Contributed by FG Alpha Management for GeoInvesting, LLC

Contributed by FG Alpha Management for GeoInvesting, LLC

We have uncovered an instance of meaningful information arbitrage, where Kandi Technologies Group Inc. (NMS:KNDI) — a U.S. listed Chinese vehicle manufacturer — could be in serious jeopardy due to a brand new government ordered production and sales suspension of almost all EV models that the company produces.

This production and sales suspension comes just months after GeoInvesting broke to the market a Chinese media report indicating that Kandi may be linked to subsidy fraud by the Chinese government.

Summary

- Chinese government suspends production of almost all of Kandi’s EV vehicles with production halts starting immediately and sales halts starting this summer

- This follows a government inquiry into potential subsidy abuse into the company that suffocated KNDI revenue throughout 2016

- With suspended production and sales of almost all of Kandi’s EV’s and lacking a strong balance sheet, the company could be in for a catastrophic 2017

On January 23, 2017, the Ministry of Industry and Information Technology of the People’s Republic of China (MIIT) released the following announcement:

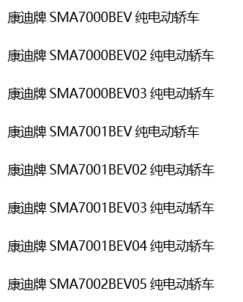

Included in the attachment that was provided alongside of this announcement (named 附件:é“路机动车辆生产ä¼ä¸šåŠäº§å“(第292批)), the MIIT provided on page 129 a list of products that do not comply with the rules of the Chinese government announcement. The attachment goes on to say [paraphrased] that sales of these products, which includes 8 Kandi models, should be suspended effective July 1, 2017. The document states:

![]()

Which we paraphrase as:

(2) The below-listed products do not comply with the rules of the <announcement>, [and they] should suspend production since the date of the announcement, and [these products]’s sales should be suspended since July 1, 2017.

There are numerous companies included on this list. On page 180, included in category 52, the document lists Zhejiang Geely Auto Limited Co:

There are 8 models of pure EVs that are in Kandi’s name included on the list:

After researching them, it appears that the 8 models listed are pure EVs (K10 and K11) that Kandi’s JV company manufactures and sells under the Kandi Technologies name. According to the company’s investor presentation from July 2015, page 7 shows that SMA7000BEV is Kandi’s K10 model, and SMA7001BEV is Kandi’s K11 model.

We believe the numbers after the “BEV” above indicate different models of the K10 and K11 vehicles. The last one listed, “SMA7002BEV05”, is a mid-tier luxury EV from the JV company sold under the K30 name.

On page 180 of the document, in category 53, “Zhejiang Haoqing Car Manufacture Limited Co” is listed alongside of the K17 model produced for Kandi:

![]()

Based on our research, “JL7001BEV03” is the K17 model manufactured by the JV company.

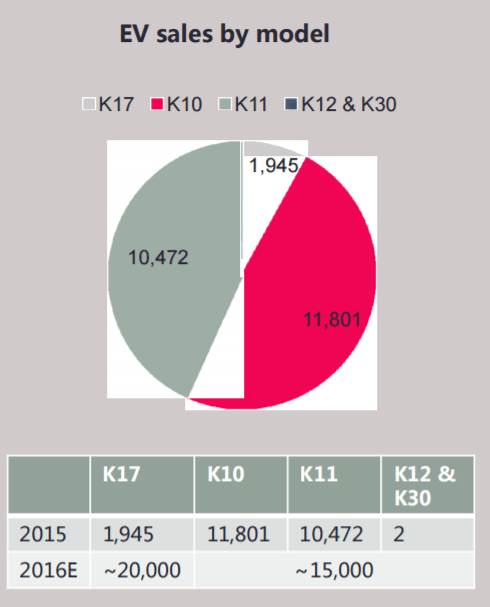

In order to examine the potential effect on KNDI’s operations that these suspensions may have, we consulted KNDI’s investor presentation from May 2016.

On page 29 of the presentation, the company breaks down EV unit sales by model. It shows that in 2015, K17 sales were 1,945, K10 sales were 11,801, and K11 sales were 10,472, essentially comprising all the EVs sold by the JV company.

The company, at the time, estimated sales of about 20,000 K17 models and 15,000 K10, K11, K12 and K30 models for 2016. We now know that EV sales made by the JV company slowed down in 2016 due to the government’s investigation into potential subsidy abuse. Heading into 2017, we believe that the JV company’s sales will be materially negatively affected by this MIIT announcement just made on January 23, 2017. The announcement requires production suspensions on numerous K10, K11, K17, and K30 models and also requires suspending sales of these models starting on July 1, 2017.

Despite these suspensions, there was one Geely branded model under the Zhejiang Haoqing Car Manufacture Limited Co name – JL7001BEV18 — that was newly approved by the government. However, we are not sure whether or not this model is even relevant to Kandi Technologies or is being produced for other purposes.

In Q3 of 2016, Kandi cited the government’s review into their potential subsidy abuse as an excuse for not producing a meaningful amount of revenue. Now, after this review, it appears as though the government is going to be suspending almost all of Kandi’s EVs produced through joint venture.

This suspension will likely substantially decrease KNDI’s revenue even further in 2017.

Based upon KNDI’s 2016 Q3 financial results, the company only has USD 18 million in cash and restricted cash, but USD 155 million in accounts receivable, including USD 114.7 million from its JV. However, the company has USD 116 million in accounts payable and owes USD 35.6 million on a short term loan.

Given this new news, it’s tough to imagine that the JV will be able to pay off the 114.7 million that it owes KNDI within any reasonable time frame. In addition, it’s hard to believe that KNDI will be able to meet its payable obligations and short term loan obligations without seeking further financing.

With most of its JV products suspended by the government and the company’s balance sheet looking shaky, the ingredients could be present for KNDI to have a catastrophic 2017.

Disclosure: Short KNDI at time of report

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com//terms-conditions-privacy-policy/

Bill Watts

Geoinvesting is WRONG again! Kandi and many other manufacturers received an extension, not a suspension. All $KNDI 2016 MIIT approved EVs were extended to July 2017 so sales can continue in Q1. The 2017 re-approval process affects all manufacturers. The first batch was announced by MIIT within 2 weeks of the 2017 re-approval announcement. Kandi’s highly successful K11 Panda was re-approved in the 2017 Directory first batch with a new designation JL7001BEV18. The remaining models are expected to be re-approved in the second batch because they were in the second batch in 2016.

In the meantime an analysis of all popular models in the China media has stated that all 2016 Kandi models are compliant with 2017 rules (which is not surprising since a draft of the rules was released to manufacturers in Q2 2016). http://www.in-en.com/article/html/energy-2259016.shtml

All of the above facts were available and verifiable prior to the date of publication of this article. Clearly no attempt was made to ascertain the reliability of the report from FG Alpha Management, a Kandi short investment fund.

Alex

All mentioned models are old ones that are not being produced any longer. All relevant new models have already been approved (K11D) or are in the process of approval (K12, K17A, K10). It is very sad that articles like this get published and get enough attention to have a major impact on the share price.

MHA

Chinese government report was released on December 20th, 2016. CEO made a huge buy on December 27th. This article clearly seems to be biased.

http://dailyquint.com/2017-01-22-kandi-technologies-group-inc-kndi-insider-purchases-293859-00-in-stock/

MHA

Why isn’t there any mention of the December 2016 report? Because it does not serve short sellers!

http://en.kandivehicle.com/NewsDetail.aspx?newsid=192