We had a chance to review and look over Sino Grandness’ recent comments, issued on November 1, 2016 and today offer this response.

Recall that on October 25, 2016, we issued a report asking whether Sino Grandness Food Industry Group was “rotten at its core”. The company issued a response on October 30, which we responded to in an October 31 article available on our website.

The company then issued a follow up on November 1, 2016, which we would like to briefly comment on.

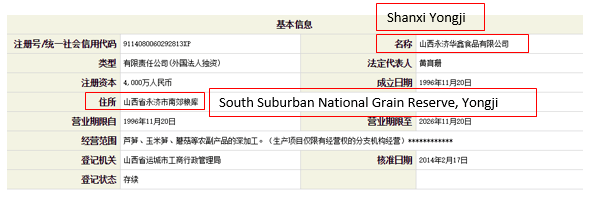

Shanxi Yongji

In our original response, we questioned whether the company was aware that it had a branch at Beiti Village. In its original response to us, the company noted that it doesn’t operate a facility at Beiti Village. We reminded them in our second report that they do in fact have a facility there.

Instead of addressing the issue, it seems the company would rather argue semantics. The company stated in its most recent rebuttal that:

“In 2012, Yuxiang Branch Office commenced operations at a production facility located at 虞乡镇北梯æ‘东 (Yuxiang Town Beiti Village East). The plant operated by Yuxiang Branch Office in Yuxiang Town is commonly known and referred to by the management of the Company as “Yuxiang plant” rather than “Beiti plant”. In the same year, Shanxi Yongji ceased operations at Yongji Southern Suburb Grain Reserve.”

Based on what is written in the second rebuttal, Shanxi Yongji commenced operations at Beiti Village (Shanxi Yongji Yuxiang Branch) and “ceased its operation at Yongji Southern Suburb Grain Reserve“. If this statement is true, it means that, currently, Shanxi Yongji does in fact have a facility at Beiti Village, but not at Yongji Southern Suburb Grain Reserve. This conflicts with the company’s original response, which states:

“The reference in the Report to “Beiti Village” is erroneous, the Company does not operate any facility at “Beiti Village”

In the process of our due diligence, we never referred to the Beiti Village facility as the “Beiti Plant,” but instead simply noted that the company has a location in Beiti Village. This facility is referred to by the company as “Yuxiang Plant.”

Based on information we were able to obtain from SAIC files for “Yuxiang Plant” (as management refers to the plant in Beiti Village East), Yuxiang Plant started its business in 2011, and its license runs until March of 2017. Shanxi Yongji (Southern Suburb Grain Reserve) was established in 1996 and its license runs until 2026. Therefore, we believe that both Shanxi Yongji (Southern Suburb Grain Reserve) and “Yuxiang Plant” are both currently operating as we stated in our original report, as observed while conducting on-the-ground due diligence.

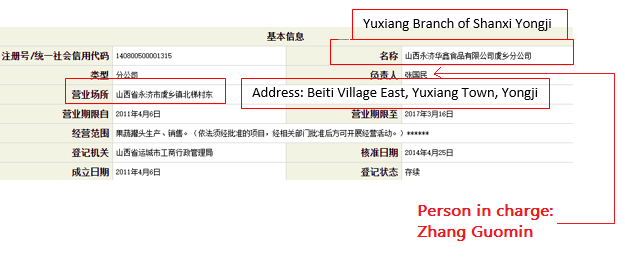

As we stated in our original report, we did find that the “Yuxiang Plant” was still there. Per the gate guard, the plant was overstocked with canned goods inventory belonging to Shanxi Yongji. Here is the “Yuxiang Plant” SAIC information.

In our research, we also found that SGFI used to have a third facility at West Old City of Puzhou, Yongji, Shanxi Province. Based on this branch’s SAIC information, it started business in 2007 and ceased operations in 2015, which is why we did not mention this in our previous reports. Could this be the closure that the company is referring to in its response?

The person in charge listed for the branch at Puzhou is also Zhang Guomin, the same person listed to oversee the Yuxiang Branch. As a reminder, Guomin is listed in Sino Grandness’ 2015 annual report as its “Deputy Chief Production Officer”.

It appears to us that Sino Grandness doesn’t understand its own operations at Shanxi or at least is not communicating their understanding to investors. Is it possible the company doesn’t have a clear vision of its current operations and operational history in this area? As we stated in our previous report, we strongly urge the company to conduct an internal audit of its assets and corresponding management to give shareholders further transparency into its operations.

SAIC Files

Regarding the SAIC filings of its manufacturing subsidiaries and its trading subsidiary, SGFI stated that:

“In the case of manufacturing subsidiaries, they will recognise sales when they sell their products to the trading subsidiaries and record the cost of sales based on manufacturing costs incurred. As such, the manufacturing subsidiaries generate their own revenue through sales to the trading subsidiaries, as reported in their SAIC filings.

As for the trading subsidiaries (Shenzhen Grandness and Shenzhen Garden Fresh), in addition to purchases from the manufacturing subsidiaries, they also purchase from third parties and these products are then sold to third parties. The sales of the trading subsidiaries and the associated cost of purchasing (including purchases from the manufacturing subsidiaries and third parties) are reported in the individual SAIC filings of the trading subsidiaries.”

We would like to discuss this issue, especially regarding SGFI’s canned goods business.

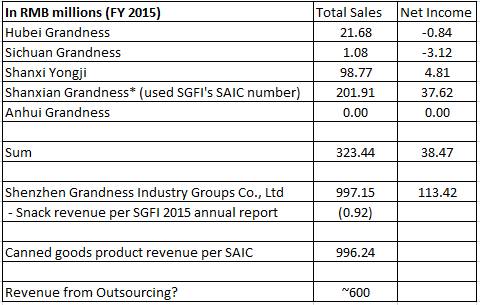

In the company’s response, it only disputes Shanxian Grandness’ SAIC data, while confirming the data from the other three manufacturing subsidiaries and Shenzhen Grandness (trading company). The only SAIC number that SGFI disputed, Shanxian Grandness, seems have an extraordinarily high net margin of 18.6%, which seems abnormal to us. Even if we assume that Shanxian Grandness’ number provided by SGFI is correct, total in-house manufactured canned goods revenue attributable to those manufacturing subsidiaries is reported as RMB 323.44 million.

To estimate the revenue generated from SGFI’s in-house manufacturing, we assigned a gross margin of about 20% to this number. This would mean that Shenzhen Grandness, as a wholesaler, could theoretically generate revenue of around RMB 400 million from this part of its in-house manufacturing.

The company confirms that Shenzhen Grandness’s SAIC revenue is RMB 997.15 million. Subtracting the reported RMB 0.915 million revenue from SGFI’s snacks business gives us RMB 996.24 million, and this should be the canned goods business revenue of SGFI per the SAIC filing. If we subtract the in-house products revenue, which we estimate it to be around RMB 400 million, from the total sales of the canned goods business, this leads us to the conclusion that around RMB 600 million of Shenzhen Grandness’ canned foods revenue appears to be from outsourcing.

Using this logic, SGFI has been outsourcing about 60% of its total canned goods business, while most of its own manufacturing facilities were idled or suspended during our on-the-ground visits — this doesn’t make sense to us.

It doesn’t make sense to us for the company to have these facilities while outsourcing some 60% of its production, and it also doesn’t make sense to us when we consider that the recently proposed rights issuance was supposed to be using 60% of its proceeds for capital expenditures for its non-beverage business.

We must ask: if SGFI is relying so much on outsourcing for its canned goods business,

- Why would the company want to pay to continue construction at its Anhui facility?

- Why would the company want to raise more money for capital expenditures related to its non-beverage business?

- Why wouldn’t the company simply become a wholesaler if the outsourcing model is that much better?

Conclusion

The company’s explanations are rooted in semantics and half-answers. They do little in our opinion to address concerns about the company’s business operations and they increase our doubts regarding the integrity of the company and its management.

For instance, when we asked the company to break out revenue contributions of outsourcing versus internal manufacturing for its canned goods business, it responded:

“The Company does not disclose its exact revenue contribution from self-production and outsourcing for both canned and beverage business per production facility, nor the Group’s outsourcing contractors’ names and corresponding products/revenue contribution, as these information constitute confidential proprietary information and/or trade secrets, and disclosing such detailed non-public information would be damaging and prejudicial to the Group’s business operations and interests as a whole, and would only serve to benefit the Group’s competitors”

Yet the company has no issue with disclosing relevant information for its beverage business in its Hong Kong IPO prospectus. What SGFI is describing as “trade secrets” objectively makes investor due diligence and proper valuation more difficult.

As we continue to state, we believe the company, its management team, and its auditor need to work with regulators to carefully audit its business for the benefit of its shareholders that deserve more transparency.

Disclosure: Neither GeoInvesting, nor any of its employees, has a short position in Sino Grandness due to vague trading laws in conjunction with research reports in Singapore.

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy/