By Maj Soueidan, Co-founder GeoInvesting

I’d be willing to bet that at some point you had a conversation with another investor who does all he or she can to convince you that investing in smaller companies is not a prudent strategy to make money in the market. In fact, you may actually believe this yourself.

What would you say if I told you that many companies that are now large caps were once nano-caps, microcaps and small-caps? I’m referring to companies like Monster Beverage (NMS:MNST), Home Depot (NYSE:HD), Microsoft (NMS:MSFT), Wal-Mart (NYSE:WMT) and Netflix (NMS:NFLX).

And what would you think if I told you that iconic investors like Warren Buffett and Peter Lynch believe that the individual investor gains an investing advantage by adding micro-cap companies to portfolios?

My Evans Sutherland (ESCC) Journey

I’d like to show you a very relevant example of why I like to invest in places that the micro-cap critics ignore. So while we are on the subject of billionaires, let’s talk about a “boring” micro-cap with a leading position in its industry. My investment in this company ended up being one of my most “exciting” multi-baggers, providing me with a return of nearly 10x my initial investment at current prices. And what some might find amazing is that its biggest shareholder for years has been billionaire investor Peter Kellogg.

Peter attended Babson College in Wellesley, MA and the Berkshire School in Sheffield, MA. He is the son of James Crane Kellogg, III of Wall Street specialist firm Spear, Leeds & Kellogg; he joined his father’s firm in 1967 after working at Dominick & Dominick. His fortune is primarily from his successful leadership of Spear, Leeds & Kellogg in the 1980s through to its sale in 2000 to Goldman Sachs for a reported $6.5 billion. (Source: Wikipedia)

After a long hiatus, Kellogg just started buying the stock in the open market again. This is going on even after the stock has nearly tripled since August 5, 2016, when we disclosed we were adding shares. I didn’t know he was a shareholder when I first bought the stock in 2014 at $0.14. But it begs the question, if a billionaire is willing to put some money in a micro-cap company why can’t I? I’d much rather follow in the footsteps of billionaires than some “Talking Heads” on CNBC playing for ratings.

Remember, not all micro-cap companies are fraudulent pump and dumps. And don’t get fooled by a fallacy that fraud does not exist in larger companies. Hello Enron! It’s not the market cap of a company that defines a company; it’s the sales, revenue, earnings and management. And it’s not lack of liquidity that solely defines the risk of buying a microcap or small cap stock. It’s good research techniques or the lack thereof. Make a bad investment and your stock goes down no matter how liquid it is.

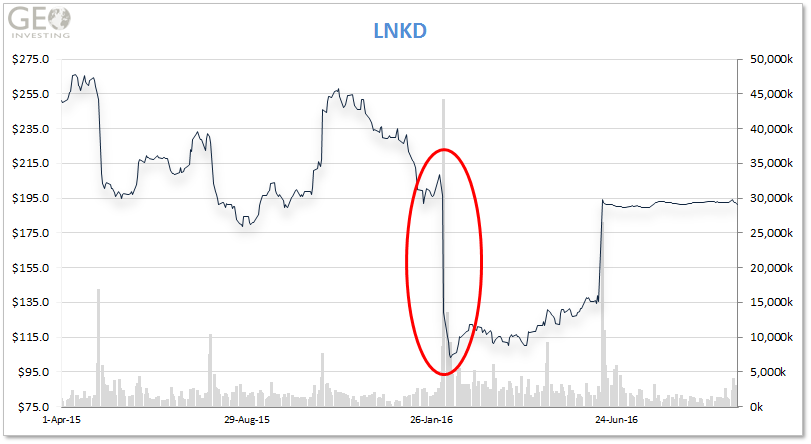

Just look what happened to big cap $LNKD on February 5, 2016 when it fell 35% at the market open in response to disappointing financial results

Read about Geo’s EVANS SUTHERLAND (OOTC:ESCC) journey below so you can hopefully connect with the quality of the research that my team produces.

Free ESCC CASE STUDY — 864% Stock Returns

|

Asset Class – Common Equity |

|

Idea – Special Situation, Bullish information Buried in SEC Filings |

|

Industry – Graphics Technology |

|

Catalyst – Pension Liability Settlement, New CEO, Billionaire Buying Shares, Healthy Backlog, Unwarranted Investor Panic, Deep Discount |

|

Market Cap – $15 Million |

Or