On Friday December 12, 2016, we added a Growth & Value “Stock of the Day” portion to our premium email for situations that warrant putting the spotlight on companies that meet certain criteria to substantiate further research. We touched on Singing Maching (OOTC:SMDM) (see our note here). Today, IESC will take the spotlight.

We have been talking about “growth + value” strategies over the last year. Geo’s Co-founder Maj Soueidan touched on the topic at length in his presentation at the Toronto Micro Cap Conference in April of 2016. You can review a full summary of that presentation here. Many investors think that you need to sacrifice value in order to pay for growth – or that you must sacrifice growth to get companies at attractive valuations. We look for the unique opportunities where companies match both criteria.

Our recent research has also been focusing on “growth at a reasonable price” (GARP), which is a common theme among “growth plus value” seekers. When we come across companies in our research which are low P/E stocks with strong growth outlooks – ones that represent what we believe to be GARP opportunities worth noting – we will highlight them if they stand out.

Early in his full-time Investing career and still today, Maj applied some of Peter Lynch’s GARP criteria as part of his strategy:

- Trailing P/E of less than 25

- Forward P/E of less than 15

- Debt to Equity of less than 35%

- EPS Growth >15% to <30%

The growth criteria used today as part of Geo’s strategy includes:

- Sales growth equal to or greater than 10%

- EPS growth equal to or greater than the range of 20% to 30%

- Pretax margins equal to or greater than 10%

Today’s focus is on IES Holdings Inc. (NASDAQ:IESC) ($21.25). IESC meets some key GARP requirements, although margins are well below our preference. One of the goals in the coming days will be to determine if IESC has an opportunity to expand its margins.

How Does IESC Stack Up Against Top Performing Comps

Ies Holdings Inc. (NASDAQ:IESC) comes right from our infrastructure screen along with two other top performing commercial/electrical construction stocks, Nv5 Global Inc. (NASDAQ:NVEE) and Willdan Group Inc. (NASDAQ:WLDN). The company owns and manages diverse operating subsidiaries, comprised of providers of industrial infrastructure services to a variety of end markets.

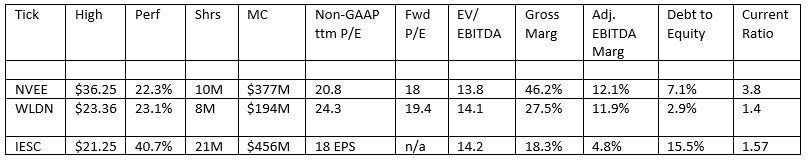

Here is a look at the performance of all three stocks since Trump was elected and some other data points:

We have already written about NVEE and WLDN is a little pricey compared to NVEE and IESC. For these reasons, We decided to take a closer look at IESC and focused on the following.

1. Management Initiatives

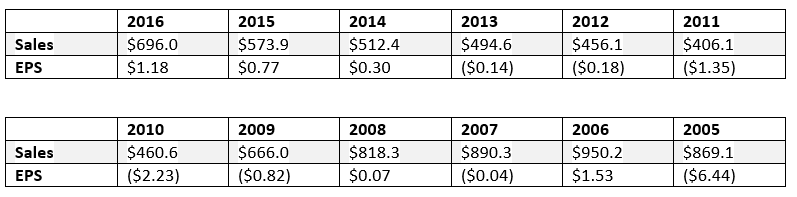

After incurring significant losses between 2005 and 2013 management’s plan to shed losing assets, acquire companies, fill its backlog with higher margin business, diversify its customer base and enter some new markets is paying off.

Quote from Press release:

“We believe that fiscal 2016 was a watershed year as we demonstrated our ability to acquire strong businesses, expand our legacy operations and maintain a healthy balance sheet that we believe will support our strategy into the foreseeable future. Equally important, we became a more diversified and balanced company in 2016. Collectively, the five acquisitions that we have completed since mid-2015 are performing as expected, which, coupled with the strength of our legacy businesses, resulted in our highest level of operating income since 2003. Looking forward into 2017, our backlog is up significantly year-over-year, the composition of our backlog is more balanced, and, with total liquidity of over $65 million, we believe we are well positioned to continue to execute our organic and acquisition investment strategies.”

2. Targeting Growing Markets

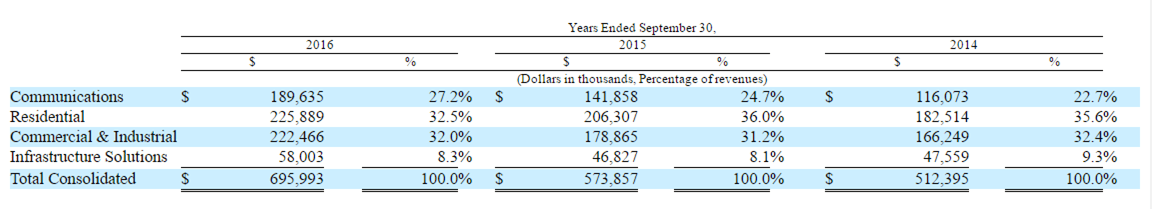

The company is targeting markets that are growing. About 60% of the company’s business comes from its communication and residential business units.

- The communication segment provides network infrastructure services for data centers. The telecom industry is going through major changes in types of services they offer and how they deliver them. “The demand increases for computing and storage resources as a result of technology advancements and obsolescence and changes in data consumption patterns.”

- The residential segment is a provider of electrical installation services for single-family housing and multi-family apartment complexes and cable television installations for residential and light commercial applications. As we pointed out in our BXC bullish article, housing starts still have a ways to go to reach their historical average.

“New housing activity in the United States has shown modest improvement each year since 2009, the trough period of the recent housing downturn. However, 2015 activity was still below the historical average of total housing starts from 1959 to 2015 of approximately 1.4 million starts based on statistics tracked by the U.S. Census Bureau (“Historical Average”). Total new housing starts in the United States were approximately 1.1 million, 1.0 million and 0.9 million in 2015, 2014 and 2013, respectively. Single family starts were 0.7 million, 0.6 million and 0.6 million in 2015, 2014 and 2013, respectively, based on data from the U.S. Census Bureau. According to the U.S. Census Bureau, total spending on new single family residential construction was $219 billion, $194 billion and $171 billion in 2015, 2014 and 2013, respectively.”

Furthermore, most of the residential segment’s revenue comes from Texas which has been one of the strongest housing markets for years. (Source: Marketwatch)

IESC also has two more business segments, Commercial & Industrial and infrastructure solutions, that we need to dig into. Growth in the commercial construction industry is expected to be favorable in 2017, but is forecast to slump in 2018 and 2019. On the flip side, the construction segment has some exposure to the refinery industry which could be a positive if oil prices have put in a bottom. The infrastructure unit appears to serve the power generation industry which is spending billions on upgrades, but the spending patterns by these customers can be erratic.

3. Increasing Revenue

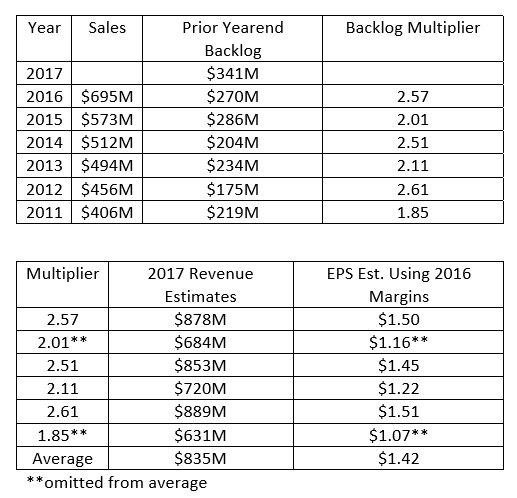

Revenue should increase in 2017. While management offered overall positive commentary in its year end press release, it did not offer any forward-looking guidance. So, we looked at past relationships between sales and backlog to estimate 2017 revenue and EPS. Looking at the last six years, we found that yearend sales are generally at least 2x the prior yearend backlog.

We omitted 2015 and 2011 from the average since the 2016 10K offered a small InfoArb nugget that 2017 revenue would be higher than the $695 million the company reported in 2016.

“Provided that no significant deterioration in general economic conditions occurs, the Company expects total revenues from existing businesses to increase on a year-over-year basis during fiscal 2017 due to an increase in overall demand for the services we provide and our efforts to increase our market share. Despite this expectation of growth within certain segments, we remain focused on controlled growth within certain markets which continue to experience highly competitive margins and increasing costs.”

What Does This All Mean?

It looks like IESC will continue to grow its top and bottom line in 2017. But a range of possibilities exist. Diversification and acquisitions should help the company offset some weakness in the commercial construction market that experts say could occur heading into 2018. We are forecasting EPS for Q1 2017 ending December 31, 2017 to come in at $0.31 to $0.37 compared to $0.21 in the prior year. A sharp pullback in shares can’t be ruled out due to the huge run in the stock. But it’s possible that shares could rise in the short-term, maybe attaining $26.00 which would equate to P/E of 25 on trailing EPS. However, premium valuation multiples may be difficult to sustain, given the company’s lower margins and higher debt than its comps. An interview management is needed to determine why net margins are sitting at only 3.5% and if they can rise from current levels.

Caveats

- Weak Margins leave little room for error

- Stock has already seen a significant run

- Project delays

- Issuance of shares to raise capital

- The “hot” infrastructure theme could attract short sellers

- We are taking a closer look at our own non-GAAP calculations and as well as verifying EV/EBITDA calculations.

Jörg Schreiber

Dear All,

according to guru focus IESC might have manipulated their financial results.

The Beneish M Score is 0,11.

The M-score was created by Professor Messod Beneish. Instead of measuring the bankruptcy risk (Z-Score) or business trend (F-Score), M-score can be used to detect the risk of earnings manipulation.

Maj Soueidan

Thanks Jörg, Great to connect with you. We will take a closer look at the M-Score thx.

Maj