Welcome to The GeoWire, Your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

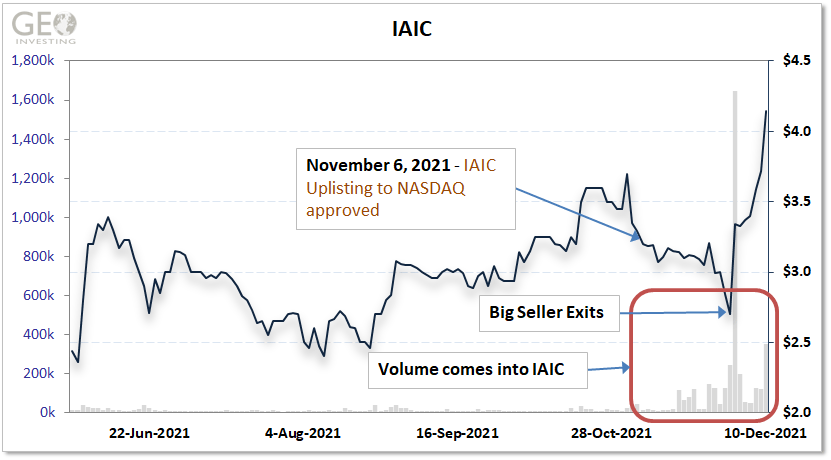

Information Analysis Incorporat (NASDAQ:IAIC) has been one of our best performing stocks since mid-2020, rising 548% from the time that we highlighted some Information Arbitrage, on August 17, 2020. The company modernizes outdated IT infrastructure of government agencies, but under a new CEO it is expanding its market reach and capabilities.

In our last Geo Weekly Issue, the concept of the ‘Raiser’ was discussed because of a short-lived event concerning IAIC during which the stock had a one-day spike of 46%, with shares continuing to inch higher into the $3.70 range in the ensuing days. You can read more about that here and why we are always on the lookout for big sellers who get inpatient and quickly exis their positions, causing shares to initially plummet.

Ironically, today’s post is about an event that occurred a week later, on Friday, December 10, that led to another spike in the price of IAIC from $3.72 to $4.15. There are most likely a number of underlying factors that are causing IAIC’s accelerated increase in price – NASDAQ Uplisting, increased chatter about entering new growth markets, a recent acquisition – but one in particular was certainly the spark that lit the latest.

In a press release, IAIC announced a $10,000,000 equity financing at $3.04 that under many circumstances would cause investors to exit the stock due to fears that their investments would be diluted from a larger pool of available shares. This issuance of stock often leads to broad skepticism about the alignment of management intentions to maximize shareholder value.

But in the case of IAIC,

“The financing was led by the Company’s Chairman and CEO, Mr. Jamie Benoit, and newly-appointed board member Chip DiPaula, with participation from existing investors, Company executives, and members of the IAI Board of Directors. Several limited partners of Marlinspike Capital (www.marlinspikecapital.com) also made leading investments in the PIPE.”

In other words, the allocation of the 3,289,525 units to the above-referenced entities, being led by insiders, conveyed to the market IAIC’s confidence in its business plan moving forward. This comes on the heels of a small $2,8000,000 million financing completed on August 30, 2021, which was also led by insiders, but at a lower price ($2.00). So, it’s also a positive sign that insiders are willing to pay a higher price just 4 months later. Furthermore, the offering is being used to finance the acquisition of Gray Matters. Although we don’t have a good deal of information on Gray Matters yet, it is worth pointing out that the pedigree of Jamie Benoit, IAC’s new CEO, is impressive, as he comes with the accomplishment of having built the last company he was involved with from zero to $500 million in revenues.

The uplisting alone served as a classic example of volume coming into a stock with the increased visibility that often comes with the listing upgrade from the OTC, which is why we encourage the management of smaller tier 1 OTC companies to do so.

Here’s to hoping for another exciting week.

~Maj Soueidan

—

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

Billionaire Chamath Palihapitiya says big companies shouldn’t receive a ‘single extra dollar’ of stimulus and Congress should pay ordinary Americans instead.

While you might know Chamath Palihapitiya as the founder and CEO of Social Capital, he was also an early senior executive at Facebook, working at the company from 2007 to 2011. Some might view him as an entrepreneurial visionary; others might say that his provocative approach to business puts him in the unique position to use his platform to call out what he might say is big business’ silent, self-perpetuating cycle of lining their pockets. He’s against dividends, bailouts, and big corp stimulus. Do you agree with him?

On the first coronavirus stimulus, Chamath exclaimed,

“The companies did not use the first stimulus to invest in research and development, raise worker wages, or save cash – and they weren’t doing that before the pandemic either.”

“What they were doing is they were entering the markets, they were buying back their stock, they were inflating earnings per share to drive their own personal compensation. And this isn’t a one-year problem; this has been happening, frankly, for the last 15 or 20 years…”

“The only way America will dig itself out of the economic crisis is by focusing on the consumer. Americans are “unbelievable at spending” and their consumption drives gross domestic product. Therefore, Congress should prioritize additional unemployment benefits, loan forgiveness programs, and small business aid in the next stimulus bill.”

See more on this here and here.

At a November 2017 episode of the Stanford’s Graduate School Business’ “View From The Top” talk, you can hear Chamath elaborate on and plant the seed for some of these views that he continues to breathlessly promote in business interviews.

Notable Tweets

—

Investing is the only field where people spend less time researching than planning a vacation.

It’s your conviction and research that determine whether you will benefit or be hurt by volatility when the stock market pulls back.

— Thomas Chua (@SteadyCompound) October 16, 2021

Volatility is the price of admission in this game, especially in microcaps. If you don’t like it, find a different game.

— Tiny Stock Ninja (@tinystockninja) December 4, 2021

Aside from priorities, is this even true? Is there any good reason to believe that inflation hits low-income households especially hard? 1/ https://t.co/72hxWaL5zW

— Paul Krugman (@paulkrugman) December 11, 2021

Featured Video

xxx

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.