Investing in COVID-19 themed stocks is about to get tricky as the economy continues to reopen and vaccines possibly gain approval in Q4 2020. Recall that on March 19, 2020, I published a video, “I Saw Red“, talking about how to view investing through the lenses of COVID-19. The challenges we face when doing this is trying to figure out which companies may:

- Experience an acceleration in the short run growth;

- Experience an acceleration in long term growth;

- Have been unfairly punished.

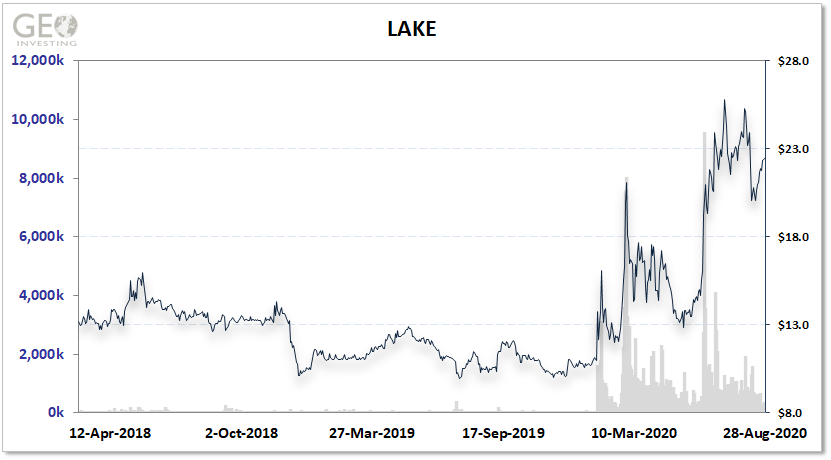

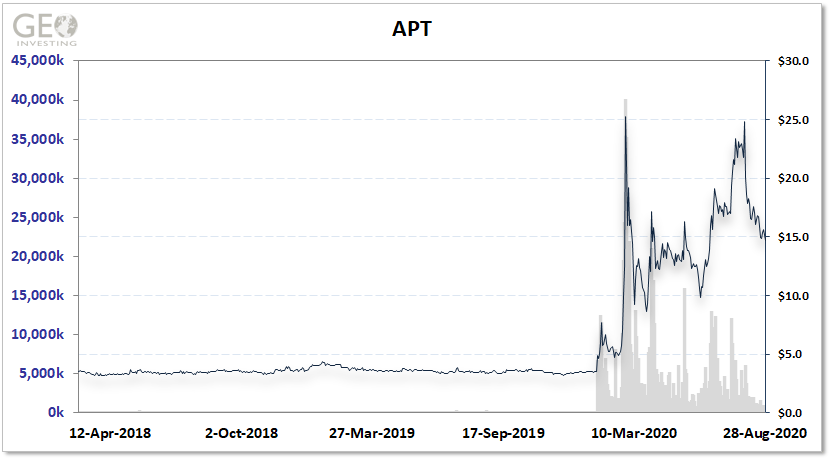

For example, companies like Lakeland Industries, Inc. (NASDAQ:LAKE) and Alpha Pro Tech, Ltd. (NYSE:APT) have seen their shares rise sharply since the onset of the pandemic.

Lakeland is:

“a leading global manufacturer of protective clothing for industry, healthcare and to first responders on the federal, state and local levels.”

Alpha Pro Tech is:

“a leading manufacturer of products designed to protect people, products and environments, including disposable protective apparel (N-95 Particulate Respirator face mask and face shields) and building products.”

Both companies have experienced a dramatic near-term improvement in their sales and earnings. Interestingly, we have followed both companies for several years, including failed attempts by management to consistently grow sales and profits.

The questions we need to ask when looking at LAKE and APT are:

- What is going to happen to sales and profits when COVID-19 eventually passes?

- Will their Personal Protective Equipment (PPE) solutions have long term staying power?

- Do other growth drivers exist outside COVID-19 driven demand?

From our point of view, we think it’s logical to assume that while some level of PPE demand will stick around, demand will eventually fall from peak levels, especially at the consumer level. However, the duration of this predominance or demand and how much of a falloff is not easy to predict. We are clearly living in a new environment. Per its Q3 report, we commend LAKE’s management for providing color on this risk:

“The COVID-19 pandemic is unique among “black swan” events in terms of its breadth, global reach, and its duration, at a minimum 6 to 9 months but probably longer when considering global stockpiling of PPE for future events. As a result, the business risks upon exit from the pandemic are also different. While manufacturing overrun and excess customer inventory remain a threat to our future sales, it may be mitigated by stockpiling that cannot begin until supply exceeds the immediate demand. We believe that we are only now reaching that point, as we are seeing attempts to begin stockpiling. The scope of this event will extend stockpiling efforts as the U.S., European Countries, China, and India will all likely seek to lay in stockpiles over time. Some will even attempt to build stockpiles prior to any potential “second wave” of COVID-19. Should we encounter a significant second wave of COVID-19, we may be thrust into a renewed heightened demand cycle. In either event, we believe that the recovery from the pandemic in terms of demand for PPE will be prolonged, extending into our fiscal 2021 fourth quarter, and that demand will be of sufficient quantity to offset any headwinds that the possibility of any lockdowns, supply chain issues or in factory COVID-19 outbreaks, or any potential recession, may generate.

Despite the chance that COVID-19 might benefit LAKE for another year or so, part of the growth will unwind and the market is going to figure this out. So, that is why we believe it’s necessary to place importance on bullet point three from above when researching for companies that benefit from COVID-19 growth drivers:

“What other growth drivers exist outside COVID-19 driven demand?”

Interestingly, even though LAKE’s COVID-19 revenue is boosting overall revenue growth, the company is also experiencing growth outside the pandemic. For example, fiscal 2021 Q1 revenue grew 84.7% to $45.6 million, but only $11.2 million was due to COVID-19 and $34.4 million was due to other revenue. So, excluding COVID-19 related business, revenue still grew about 40%.

Maybe this is a sign that management has finally and successfully addressed some of LAKE’s past growth challenges.

On the flip side, when you look at APT, almost all of its growth in Q2 was generated from PPE.

We are not conveying any investment opinion on LAKE or APT, but just wanted to highlight how you might want to view PPE companies as you break them down.

Basically, we are trying to figure out what type of habits will stick around (unified communication) and which ones will fade back to normality (PPE) That is why when it comes to COVID-19, we are more interested in looking at companies that will experience an acceleration in long term growth due the long-lasting implications of the pandemic, are not impacted by COVID-19, or stocks that have fallen due to what we believe are temporary negative business impacts from COVID-19. I briefly touched on this in the “I Saw Red” Video.

For example, we own shares of home healthcare product or service providers that should experience an acceleration in their already positive growth trends. Beaten down restaurant stocks with modern management teams who prepared for mobile ordering should see business bounce back and benefit from our world’s new normal. Another company we own that offers trucking accessory/technology solutions should benefit from increased on-line ordering trends. It may also be time to start looking at medical device companies that have become temporarily punished due to a reduction in elective surgeries. Three companies in these respective categories were all added to our Buy On Pullback Model Portfolio #8 on May 18, 2020 and have performed well for premium members.

In order to help you with your research, investment decisions and educational journey, we are in the process of creating a table to help categorize some of the companies in our coverage universe and where they stand in terms of COVID-19. We hope you will find this helpful as you assess Geoinvesting stocks that you may already own or want to own in your portfolios.

Sincerely,

Maj Soueidan, Co-founder GeoInvesting

GeoInvesting Weekly Premium Email and Call To Action Updates (Aug 24 – Aug 28)

Weekly Wrap Up Summary…

Log in below with your Premium Account to continue reading.