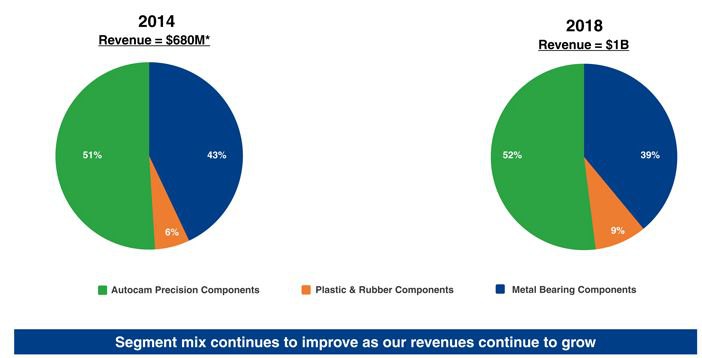

NN, Inc. (NN BR) intends to become an over 1 billion dollar company by 2018, as relayed in a strategic plan outlined in its investor presentation via an 8-K this morning. NNBR expects to grow revenue 270% and EPS 400% over its “strategic plan years” (2013 to 2018), translating into near $5.00 per share in EPS by 2018 (projected EPS does not factor in any possible dilution). This echoes the sentiment from the investor presentation released in early February at the company’s Investor & Analyst Day in New York City.

BR) intends to become an over 1 billion dollar company by 2018, as relayed in a strategic plan outlined in its investor presentation via an 8-K this morning. NNBR expects to grow revenue 270% and EPS 400% over its “strategic plan years” (2013 to 2018), translating into near $5.00 per share in EPS by 2018 (projected EPS does not factor in any possible dilution). This echoes the sentiment from the investor presentation released in early February at the company’s Investor & Analyst Day in New York City.

Key Points of today’s plan:

- Build upon a strong, global operating platform while maintaining financial strength and flexibility

- Financial Policy:

- Maintain healthy leverage over business cycles and strategic growth period: Debt to EBITDA 2.0x – 3.0x, <4.0x peak

- Cash flow priorities:

- Debt repayment to achieve target leverage

- Capex to achieve operational excellence and growth

- Stable common dividends to shareholders (<20% free cash flow)

- Strategic acquisitions financed by debt and equity issuance to maintain leverage target

- Generate above-market revenue growth and capture market share in key areas of new technology over Strategic Plan period

- Improve market mix by decreasing auto exposure from 70% to 50%

- Increase industrial/aerospace/medical offerings in existing product lines

- Expand segment gross and operating margins (optimize mix, operational improvement, cost reductions)

- Continue to invest in R&D

- Continue to pursue selective strategic acquisitions to diversify end markets and expand global reach, within leverage targets

(Source: Presentation)

Note: *Proforma Full Year Consolidated Revenue

Management Maintaining Bullish Outlook Despite Weak Euro

While it seems the weak Euro has slightly impacted current results, management is confident in maintaining its long-term bullish growth outlook, in line with its 1 billion dollar company revenue plan. Recall that on March 11, 2015 GeoInvesting stated it was adding to its long position as it felt the drop of near 30% on Q4 2014 results was overdone. Shares had begun to rebound off the lows of around $19.30 at that time.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight