We have initiated a short position in DAVIDsTEA Inc. (NASDAQ:DTEA). The company is a Canadian specialty tea and tea accessory retailer that is the largest of its kind. It competes directly with Starbucks-owned Teavana, which already has a stronghold on the U.S. market and a seemingly endless supply of resources and cash to do its business with, as its parent company is a $92 billion juggernaut that is still in the midst of aggressive expansion globally.

We have initiated a short position in DAVIDsTEA Inc. (NASDAQ:DTEA). The company is a Canadian specialty tea and tea accessory retailer that is the largest of its kind. It competes directly with Starbucks-owned Teavana, which already has a stronghold on the U.S. market and a seemingly endless supply of resources and cash to do its business with, as its parent company is a $92 billion juggernaut that is still in the midst of aggressive expansion globally.

One of the value adds for our members is that not only do we come up with ideas in-house, but we are constantly looking for longer term ideas that can generate alpha across the web and in collaboration with some of our contributors and other research firms. We have found an idea from a recent Seeking Alpha article that we believe makes for a good common sense short, and we wanted to share it with our members.

In this case, the stock has already fallen ~17% from the time this article was released, but we believe it could have up to 45% more downside.

Starbucks Corporation (NMS:SBUX) also owns Tazo Tea Company, which is the other type of tea offered at its retail locations. Starbucks bought Tazo in the 90’s and since then, it has become the primary brand of tea sold in Starbucks retail stores. These two brands make up the majority of the competitive landscape in the U.S. for David’s Tea. Starbucks has 23,132 retail locations worldwide and Teavana has over 355.

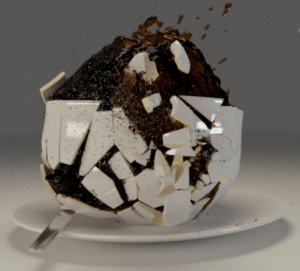

We find DTEA trying to compete with Starbucks about as fruitless as Overstock and Wayfair trying to compete with Amazon — it just doesn’t make sense.

Why GeoInvesting is Short DAVIDsTEA

Our elevator pitch on why we’re short is relatively simple:

- DavidsTEA has set extremely lofty expectations for itself and the first instance of the market getting a look at the company’s numbers led to an immediate 25% haircut from the company’s IPO price.

- The core of its stores, in Canada, have just started posting declines in same store traffic, leading some analysts to believe the move to the U.S. is a “rush for growth”

- The CEO of the company appears to have a peculiar past that includes numerous scandals and bankruptcies

- The CEO has failed in previous attempts to expand businesses into the U.S.

When we look at the company’s current valuation, combined with the “common sense” arguments made above, we continue to think there’s far more risk to the downside. The company trades at about 18X estimates, indicative of a company with a long runway of growth, which we do not believe DTEA has in front of it.

Analyst estimates are for $0.64 next year, revised down from the $0.65 to $0.69 range they were in for the last two to three months.

The main caveat is that the company doesn’t seem to be leveraged at all. With the balance sheet clean, there is nothing preventing the company from raising cash through debt in order to fund its expansion, buy back shares, or to allocate elsewhere.

For more information, you can reference this in-depth Seeking Alpha article, which is what originally piqued our interest in the company.