Summary

- China Mobile Games is a mobile gaming company that we believe is engaging in questionable business practices and operating in a cloud of obfuscation.

- We believe CMGE could be overstating its revenues significantly through an improperly disclosed relationship with an entity called Zhongzheng.

- The relationship between CMGE and Zhongzheng is reminiscent of NQ Mobile’s relationship with Yidatong: an undisclosed related party of the business.

- We believe the SEC should open a formal investigation probing the company’s non-disclosed entities.

- We urge the company’s auditor, Ernst & Young, to investigate and we believe the risk of these undisclosed entities is not priced into the company’s stock.

We see this as reminiscent of NQ Mobile (NYSE:NQ) and Yidatong. Yidatong was a significant NQ customer that was argued by Muddy Waters Research to be a non-disclosed related party of the company. Muddy Waters claimed that Yidatong existed for the purpose of inflating NQ’s revenues and we believe that the situation between CMGE and Zhongzheng could be much worse. We will show why we believe the former President and current COO of CMGE, Shuling Ying, also independently controls Zhongzheng.

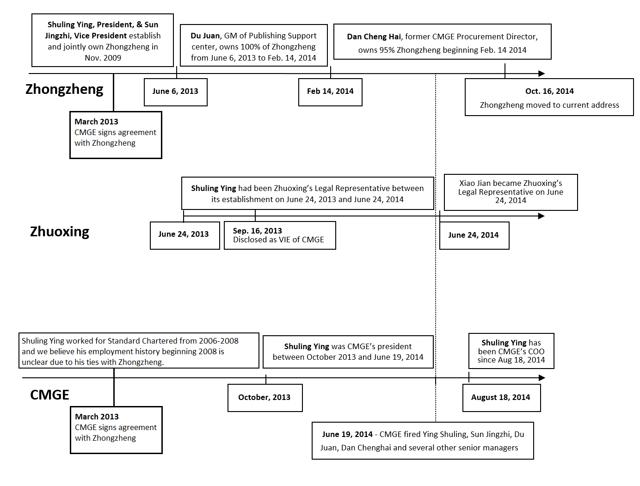

We discovered that Shuling Ying founded Zhongzheng, yet CMGE omits this fact from his resume in CMGE filings. We also discovered that right before being appointed as CMGE’s President, Shuling Ying transferred his ownership interests of Zhongzheng to an employee (Juan Du), a mid-level manager at CMGE who, in turn, transferred her ownership interests in Zhongzheng to a lower management individual (Chenghai Dan) at CMGE. Both of these employees were fired from CMGE on June 19, 2014, yet the lower management individual (Chenghai Dan) still is listed as current owner of Zhongzheng. We believe these individuals are just “straw men,” used to hide Shuling Ying’s ties to Zhongzheng.

We believe CMGE booked/books revenues from games that are actually published by Zhongzheng. CMGE lists all of its subsidiaries in its 20-F filings, yet Zhongzheng is not, and has not, been disclosed as one. This begs us to question: why is CMGE not disclosing the details surrounding its relationship with Zhongzheng? We conclude that shareholders may be getting “played” and may not have legal claims to revenues booked under Zhongzheng.

We think that meaningful revenues booked as CMGE’s could belong to Zhongzheng. Our conclusion that Zhongzheng and CMGE have an intimate relationship is strengthened by our onsite visits to Zhongzheng’s registered address, which turned out to be the location of one of CMGE’s offices.

CMGE’s Curious Background

CMGE became a publicly traded company in September 2012 via non-traditional means. Instead of offering shares to the public via a regular IPO, it listed itself on the NASDAQ “by way of introduction.” The method in which CMGE was listed is unusual, and we were unable to find significant amounts of information on it. Further, they were met with a chilly reception: the company’s high bid on its IPO day was less than 10% of the $40 price that the company was asking for.

CMGE became a US-listed public company as a provider of mobile games for feature phones. At the time, the mobile industry in China and around the world was rapidly shifting to smart phones using Android and iOS. With break-neck speed, CMGE rolled-up a bunch of smart phone game publishers and developers. In our experience, companies undergoing these types of structural business transitions rarely do so quickly and effectively. In this case, CMGE was able to successfully complete these transitions within a year, while growing revenues at an astonishing rate. In turn, the company’s stock price soared.

We’ve noticed in the past that such successful transitions like this rarely work out so quickly and so perfectly, which led us to our initial skeptical view of the company. This report will investigate CMGE’s key operating entities, recent corporate actions, and performance compared to other major mobile gaming firms.

Opening Pandora’s Box

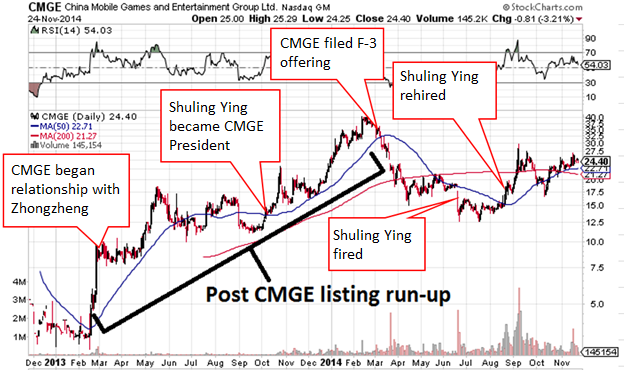

Investors know from this document that on June 19, 2014, CMGE fired 9 executives and managers including Shuling Ying, the company’s former president. After Chinese media broke this news, of which we helped break to U.S. investors, CMGE’s stock price dropped from USD $18.93 to as low as USD $12.58 on June 20, 2014. We should note that many of the U.S. reports of this event described these employees as “suspended,” whatever that means, but this Chinese media report denotes them as “fired”.

The content of the firing notice on June 19, 2014, with our translation, is as follows:

通知原文如下:

CMGEä¸å›½æ‰‹æ¸¸é›†å›¢ã€å„下属åå…¬å¸åŠåˆ†æ”¯æœºæž„:

å› å·¥ä½œå‘展需è¦ï¼Œç»æ‰§è¡Œè‘£äº‹å±€ç ”究决定:

å…去应书å²é›†å›¢æ€»è£èŒåŠ¡ï¼›[Remove Shuling Ying from the position of President]

å…去å™æ™¶èŠé›†å›¢å‰¯æ€»è£èŒåŠ¡ï¼›[Remove Jingzhi Sun from the position of Vice President]

å…去æœé‘«æ¬£é›†å›¢å‰¯æ€»è£èŒåŠ¡ï¼›[Remove Xinxin Du from the position of Vice President]

å…去闵曙ä¸æ™¨æ˜Ÿæ¸¸æˆæ€»ç»ç†èŒåŠ¡ï¼›[Remove Shuzhong Min from the position of Chenxing Game’s GM]

å…去王昆å“星游æˆæ€»ç»ç†èŒåŠ¡ï¼›[Remove Kun Wang from the position of Zhuoxing Game’s GM]

å…去æœå¨Ÿå‘行支撑ä¸å¿ƒæ€»ç»ç†èŒåŠ¡ï¼›[Remove Juan Du from the position of Publishing Support Center’s General Manager]

å…去æ¨æ–Œæµ·å¤–å‘行事业群副总ç»ç†èŒåŠ¡ï¼›[Remove Binhai Yang from the position of Oversea Publishing Group’s Vice GM]

å…去罗潇平å°æ”¯æ’‘äº‹ä¸šç¾¤ç ”å‘ä¸å¿ƒåŠ©ç†æ€»ç»ç†èŒåŠ¡ï¼›[Remove Xiaoping Luo from the position of Platform Support R&D Center’s GM Assistant]

å…去但æˆæµ·é‡‡è´æ€»ç›‘èŒåŠ¡ï¼›[Remove Chenghai Dan from the position of Procurement Director]

……

CMGEä¸å›½æ‰‹æ¸¸

2014年6月19日

Soon after the negative stock price reaction to the firing of the executives and managers, CMGE claimed that this move was a part of the streamlining process and that there would be no risk to the current business. Chinese media alleged that bribery was potentially involved with the layoffs. CMGE also established an Independent Committee to investigate this case. On August 14, 2014, CMGE announced completion of Investigation by Independent Committee and stated that “The foregoing investigation did not find any evidence that suggested CMGE or anyone at CMGE had engaged in bribery.” CMGE also announced that they would re-hire Shuling Ying as the COO as of August 18, 2014. We’ve never seen a maneuver like this and find it extremely peculiar that CMGE would so quickly re-hire someone that they had just fired. CMGE did not announce where the other eight fired executives and managers currently are. While the “independent investigation” took a look at bribery claims, it apparently failed to look deeper into the serious issues we have been led to.

The question then becomes: who are the other eight fired executives and which companies are they associated with? We were surprised to find that at least four out of these nine fired employees once were or currently are shareholders of a company called Zhongzheng, which was originally founded by Shuling Ying. When we looked into Zhongzheng, we found out that they published a significant amount of games that CMGE claims to publish.

We found that CMGE started some type of relationship with Zhongzheng in March 2013, right before the stock began to rally. Here’s the timeline of events plotted on top of CMGE’s chart.

Zhongzheng and CMGE: A Scenario Reminiscent of NQ and Yidatong

Investors should be wary of what’s transpired over the last seven years involving U.S. listed Chinese companies and situations involving variable interest entities (“VIE”). We published this report in 2011 and this report in 2010 to help investors understand VIEs and FIEs, and their role in publicly listed U.S. companies.

We found a scenario at CMGE that reminds us of the relationship between NQ Mobile and Yidatong, in that CMGE has a non-variable interest entity, non-disclosed related party that we believe has and is leading to an overbooking of revenues. When this type of relationship about NQ Mobile and Yidatong was questioned, shares began their decent from prices near $22.33 to where NQ currently trades, around $4.5, and the company’s auditor (PriceWaterhouse) resigned. Now, CMGE has some non-disclosed related party questions of their own to answer.

Part of CMGE’s revenue is generated from publishing games it licenses from developers.

We strategically license games developed by mobile game developers to complement our existing portfolio. When we license games, we generally share a proportion of the income generated by the game with game developers. (2013 20-F)

CMGE credits much of its recent growth from games it claims it published for third parties through licensing arrangements with game developers. Through our research, we found out that the several important games CMGE claims to publish through license relationships are actually published by Zhongzheng. As we’ve discussed, Zhongzheng is not disclosed as a related party in CMGE’s filings.

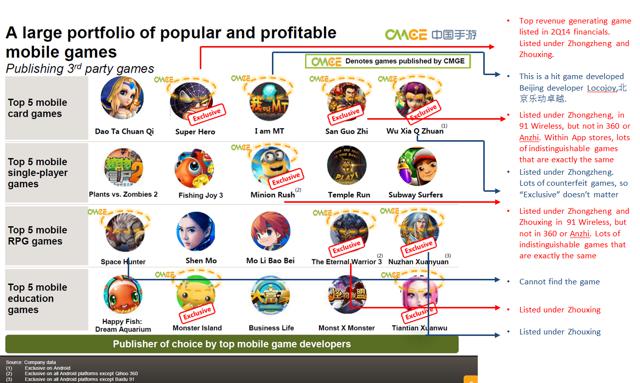

In the most recent CMGE investor presentation, CMGE lists several of its claimed top profitable games among the industry, published through licensing arrangements. We found that almost half of these games are not published by CMGE, but by Zhongzheng. During our due diligence process, we conducted channel checks via the 91 Wireless (owned by BIDU), 360 Mobile Assistant (owned by QIHU), and other additional app stores.

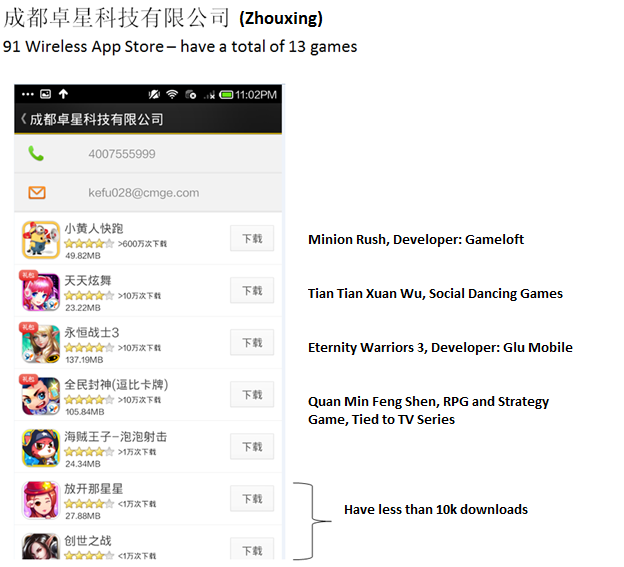

Although there are many Android app stores in China, these two are the formidable ones. They provide a reasonable proxy to the popularity of the games and subsequent revenues that should be generated. With a quick check of these app stores, one will discover that Zhongzheng and Chengdu Zhuoxing Science & Technology Co., Ltd. (“Zhuoxing”) account for a significant portion of the game titles and accompanying downloads claimed by CMGE.

The problem is that while Zhuoxing is listed as a CMGE subsidiary through VIE arrangements, allowing CMGE to realize its revenue, Zhongzheng is not listed as a subsidiary and, as a matter of fact, its name is nowhere to be found in CMGE’s 2013 20-F and was only briefly mentioned in the 2012 20-F. This means that CMGE shouldn’t be able to book revenue from Zhongzheng games, which indicates to us that CMGE could be misleading investors.

We performed searches in China in order to prove that certain games carried Zhongzheng’s name. Notice that the following illustration from a recent investor presentation is very specific in stating that the highlighted games were published through third party licensing relationships:

Figure 1: Top games as listed in recent investor presentation

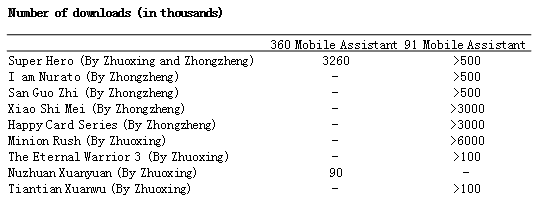

As one can see in the following table, the majority of the games highlighted in the investor presentation are published under the names “Zhongzheng” and “Zhuoxing” on the 360 Mobile Assistant and 91 Mobile Assistant app stores.

Figure 2: Number of cumulative downloads by Zhuoxing and Zhongzheng as of Sept. 2014

We performed diligence to determine which developers were tied to certain games. Since Zhuoxing is a subsidiary of CMGE, we were not surprised to see it listed as a publisher of some games. Our issues mainly lie with Zhongzheng and the company’s questionable relationship with CMGE. We have concluded that CMGE appears to have some type of relationship wherein Zhongzheng is allowing CMGE to use its top selling games in its promotional material doled out to investors – perhaps in order to promote the appearance of success.

Zhongzheng is not a well-known entity to US investors. Scanning through the past two years of SEC filings, we found that Zhongzheng has only been mentioned once, in the company’s 2012 20-F filing.

The 20-F reads:

“In addition, in March 2013 we entered into an agreement with Shenzhen Zhongzheng Ruanyin Technology Co. Ltd., pursuant to which Zhongzheng Ruanyin will promote and advertise our games.”

In no way does this statement, or any statement in subsequent filings/releases, infer that Zhongzheng is a CMGE subsidiary or that it has licensed its games to CMGE to publish. Referencing disclosures (or lack thereof), Zhongzheng appears to be an entirely independent company of CMGE, and CMGE theoretically shouldn’t have ties to Zhongzheng’s revenue, but for some type of unknown alternately disclosed revenue sharing agreement.

The agreement could provide a means for CMGE to funnel money to Zhongzheng through fees paid for “promotional activities.” Conversely, it is also possible that CMGE could manipulate its revenue with the help of Zhongzheng’s promotional and advertising services. It also appears that CMGE took a series of steps to hide the real ties that it’s former President and current COO has to Zhongzheng.

Investors should be extremely concerned that we could not find any evidence of Zhongzheng being a legal subsidiary and/or VIE of CMGE. It seems that the only thing binding CMGE and Zhongzheng together is an advertising “agreement.” Our questions then become:

- Who is really in control of Zhongzheng?

- Why has CMGE chosen Zhongzheng as its promoter and advertiser for its mobile games?

- What’s the current relationship between Zhongzheng and CMGE?

- What, if any, cash is moving between Zhongzheng and CMGE?

- Can we trust the revenue that’s being reported by CMGE?

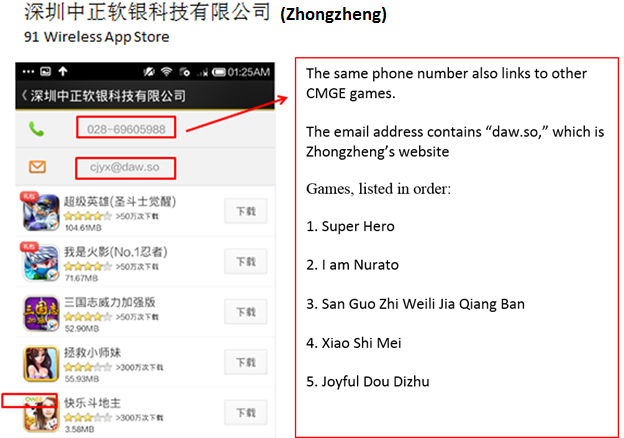

We think CMGE could be hiding the extent of its dealing with Zhongzheng, as CMGE’s “top games” are reportedly published by Zhongzheng. This can be easily confirmed by searching for “Zhongzheng” at the Android app stores. Below is a list of games published under Zhongzheng on Baidu’s 91 Wirelessapp store. As of September 2014, we found numerous games listed under Zhongzheng on the 91 Wireless app store.

Figure 3: Zhongzheng games on Baidu 91 Wireless App Stores as of Sept 2014

“Super Hero,” in the 2014 2Q filing, was described to be a significant revenue contributor. It was inferred that CMGE was its publisher:

“The sequential increase was mainly due to our continued success in ourpublishing business, namely the success of Super Hero

which was launched in May.”

In the 2014 3-Q filing, the relevant description of “Super Hero” is as follows:

“The Hero Series has been continually successful so far with Super Heros

and Tian Tian Ying Xiong

becoming the drivers in the publishing business during the third quarter.”

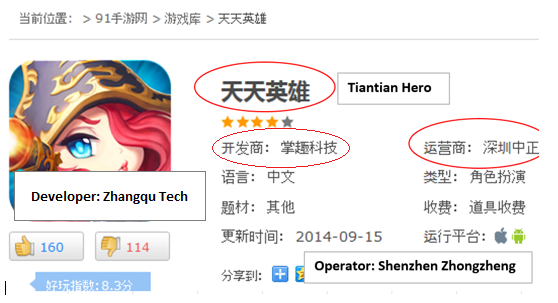

We captured the following images of Tian Tian Hero, which clearly stated that this game is operated by Zhongzheng from 91wireless on December 2014 as follows:

“I Am Nurato,” a Ninja-based card game, has been a key contributor for3Q13 and 4Q14 and was also mentioned in high regard:

“The number of paying users for social games increased by 96.5% over the second quarter of 2013, primarily driven by the continued success ofJoyful Zha Jin Hua, the increase in the number of paying users forMonster Island, Wu Xia Q Zhuan and the debut of a Ninja themed card game in September.“

We captured the following image of “I am Nurato,” which clearly states that these two games are operated by Zhongzheng from 91wireless on December 2014 as follows:

We’ve only listed a small sampling of Zhongzheng games in this report. We encourage investors to do their own searches through different app stores in order to first handedly check the publishers of games claimed by CMGE. CMGE lists its full repertoire of games on its website, cmge.com

Related Party Run Around

A number of ownership moves made within Zhongzheng beginning in June 2013 appear to have been orchestrated to make it difficult for investors to uncover CMGE’s relationship, including the COO’s past ties, with Zhongzheng.

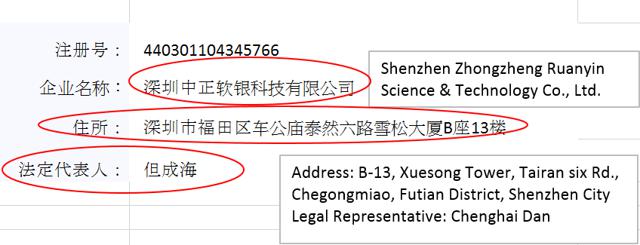

After a quick search through the Shenzhen government databases, we found the location of Zhongzheng and its legal representative. From this database, we also learned that Zhongzheng was founded on November 5, 2009.

Zhongzheng’s current legal representative is a man named Chenghai Dan (但æˆæµ·), who was most recently the Procurement Director at CMGE (Lower Management). He was fired by CMGE on June 19, 2014.

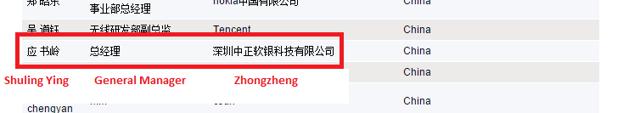

When we went through Zhongzheng’s history, we found that the company was founded by Shuling Ying and several other partners. At the time of the execution of the promotion/advertisement agreement between CMGE and Zhongzheng (March 2013), Zhongzheng was 70.8% owned by Shuling Ying, the former president and current COO of CMGE and 24.2 % owned by Jingzhi Sun, the former Vice President of CMGE. However, Zhongzheng’s current registered address is exactly the same as one of CMGE’s Shenzhen office addresses: B-13, Xuesong Tower, Tairan Six Rd., Chegongmiao, Futian District, Shenzhen City.

Zhongzheng was founded by Shuling Ying and other founders on November 5, 2009. Since then, there have been several mystifying shareholder changes. Shuling Ying had always been Zhongzheng’s controlling shareholder before June 2013, four months before he officially became CMGE’s President. We believe this appears to explain Shuling Ying’s employment history between 2009 and 2013, when he is described in the 20-F.

“Shuling Ying became our president in October 2013. He has extensive experience in the licensing, publishing, operation and marketing of mobile games and helps manage our publishing business. Prior to joining our company, Mr. Ying served as a director of the investment division of Standard Chartered Bank Shanghai branch from 2006 to 2008.”

We also found out that Shuling Ying, while registered under the titles of both CEO and General Manager of Zhongzheng, attended the Global Mobile Internet Conference in May 2011 and in May 2012. His conference registrations look like this:

2011:

2012:

Suspiciously, when the conference rolled around in 2013, Jian Xiao attendedwith the title of CMGE’s Chairman, and Shuling Ying did not attend this conference. We believe this to be further evidence explaining Shuling Ying’s employment history gap between 2009 and 2013, the time in which Ying founded Zhongzheng and operated Zhongzheng independently from CMGE.

On June 6, 2013, four months before Shuling Ying became CMGE’s President (October 2013) and three months after the execution of the agreement with CMGE (March 2013) as disclosed in the 2012 20-F, Shuling Ying and two other shareholders of Zhongzheng, including Jingzhi Sun, former VP of CMGE, transferred their Zhongzheng ownership to Juan Du, who was the General Manager of CMGE’s Publishing Support Center (Middle Management).

In other words, they handed down ownership of Zhongzheng to a person one peg lower in the CMGE pecking order. We believe this is the beginning of a number of ownership moves made specifically to obfuscate CMGE’s relationship with Zhongzheng. From here, Shuling Ying disappeared from Zhongzheng’s SAIC record.

A little over a half year later, Chenghai Dan, CMGE’s Procurement Director, became 95% owner and legal representative of Zhongzheng, replacing Juan Du and again moving ownership another tier lower in the company’s hierarchy. Without the firing notice on June 19, 2014, investors might not have even known that the 95% owner and legal representative of Zhongzheng, Chenghai Dan, was once the Procurement Director for CMGE and that Juan Du was once the General Manager of CMGE’s Publishing Support Center.

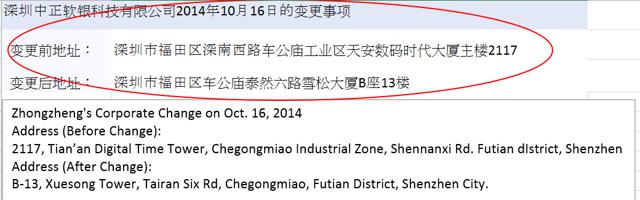

It seems that after the crisis of June 19, 2014, Zhongzheng moved to its current address. On October 16, 2014, Zhongzheng changed its registration address to its current address: B-13, Xuesong Tower, Tairan Six Rd, Chegongmiao, Futian District, Shenzhen City.

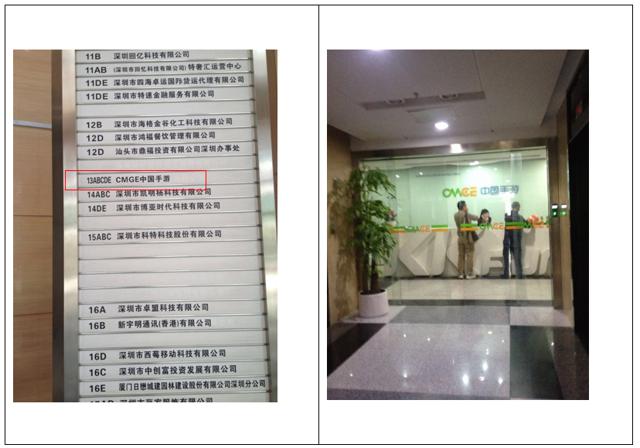

When we visited Zhongzheng’s new office in Nov. 2014, we noted that it clearly carries the CMGE sign (ä¸å›½æ‰‹æ¸¸), but not Zhongzheng’s sign. After we spoke to the front desk representative at Zhongzheng’s/CMGE’s registered office, it became clear to us that she did not know of and had not heard of the name Zhongzheng.

Here is a picture we took of Zhongzheng’s registered offices, which bears the name “CMGE”. We also have a photo of the building directory indicating they are on the 13th floor:

After it became clear to us that Zhongzheng was operating its business out of CMGE’s office, we researched the story further on the internet. What we found is that Zhongzheng is apparently operating as a part of CMGE’s publishing department.

CMGE’s publishing department is also sometimes referred to as “Joygame,” as we can see from Joygame’s website. In the introduction of the company on its website, Joygame says the following:

å“越游æˆéš¶å±žäºŽä¸å›½æ‰‹æ¸¸å¨±ä¹é›†å›¢ï¼ˆCMGE),是由集团é‡é‡‘æ‰“é€ ï¼Œé›†æ‰‹æœºæ¸¸æˆç ”å‘ã€å‘è¡ŒåŠè¿è¥äºŽä¸€ä½“的综åˆæ€§æ‰‹æœºæ¸¸æˆå¹³å°ï¼Œæ‹¥æœ‰é›†å›¢å¼ºå¤§çš„支撑体系ã€æ¸ é“体系和è¿è¥ä½“系。

TRANSLATION: Joygame is a part of and is financially supported by CMGE. Joygame is an integrated mobile game platform combining mobile game R&D, publishing and operating with a strong supportive system, channel system and operating system from the group.

å“越游æˆä½œä¸ºå›½å†…最大的移动游æˆå…¨æ¸ é“å‘行商,总部ä½äºŽæˆéƒ½é«˜æ–°ç§‘技å›E区å“越游æˆå¤§åŽ¦ï¼Œå…·æœ‰å›½å†…领先的安å“å’ŒiOSå…¨æ¸ é“å‘行能力,在北京ã€ä¸Šæµ·ã€æ·±åœ³ã€æˆéƒ½å‡è®¾æœ‰ç‹¬ç«‹è¿è¥å’Œç ”å‘能力的è¥é”€æœºæž„。

TRANSLATION: Joygame is the is the biggest domestic mobile game publisher, headquartered at Joygame Building, at E zone, Hi-tech park, Chengdu, with a strong full channel publishing capacity in the Android platform and iOS platform. Joygame has different offices in Beijing, Shanghai, Shenzhen and Chengdu with independent operations and R&D capacity.

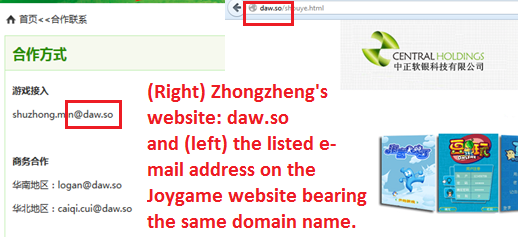

The contact information at the bottom of Joygame’s webpage belongs to Zhongzheng’s registration office, which is the same as CMGE’s office in Shenzhen. In part of Joygame’s website, a contact employee is listed with an e-mail address that ends in “daw.so,” which is the domain name of Zhongzheng’s website. We believe that Zhongzheng’s employees operate Joygame, CMGE’s publishing business, in Zhongzheng and CMGE’s Shenzhen office.

We also noticed that Shuzhong Min, whose address is listed on Joygame’s website, is also one of those nine executives/managers fired by CMGE on June 19, 2014.

On June 19, 2014, Chenghai Dan, Zhongzheng’s current legal representative was terminated from CMGE, which was made public when an internal company-wide memo was revealed by the Chinese media.

With the exception of Shuling Ying, we do not know the whereabouts of Chenghai Dan or the other seven executives/managers named in the memo.

Soon after the negative stock price reaction to the firing of the executives, CMGE claimed that this move was a part of the streamlining process and that there would be no risk to the current business. We found out that at least 4 out of these nine fired managers appeared in Zhongzheng’s corporate history as Zhongzheng’s former and/or current management team. Based on the nature of this firing, we believe that all of these nine managers may be relevant to Zhongzheng. The questions about Zhongzheng have piled up, and we’d love to hear what the company has to say in response.

We question why Zhonzheng is not a properly listed VIE of the company because, as we’ll show from Zhouxing, the company seems to know how to properly set up a VIE relationship. This is particularly interesting, since some of the individuals involved in the ownership structure of Zhouxing are/were part of Zhongzheng structure.

Zhuoxing – CMGE’s “Legitimately” Listed VIE

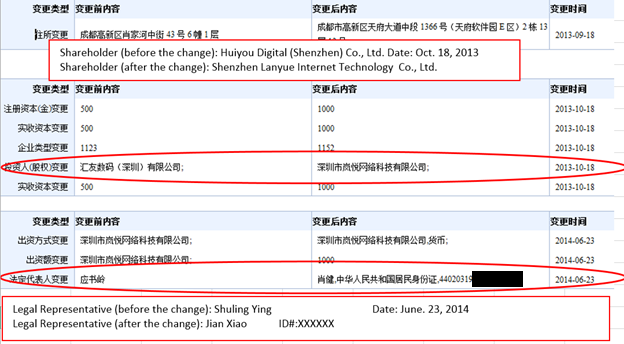

Zhouxing is a legitimately listed VIE of CMGE, as per the company’s public filings. Zhuoxing is located in the city of Chengdu and came into existence on June 23, 2013. As shown in the SAIC file, Shuling Ying was the legal representative of Zhuoxing from Zhuoxhing’s establishment until June 23, 2014.

Below is a screenshot of the top mobile games produced by Zhuoxing on the91 Wireless App Store

Figure 4: Snap shot of major games published by Zhuoxing as of Sept. 2014

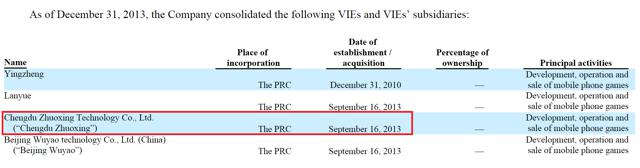

In the 2013 20-F filing, Chengdu Zhuoxing is listed as a Variable Interest Entity (“VIE”) as of September 16, 2013.

Figure 5: Chengdu Zhuoxing listed as a VIE and VIE subsidiary established in September 2013

Scrutiny of Zhuoxing’s SAIC filings show that Zhuoxing was first established in June 24, 2013 by Huiyou Digital, yet another subsidiary of CMGE. At the time of the establishment, before becoming CMGE’s president, Shuling Ying was already Zhuoxing’s legal representative. The information relevant to Zhuoxing’s corporate change is shown below:

Since September 16, 2013, Zhuoxing has been listed as one of CMGE’s subsidiaries. The relevant disclosure states:

On September 16, 2013, China Wave agreed to provide unlimited financial support to Lanyue for its operations. In addition, pursuant to a power of attorney agreement entered into between Huiyou and China Wave, Huiyou re-assigned the rights to attend Lanyue shareholders’ meetings and to vote on all of the matters in Lanyue that require shareholders’ approval irrevocably entrusted to it by shareholders of Lanyue to China Wave. As a result of the reassignment of power of attorney from Huiyou to China Wave and the provision of unlimited financial support from China Wave to Lanyue, China Wave replaced Huiyou to have the power to direct the activities of Lanyue that most significantly impact Lanyue’s economic performance and the obligation to absorb the expected losses of Lanyue. Huiyou essentially only retains the right to receive the expected residual returns of Lanyue. China Wave and Huiyou, as a group of related parties, have held all of the variable interests of Lanyue since September 16, 2013.

Zhuoxing filed its ownership change from Huiyou to Lanyue on October 18, 2013 and Shuling Ying was still Zhuoxing’s legal representative after Zhuoxing’s ownership change.

On June 23, 2014, four days after CMGE fired Shuling Ying as its President (according to the SAIC record), Zhuoxing’s legal representative changed from Shuling Ying to Jian Xiao. Even though Shuling Ying was reappointed as CMGE’s COO, he did not remain the legal representative position of Zhuoxing.

Zhuoxing is another important CMGE game publisher which operates as a CMGE subsidiary. However, as we stated before, Zhongzheng is not CMGE’s subsidiary. CMGE did not remove Chenghai Dan from Zhongzheng’s legal representative position.

This is a full timeline of the events described above:

In the event that Zhongzheng is a subsidiary and/or VIE of CMGE (the same as Zhuoxing), we would not be challenging Zhongzheng and its relationship with CMGE. However, CMGE did not list Zhongzheng as a VIE in its 2012 20-F or 2013 20-F. Zhongzheng was only disclosed in the 2012 20-F as an entity engaged to promote CMGE’s business. Based on our research, it would appear Zhongzheng is not just some promoter, but a non-disclosed related party. As we’ve shown, Zhongzheng’s registered office carries CMGE’s sign.

In the Yidatong and NQ case, there was only a mystery relationship between Xu Rong, Yidatong’s legal representative, and Zhou Xu, NQ’s founder and director. Worse than the relationship between Yidatong and NQ, Zhongzheng was apparently founded by CMGE’s former President and current COO, and was then transferred to lower level CMGE employees several months before Shuling Ying became CMGE’s President.

We believe the cloud of obfuscation and control changes speak for themselves: CMGE owes its shareholders some clear, concise answers about the relationship between itself and Zhongzheng.

CMGE Has Weak Internal Controls, Questionable Personnel

While looking into the background of CMGE’s executive suite, we also investigated those on the company’s audit committee. We found that Chen-Wen Tarn, who currently is a CMGE director and sits on the audit committee, has a questionable past involving VIEs.

The company’s 20-F ties him to GigaMedia, Ltd, stating that he was an executive vice president:

Chen-Wen Tarn became our director in May 2012. He is a general partner and a member of the investment committee at Pacific Venture Partners, an affiliate of PVG. Dr. Tarn has been engaged in academic research and higher education for over fifteen years. He has worked at the National Taiwan University of Science and Technology as professor in the department of electrical engineering from September 1991 to January 2004 and as a professor at the Graduate Institute of Electro-Optical Engineering since February 2009. Dr. Tarn has also held senior positions in various telecommunication, Internet and technology firms, including as a consultant of Pacific Venture Partners from February 2004 to August 2007, as the executive vice president of GigaMedia Limited and as the president of Koos Broadband Telecom Inc. from February 2004 to October 2008. He also served as the chairman of the Taiwan Internet Association from 2006 to 2009. Mr. Tarn received a Ph.D. degree in electrical engineering from Syracuse University in 1991.

GigaMedia had a sordid past, detailed in this report which shows exactly what can go wrong with a VIE when an executive holding all of the cards decides he or she wants to impose their will and make a mess of things. In GigaMedia’s case, we saw the company have one of its own subsidiaries swept out from underneath them when an executive that controlled the underlying VIE had a disagreement with upper level management at GigaMedia.

In CMGE’s past financial reports, they continue to report material weaknesses in their internal financial controls. This should alarm investors, as the nuances of financial reports beg to be questioned – that is the point of redundant internal and external controls. It appears to us that CMGE is not in any hurry to correct these accounting control issues because the same weaknesses have continued for the past four years. From the 2013 20-F:

“In the preparation of the consolidated financial statements for the year ended December 31, 2013, we identified a material weakness in our internal control over financial reporting. The material weakness identified was identical to the one identified during the audit of our consolidated financial statements for the years ended December 31, 2010, 2011 and 2012. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control such that there is a reasonable possibility that a material misstatement of our company’s financial statements will not be prevented, or detected and corrected on a timely basis. Effective internal control over financial reporting is necessary for us to provide reliable financial reports, effectively prevent fraud and operate as a public company.

The material weakness relates to insufficient personnel with U.S. GAAP expertise in the preparation and review of the financial statements and related disclosures in accordance with U.S. GAAP and Securities and Exchange Commission, or SEC, requirements. We have taken initiatives to improve and will continue to strengthen our internal control over financial reporting and disclosure controls. For details on these initiatives, please see “Item 5. Operating and Financial Review and Prospects-Internal Control Over Financial Reporting.” However, the implementation of these initiatives may not fully address the material weakness in our internal control over financial reporting. In addition, the process of designing and implementing an effective financial reporting system is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to employ significant resources to maintain a financial reporting system that satisfies our reporting obligations. Our failure to remediate the material weakness or our failure to discover and address any other material weaknesses or deficiencies may result in inaccuracies in our financial statements or delay the preparation of our financial statements. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of the ADSs, may be materially and adversely affected. Ineffective internal control over financial reporting could also expose us to increased risk of fraud or misappropriations of corporate assets and subject us to potential delisting from the stock exchange on which the ADSs are listed, regulatory investigations or civil or criminal sanctions.”

Conclusion

We believe there are some serious unknowns up in the air at CMGE:

- Why has Zhongzheng’s control shifted so many times among CMGE’s executives and managers?

- What is the exact nature of the CMGE/Zhongzheng relationship?

- Is CMGE’s lack of internal financial controls a major concern, given that many past U.S. listed Chinese companies that defrauded investors shared this characteristic?

We believe there are major questions about this public company that deserve clear and transparent answers and we also believe that its auditor, Ernst & Young, needs to examine our findings closely.

It’s extremely important to note that because Zhongzheng is not a subsidiary of CMGE, as evidenced by its lack of VIE status, its revenues can’t be claimed by the company. Investors are left in the dark, wondering how much revenue is derived from Zhongzheng and booked by CMGE.

Alternatively, we’d like further transparency with regard to remuneration paid to Zhongzheng for their services rendered per the claimed contract they have in the 2012 20-F. How much money is moving from Zhongzheng to CMGE and from CMGE to Zhongzheng?

We know that games being listed under the name “Zhongzheng” are key drivers to CMGE’s growth. To reiterate, we know the company can properly list a VIE from the example of Zhouxing – so what’s preventing this practice with Zhongzheng? What about Zhongzheng does the company not want to share with U.S. investors?

From our experience, this highlights yet another situation where the Chinese arm of a U.S. listed public company fails the test of transparency. We believe that Zhongzheng needs to be scrutinized by investors, regulators, and the company’s auditor. If it’s revealed by CMGE’s auditors and brought to the attention of the market that Zhongzheng’s revenues can’t be booked by CMGE, there could be a materially negative impact for CMGE’s shareholders. Surely, this type of revenue sharing arrangement wouldn’t be made in a promotional “agreement.”

CMGE’s non-disclosed related parties are a breeding ground for opaqueness and potential questionable activity. We believe the SEC should open a formal investigation probing the company’s non-disclosed entities.

We ask ourselves if the risks of these undisclosed parties are priced into CMGE’s stock. For us, the answer is clearly “no”. When we take a closer look at CMGE, we ask ourselves: who is really being played here?

Disclosure: Short CMGE

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.