We are following a real estate developer that mainly focuses on residential properties. They are paying a dividend and continue to buy back stock.

The company went public and started trading on the NYSE in December of 2007 and caught our attention after a GeoInvesting contributor published a bullish article on another company in the same geographic region in which he posed the likelihood of shares hitting $10 with its own stock buyback program. That stock has since eclipsed this target after we initiated a position on August 26, 2016 at a price of $8.00. We then followed up with our own on-the-ground due diligence.

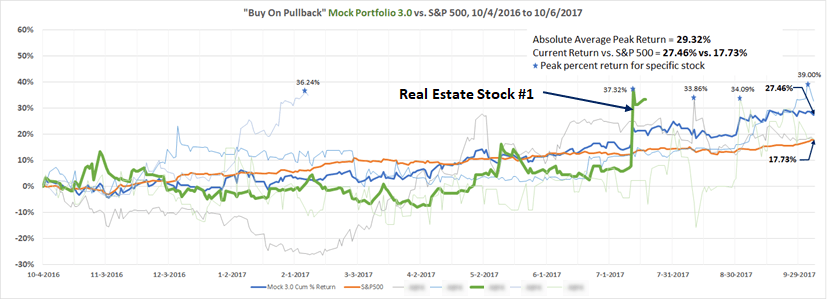

We agreed with the author’s belief that the near-term upside was $10 and possibly $20+ per share in the longer term, based on appraisals of the company’s land that we reviewed and highlighted in our November 1, 2016 research article. The stock now trades near 52 week highs and it remains as a core long. We did close out the stock from our Buy on Pullback Mock Portfolio 3.0 on July 18, 2017 with shares up 31% after being added to the portfolio on October 4, 2016.

Coverage on Second Company Commences

The newly researched company is under-covered and we are currently considering it as an investment opportunity. It may be an interesting idea for value investors who are willing to accept the risk of there being no sell-side analysts covering the stock, as well as the geographic region where it operates.

Right now, the company is trading below $6 per share, with a book value per share at about $14 as of June 30, 2017. The company resides at a 58% discount to its book value. In other words, if it was trading at its current book value, its price would need to appreciate about 140% from current levels. We believe at today’s price, there is a high degree of safety for the investment and the near or mid-term potential return could be very high.

Paying A Dividend For Years

In the meantime, the company has been paying decent dividends to shareholders, similar to how the first company has also paid a dividend. It started paying out cash dividends to shareholders in 2011, and as shown in the table below. The annual dividend has tripled from $0.10 per ADS in 2011 to $0.30 per ADS in 2016.

Currently, the company is paying a quarterly dividend of $0.10 per ADS, making its run rate annual dividend $0.40 per ADS, which presents a dividend yield rate of 6.9%. Companies paying out cash dividends represent a positive sign, and it also shows the management and board’s intention to be shareholder friendly. A quarterly dividend in the first company helped us gain more confidence with the company’s integrity when we were first analyzing it.

Buying Back Stock For Years

In addition, the company is repurchasing shares in the open market, another shareholder-friendly move. The table below summarizes the ADS’s repurchased by the company since 2011. In the meantime, the average price of ADS’s repurchased by the company could provide some support for investors, as they may consider the company to be undervalued at this price level/range.

Want more insight? Log in below with your Premium Account to read more on this Information Arbitrage play. Or join GeoInvesting and please become an Annual or Bi-Annual Member to continue.