A case study on how to use GeoInvesting to perform your own research

We like to think that our research doubles as a learning tool to help you grow as an investor. Maybe you already have your own set of criteria, and what we do resonates with you and serves as a complimentary platform to galvanize what you already may have found on a stock. In the base scenario, our research helps you look under the hood of stocks in our universe, and maybe yours, regardless of its inclusion in or exclusion from any one of our Model Portfolios.

We’d really like to stress that we are first and foremost a stock idea generation platform. We don’t think it’s often that you will come across a bunch of dedicated individuals who wholeheartedly believe that doling out stock picks for rote consumption is not a great business model. That is what we want you to see, that while we DO have our standard portfolios, an omission of a stock from these lists does not necessarily mean that it doesn’t deserve some serious due diligence.

There are many stocks that fit into the buckets we stress on a continual basis. We look for growth stories, high probability turnarounds, catalysts on the horizon, great management teams, consistency, but always make sure to temper enthusiasm with caveats. This is where we don’t want people to get confused. There is no perfect story, and using a critical approach is part of the research process.

There are multiple instances where a company’s story did not fully align with our criteria for an immediate investment. Having said that, skepticism and overanalysis can admittedly be a crutch.

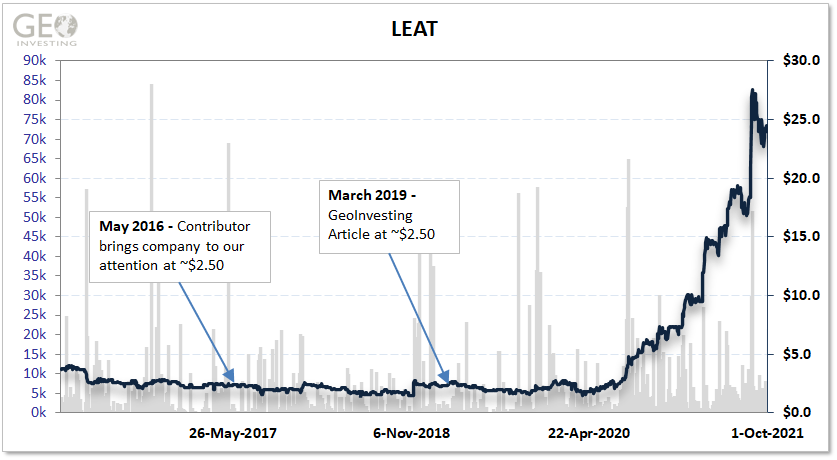

LEAT

Leatt Corporation (OTC:LEAT) is one example that stands out. The company designs, develops, markets, and distributes personal protective equipment for participants of motor sports and leisure activities worldwide.

The stock was about $2.50 when the company was brought to our attention by a GeoInvesting contributor in May of 2016. We didn’t add it to any of our model portfolios.

Even though we didn’t initially think LEAT was timely in March of 2019 when the stock was still trading in the mid $2 range, and before the stock’s run to its current level of about $24 per share, we wrote an RFT on it. That article went into some of the turnaround inflection points that we thought were just on the horizon. Unfortunately, even given our bullish reasons to track the company, we still never included the stock in our Select Longs Disclosures Model Portfolio.

Did we learn a lesson from that? Sure. Don’t diminish a company’s potential and ability to evolve.

LEAT was broadening its portfolio, creating new revenue channels, was an established brand and basically diversifying its whole product offering so it would not be dependent upon its flagship product, neck braces, that had initially put the company on the map.

Aside from sales of LEAT’s main product suffering from extreme seasonality, margins were coming under pressure. That particular market segment was getting mature and even though the company was selling more units, the price per unit was declining. Therefore, the company had to figure out how to take an existing customer base and sell more products to them. To satisfy this need, the company decided to broaden the depth of its accessory product offerings.

Diversifying helped to mitigate and eventually offset some of the lack of growth in the neck brace line, and the company has grown earnings and sales at an incredible rate since then. And then obviously, COVID-19 helped the company when people started to cope with the pandemic through leisure activities and sports.

Read on to learn about another case study that draws upon past research on GeoInvesting.com.

GeoInvesting Weekly Premium Email and Call To Action Updates (Oct 27 – Sept 1)

Weekly Wrap Up Summary…

Log in below with your Premium Account to continue reading.