High-Paying Dividend Infrastructure Stock No One‘s Talking About Now On Our Screen [GeoWire Weekly No. 125]

- Home

- GeoWire Weekly

- High-Paying Dividend Infrastructure Stock No One‘s Talking About Now On Our Screen [GeoWire Weekly No. 125]

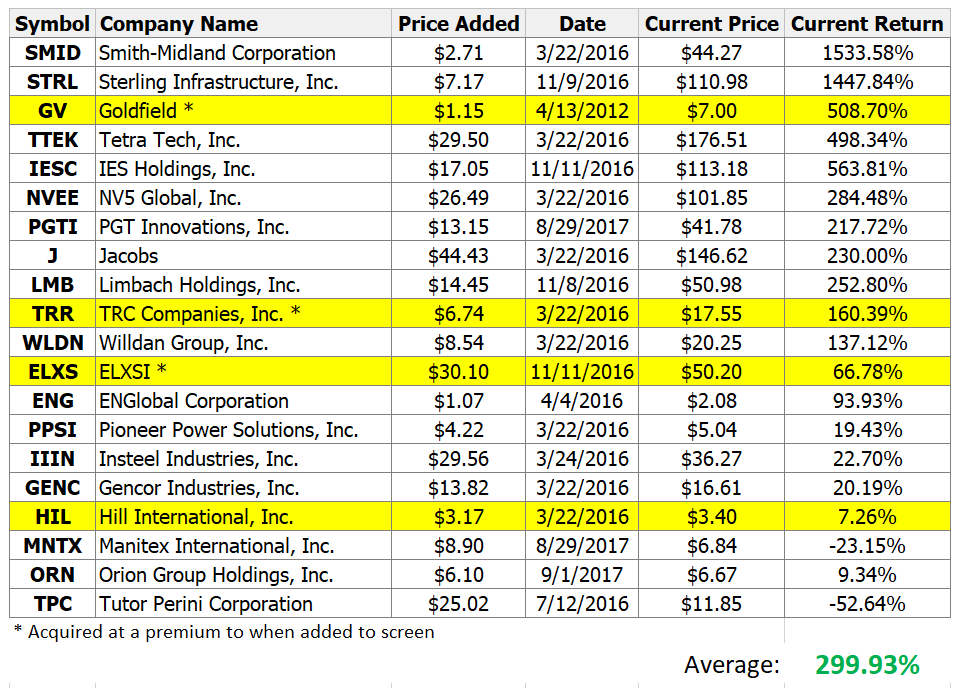

A few weeks ago, I revisited the infrastructure screen we began to develop back in 2016, a project I hadn’t examined closely for quite some time. Upon looking at the stocks in that screen that as of now show an up-to-date average return of 299.93% (vs. 247.91% as of the previous post) …

…I felt it was time to re-evaluate the past inclusions.

Keeping informed on infrastructure stocks opens the door to identifying lucrative growth opportunities that can significantly enhance the value of your investment portfolio. Infrastructure is a foundational sector that often experiences steady growth due to constant demand for construction, maintenance, and upgrades of facilities and services. Aligning a portfolio with these trends ensures the opportunity to benefit from governmental and private sector spending in infrastructure. This approach not only maximizes potentially great returns but also contributes to a diversified and resilient investment portfolio in sectors that often get passed by for sexier themes

Part of this reassessment was to determine which stocks still possess growth potential or if there were any new candidates that could be added to the screen.

By the way, Sterling Infrastructure, Inc. (NASDAQ:STRL) and Ies Holdings, Inc. (NASDAQ:IESC) have both eclipsed the $100 mark, up 41.56% and 42.63% from our opening prices, since the last update, respectively. Another, Limbach Holdings, Inc. (NASDAQ:LMB) added 28.80%.

This has us really angry. – angry enough to get serious about finding more infrastructure screen candidates.

Interestingly, during our research, we stumbled upon a company that, despite our previous criticisms, now appears to have realigned itself with an innovative vision that caught our attention and where the infrastructure bill has carved out a nice chunk of money for the company’s industry.

This company, with annual revenue of about $12 million, operates within a sector valued at $51.16 billion in 2023 and now projected to grow at a significant compounded annual growth rate (CAGR) of 8.5% from 2023 to 2030. Furthermore, an interdependent market segment is expected to grow at a CAGR of 17.5% during that same period.

What Has Us Excited

After years of stagnating growth, management has made considerable strides in revamping its software platform that works more comprehensively with its hardware and third party hardware. The software is fed real time data through sensors placed in the hardware to help its customers make decisions to prevent future loss of civilian life due to safety mishaps.

Of note, management is now very clear in their verbiage that they are viewing the platform to have an AI data analytics focus.

We also uncovered some significant Information Arbitrage commentary from management in a shareholder meeting, that we are confident the market has ignored. You can listen to some relevant commentary from the company’s CEO below (sign in required):

With a price to earnings multiple of about 10x, we see significant upside to the price of the stock once the company proves it can grow consistently. In the meantime, collect a nice dividend, just like we did with Spok Holdings, Inc. (NASDAQ:SPOK).

The remainder of this post is only visible to paid subscribers of GeoInvesting

If you are A premium Subscriber To See The Rest of this post

If you are A premium Subscriber To See The Rest of this post

Along with this idea, you will gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Our History

1500+ Equities Covered

200+ Multibaggers

30+ Years Of Investing Experience

200+ Management Interview Clips

Subscribe Now For A Risk Free Trial

About GeoInvesting

Geoinvesting is a research platform founded in 2007 to publish premium research on microcap stocks that meet a certain set of criteria that we have proven leads to superior returns. Empirical evidence proves that investing in microcap stocks beats the returns of larger cap stocks by 8.24% per year. Even Warren Buffett and Peter Lynch have said that if they were to invest in one type of stock, it would be microcaps.

We provide our subscribers with an even bigger edge by combining the microcap investing edge with our own tested strategies to find the best stocks that are undervalued relative to their growth prospects or other positive catalysts. For example, our Model Portfolio that comes with a GeoInvesting Premium Subscription, and includes stocks the crowd is ignoring, has produced 9 out of 10 winning portfolios with an average return of 43.41%.

Our approach is based on qualitative and quantitative factors that finds stocks a point where they are going through significant changes that the market has yet to identify. This opportunity is only available in the Microcap world, an area ignored by institutions, Wall Street and the financial media.

Over the last 15 years, we have also built a expert Microcap investor network who contribute ideas to our subscriber base.