At times we inform our GeoInvesting subscribers about investment ideas that we think institutions have yet to fully identify, but may soon quickly allocate significant capital into. In such cases, we savor the opportunity to buy a stock before institutional players drive its share price to much higher levels. We believe an investment in Hilltop Holdings (HTH) presents such an opportunity.

Hilltop’s present business is not sexy by any means. Since 2007, when the company sold its Real Estate Investment Trust (“REIT”) business and purchased NLASCO Group, the company’s business has solely consisted of a property and casualty insurance operation. But the story is about to become more exciting.

On May 8, 2012, HTH announced that it had entered a merger agreement with Plains Capital, a one billion dollar, profitable banking institution with operations in the United States’ number one ranked growth state, Texas. The Chairman of HTH, Gerald Ford, has an impeccable track record of successfully investing in banking enterprises and “Since the 1970s has been one of the most successful bankers in the sector.”

We believe that savvy investors who buy HTH now will likely quickly capture $3.40 per share of gains in ensuing trading sessions. Why? Even though shareholders have already approved the merger transaction, the market is discounting the value of HTH shares as it waits for the company to “formally” consummate the acquisition agreement with Plains Capital. Note that the transaction is expected to close before the end of 2012.

Aside from Raymond James which has covered HTH since December 21, 2009, only one new brokerage firm has initiated coverage on HTH before the closing of the transaction. Once the acquisition officially closes, we predict that a slew of “Bulge Brackets” (large well known Brokerage Houses) including JPMorgan Chase & Co. (JPM), who currently covers 27 regional banks, as well as Morgan Stanley (MS), Goldman Sachs Group, Inc. (GS) and Deutsche Bank (DB) will likely initiate coverage on HTH. This should lead to a:

- Large influx of capital competing for HTH shares.

- Surge in the stock well above current analyst price targets of around $15.

Assuming the merger transaction closes, if we add Plains Capital’s value to Hilltop’s current operations, we derive a low end near-term target of $15.50 to $16.95, which is comfortably above analyst expectations. As we will discuss, we believe shares could conceivably fetch north of our target price range.

Post-acquisition, the Plains Capital transaction will:

- Introduce improved predictability and consistency to overall operations.

- Increase HTH shareholder equity by nearly 90%.

- Create significant EPS accretion.

In the end, the Plains acquisition is expected to result in significant EPS accretion for HTH. For 2012, not including Plains’ operations, analysts had expected HTH to report EPS of negative $0.10. Some Analysts are assuming that the HTH/Plains transaction will close and have baked in Plains Capital’s contribution into 2013 and 2014. They are projecting 2013 and 2014 EPS of $1.12 and $1.23, respectively.

Acquisition Consideration:

“The purchase consideration to Plains Capital Corporation common shareholders includes approximately 27.5 million shares of Hilltop common stock and $318 million of cash. Each share of Plains Capital Corporation common stock will be converted into the right to receive $9.00 in cash and 0.776 shares of Hilltop common stock.”

The Catalysts that will quickly propel HTH shares at least 25% before the end of 2012

- The HTH/Plains acquisition agreement entered on May 8, 2012 has not been “officially” completed. However, on September 20, 2012 shareholders voted on the items needed to close the transaction. At this point:

“The merger remains subject to the satisfaction of certain closing conditions, mainly regulatory approvals.”

Information Arbitrage: participate in the knowledge of the information flow that the big boys have…

News that shareholders have voted in favor of the merger has not yet been disseminated by way of a press release, but only through SEC filings. Once news of the closing becomes more known and it becomes evident that the routine closing conditions will be met, we believe investors will push HTH shares higher as they wrap Plains Capital operations into those of the company.

In fact, on October 9, 2012, Raymond James, a well-respected investment banking firm, increased its price target on HTH by 36% to $15.00. The fact that a firm of this caliber has been closely following the progress of the merger transaction and has the advantage of quickly digesting details surrounding the HTH/Plains transaction before mainstream investors strengthens our optimism.

- We further believe that additional analysts will jump on board to initiate coverage on HTH. To that end, on October 16, 2012, Sterne Agee, a privately-owned brokerage firm with more than 140,000 clients across all 50 states and more than $17 billion in assets, initiated coverage on HTH with a price target of $15.25.Sterne commentary suggests that upside exists to its target:

“The bottom line is we believe the combination of the Plains Capital business mix and Hilltop’s management history of execution bodes well for returns superior to the bank industry. We have not assumed additional deals in our modeling.”

Once the acquisition officially closes, we predict that a slew of “Bulge Brackets” will initiate coverage on HTH leading to a large influx of capital competing for its shares.

- We believe that analysts have purposely left room for upside to their price targets. For example, Sterne Agee is using a P/E of 13.5 times its 2013 EPS estimate to justify its price target of $15.25. However, if we reference how the market is valuing Cullen/Frost Bankers, Inc. (CFR), a large publicly traded San Antonio, Texas banking institution, we notice that shares of CFR are being valued at nearly 15x 2013 EPS estimates of $3.77 despite expectations that the bank will show zero EPS growth in 2013. Thus, it is fair to assume that HTH could fetch at least 15x 2013 EPS estimates of $1.12, leading to $16.95 per share since it is expected to reel in positive EPS growth through 2014.

- Furthermore, HTH has been quiet on the investor relations front as is evident by its lack of press releases. Once the acquisition closes, we postulate that the company will likely begin an aggressive IR campaign.

- With an estimated post-acquisition market cap of just over $1 billion, HTH could be an ideal candidate to be added to major indices, meaning that index funds will have to purchase shares.

Investors need to stay alert and consider taking action as the information arbitrage gap is closing at an accelerated rate.

Filling the Arbitrage Gap

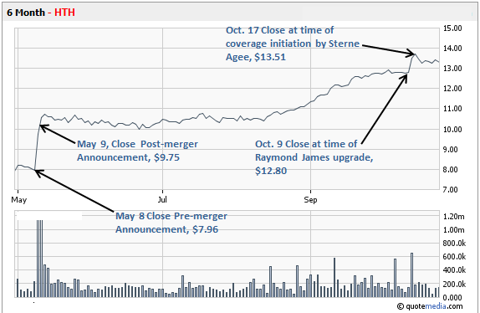

Leading up to the announcement of the Plains Capital agreement on May 8, 2012, the market was valuing HTH shares at around $8.00. The following chart shows that the market has been closing the arbitrage gap since HTH and Plains Capital entered into an exchange agreement.

As can be seen, upon the announcement of the merger agreement, shares quickly jumped by 22% to $9.8 on May 9, 2012 and have been gradually accelerating upward as the market prices in the high probability that these two companies will consummate the transaction. Even though the stock is trading at $13.59 as of October 31, 2012, we still believe attractive near-term upside exists.

Investors can also reference the “arbitrage” price action of Tile Shop Holdings (TTS), a large legitimate expanding retail tile company that saw its shares rise roughly 18% percent in anticipation of the consummation of a merger transaction and added another 18% after the completion of this transaction on August 21, 2012.

Valuation:

Tangible book value, which eliminates preferred stock, goodwill and other intangible assets, has been an accepted valuation practice when assigning a minimum takeover value price point for financial service companies for at least 3 reasons:

- Many of the assets are financial assets that are traded, and getting market value is relatively straightforward; there is a lesser need for estimation and subjective judgment with these assets.

- Financial service firms are less likely to hold assets to maturity; banks often securitize their loan portfolios and sell them to investors.

- EPS growth can often be masked by non-cash or non-operating items.

Following this logic, we calculated the individual tangible book value per share as of June 30, 2012 for HTH’s current operations to be $3.4 and Plains operations to be $4.83. We then valued HTH’s current operations at 1x book and banking operations at $2.5x book to derive a near-term valuation low end target of $15.50.

We were able to justify a 2.5x tangible book valuation assumption by referencing recent acquisition deals involving two Texas-based banks.

Earlier this year, Cadence Bancorp, LLC paid 2.4x price to tangible book value per share to purchase Encore Bancshares, Inc. (EBTX) in an all-cash transaction. In 2011, Dallas-based Comerica Inc. (CMA) bought Houston-based Sterling Bancshares Inc. in a transaction valued at 2.3x tangible book value despite the bank’s asset quality issues.

Because HTH is a public company, it also necessary to value the company on its EPS. For those investors that would prefer to value HTH on its earnings power, recall what we mentioned earlier in this article that:

“it is fair to assume that HTH could fetch at least 15x 2013 EPS estimates of $1.12, or $16.95 since it is expected to reel in positive EPS growth through 2014″

Upside to Short-Term Valuation Assumptions:

We argue that assigning a premium valuation to Plains Capital is appropriate and also think it is quite possible that HTH shares could trade at higher multiples than our assumptions. The current low interest rate environment and improving housing sector will provide a favorable growth environment for at least the next two years, leading investors to assign higher multiples to high-quality banks, especially if they are serving growth geographies, as Plains does in Texas. Banking operations would bring more consistent cash flows to the company compared to the sometimes unpredictable nature of a property casualty insurer. Also, while HTH insurance operations have not shown consistent growth, Plains Capital has experienced substantial growth over the past few years which could support higher than average valuation multiples:

- The company has grown its cash balance at a compounded annual growth rate of 45% over the last three years.

- Net income has grown at a compounded annual growth rate of 34% between 2009 and 2011 to $44.0 million.

- Net income has increased 120% for the first six months of 2012 to $44.5 million.

- Book Value to Equity and Tangible Book Value to Equity have both grown at a compounded annual growth rate of 8% over the 2008 to 2011 period.

- The Bank’s Return on Average Shareholders’ equity has grown by 14% over the 2008 to 2011 period.

- Plains Capital’s favorable risk profile can also support higher valuation multiples:

- Leverage ratio over the same period has decreased tremendously to 9.67% in Fiscal 2011 from 12.71% in Fiscal 2008.

- Tier 1 risk-based capital ratio has been steady or increased slightly to 12.1% from 2009 to 12.54%

- Total risk-based capital ratio has increased over the same period from 13.9% in Fiscal 2009 to 14.05% in Fiscal 2011.

To put these risk measurements into perspective, consider that a well-capitalized bank should have a leverage ratio of at least 5%. Furthermore, the Federal Reserve System and the FDIC require that a bank is considered to be well capitalized if it has a total risk-based capital ratio of 10% and a tier 1 risk-based capital ratio of 5%. It should be noted that risk-based capital requirements establish minimum liquid reserves for financial institutions and exist to protect the firms, their investors, customers and the economy as a whole.

Mid to long-term valuation multiples could get a boost if HTH were to dispose of its insurance operations, post- merger.

Referencing history, when HTH made the decision to operate an insurance company, it divested its prior business ventures. For this reason, we believe that, post-acquisition, HTH could eventually consider selling its insurance business at a multiple of book greater than one. Our current valuation scenario only values insurance operations at one times book. Investors would likely welcome the divestiture of the Insurance Company. Aside from bringing an influx of cash to grow banking operations, such a move would eliminate a volatile operation and allow investors to reduce the required risk premium they assign to HTH shares through higher book value and P/E multiples.

Ride the Coattails of Success

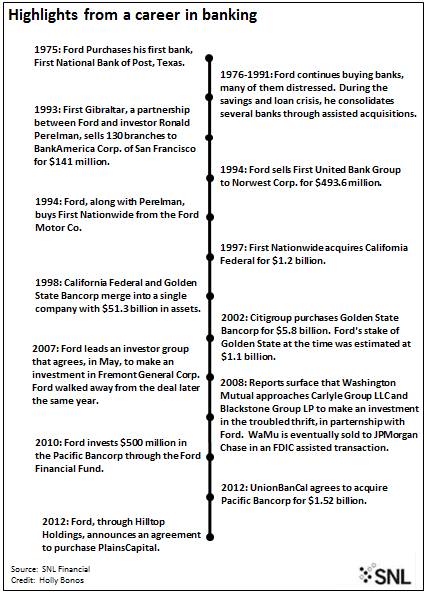

Another interesting sizzle to the story is that the Chairman of HTH, Gerald Ford, has an impeccable track record of successfully investing in banking enterprises.

“Since the 1970s, Hilltop Holdings Inc. Chairman Gerald Ford has been one of the most successful bankers in the sector. Starting with his first bank acquisition in 1975, Ford consolidated a number of banks into First United Bank Group Inc., which he sold in 1994 to Norwest Corp., now Wells Fargo & Co. In 2010, Ford invested in Pacific Capital Bancorp and is set to more than double that investment when the company completes its sale to Mitsubishi UFJ Financial Group Inc. unit UnionBanCal Corp.”

And here is a look at a resume of Ford’s impressive accomplishments…

Conclusion:

Investing in HTH gives investors a chance to take advantage of an information arbitrage that even the institutions have not fully identified in mass – one that we predict will lead to HTH shares quickly reaching and possibly exceeding $17.00 per share. This opportunity has been created by the lack of press releases and also by the fact that the HTH/Plains Capital transaction has not “technically” closed. The price action and recent analyst upgrades indicate that the acquisition will close. Given that the market will not allow the value inefficiency in HTH shares to linger, we believe that investors only have a limited window to jump aboard this accelerating train.