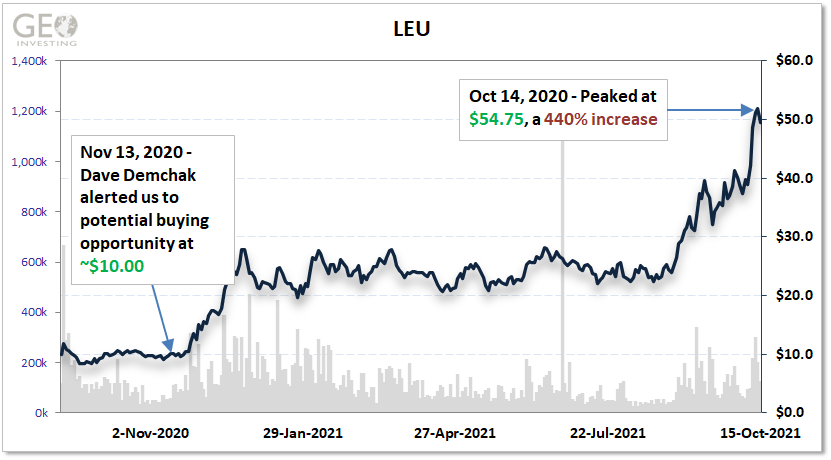

Greetings. I’d like to start out with the 12-month chart of Centrus Energy Corp. (AMEX:LEU). Centrus supplies nuclear fuel and services for the nuclear power industry in the United States, Japan, Belgium, and internationally.

This stock was pitched to us by premium member Dave Demchak, who liked the stock after it retraced by about 50% from mid-August 2020 highs, to around $10 per share. LEU’s most recent high of $54.75 on October 14, 2021 translates to a 440% return from his initial mention of the company’s potential.

This is a perfect case study in how, as a stock researcher, you can use a combination of sources and methods as a launching pad to build a pitch. In this instance, Dave:

- Tuned into an episode of Macro Voices* with Erik Townsend that resonated with his own viewpoint on uranium trends

- Furthered his research with the use of criteria to screen for uranium stocks within a certain price range, a level of free cash flow, and market cap

- Came upon a thesis by Old West Capital Management Corp, through a letter to their investors, referenced in an SEC filing. He decided to run with it and proceeded to do more research on LEU based on Old West’s commentary.

*The Macro Voices episode can be heard here:

Given the current energy environment, while we can look at this as being at the right place at the right time, Dave’s successful investment is far from serendipitous – it was based on some noticeable trends, known facts, smart assumptions and yes, even politics that would catapult the uranium sector to levels it has not seen in 7 years.

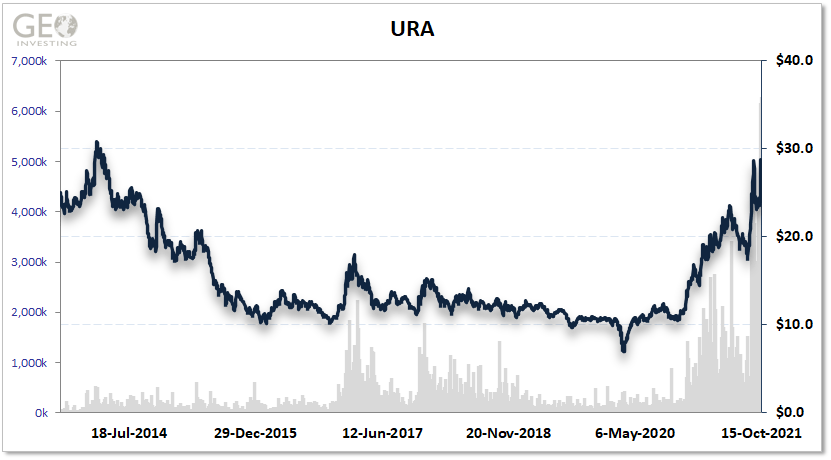

Global X Uranium ETF (NYSE:URA), October 2014 to October 2021

As other energy prices rise, uranium becomes more attractive from the perspective of its relative price to its resource counterparts and the underlying clean aspect of its use. Combine this with an administration that wants to increase spending on cleaner energy, the diminishing negative stigma attached to nuclear power, as well as barriers posed to other companies to match LEU’s one-of-a-kind HALEU product, and you have a recipe for success.

From Centrus’ site:

Next-generation reactors will require innovative nuclear fuel. A fuel design that maximizes a future customer’s operations while minimizing costs will drive the commercial success and marketability of the reactor.

Centrus has the expertise to produce and manufacture affordable new reactor fuels to customer specification based on decades of experience providing nuclear fuel services to utility customers around the world and producing a wide range of enrichment levels supporting U.S. Government requirements. This expertise includes uranium chemistry, nuclear facility licensing, and alternative uranium fuel cycles.

Centrus has also been chosen by the U.S. Department of Energy to deploy a U.S. uranium enrichment demonstration facility for producing high-assay low-enriched uranium, the expected fuel source for many potential advanced reactor designs.

After expanding on the government’s focus on scaling production of enriched uranium, by a factor of several hundred tons per year, Dave posited his valuation for LEU:

I think, to the upside, I think over a couple years, [LEU is] worth at least $40, trading at a multiple of 15 PE, assuming we meet earnings. And that’s not factoring in crazy multiple expansion. I don’t factor that. But let’s just hypothetically say this market’s really aggressive. If this catches on, we might see 20, 30, 40 PE, and at that point I’d probably be a seller of the stock. And a lot of people I know, I know they’d say that’s too high. So that might happen. But I’m not baking it into any estimates. And it looks like based on the price action in the sector, that probably will happen. But I’m not going to say “go buy it” [simply] because it’s going to grow off multiple expansion.

Needless to say, the $40 price target Dave assigned to the stock was handily surpassed. We have yet to follow up with him to see if he exited his position. Nevertheless, we hope to speak with Dave soon for a skull session on the current state of the microcap market and pick his brain on what he might be following outside of GeoInvesting’s universe.

~Maj Soueidan

GeoInvesting Weekly Premium Email and Call To Action Updates (Oct 11 – Oct 15)

Weekly Wrap Up Summary…

Log in below with your Premium Account to continue reading.