GeoInvesting has become aware of a piece on Amtrust (NASDAQ:AFSI) written by Roddy Boyd for the Southern Investigative Reporting Foundation, published on August 17, 2014. The piece is going to be sourced throughout this write-up and can be viewed in its entirety here. GeoInvesting recommends that all parties involved with AmTrust read the full article, as its consequences not only serve to point out questionable activity, but also could have a material effect on AmTrust stock.

Summary

- The Karfunkel brothers, board members and majority shareholders of Amtrust (AFSI) stock, used their foundations to place high-risk bets on financial institutions in 2008 that ultimately resulted in significant losses.

- Michael Karfunkel has been using a GRAT (a form of a trust) in violation of both SEC and IRS rules.

- Stock donated to the brothers’ foundations was valued higher than it should have been, presumably for a larger tax write off.

- In order to comply with IRS rules, 16% of AmTrust outstanding shares appear to need to be either donated to an “unaffiliated charity” or outright sold.

In his column, Mr. Boyd takes an in-depth look into how the Karfunkel brothers have seemingly been conducting family business.

His article starts by pointing out that the Karfunkel brothers have used their foundations (the “Hod” and “Chesed” foundations) to stake high risk gambles and appease their unusually large tolerance for risk, with transactions including selling puts on both Fannie May and Citigroup (NYSE:C) in 2008. The brothers also took on similar bets with American International Group (NYSE:AIG) and Lehman Brothers (OTC:LEHLQ) the very week before the institutions collapsed.

Boyd’s article notes:

Contrary to the Karfunkel’s assertions below, losses from their option trading adventures – in combination with the collapse in the equity markets – had a disastrous effect on the fair market value of the foundation’s portfolios, with declines of 64 percent for Hod and 43 percent for Chesed.

Questions about the brothers’ foundations extending loans

The article raises questions about the brothers’ foundations extending loans. While loans are allowed to be received, the article notes that they are prohibited from making loans or extending credit, “especially to what the IRS refers to as ‘disqualified persons’, a term meaning the founders, their spouses and immediate family members, as well as substantial donors to the fund.”

The article then argues that a GRAT set up by Michael Karfunkel was “gifted 320,000” AmTrust shares by its grantor. A GRAT executes an annuity to the grantor before then distributing the rest of the assets to beneficiaries. The point of a GRAT, simply put, is that the underlying assets will hopefully appreciate more than the interest required to be paid to the IRS. The filing for the transaction, the article notes, was done four months late. Contributing additional shares to a GRAT after its initial contract is forbidden to begin with, the article notes.

Boyd’s article cites the founder of the GRAT, Richard B. Covey, who states that there’s basically no reason to alter the GRAT contract in place from the initial annuity inner workings. Covey also couldn’t understand any way in which a GRAT could make a donation.

In addition, the article goes on to question whether or not the Karfunkel brothers were inflating the price of the stock donated to their foundations to begin with. This would benefit the donor, who gets to write off the amount.

The article goes on to note:

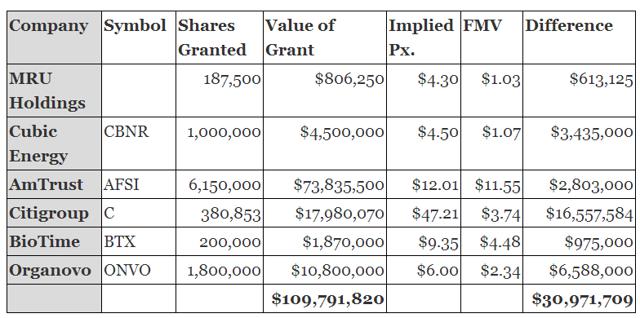

Of the nearly $110 million in shares Chesed received from George Karfunkel, SIRF estimates that almost $31 million of this came from valuations above the then market prices.

For his part, Michael Karfunkel’s donation on Dec. 31, 2009 of Fannie Mae, Maiden Holdings and AmTrust stock that he valued at $60,974,615 to Hod appear to have been $8.65 million overvalued.

The article argues that the accounting policy governing fair market value of stock donations appears to have been simply ignored. Take, for instance, this 2005 donation of MRU Holdings:

Consider the November 1, 2005 donation of 187,500 shares of MRU Holdings to Chesed. Valued at $806,250 in the annual filing, this implies a price of $4.30 a share. The closing price on that date, however, was $1.03, making Chesed’s valuation – and his deduction – over $613,000 greater than if he had donated it at market price.

Additionally, the article notes:

On Jul. 1, 2009 George Karfunkel gave Chesed one million shares of Plano, Texas-based energy concern Cubic Energy and 6.15 million shares of AmTrust, worth, the filing asserted, $78.33 million. Chesed’s claimed value was well above the market value of the securities. According to Yahoo! Finance, the average of the high and low prices for Cubic and AmTrust on Jul. 1, 2009 were, respectively, $1.07 and $11.55 versus Chesed’s implied values of $4.50 and $12 per share.

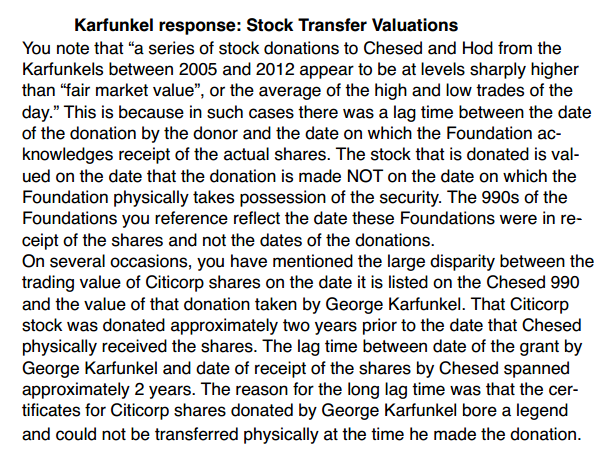

On Jul. 1, 2010, Chesed received 380,853 shares of Citigroup from Karfunkel that it claimed were worth $17.98 million, or $47.21 per share. Citigroup’s average share price on the date the donation was recorded was $3.74, making the value of the entire block of stock just over $1.42 million, a difference of $16.55 million

Here’s the full list of donations and corresponding prices that Boyd identified:

The Karfunkel’s response, found here, was as follows:

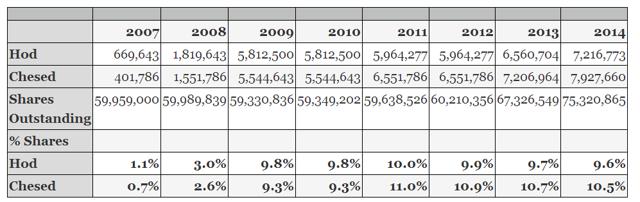

Boyd goes on to write that the brothers’ foundations both currently hold a substantial amount of AmTrust stock; Hod and Chesed, respectively, hold 9.6 percent and 10.5 percent of the shares outstanding.

The article lays out a timeline in which the brothers’ foundations began to stockpile AmTrust stock:

The article concludes that due to IRS rules surrounding the amount of stock that private foundations can own, that “about 6.4 million shares [of AmTrust] for Chesed and 5.7 million shares [of AmTrust] for Hod” need to be sold or donated away.

GeoInvesting’s Take

If Mr. Boyd’s article holds water, there could be serious reason for concern for holders of AmTrust common stock.

According to Yahoo Finance, there’s currently 75.62 million shares outstanding. Accordingly, the foundations’ holdings represent about 16% of the outstanding shares that could potentially need to be liquidated, which would no doubt cause a serious move in AmTrust stock when it’s brought to market.

According to the article, these shares cannot be sold back to the Karfunkel family; they can only be sold on the open market or offloaded to an unaffiliated public charity.

Our involvement in this case stems back to our original report on AmTrust entitled “AmTrust Financial: A House of Cards?” that we released on December 12, 2013.

Disclosure: Short AFSI Stock, Long AFSI puts

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.