We rarely wind up going long U.S. listed China based companies and we often look extensively at each company’s caveats. At GeoInvesting, our focus over the last 7 years has been providing investors in the United States with a look on the ground overseas where it is difficult to personally vet investments. Throughout our history, we have identified not only instances of fraud and material misrepresentation, but unique opportunities to the long side as well. We have found an opportunity in China that we believe could lead to short term 80% upside.

To get access to this article and everything we have to offer on GeoInvesting, please go here to see the features you will get access to and sign up.

[hide]

Nam Tai Is Sitting on Significantly Undervalued Property

We have found an opportunity in China that we believe could lead to short term 80% upside to levels near $15. GeoContributors Dane Capital LLC and Maarten Pieters have both offered up analysis (here and here) that stated Nam Tai Properties (NTP) could be worth anywhere between $15 and over $25. We found the analysis intriguing and wanted to bridge the gap for our contributors by performing on the ground due diligence of our own in China.

Nam Tai Properties (NTP) is a former electronics company turned Property Company that has three prime pieces of land in great locations in China. Two pieces of land are located in Shenzhen City, Guangdong Province and one is located in Wuxi, Jiangsu Province. Combined, these parcels of land have a fair market appraisal value significantly higher than NTP’s entire current asset base and market cap. Management’s propensity to consistently buy back shares and implement shareholder friendly initiatives has also contributed to our bullish sentiment.

NTP reported earnings on 10/31/16 and provided investors with some recent positive highlights about its business:

- The company appears to be well funded for the next two years, which we are hoping implies it will not need to raise equity capital in the near term. As of September 30, 2016, the company has cash and cash equivalents of $192.1 million and no debt.

- Both land development projects in Shenzhen are moving in the right direction. In addition, for the “Inno Park” project in Guangming, the Architectural Schematic Design was approved by the District Planning Bureau on September 20, 2016. The construction of the “Inno Park” project is planned to start before June 2017 and construction of the “Inno City” project is planned to start before September 2019.

- The company stated in its 10/31/16 press release that “relevant authorities of the local governments will provide full support for the permit application of ‘Inno City’ and the ‘Inno Park’.”

- The company’s Wuxi plant continues to be listed for sale and the company still expects it to be sold by 2017.

At GeoInvesting, our focus over the last 7 years has been providing investors in the United States with a look on the ground overseas where it is difficult to personally vet investments. Throughout our history, we have identified not only instances of fraud and material misrepresentation, but unique opportunities to the long side as well.

We also have experience investigating China based land developers. In early 2013, we took a look at China Housing and Land Development (CHLN). We wrote about our findings in May of 2013 after performing on the ground due diligence which found that their operations were as the company described. The stock was trading around $2.25 at the time of our report. The company was subsequently taken private in early 2014 for around $3 per share.

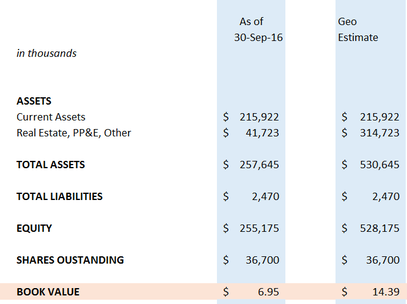

NTP has listed $41.7M in real estate, PP&E and other non-current assets on its most recent balance sheet. The company also lists $215.9M in current assets. By adding the $273M that we believe is the fair value for property assets booked at cost, we’d see the company’s non-current assets expand to $314.7M, a difference of $273M. This would, in turn, give the company a book value of just above $14 per share, versus the current book value of $6.95 per share.

(source: October 31 6-K)

If the company’s market cap moves to reflect the fair value of these properties, NTP’s share price should move closer to the $15 level in the short term.

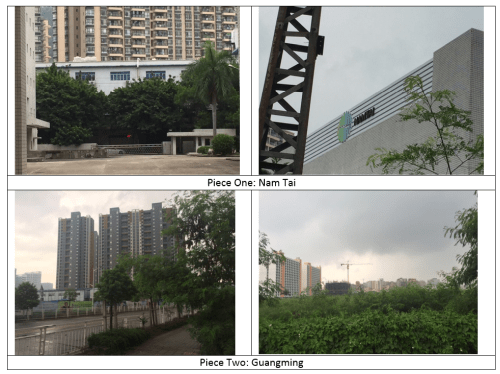

Our On the Ground Visit to NTP’s Properties

The company’s two pieces of land in Shenzhen City are worth RMB 1.7 billion (USD 253 million), according to top rated appraisal agency Jones Lang LaSalle (JLL) (which was named the 2016 World’s Most Ethical Company by the Ethisphere Institute) and other appraisal agencies. The company’s third property in Wuxi, Jiangsu Province has an appraised valuation of RMB 138 million (~USD 20.6 million). The company is looking to sell its Wuxi property, according to both its annual report and its earnings report issued on 10/31/16.

We had our team visit NTP’s properties in Shenzhen City with local professionals that could help assess the properties’ value and compare it to the appraisals that were available. Our team, with help of local professionals, concluded that the properties did in fact have values that were worth at least what they were appraised for.

The company noted in its press release on 10/31/16 that despite the Chinese real estate climate “overheating” that demand in top cities like Shenzhen City will continue to be robust due to “increasing population and limited land resources”.

Here are our exclusive photos from our trip to NTP’s properties:

Management Is Loading the Boat & Billionaire Ownership

It seems management may also know the company is worth far more than it is trading for. In August, the company’s Chairman, Mr. Ming Kown Koo, exercised options to purchase 261,869 shares at a price of $8.00.

The company also conducted a share repurchase program recently. In the month of September, it bought back 724,750 shares of common stock at a cost of USD $6.3 million in the open market. The average price of this buyback was $8.47 per share, about 8% higher than the current share price of $8.10.

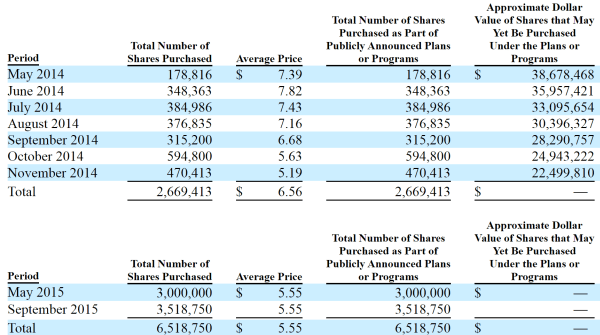

In addition, the company has spent a significant amount of capital on buying back stock and tendering for shares from 2014 to present.

(source: company’s 2015 20F)

Dane Capital has, in other reports, cited that “following the billionaire” can be a great investing strategy.

For example, in their recent article about GRSH, they state:

“We like investing alongside billionaires. While doing so doesn’t guarantee a positive outcome, a study by Joel Shulman and Erik Noyes of Babson College published in the Journal of Index Investing indicates that over the 15 year period of their study, on average, billionaire-run companies outperformed indices by 700bps per year.”

NTP has a billionaire, and Babson graduate, of its own. Peter R. Kellogg, a businessman and philanthropist reportedly worth around $3.4 billion, is on the Board of Directors and holds 18.8% of the company’s common stock. Mr. Kellogg’s involvement in NTP makes us even more confident that there is an opportunity for price appreciation in the future.

The Company’s Plan Going Forward

Nam Tai plans on developing its two properties in Shenzhen City into high end office buildings and apartments. The company is in the process of obtaining necessary governmental approvals to make changes to the properties and it has also obtained lines of credit to begin renovating these properties.

NTP announced at the end of August that it signed a non-binding strategic cooperation agreement with China Construction Bank Corporation, Shenzhen Branch, pursuant to which the bank intends to finance NTP with a US$750 million ($5 billion RMB) revolving credit line over the next five years to support the Company’s construction costs and its land development projects.

Finally, the company had been paying a consistent $0.02/quarter dividend, which was an annual yield of about 1% at today’s share price. The company announced, in conjunction with its 10/31/16 earnings report, that it plans to increase its annual dividend from $0.08 (4 qtr x $0.02) in 2016 to $0.28 (4 qtr x $0.07) in 2017, a 250% increase of its annual dividend distribution that is now nearing a 3.8% yield.

We believe the consistent payout of the dividend and the recent buyback helps us get a better picture of the legitimacy of the company’s cash position — constantly a variable that needs to be addressed with U.S. listed China based companies.

Caveats

Like all of our theses, we like to try and look at the other side of the coin and point out potential caveats to our case going forward. In the case of NTP, we have developed the following caveats:

- The timeline for construction the on the properties in Shenzhen City could be lengthy. It may take years for the company to make the changes they want, which may wind up costing them more than expected.

- Timing for operating cash flow positive is questionable over the course of time that these projects are being developed.

- China tightened its real estate development regulations this month, which may adversely influence the company’s future development plans for the properties south of Shenzhen

- We do, however, believe that because NTP plans to develop more of a corporate complex instead of simply apartment buildings for its premier location in Shenzhen City, the adverse influence of the new real estate rules may be limited

- As is the case with most China based companies, liability for C-level executives in the United States is limited

Conclusion

We rarely wind up going long U.S. listed China based companies and we often look extensively at each company’s caveats, as we have done in the case of NTP. Despite these caveats, we still believe that NTP still represents a significant opportunity worth pursuing, and we are currently long. We believe that the true fair market value of these real estate properties gives the company a true intrinsic value that is almost double today’s $8.10 share price. We think upon realizing the true value of these properties that NTP may move closer to $15 and over the course of the longer term, as the company develops these properties and works to secure constant cash flow streams from them, shares may move much higher.

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy/

[/hide]