It’s been 13 days since we published our “Whistle Blower” report on LLEN when we presented several pieces of evidence to support our opinion that LLEN has been misrepresenting its operations to investors. The National Business Daily (“NBD”), a national financial newspaper in China, published an article that confirmed some of our findings. This article will continue to address details around LLEN issues and summarize a followup article published by NBD that continues to confirm our evidence. But first we think its imperative to expand on a topic we touched upon regarding a highly dilutive debt for equity exchange transaction.

On July 2, 2013, Ironridge Global IV, Ltd filed a lawsuit in the Los Angeles Superior Court against LLEN seeking to collect debts Ironridge purchased from LLEN’s creditors.

On August 4, 2013, Dickson Lee sold $800,000 of debt LLEN owed him to Ironridge. Dickson joined two other creditors who had assigned their debts to Ironridge to collect in Court.

On August 12, 2013, Dickson signed a declaration to the Court acknowledging that LLEN currently owed $4,983,075 plus attorney and agent fees, costs and expenses to Ironridge. Dickson declared that LLEN had agreed to issue to Ironridge 2,588,888 shares of LLEN common stock and promised to issue more shares for each 10-cent drop in LLEN’s stock.

LLEN did not disclose the debt for equity deal to investors until an August 16, 2013 8-K filing. Furthermore, Dickson Lee’s involvement in the deal was only reported in the annual proxy statement filed the same date, rather than included in the 8-K.

LLEN represented in the stipulation for settlement of claims that prior to the issuance to Ironridge, the Company had 38,149,277 issued and outstanding common shares. Adding the 2,588,888 shares initially issued to Ironridge, LLEN should have 40,738,165 shares outstanding following the deal, subject to further issuance for every 10 cent decline in LLEN’s share price.

In an email from LLEN’s transfer agent, as of September 30, 2013 there are now 45,084,191 shares outstanding. Thus LLEN’s share count has increased by 6,934,914 shares since the debt for equity exchange with Ironridge. Presumably, most of that huge dilutive issuance has been to Ironridge.

LLEN shareholders can contact the transfer agent to confirm this amount:

Brian Barthlow

brian@empirestock.com

Empire Stock Transfer

1859 Whitney Mesa Dr.

Henderson, NV 89014

Telephone (702) 818-5898

If LLEN was as profitable and generating the operating cash flow the company claimed, why would Dickson Lee and other creditors engage a debt collector? Why would LLEN then immediately agree to exchange $5 million in debt for a highly dilutive toxic equity deal?

The National Business Daily Continues its Diligence

The National Business Daily (“NBD”), a national financial newspaper in China, has issued a follow up report to its September 25, 2013 article discussing certain facets of the LLEN story and confirming some of our claims of misrepresentation by LLEN. It also offers some new information that we are sure investors will find intriguing.

We find it incredible that LLEN has not even attempted to address our finding regarding the Hong Xing coal washing factory. In our first report, we stated:

“Most notably, we will show that revenue of $77.6 million disclosed in LLEN’s 2013 10K, generated from its Hong Xing coal washing factory, was actually close to zero, if it is not actually zero. “

https://geoinvesting.com/wp-content/uploads/2013/09/independent-commitee-farce.png

Before we get into NBD’s follow up article it’s important to bring investors up to speed on the LLEN saga.

Refresher

On September 24, 2013, five days after GeoInvesting published its negative research report, “Blowing the Whistle on LLEN”, LLEN issued a press release, “L&L Energy Produces Documentation to Repudiate Short-Seller Allegations,” to counter our claim that LLEN does not own two mines it claims to have bought from a PRC based mining company, Union Energy. Through multiple data sets, specifically including the SAIC filings of Union Energy, we showed that LLEN never purchased the LaShu and LuoZhou coal mines from Union energy and that Union Energy still owns these mines, contrary to LLEN’s claims. To argue its case, in its release LLEN provided statements that it claimed it made in its 2013 10-K to describe its alleged acquisition of the LaShu and LuoZhou coal mines:

“In the company’s SEC Form 10-K report for the year ended July 31, 2013, the company clearly states that it acquired the mines by purchasing equity interests in Union Energy subsidiaries. The Company completed the acquisition by obtaining a 95% equity interest in two entities, “Guizhou Union Energy Shun Da Inventory and Transport Corporation” (“Union Shunda”), the owner of LuoZhou Coal Mine and “Guizhou Union Energy WuZhou Energy Development Corporation” (“Union WuZhou”), the owner of LaShu Coal mine.”

As we will discuss later, our team was quick to publicly point out that the above-referenced statements were in fact not made anywhere in LLEN’s SEC filings.

Also on September 24, 2013 we published and summarized the translated content of an article written in the NBD which supported many of our findings, including the fact that LLEN does not own and never did own the LaShu and LuoZhou coal mines and that Union Energy actually owns these two mines. On September 25, 2013 LLEN issued a “clarification” of some of the statements made in its September 24th 2013 press release and reaffirmed its ownership interest in the LaShu and LuoZhou coal mines.

NBD Part Deux

In the most recent development, on September 27th 2013, NBD published a follow-up article that continued to address LLEN’s ownership claims in the LaShu and LuoZhou coal mines. Here are some of the major points from the article:

- Based on NBD’s analysis of SAIC files, LLEN does not have any ownership interest in Union Shunda or Union Wuzhou. In fact, Union Energy owns 100% of both Union Shunda and Union Wuzhou. Furthermore, Union Shunda owns 100% of the LuoZhou mine, while the LaShu Mine is 90% owned directly by Union energy and 10% owned by an individual named Yingquan Guo. Union WuZhou does not have any ownership interest in either mine.

- Through an interview with a Taiwanese investor who has had contact with Dickson Lee, LLEN has been attempting raise money in Taiwan and encountered some obstacles when trying to draw in investment from Taiwanese institutions.

- Yunnan Liwei Taifeng Mining Co., Ltd., LLEN’s wholesale subsidiary, was cited for failure to declare and file tax payable on time by the Shizong County Local Tax Bureau, and was publicly criticized during Qujing City’s 2012 joint annual inspection of foreign-invested enterprises.

GeoInvesting has obtained the SAIC filings of Union Shunda and Union WuZhou and has verified NBD’s findings. We also have video of a lengthy interview of a Union Energy manager who states that LaShu Mine is 90% owned by Union Energy and 10% owned by an individual. We provided all of our video evidence to NASDAQ and SEC.

Investors can view the entire transcribed second NBD article here.

We will now go into more detail of the new elements of the LLEN story.

Press Release Carousel

On September 24, 2013 LLEN issued a press release, “L&L Energy Produces Documentation to Repudiate Short-Seller Allegations”.

However, LLEN has yet to produce any such documents to the public, only claiming that it supplied the following material to its “independent” special committee:

- The LuoZhou and Lashu equity acquisition agreement;

- A supplement that explains the deal structure;

- A Proof of Purchase Status document stating that L&L fulfilled its payment obligations under the agreement;

- A legal opinion from DaCheng Law Offices that confirms L & L’s controlling interest in the LuoZhou and LaShu mines.

Interestingly, in the press release, LLEN also stated:

“In the company’s SEC Form 10-K report for the year ended July 31, 2013, the company clearly states that it acquired the mines by purchasing equity interests in Union Energy subsidiaries. The Company completed the acquisition by obtaining a 95% equity interest in two entities, “Guizhou Union Energy Shun Da Inventory and Transport Corporation” (“Union Shunda”), the owner of LuoZhou Coal Mine and “Guizhou Union Energy WuZhou Energy Development Corporation” (“Union WuZhou”), the owner of LaShu Coal mine.”

As required, we would have expected that LLEN would have disclosed the alleged “equity acquisition agreement” regarding LuoZhou Mine and LaShu Mine in its SEC filings, shortly after the claimed transaction. However, 10 months after the consummation of this “deal”, LLEN has yet to file such an agreement to the SEC, that we have seen.

We could not find the verbiage in the press release quote in any of LLEN’s SEC filings explaining that the LuoZhou and LaShu mines were acquired from Union Energy subsidiaries. In fact, in LLEN’s 2013 10K, LLEN only disclosed the following statement regarding the acquisition of the LuoZhou and LaShu mines:

“On November 18, 2012, we acquired 95% equity interest in both LuoZhou and LaShu Coal Mine from Union Energy, Inc., and Guizhou Union Capital Investment Holding Co., Ltd., a Chinese corporation (“Union Capital”) with a cash outlay of approximately $1.7 million and the transfer of the Company’s interests in ZoneLin Coking Plant (98%) and the DaPing Coal Mine (60%).” (Source: LLEN 2013 10K)

In the relevant 8K on Nov. 21, 2012, LLEN further stated:

“On November 18, L & L Energy, Inc., a Nevada corporation (“L&L”), entered into the LaShu and LuoZhou Mines Sales and Purchase Agreement (the “Agreement”) acquiring the LuoZhou and LaShu mines in the Guizhou Province, China.

Under the Agreement, L&L acquired 95% of both LuoZhou and LaShu mines from Union Energy for $37.1 million. This payment was satisfied by a cash outlay of approximate $1.7 million and transfers of the Company’s interests in ZoneLin Coking Plant (98%) and the DaPing Mine (60%).”

(Source: LLEN Nov. 21, 2012 8K)

LLEN’s stock price reacted positively to its false and misleading September 24, 2013 release, pumping more than 40% within three trading hours after the release, reaching a high of 1.70. However, investors likely realized that LLEN’s release did not match its statements in its 10K 2013, causing its share price to retreat. LLEN’s price has since pulled back to around $1.30.

It appears that LLEN also realized its press release folly and accordingly, at 9:22 at night on September 25, 2013, issued another press release:

“To clarify the statement quoted above the 10-K only discloses that the Company did complete the acquisition by purchasing 95% interest in both the LuoZhou and LaShu mines from Union Energy through an equity ownership transfer agreement. The additional disclosure of the names of the two Union Energy subsidiaries were made to respond to short sellers questioning of L&L’s ownership of mines that do not bear L&L’s name. Retaining the name of Union Energy, our joint venture partner and a reputable and well-connected mining group in the region, on our operating businesses in no way influences L&L’s ownership rights.” (Source: Sept. 25, 2013 Press Release)

Running Around in Circles

We believe that the “additional disclosure of the names of two Union Energy subsidiaries” appears only to be another misrepresentation made by LLEN to cover up its claimed ownership of the LuoZhou and LaShu mines.

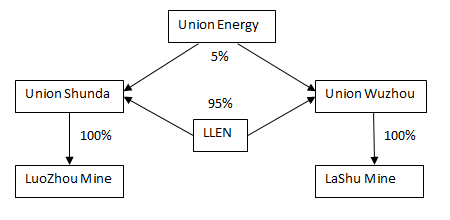

Based on LLEN’s claim in its September 24 and 25, 2013 press releases, the LuoZhou and LaShu mines’ ownership structure would be as follows:

In our original report, based on the SAIC files of Union Energy, LuoZhou Mine, and LaShu mine, we already presented a corporate structure diagram (see below).

In our original corporate chart, we already displayed Union Shunda’s role in Union Energy’s corporate structure. Union Shunda owns 100% of the LuoZhou Mine (officially Guizhou Hezhang County LuoZhou Union Energy Co., Ltd. (“LuoZhou Union Energy”). However, based upon the SAIC file we pulled in September 2013, Union Shunda is 100% owned by Union Energy, rather than 95% owned by LLEN and/or its subsidiaries, as claimed by LLEN.

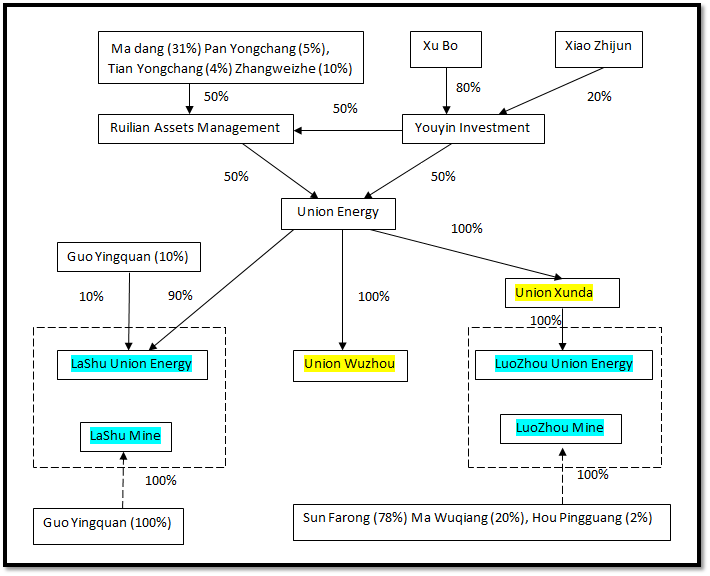

Union Wuzhou was not included in our original corporate chart. At the time of our publication, there was no reason to discuss Union Wuzhou, since it simply does not have any ownership interest in the LaShu Mine. Based on the SAIC file we pulled in September 2013, Guizhou Hezhang County Liuquhe Town LaShu Union Energy Co., Ltd. (“LaShu Union Energy”), the legal entity operating the LaShu mine, is in fact 90% owned by Union Energy and 10% owned by an individual, Guo Yingquan, just as NBD affirmed.

We also have a lengthy video interview of a Union Energy manager who stated that LaShu Mine is 90% owned by Union Energy and 10% owned by an individual. We already provided all of our video evidence to the NASDAQ and SEC.

Union WuZhou does not own the LaShu Mine at all, period. We are utterly baffled as to LLEN’s motivation to defend itself by claiming:

1) It acquired Union WuZhou, and

2) That Union WuZhou directly owns the LaShu Mine.

The facts to prove that these claims are false are so easy to prove!

After LLEN’s press release, we pulled Union WuZhou’s SAIC file. Based on the SAIC file, Union Energy currently still owns 100% of Union WuZhou. We updated the corporate chart of Union Energy to include the addition of Union WuZhou as follows:

As you can see Union Energy owns Union WuZhou, but Union WuZhou does not have any ownership interest in the LaShu Mine. LLEN doubly misrepresented the true ownership.

Nation Business Daily’s reporter confirmed GeoInvesting’s finding regarding LLEN’s ownership issues of the LaShu and LuoZhou mines

On September 28, 2013, NBD published a follow up article regarding LLEN. The article clearly states:

“Based on the SAIC information of Union Energy and other related companies, the National Business Daily reporters discovered that, as of September 2013, Union ShunDa controls 100% of the LuoZhou Mine. Neither LLEN nor its subsidiaries are among the shareholders of Union ShunDa. Union Energy owns 100% equity interest in Union ShunDa. Union Energy owns 90% of the equity interest of the Lashu Mine, while an individual named Yingquan Guo owns the other 10%. The 100% sole controlling shareholder of Union WuZhou is Union Energy itself and Union Wuzhou does not own any equity interest in the Lashu Mine.”

Simply put, the NBD reporters independently came to our same conclusion regarding the ownership issues of the LaShu and LuoZhou mines.

Again, you can view the entire transcribed NBD article here.

Additionally, the following are links to copies of the SAIC files for:

- Union Energy,

- Union Shunda,

- Union WuZhou,

- LuoZhou Union Energy,

- LaShu Union Energy,

- LuoZhou Mine and

- LaShu Mine

Conclusion

We obviously believe that the totality of our evidence proves that LLEN has orchestrated a clever, though easily disprovable, web of deception that in the end will lead to larger losses for those who continue to believe LLEN’s rhetoric. We hope but doubt whether LLEN’s “independent” special investigatory committee has shareholder interests in mind, and, if so, we doubt they will honestly consider our evidence as well as the facts presented by the Chinese Media.

Disclosure: Short LLEN