GeoInvesting July 2017 Highlights

On The Radar

New stocks we’re taking a first glance At

Our latest buying opportunity: A stock we have been following since March of this year recently reported strong earnings, but had a muted reaction to the report, which we believe makes for a buying opportunity. We believe this was a result of the company putting out the report during the day as well as not presenting adjusted numbers clearly. The more representative numbers would have helped the market see the company’s true growth.

We believe that these information arbitrage opportunities could eventually help this stock double from current levels — even after gaining more than 40% since we began following it in March. Additionally, we like the fact that its new management team is led by activist investors that we believe can generate significant value.

Join our community today for full access.

Learn With Us

Learn With Us

Education to help you become a better investor

Microcaps Give You a “First Mover Advantage”

By Maj Soueidan, GeoInvesting Founder

This article talks about how I learned how to get a “first mover advantage” from investing in microcaps. My introduction to microcaps began when my Dad would occasionally emerge from his “stock cave” in the basement. He would tell me about a great company he found that I never heard. Then it would end up quickly doubling! When I finished reading “One Up On Wall Street” by Peter Lynch, given to me by my Dad, I knew I wanted to invest for a living one day. I eventually learned that my Dad gained a competitive advantage, whether he knew it or not, by investing in Microcaps because it gave him a ”first mover advantage.”

Studs & Duds

The reality of investing – Our best and worst picks

STUDS

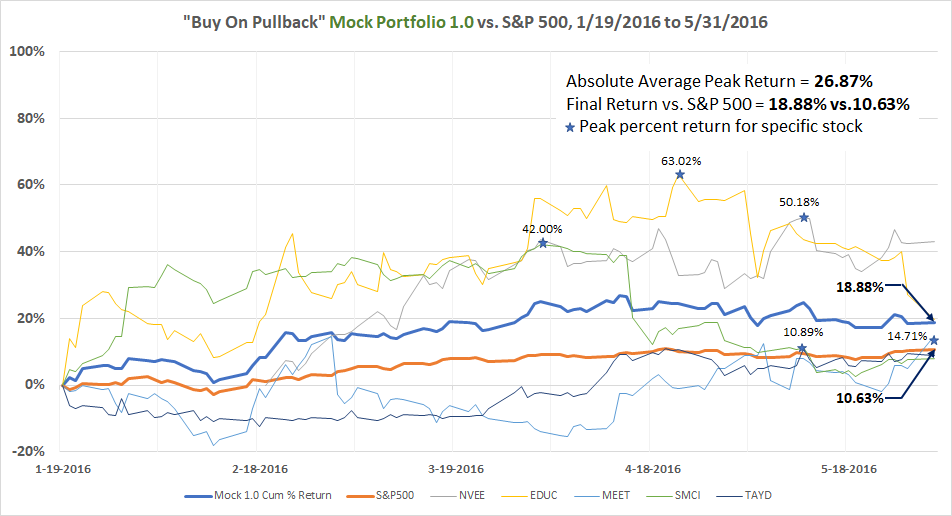

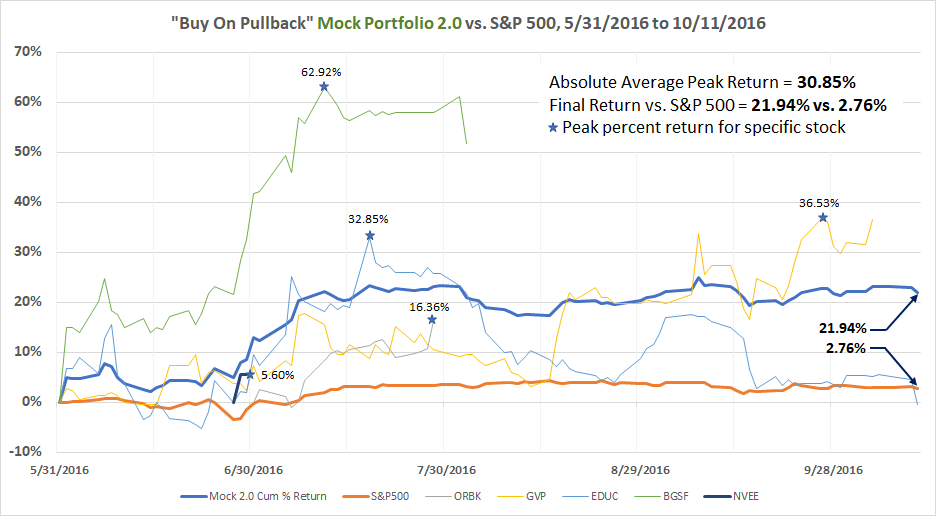

Not only have our Mock Portfolios performed extremely well on their own over the last several months, they have also outpaced the S&P — the true definition of alpha.

Here’s a more graphical representation of how our “Buy on Pullback” Mock Portfolios 1 and 2 fared vs. the S&P, even as the S&P itself itself was in took advantage of favorable market sentiment.

DUDS

Systemax Inc. (NYSE:SYX) is a company we have been following since the first quarter of this year. Despite working to conduct our due diligence on the name, we were a little late to pull the trigger, resulting in us missing out the company’s most recent earnings report. Reporting on August 2, the company saw sales increase 5.1% and operating income nearly quadruple. The stock shut up as a result, moving from about $19 to over $25 on the results. We first started research SYX in March of 2017 with the stock trading at $9.85.

A Note From Maj Soueidan

This month’s message from Geo Co-founder Maj Soueidan

It remains an exciting time to be a microcap investor. The emergence of activism in the smaller cap space is yet another reminder that interest levels continue to rise in an area that we’ve honed as our specialty. Though we have always thought microcaps to be the dominant asset class in terms of risk and reward, we are also trying our hand in some activism, with some success.

A recent activist effort in Bluebird (BLBD), covered by Barron’s, proved to be a success on both the monetary front as well as the PR front for GeoInvesting. Watching other, larger name investors move into the microcap space continues to keep us excited about what the future holds for GeoInvesting and our subscribers.

We currently have a pipeline full of ideas that we are working on vetting so that they may, someday, become points of action for us, and possibly for our members — and you!

Thank you for reading…

~ Maj Soueidan, GeoInvesting Founder

Have the next big idea? Become a contributor and get FREE access to GeoInvesting Premium Content.

Knowledge is power. Please join now to become a member of our exclusive investor community.