Published by FG Alpha to GeoInvesting

Summary

- More than 50% of Playa Hotel & Resorts N.V. (PLYA) real estate portfolio and Adjusted EBITDA come from the Yucatan Peninsula, where the U.S. State Dept. has recently issued new travel warnings

- Tourism to popular “all inclusive” PLYA resorts in Cancun and Playa del Carmen could decline as a result

- Increased reports of homicide, tainted illegal liquor, rape and costly medical bills on the Yucatan Peninsula stand to possibly have a materially negative impact on PLYA’s business

- The negative impacts of this travel advisory and negative press do not appear to have been priced into the stock

Avoiding the Yucatan Peninsula Means Avoiding Playa Hotels & Resorts

Playa Hotel & Resorts N.V. could see a very near term and material hit to both revenue and EBITDA as a U.S. State Department Travel Advisory has cautioned U.S. citizens from traveling to an area that makes up almost half of the company’s revenue and more than 50% of its adjusted EBITDA, according to its most recent 10-Q.

Investors may look to ignore or write off the potential impact from this travel advisory — after all, the stock has not shown any profound impact from it thus far. However, investors must realize that this is a new travel advisory and that the perceived safety of PLYA destinations are probably one of its biggest attractions.

The company acknowledges that this type of perception change could have a material adverse effect on the business in their 10-Q:

Terrorist acts, armed conflict, civil unrest, criminal activity and threats thereof, and other international events impacting the security of travel or the perception of security of travel could adversely affect the demand for travel generally and demand for vacation packages at our resorts, which could have a material adverse effect on us, including our business, financial condition, liquidity, results of operations and prospects.

The 10-Q continues by saying:

Nine of the thirteen resorts in our portfolio are located in Mexico, and Mexico has experienced criminal violence for years, primarily due to the activities of drug cartels and related organized crime. These activities and the possible escalation of violence associated with them in regions where our resorts are located, or an increase in the perception among our prospective guests of an escalation of such violence, could instill and perpetuate fear among prospective guests and may lead to a loss in business at its resorts in Mexico because these guests may choose to vacation elsewhere or not at all.

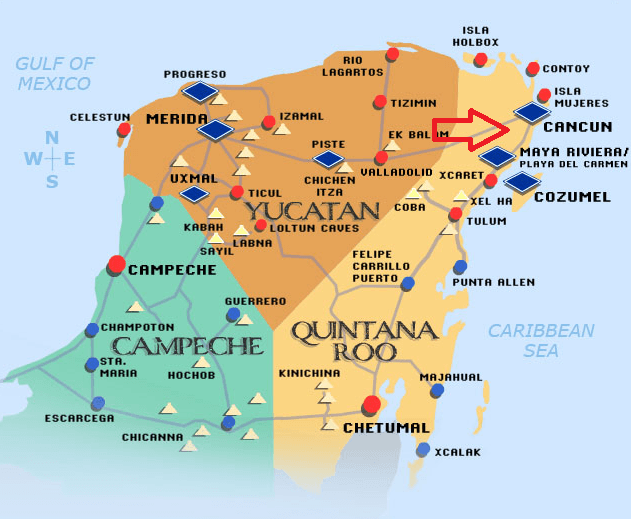

The travel advisory is regarding Cancun and the Yucatan Peninsula in Mexico, a popular destination full of resorts that include many “all inclusive” packages that entice travelers not only from the United States, but also from around the world to make their way to, and spend money in, the area.

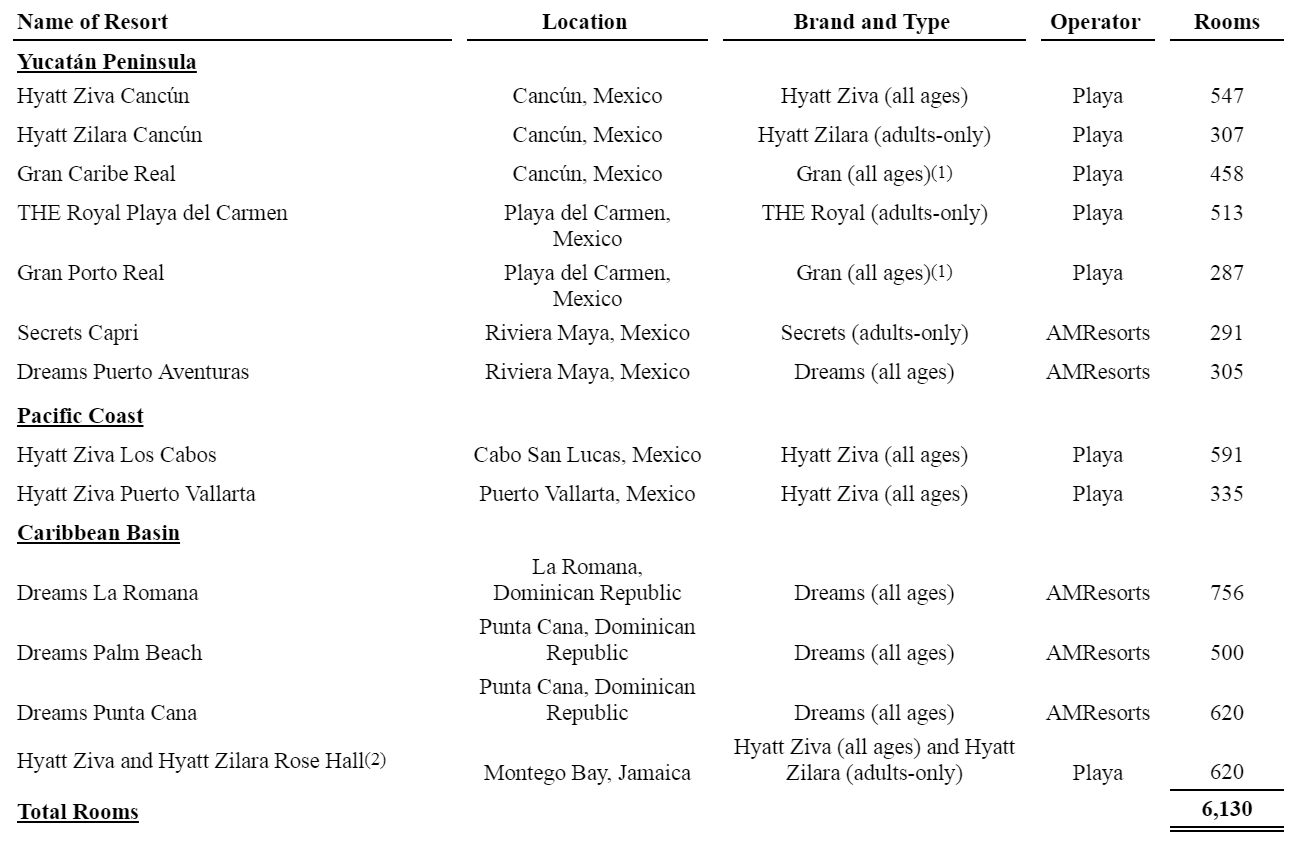

PLYA calls itself a “leading owner, operator and developer of all-inclusive resorts in prime beachfront locations at popular vacation destinations in Mexico and the Caribbean.” The company’s 10-Q states that as of June 30, 2017, it owned a portfolio consisting of 13 resorts (6,130 rooms) located in Mexico, the Dominican Republic and Jamaica.

As you can see from the following chart pulled from the PLYA’s most recent 10-Q, more than half of the company’s resorts are located on the Yucatan Peninsula:

Unfortunately for them, the U.S. State Department doesn’t see these locations as safe travel destinations and they are urging warnings on these regions of Mexico. A recent NPR report stated,

The U.S. State Department has released an updated travel advisory for Mexico, expanding its warnings specifically about the regions that are home to some of the country’s most popular tourist destinations.

The agency cautioned U.S. citizens that homicide rates are on the rise in areas such as the states of Quintana Roo, which includes Cancun, and Baja California Sur, which is home to Los Cabos.

Citing Mexican government statistics, the State Department noted Tuesday that, so far, 2017 has seen much higher rates of violence in those regions than during the same period last year.

A Bloomberg article followed up, stating that:

The expanded travel advisory hits at the heart of a tourism industry that brings in $20 billion a year for Mexico. The state of Quintana Roo, where the resorts of Tulum and Cozumel are also located, gets 10 million tourists a year, a third of the national total. The warnings come as homicides in Mexico are set to rise to their highest since at least the turn of the century. Quintana Roo alone has seen 169 murders this year.

The increased rate of homicides in the area, coupled with the U.S. State Department Advisory, have a chance to make a severe impact on PLYA’s financials for the upcoming quarter and potentially future quarters, depending on how long the advisory is kept in place and whether or not it becomes more stringent in nature.

Stories like this one about tourists becoming gravely sick, waking up with brain damage, being accosted with strange demands for cash, being sexually assault and being “drugged and raped”, reported on August 24, 2017, are becoming all too common. People are blacking out and waking up to “nightmare scenarios” with little or no recourse:

The despair and frustration he’s facing are familiar to dozens of vacationers who have been victimized at upscale, all-inclusive Mexican resorts.

Following blackouts, robberies, assaults, even the death of a loved one, they have experienced indifferent – if not hostile – treatment from resort staffers, local police, and doctors, a Milwaukee Journal Sentinel investigation has found.

The harm is worsened when travelers quickly learn that catching criminals, filing a lawsuit and otherwise obtaining justice in Mexico is nearly impossible.

And that the U.S. Department of State does little or nothing to help them.

“The laws in Mexico make it very, very difficult to hold anyone accountable,” said Nancy Winkler, a Philadelphia attorney who represented a family whose 22-year-old son drowned in a Mexican resort pool in 2007. “It’s a nightmare.”

For most, the trouble started when they blacked out after drinking small or moderate amounts of alcohol at resort bars. Often the blackouts happened simultaneously among couples and friends, something none had previously experienced.

While many said they woke up hours later and found no obvious crime had been committed, others described regaining consciousness to learn they had been sexually assaulted, taken to jail, robbed, kicked out of their hotels, swindled by local hospitals and ambulance companies.

Stories like these certainly don’t help the collective PR effort for tourism to the Yucatan, where Playa Hotels does a majority of its business. The same article noted another instances that cost travelers tens of thousands of dollars simply to be seen and treated by local medical professionals,

Rick Autrey, a barber from Dallas, was pulled from a resort pool in May, pulseless and blue. While he was unconscious, his friend had to put $10,000 on his credit card to ensure Autrey would receive care.

Autrey’s wife and children flew down from Texas the next day to be by his side. Upon arrival, the hospital charged his wife tens of thousands more. In all, their bill totaled more than $50,000, including the airlift back to Texas.

Another similar story involving the drowning death of a woman named Abbey Conner surfaced in July of this year in USA Today. While this story did not unfold at a PLYA resort, it took place in the same area as many of PLYA’s resorts — near Cancun and Playa del Carmen. USA Today wrote:

The scene at the swim-up bar at the Mexican resort where Abbey Conner was pulled listless from the pool in January was full of young tourists last month when an attorney hired by Conner’s family showed up.

It wasn’t surprising. It was a typical scene at an all-inclusive five-star resort where foreigners from both sides of the equator flock to escape their cold winters.

But as he watched, the attorney noticed something disturbing.

“They serve alcoholic drinks with alcohol of bad quality and in great amounts, mixing different types of drinks,” he wrote in his native Spanish.

That single paragraph, buried near the end of a four-page report summarizing how 20-year-old Conner drowned within a couple hours of arriving at the Iberostar Hotel & Resorts’ Paraiso del Mar, offers a possible lead in the investigation into her death.

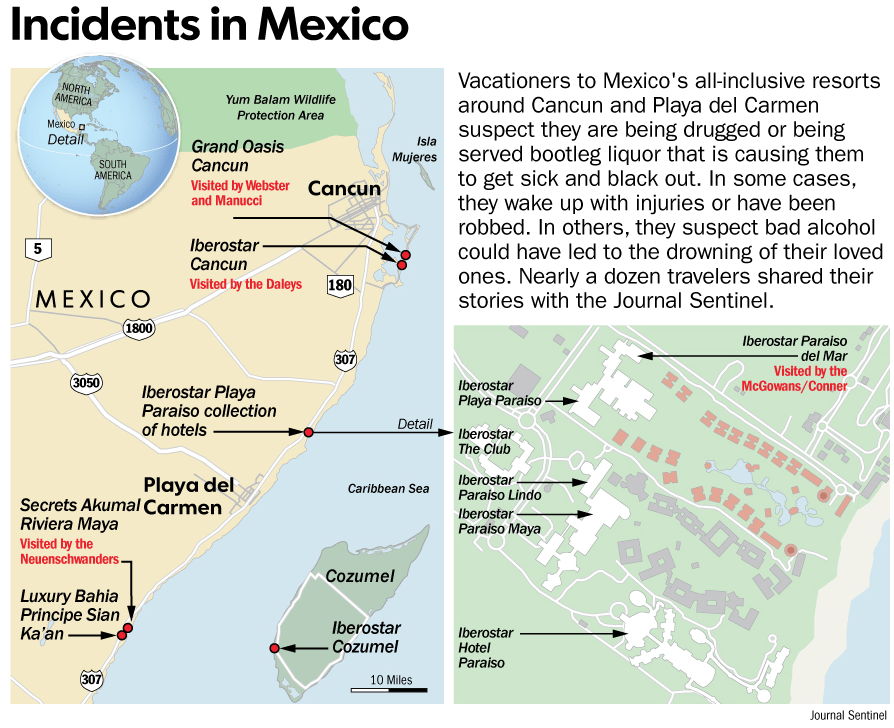

This chart from the Journal Sentinel showing where similar incidents have taken place also points out the specific area of the Yucatan that is home to more than half of PLYA’s resorts:

Extortion also continues to be a theme that surfaces in each of these reports, as Abbey Conner’s family wound up not only losing their daughter, but spending “about $17,000” to a small medical clinic south of Playa del Carmen and “tens of thousands more” to a hospital in Cancun:

Extortion? In at least three cases, travelers reported that local hospitals, part of the Hospiten chain, appeared to be gouging them, demanding large sums of cash. One man was told to take a cab to an ATM. The vacationers suspected Iberostar might be in cahoots with the medical company. The resort contracts with Hospiten and refers sick and injured guests to Hospiten’s facilities. Abbey Conner’s family paid about $17,000 to a small medical clinic south of Playa del Carmen and within several hours paid tens of thousands more to a hospital in Cancun, north of the resort, where Abbey and her brother were transferred.

Whether these incidents prove to be motivated by cost cutting, extortion, or other nefarious reasons, they collectively paint a terrible picture of the area for not only potential first-time tourists, but also those considering planning weddings and corporate events in the area.

Scrutiny on the Yucatan

The Yucatan Peninsula is an area that encompasses many famous resort cities, but both Cancun and Maya Riviera/Playa Del Carmen are both home to PLYA resorts which make up more than 50% of the company’s total resort portfolio, per its 10-Q.

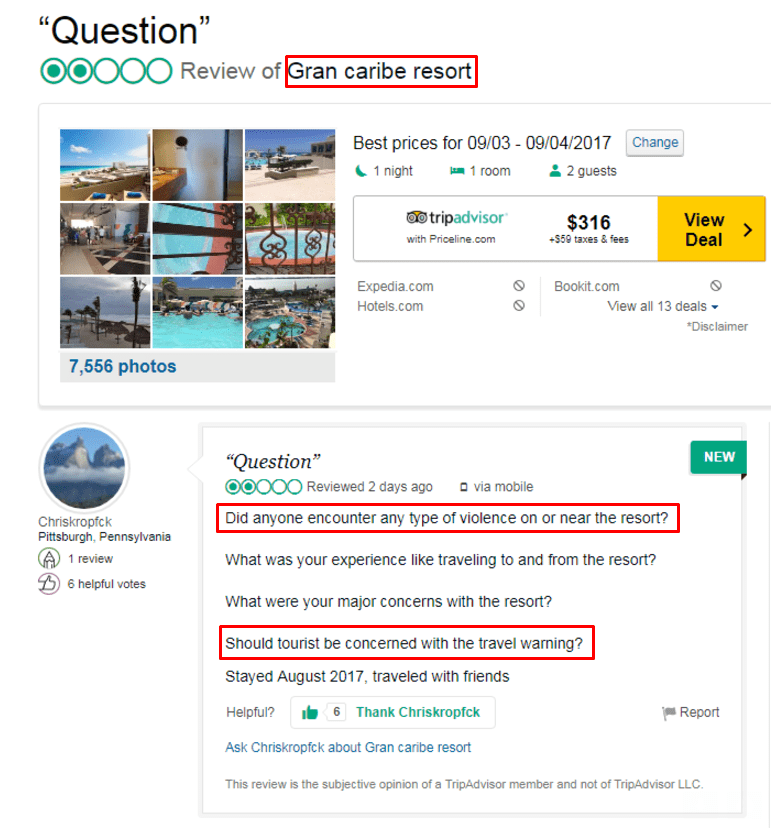

Potential travelers already seem to have nerves about not only the travel advisory, but also the possibility of encountering trouble while traveling to Cancun. Reviews like this one on TripAdvisor have popped up, asking pointed questions about the travel advisory and whether or nor anyone “encountered violence on or near the resort”.

Areas Under Advisory Make up More than Half of PLYA’s Adjusted EBITDA

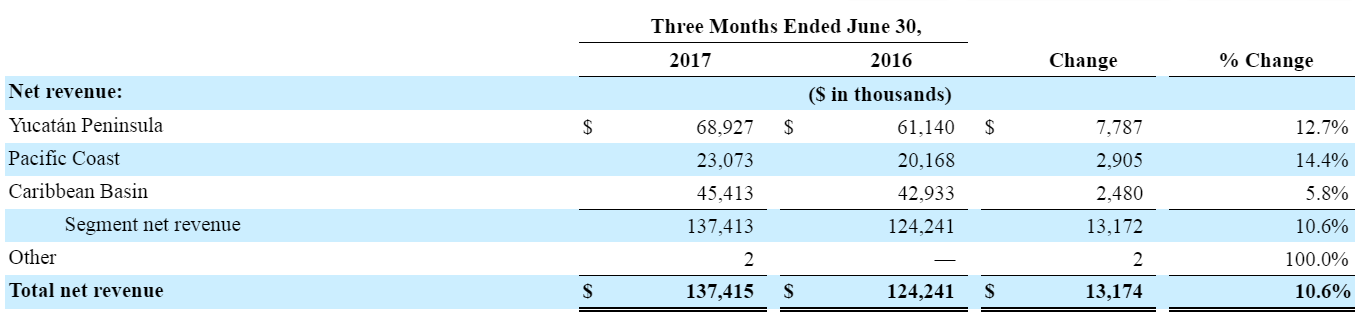

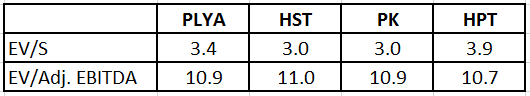

On top of that, according to the company’s most recent 10-Q, you can see that the properties in the Yucatan Peninsula make up more than half of the company’s net revenue and nearly half of the company’s gross revenue:

The Yucatan Peninsula also accounts for more than 50% of the company’s adjusted EBITDA, according to its most recent 10-Q:

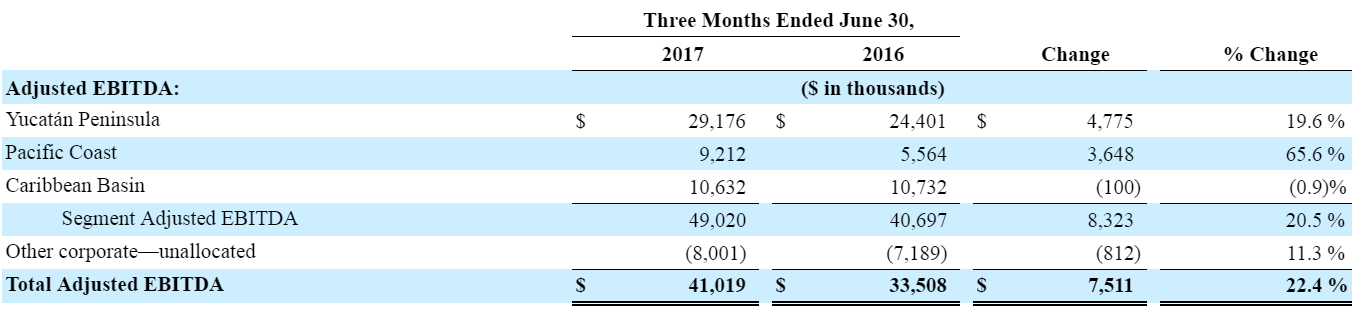

In order to analyze a potential impact on PLYA’s revenues, as well as its adjusted EBITDA, we used its reported financials for the first half of 2017. The analysis assumes 5%, 15% and 25% declines in revenues from the company’s Yucatà n Peninsula segment.

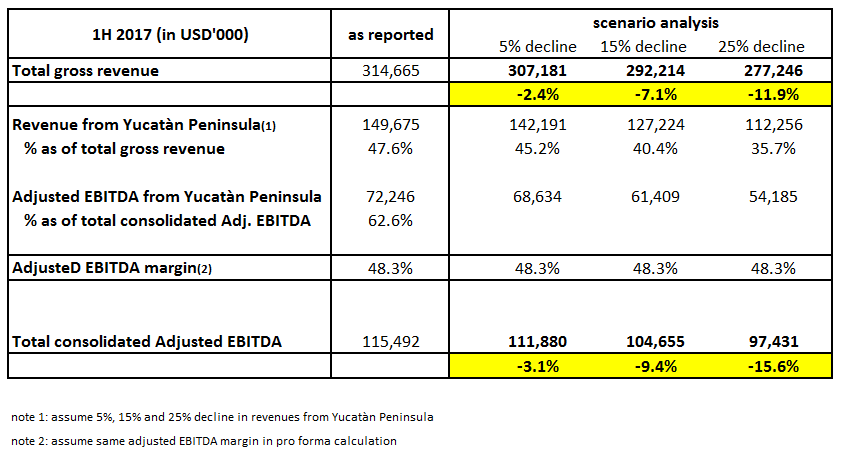

PLYA’s total gross revenue would decrease 2.4%, 7.1%, and 11.9% if revenues from Yucatà n Peninsula saw a 5%, 15%, and 25% decline, respectively. In addition, adjusted EBITDA would decrease 3.1%, 9.4% and 15.6% correspondingly. Currently, the company is trading at a trailing EV/Adj. EBITDA of about 11X, and if the estimated decreases in adjusted EBITDA, based on the 1H 2017 financials, are applied to the company’s trailing adjusted EBITDA, the company’s stock price would likely decline approximately 5%, 15%, and 24% under these three scenarios to maintain the same trading multiple. Since PLYA has about $880 million debt on its balance sheet, a decrease of the company’s adjusted EBITDA, should it happen, could add significant risk to the company’s equity investors.

Up to 24% Downside Possible in PLYA Stock

Over the course of the last couple of days since this news has been released, the stock has shown little reaction, trading flat to incrementally positive.

To better understand PLYA’s valuation as it currently stands, we compared it to three peers in the space:

- Host Hotels and Resorts Inc (NYSE:HST, market cap: $12.9 billion)

- Park Hotels & Resorts Inc (NYSE: PK, market cap: $5.5 billion)

- Hospitality Properties Trust (NASDAQ: HPT, market cap: $4.4 billion)

note: calculation is based on last twelve months and companies’ filings

In our opinion, we believe EV/Adj. EBITDA should be the closest monitored trading multiple for hotel and resort companies. Since PLYA is already near fully valued at an EV/Adj. EBITDA of about 11X as compared to peers, we think the residual effects of a cap on tourism could have a near term and relatively meaningful impact on the stock price as analysts look to adjust their earnings estimates and cash flow models to account for what is definitely going to be an aberration in business over the coming quarter or two.

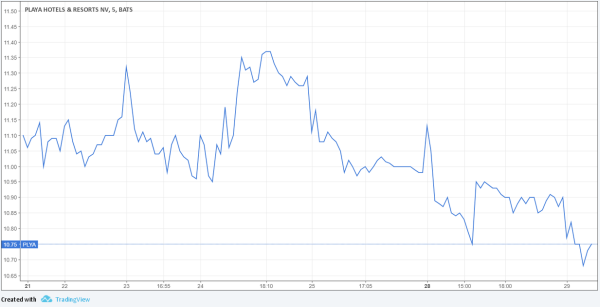

PLYA Last Five Trading Days

While it is difficult to say how long this travel advisory will last, the implications could be significantly worse for the company should further restrictions be enforced or if the current advisory remains in effect for more than just a couple of months. One thing is for sure, and that is that this advisory introduces a new risk factor that potentially hits at the heart of where the company derives most of its sales and EBITDA. This factor has not been priced into the stock and we believe that near term downside of up to 24% in the stock is possible as both investors and analysts look to adjust their list of caveats for the company.

Disclosure: FG Alpha Short PLYA at time of publication

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy/