infrastructure and Donald Trump

We have sifted through several sectors and names to try and identify which companies could potentially benefit from the results of the election. For example, many people were speculating that infrastructure stocks could see significant gains if Donald Trump became the President Elect. Donald Trump has spent a majority of his campaign talking about rebuilding the infrastructure of the country and we have taken the time to identify a couple of potential picks that may stand to directly benefit if Mr. Trump is elected. In yesterday’s victory speech, Trump spent a good amount of time speaking about the country’s infrastructure – it clearly took a front stage.

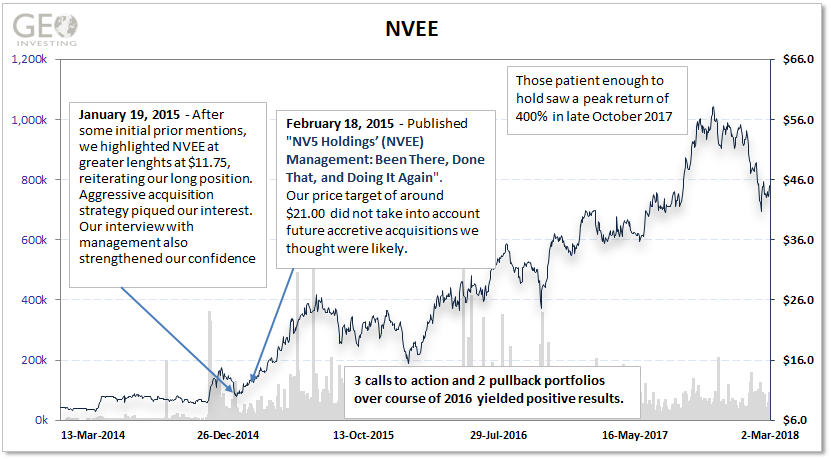

Infrastructure stocks have been strong over the past year, and many analyst see that theme continuing. Luckily, over the past several months we have constructed a infrastructure stock screen. One of our best performing GeoBargains, NV5 Global Inc. (NASDAQ:NVEE) has seen its shares rise from $12 to as high as $37 in the last 18 months. Shares recently pulled back during market volatility leading up to the election but are up over $2.00 to today. Another stock off our infrastructure screen, Willdan Group Inc. (NASDAQ:WLDN), has seen its shares nearly double in the last 3 months. Other stocks on this screen are starting to move. We are now looking at (and long) two stocks that we believe could have similar near term upside to NVEE and WLDN.

To see our entire Infrastructure Overhaul screen that has been published for several months for our Premium Members, you can go here.

Defense

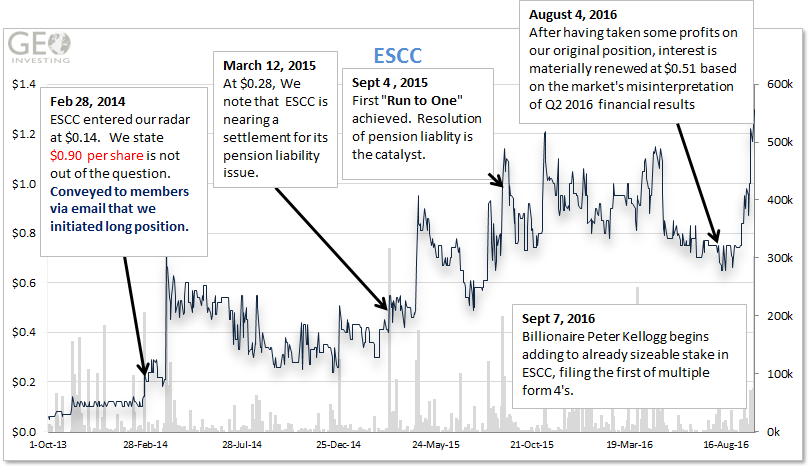

We happened to believe that defense stocks could thrive in any situation. Both Clinton’s and Trump’s approaches would help the defense sector far more than Obama’s hawkish views. The defense sector has underperformed during the last few years, but we have two speculative plays trading under $1.50 that we feel could benefit from Trump’s win. We are also long those two stocks.

Pharma

Hillary Clinton’s campaign spent a significant effort criticizing and scrutinizing pharmaceutical companies. While the mainstream seemed to think that a Clinton win would be detrimental to pharmaceutical stocks, we took a contrarian view and believed that a Clinton election may have actually taken some pressure off of this sector as things generally revert to the status quo after elections are over and politicians back off their promises. At any rate, we don’t think it was disputed that a Donald Trump win would give immediate upside to the Biotech indices as the short-term uncertainty that would have come with Clinton is off the table. For example pharma stocks like Mylan (NMS:MYL) Lannett Co. (NYSE:LCI) Allergan (NYSE:AGN) Bristol-Myers Squibb (NYSE:BMY) Taro Pharma (OOTC:TAROF) Endo International (NMS:ENDP) and Mallinckrodt (NYSE:MNK) are pushing higher. The iShares NASDAQ Biotechnology Index ETF (IBB) is ripping near 10%.

My team focuses on conveying our investment ideas to members, based not only on our analysis of individual companies, but the ever changing political and economic environment. To see our handpicked companies that we believe are worth taking a look at, subscribe below.