Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

If you are a premium member make sure you sign in to see All the exclusive content In This Issue.

Highlights

|

This week, we’re really excited to bring you another multibagger case study by GeoInvesting Contributor Thomas Birnie where he talks about how a favorable setup enabled Mercadolibre, Inc. (NASDAQ:MELI) to achieve returns of 700% in just a few years, and how another company is exhibiting parallels that warrant a seriously closer look with respect to its own multi-bagger potential. We’ll visit that a little later. Thomas’ first multibagger case study was on Netflix, Inc. (NASDAQ:NFLX)’s 6000% return.

Buy on Pullback Portfolio #12 Update

Before we get to that, In case you haven’t been keeping close tabs on the S&P 500 index continues to set new records, reflecting a surge in market confidence. On Friday, the index closed at 5,969.34, rising 0.3% on the day and posting a 1.7% gain for the week as markets geared up for the Thanksgiving holiday. This milestone follows another historic achievement earlier this month when, on November 11, the S&P 500 crossed the 6,000-point threshold for the first time, closing at 6,001.35. The market’s upward trajectory in recent weeks has been fueled by strong economic signals and investor optimism in the wake of the Presidential election.

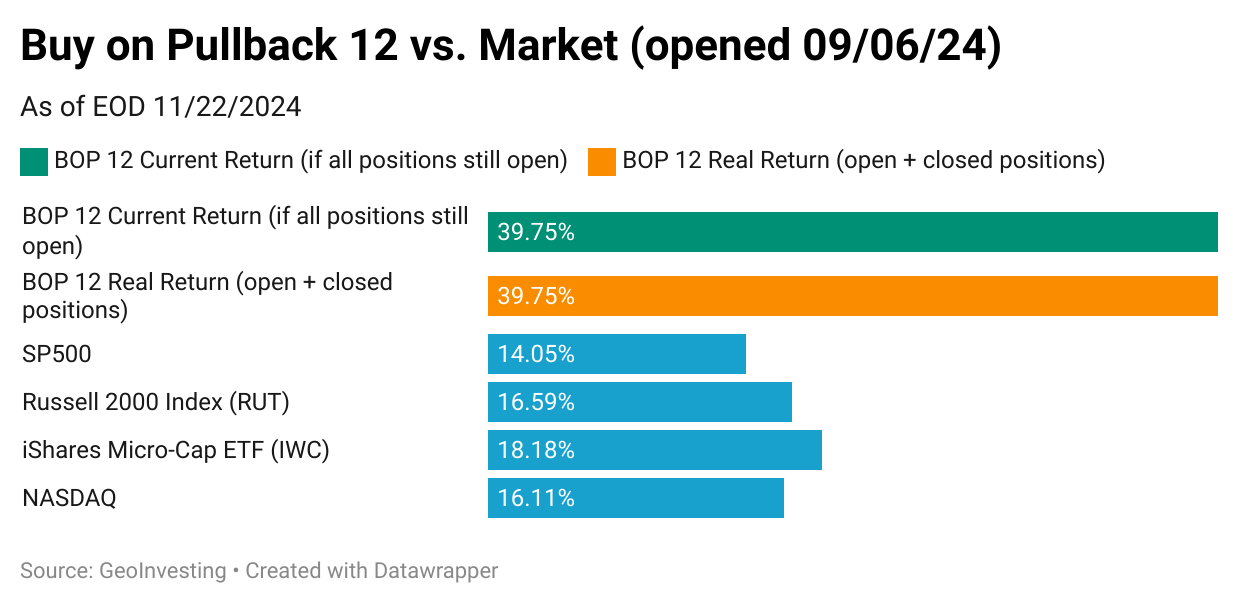

As well as the S&P has been performing, it’s worth bringing up that by comparison, it still lags the 39.75% return of our 8-stock Buy on Pullback Model Portfolio #12 by a margin of 25.7%, as some portfolio standouts have been performing well, well before we thought they would.

As a matter of fact, its nearly 3-month return is already knocking on the doorstep of BOP #11’s return of 45.05%, achieved over the course of 12 months.

The highest performing stock, Power Solutions International, (OOTC:PSIX), is up 178.72% (helped buy a new data center product). Also helping the portfolio’s performance over the past two weeks has been the 46.94% rise of medical device player, Sensus Healthcare, Inc. (NASDAQ:SRTS), which is finally benefiting from management’s emphasis on implementing a recurring revenue model, which happens to be one of our eight key multi-bagger traits that we look for when filtering for the best stocks in the microcap universe.

|

About GeoInvesting Buy on Pullback Model Portfolios The Buy on Pullback (BOP) Model Portfolios are a cornerstone of GeoInvesting’s investment strategies. These portfolios focus on identifying high-quality stocks that have experienced temporary pullbacks in their share price, creating opportunities for long-term growth. Each portfolio is carefully curated to balance risk and reward, leveraging GeoInvesting’s deep research and management interviews to uncover stocks with strong fundamentals and growth potential. With a proven track record, 9 out of 11 BOP portfolios have outperformed the market, offering returns ranging from 50-100% in some cases. The BOP strategy prioritizes actionable stock ideas that are both timely and supported by detailed research, making it a valuable resource for growth-oriented investors. |

Final Thoughts on TSSI Q3 2024 Results

Sharing the stage with BOP #12 was the anticipation of Tss, Inc. (NASDAQ:TSSI)’s Q3 2024 earnings release. You can revisit some of our major takeaways at the pro portal on where we think TSSI’s story is ultimately going to land. This includes some post-earnings commentary as well as a conversational PodClip positing some further reflections and possibilities.

- How the third quarter earnings call,10Q filing disclosures, Mark Gomes’ most recent video on TSSI, as well as a post-earnings interview Breakout Investors had with the CFO gives us clues into base case EPS potential at full capacity.

- Upside and downside risks to consider.

- Regardless of market disappointment in Q3, TSSI has come a long way.

Pros and Cons Takeaways from TSSI Q3 Results

Pros:

- Significant Revenue Growth: Sales increased to $70.1 million compared to $8.8 million in the prior year.

- Strong Reseller Revenue: Jumped to $60.5 million, showcasing robust growth in the procurement business.

To access The Remainder of our Final Thoughts on TSSI, Thomas Birnie’s Multibagger Case Study, and expanded coverage on Our 1500+ Microcap Universe, Subscribe below.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ multibaggers and counting

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)