On March 24, 2015, GeoInvesting disclosed that it decided to initiate a small speculative long position in Goldfield Corp (GV) ahead of its Q4 2014 financial release. Goldfield Corp is engaged in the electrical construction operation in the United States.

On March 24, 2015, GeoInvesting disclosed that it decided to initiate a small speculative long position in Goldfield Corp (GV) ahead of its Q4 2014 financial release. Goldfield Corp is engaged in the electrical construction operation in the United States.

We also stated :

“Although we are still in the process of breaking down GV, our quick analysis of backlog trends indicates that the company’s core backlog minus STEC is healthy and is being replaced with new projects. We plan to provide more details shortly.”

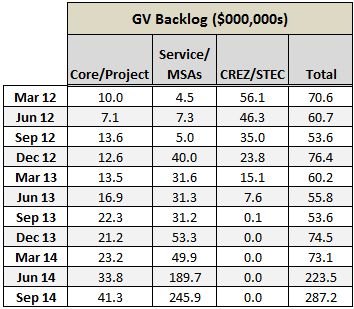

What follows is a summary of Goldfield Corp’s recent backlog and margin trends since it was awarded a large project in Texas (STEC/CREZ) in February of 2012.

Goldfield Corp Backlog Analysis

This Goldfield Corp backlog analysis is important since investors questioned the ability of GV to replace the larger than normal STEC contract, potentially sending record revenues lower to more historical levels. Thus, we wanted to determine if GV’s core backlog, excluding STEC, was stable or growing as STEC backlog diminished.

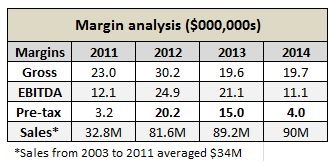

Skeptics also questioned GV’s ability to sustain higher than industry margins that the STEC contract brought to the company.

The good news

Goldfield Corp’s core backlog is showing signs of growth , partly helped by the acquisition of C and C Power Line it closed in January 2014. Specifically, core backlog has risen from $10 million at the end of March 31, 2012 to $41.3 million as of September 30, 2014. More importantly, it appears that 2014 revenue will reach $90 million without any STEC contribution. This is good news and at least for now can put to bed the opinion that Goldfield Corp would be unable to replace revenues generated from STEC. A good deal of GV ability to maintain elevated revenue levels is due to the company putting a greater emphasis on filling its backlog with recurring maintenance and service work (MSA). We presume that if the company can prove that MSA will be a reliable and more predictable source of revenue that investors will reward shares with higher valuation multiples.

The not so great news

Margins have fallen well off their highs attained during the period when STEC was being worked through. Management needs to provide some color on whether it believes that MSA revenues will carry higher margins than its project revenue. Soon to be released Q4 2014 financial results should shed some light on the issue.

In the meantime we will stick with our small pre-earnings trade bet based on improving backlog trends.

Valuation scenarios

Our next task will be to determine how to value shares of GV. Since the company has not been responsive to arrange an interview, we will have to rely on historical financials to forecast 2014 EPS. We estimate that Goldfield Corp will report fully taxed 2014 non-GAAP EPS of ~$0.09 and adjusted EBITDA of $10.4 million. This means shares are currently trading at a P/E of 29 and EV/EBITDA of 8.1. While the P/E multiple is high, the EV/EBITDA multiple is reasonable enough for multiple expansion if the company can re-establish positive growth trend.

To see more on GeoInvesting ongoing coverage of Goldfield Corp only available to Premium Members, please go here.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight