Latest Auction Developments Should Send FFHL Shares Back to $1.00 Per Share or Lower

This is a follow up to our message board post from Aug. 26,2013.

On Aug 14, 2013 Fuwei Films (FFHL) made an announcement claiming that its controlling shareholder will try to sell its shares for $5.16 at a public auction (total value RMB 218,746,600). The details are as follows:

“BEIJING, Aug. 14, 2013 /PRNewswire/ — Fuwei Films (Holdings) Co., Ltd. (NASDAQ: FFHL, “Fuwei Films” or the “Company”) announced today that it has received a notice from its controlling shareholder, the Weifang State-owned Assets Operation Administration Company, a wholly-owned subsidiary of Weifang State-owned Asset Management and Supervision Committee (collectively, the “Administration Company”) indicating that the Administration Company has determined to place control over 6,912,503 (or 52.9%) of its outstanding ordinary shares up for sale at a public auction to be held in The People’s Republic of China (“PRC”).”

“These shares are currently held indirectly through an intermediate holding company, Apex Glory Holdings Limited (“Apex Glory”), all of whose shares are the subject of the public auction, and the indicative target price for the first auction is RMB218,746,600 (approximately US$35.7 million) or approximately US$5.16 per ordinary share of Fuwei Films held by Apex Glory. The auction regarding Apex Glory is to be held on August 27, 2013 and will be run by Shandong Jialian Auction Co., Ltd. and Shandong Outstanding Auction Co., Ltd.”

Interestingly enough, as disclosed by FFHL this morning, this auction was a failure. We confirmed that there were no bids for FFHL’s shares on August 27, 2013, even with a lower price than the indicated target price. Furthermore, no other date has been set to carry out another auction.. We believe that additional facets of the story also reduce the chance that possible future auctions will be successful.

As we will discuss, the auction notice press release in China indicates that the “court” (Jinan City Intermediate People’s Court) , not the Weifang State-owned Assets Operation Administration Company , assigned auction companies to sell 52.9% of FFHL’s shares (or “The Shares”) at the auction. Investors need to be aware that FFHL has been accused of not being fully honest with investors in the past regarding disclosure in its IPO prospectus in 2006. This eventually led to a class action litigation which was settled for $2.15 million.

“The suit charged that company officials had provided false and misleading information relating to the company’s IPO.”

There was also a lawsuit in China:

“In 2009, the company disclosed that three executives had been convicted in China on charges that they had illegally taken control of the business there. Shareholders alleged in a lawsuit that Chinese authorities were investigating the hijacking of the company while stock promoters in the U.S. hyped the new issue. The suit charged that company officials had provided false and misleading information relating to the company’s IPO. One of the executives arrested in China has been sentenced to death there, and the two others to life imprisonment, the company has said.”

The court system’s involvement in the auction of The Shares forces us to ask several questions:

- Does the Weifang State-owned Assets Operation Administration Company really currently own shares of FFHL?

- If the Weifang State-owned Assets Operation Administration Company really owns FFHL shares, why was the court involved in the proposed auction and why did it assign auction companies to conduct the auction?

- Why did FFHL management not disclose that the court would be involved in the auction and only tell U.S. investors that the Weifang State-owned Assets Operation Administration Company was to sell the shares?

- Did FFHL for some reason intentionally fail to disclose the court’s involvement in the auction?

The Pump Should Dump

Before this news, FFHL’s shares were trading only around $1.00. Following the news of the auction, FFHL’s stock price quadrupled, spiking from around $1.00 to reach a high of $4.00 during the August 14, 2013 trading session. Since then shares have fallen and currently trade around $2.00 per share. There seemed to be an initial belief by many investors that the auction news implied that FFHL was worth $5.16. But really, this number only means something if entities place bids.

However, we confirmed that no one placed any bids for FFHL’s shares as it relates to the auction at the desired $5.16 indicative target price. Worse yet, no lower bids were placed for the shares. Thus, we believe that FFHL should minimally trade at the price it was trading at on the day before the auction announcement (around $1.00).

Furthermore, we think the stock could trade lower than $1.00 as investors who have yet to digest the facts of this story may rush to sell their shares with a float of only 4.5 million shares and little institutional support.

To cap it all off, the company reported dismal second quarter 2013 financial results on August, 22, 2013, making it the seventh consecutive quarterly loss the company has experienced. This is particularly concerning since FFHL subsidiaries were purchased during foreclosure/bankruptcy proceedings in 2003 and 2004.

“On September 24, 2004, the People’s Court of Weifang declared Shandong Neo-Luck bankrupt due to its financial difficulties. We acquired the Brückner production line in 2003 as a result of a foreclosure proceeding enforcing an effective court judgment and the DMT production in 2004 as a result of a commercial auction from a consigner who obtained such assets through a bankruptcy proceeding.”

Thus, for the time being we are disregarding the RMB 218,746,600 ($5.16 per share) auction target price as the true value of FFHL. Please read on for more details on this developing story.

FFHL management Conceals Important Facts

Different press releases in China and United States cast a cloud of doubt on the ownership of The Shares that FFHL claims is owned by the Weifang State-owned Assets Operation Administration Company.

In China, the FFHL auction news was actually published in the Securities Times on August 8, 2013, around one week ahead of the press release issued by FFHL in United Sates. Following this news in China and before FFHL’s press release, FFHL’s stock price barely moved.

The press release in China regarding the auction reads as follows:

“…

Shandong Jialian Auction Co., Ltd. & Shandong Outstanding Auction Co., Ltd.

Auction Announcement

Assigned by Jinan City Intermediate People’s Court, on 10 am, August 27, 2013, there will be an auction in Auction Hall, 6 Floor of Jinan City Intermediate People’s Court (Jing’er Road, Jinan City, entrance is on East Gate):

Subject of Auction: 52.9% FFHL shares;

Note: This company is a NASDAQ listed company with its registered address Gorge Town, Cayman Island and with business address Weifang City Shandong;

Indicative target price: RMB 218,746,600

Subject Exhibit Period: From the date of this press release to Aug. 26, 2013.

Auction Registration Process: intentional bidder shall deposit RMB 40 million to court bank account (Jinan City Intermediate People’s Court, Bank Account: Shiqiao Branch, Qilu Bank, 000000028004100000378)

…”

Apparently, based on the Chinese press release, this auction was assigned by the Jinan City Intermediate People’s Court in its court house, which is different from the press release made by FFHL, which claimed that:

“Administration Company has determined to place control over 6,912,503 (or 52.9%) of its outstanding ordinary shares up for sale at a public auction to be held in The People’s Republic of China (“PRC”).”

Most importantly, it appears that FFHL intentionally omitted the court’s involvement in this auction.

A little background information is relevant to fully understand the FFHL story. In 2003 to 2004, state-owned assets (Brückner and DMT) were purchased by FFHL during foreclosure/ bankruptcy proceedings. In 2009, the former controlling shareholders of FFHL involved in the purchase of Brückner and DMT were convicted of fraud. All of the personal property of these controlling shareholders, including 52.9% FFHL’s shares were ordered to be confiscated by the Jinan City Intermediate People’s Court. FFHL claims that the shares of the former controlling shareholders were transferred to Weifang State-owned Assets Operation Administration Company, which is why we are perplexed that the court assigned the auction in its court house. The following disclosures in FFHL’s most recent 20F discuss some of these details and references the 52.9% of ordinary shares to have been auctioned is summarized below:

“The March 2009 initial verdict sentenced Mr. Yin to death, with a stay of execution for two years, and the other two defendants, Mr. Zhou and Mr. Wang, each received life imprisonment. All of the personal property of the three individuals will be confiscated.”

“On May 9, 2011, the Company received a notification from the Weifang State-owned Assets Operation Administration Company, a wholly-owned subsidiary of Weifang State-owned Asset Management and Supervision Committee (the “Administration Company”) regarding the transfer of the ownership of controlling shareholders.”

“According to the notification, the former controlling shareholders of the Company, Messrs. Jun Yin, Duo Wang and Tong Ju Zhou, had transferred their entire ownership in several intermediate holding companies to the Administration Company, Ms. Qing Liu and Mr. Zhixin Han. As a result of the transfers, and based on the information provided by the Administration Company, 52.90% of its outstanding ordinary shares are controlled indirectly by the Administration Company and 12.55% of its outstanding ordinary shares are jointly controlled indirectly by Ms. Liu and Mr. Han.”

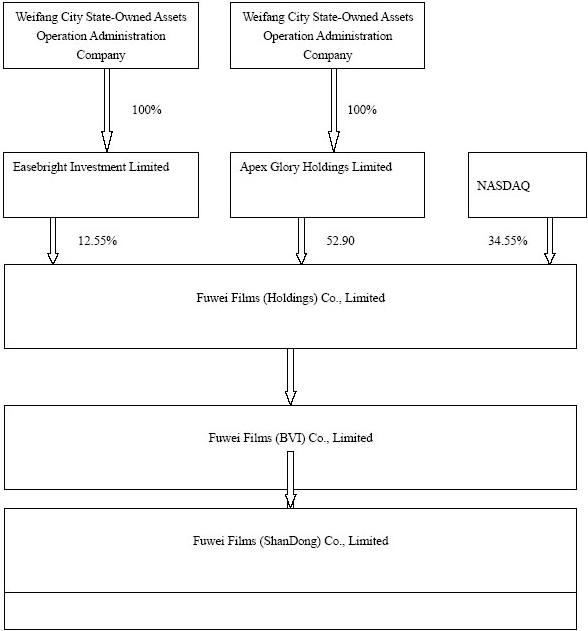

FFHL also provides its corporate structure chart as follows with its claim that Weifang State-owned Assets Operation Administration Company owns 52.9% of the company:

Source: FFHL May 17, 2011 6K, Exhibit 99-1

If Administration Company is the owner of The Shares, we do not understand why Jinan City Intermediate People’s Court needs to continuously be involved with and even assign the auction company to administer the auction. We also do not know why FFHL has failed to disclose the court’s involvement. As The Shares were assigned to the auction by Jinan City Intermediate People’s Court, we believe that either the Administration Company never owned theses shares free and clear or that there is another undisclosed legal proceeding in Jinan City Intermediate People’s Court concerning The Shares. However, FFHL never disclosed either possible situation. This lack of transparency may keep potentials entities away from bidding in future possible auctions, if there is one.

FFHL Business is Faltering

FFHL’s poor business performance is likely another reason why investors are not bidding for FFHL shares.

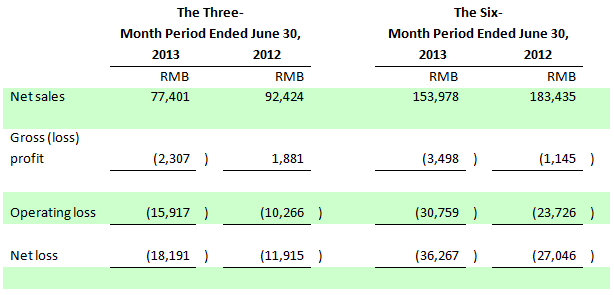

On August 23, 2013, two business days before the scheduled auction in the PRC, FFHL released its financials as of June 30, 2013. Revenue decreased from RMB 92.4 million to RMB 77.4 million and the net loss increased from RMB 11.9 million to RMB 18.19 million.

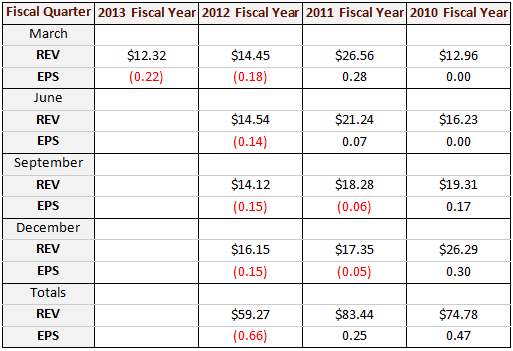

The trend of consistent losses has been recurrent for several quarters after a brief period of profitability in 2010 and 2011.

FFHL did not provide revenue and/or net income guidance for its business. However, FFHL’s main source of revenue, the BOPET film business, has been very sluggish in China over the past two and half years.

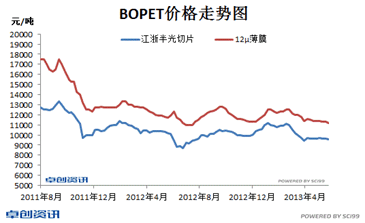

BOPET Price Trend Chart, August 2011 To June 2013

As of July and August 2013, BOPET prices were still very low and are predicted to remain at depressed levels.

Therefore, without an improvement in the prospects for the BOPET market, we believe that FFHL will continue to experience big losses. Considering these trends, when combined with everything else we have discussed, it is hard to believe that investors/entities will seriously bid for 52.9% of FFHL shares, especially at a price anywhere close to $5.16 per share.

Conclusion

It appears that FFHL’s management team successfully pumped its stock price from $1.00 to $4.00 per share for a brief moment, fueled by the August 14, 2013 auction disclosure press release in the U.S, even though the auction announcement was made around one week prior to this date in China.

Furthermore, the facts have led us to conclude that FFHL intentionally concealed the court’s involvement in the auction. Because of this possibly masked information, we believe there is an under-handed reason why management took this course of non-disclosure, and investors will see that too much risk is involved in bidding for or holding onto FFHL’s shares, especially given the company’s past legal problems in China and the U.S.

Additionally, FFHL’s business is in the red and may continue to lose money going forward. This adds to our belief that no entities will have an interest to bid on The Shares.