Last week we shared a screen focused on stocks that had a history of losing money, but whose margins were improving, one of a slurry of combinations which can be otherwise understood by investors as stocks that are on the verge of turning around. It yielded 99 stocks, a manageable basket of stocks to dig through. Please read that first if you haven’t.

As stated, the turn-around is of our favorite categories, but there is more than one way to skin a cat.

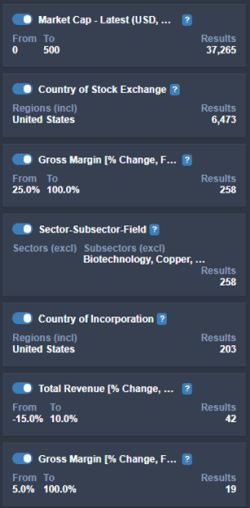

This week, we are changing it up a little with the screening criteria, this time getting a little more granular and using the following core metrics to find potential turn-arounds:

- Revenue growth of less than 10% but limited at 15% decline year-over-year

- Gross Margin increases over past quarter and over the quarter last fiscal year

Similarly to the prior screen we ran in our go-to application, Sentieo, and a theme that we will most likely abide by going forward, we focused on US microcap stocks with at least $1 million in revenue, and filtered out biotechs, banks and resource companies.

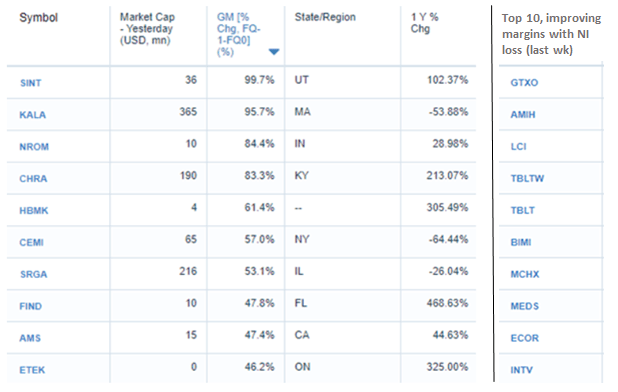

The outcome was an even more manageable 19 stocks, the top 10 of which are shown below. (best viewed on desktop)

Some might think that these results would have mirrored last week’s, but as you can see, the top 10 from each do not share a single ticker. Thus, it appears that we have come up with another unique set of opportunities. As a reminder, we always include the state or region of the company just in case we feel compelled to give them a visit if they are nearby,

Stay tuned for more screening ideas, as we are far from done!

~Maj Soueidan

GeoInvesting Weekly Premium Email and Call To Action Updates (May 24 – May 28)

Weekly Wrap Up Summary…

Log in below with your Premium Account to continue reading.