FAB Universal Failure to Disclose 100 Million RMB Debt Adds to Problems

Questions regarding the motives of the FAB Universal (FU) management team and the transparency of its Chinese operations first surfaced in back to back Seeking Alpha articles published on September 26 and October 1 discussing massive dilution headwinds on the horizon. The dilutive events that could ultimately result in 37.9 million shares hitting the market arose from the back door RTO transaction that FAB’s Chinese subsidiary used to go public in April 2012.

Next, after an over two year hiatus since Alfred Little (A*L) published his last report leading to the delisting of a ChineseHybrid, SinoTech Energy, A*L broke his silence. On Thursday November 14, 2013, A*L put out a scathing report concluding that FAB Universal is a fraud. A*L’s report went beyond capital structure issues and addressed FU’s operations through intensive on-the-ground research. He found FAB guilty of rampant piracy, back-end deals with franchisees that guarantee returns, and of inflating its kiosk count by as much as 10 times. A*L’s findings put into question 90% of FAB’s kiosk revenues of $26 million reported for the first nine months of 2013 (see page 28 of the Q3 10-Q). We had opened up an investigation into FU’s operations several months ago and our initial attempt (or should we say inability) to locate FAB kiosks in Beijing leads us to believe A*L’s claim that FAB has grossly exaggerated its kiosk count.

New Evidence of Deception Brought to GeoInvesting’s Attention

On Friday, November 15, 2013, a Seeking Alpha contributor, “Unemon1” alerted GeoInvesting to an undisclosed RMB 100 million ($16.4 million) Chinese bond issuance by FAB. The implications of this development are significant, especially when one considers that FAB operates through Variable Interest Entities (VIEs) wherein U.S. investors have been found historically to have questionable legal claims to assets and cash flows.

Verification of FAB’s undisclosed bond issuances is confirmed by three independent and authentic sources:

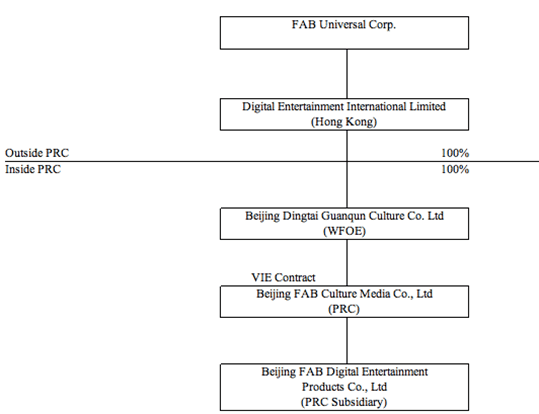

In April 2013, FAB issued RMB 100 million ($16.4 million) of bonds to Chinese investors through one of its VIE subsidiaries, Beijing Fab Digital Entertainment Products Co., Ltd. (“FAB Digital”), and failed to disclose this debt in its U.S. filings. Page 37 of FAB’s 2012 10-K clearly shows that FAB Digital is a subsidiary of FAB. (FAB’s corporate structure diagram is presented later in this report). This bond issuance should have been reflected in both FAB’s second and third quarter 2013 10Q filings, but it was not.

For now let’s take a look at how easy it is to prove FAB’s bond offering.

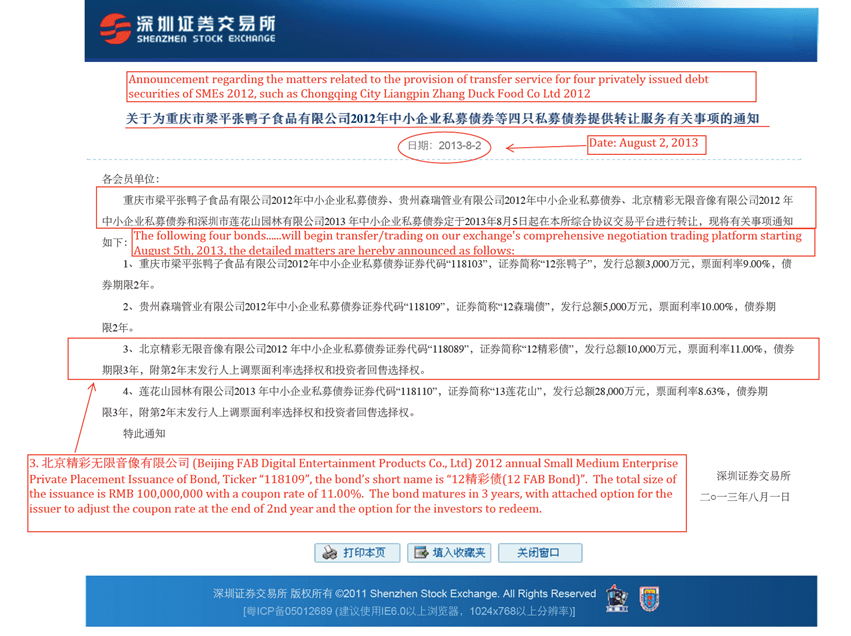

- A public announcement regarding the bond offering was posted on August 2, 2013 on the official website of the Shenzhen Stock Exchange.

- Wind Info, China’s leading financial data provider (the Chinese Bloomberg), disclosed information about the bond offering.

- An asset management report shows that a mutual fund sponsored by China’s Daton Securities owns 20,000,000 RMB of the FU bonds.

Independent Verification Number One

A public announcement posted on August 2, 2013 on the official website of the Shenzhen Stock Exchange clearly stated that 100 million RMB in bonds (collectively, the “12 FAB Bond”) had already been issued by FAB Digital (åŒ—äº¬ç²¾å½©æ— é™éŸ³åƒæœ‰é™å…¬å¸). The announcement was dated August 1, 2013 (The 12 FAB Bonds were issued on April 25, 2013).

As shown in the screenshot below, the Shenzhen Stock Exchange announced under item 3 that:

“…

3. Beijing FAB Digital Entertainment Products Co., Ltd 2012 annual Small Medium Enterprise Private Placement Issuance of Bond, Ticker “118109”, the bond’s short name is “ 精彩债(12 FAB Bond).” The total size of the issuance is RMB 100,000,000 with a coupon rate of 11.00%. The bond matures in 3 years, with attached option for the issuer to adjust the coupon rate at the end of 2nd year and the option for the investors to redeem.

…”

Independent Verification Number Two

Wind Info, China’s leading financial data provider (the Chinese Bloomberg), displays the following information regarding the 12 FAB Bond:

Independent Verification Number Three

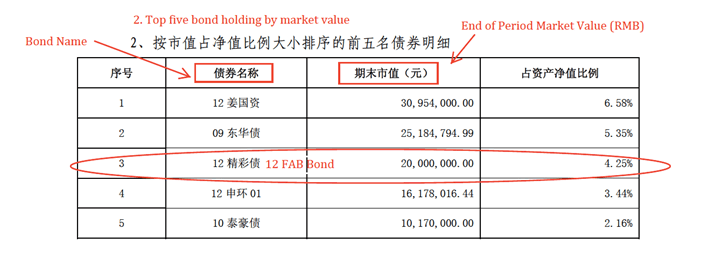

A mutual fund sponsored by China’s Daton Securities named “Daton Three Stone No. 2 Aggregate Asset Management Plan” reported holding 20,000,000 RMB of the 12 FAB Bond, according to its 2013 2nd Quarter Asset Management Report dated July 20, 2013, as shown below:

FAB completely failed to disclose this debt in its financials filed with the SEC.

Below is a screenshot of FAB’s consolidated balance sheet taken directly from FAB’s Q3 10-Q filed on November 14, 2013:

A simple review of each of FAB’s liabilities shows no sign of the $16.4 million FAB Digital debt.

By failing to disclose this debt, FAB violated many SEC rules including:

- Section 17(a) of the Securities Act for making untrue statements of material fact and engaging in engaging in transactions that deceived purchasers of FAB common stock.

- Section 13(a) and 10(b) of the Exchange Act for filing inaccurate quarterly reports and failing to disclose indebtedness.

- Section 13(b) of the Exchange Act for failure to keep accurate books and records.

- Section 13(b)(5) and Rule 13b2-2 of the Exchange Act for knowingly falsifying books and records and making materially false and misleading statements.

- SOX Section 302 for principal officers falsely certifying the integrity of financial reports.

- SOX Section 906 for falsely certifying that financial reports were accurate and reflected the true financial condition of the issuer.

FAB’s SEC Filings Confirm that Fab Digital Entertainment Products Co., Ltd. is indeed the FAB Digital that issued the 12 FAB Bonds

As shown in the following organizational chart copied from FAB’s 2012 10-K, FAB conducts its operation in China through a series of contracts (VIE agreements) that allowed them to consolidate the operations of its two main Variable Interest Entities (VIEs), Beijing FAB Culture Media Co., Ltd (“FAB Media”) and its wholly owned subsidiary, Beijing FAB Digital Entertainment Products Co., Ltd. (“FAB Digital”).

According to page 49 of the 2012 10-K shown below, FAB Digital was incorporated in September 2003 with registered capital of 1 million RMB.

“…

…”

FAB disclosed in its Definitive Proxy Statement filed on 6/15/12 (link here and excerpted below), that the legal representative of FAB Digital is Mr. Jiliang Ma, who is also a 40% owner of FAB Media. Mr. Ma was also the authorized signing representative of FAB Digital on FAB Universal’s various publicly disclosed VIE agreements that enabled FAB’s consolidation of FAB Media and FAB Digital.

“…

…”

The Chinese name of FAB Digital is https://geoinvesting.com/wp-content/uploads/2013/11/10-fab-digital.pngåŒ—äº¬ç²¾å½©æ— é™éŸ³åƒæœ‰é™å…¬å¸ , which we confirmed using the Beijing Enterprise Credit Website operated by Beijing Government’s State Administration of Industry and Commerce (“SAIC”)(link here and here). As shown in the screenshots below, FAB Digital <image src=”https://geoinvesting.com/wp-content/uploads/2013/11/10-fab-digital.png” > åŒ—äº¬ç²¾å½©æ— é™éŸ³åƒæœ‰é™å…¬å¸ was founded on September 3, 2003 with 1 million RMB registered capital and with Jiliang Ma serving as its legal representative. FAB Digital’s business scope of “distribution and rental of audio, visual and other media products” described in SAIC records matches FAB Digital’s business description in FAB’s 10-K.

Conclusion

In contrast to A*L’s allegations, FAB’s very obvious failure to disclose $16.4 million in debt should take very little time for securities regulators and FAB’s auditor (Friedman LLP) to confirm. In fact, this should take Friedman, CEO Chris Spencer, CFO John Busshaus, the NYSE, SEC, or even Jim Rodgers all of 20 minutes or at most one day, being generous, to confirm this.

FAB indicated on Friday November 15, 2013 that they would respond to the A*L report in short order. At this point FAB’s U.S. management should proactively halt their own stock to protect investors and commence an independent investigation to carefully check these very serious allegations.

Disclosure: Short FU