Finally, after four years of searching we are bullish on a China based company

- China Automotive Systems (CAAS) is a market leader with validated quality and service standards.

- Three years of OTGDD on CAAS, including 40 days of video surveillance, prove a very busy business concern. We counted 600 trucks at one entrance in just 14 days alone.

- CAAS will pay its first cash dividend this year, and remains a prime candidate for a go-private transaction in the longer term.

- First orders from Ford underpin growth, competitiveness, and warrant an equity re-rating.

- At only 1.0x book value, with zero long-term debt, and a durable ROE of 12.6%, we see fair value of US$16 per share, nearly double recent levels.

The GeoTeam is better known for its bearish calls on China-based companies. That is not to say there are no trustworthy companies in China to invest in, but given the recent history of fraud-ridden and dubious RTO debacles, finding an investable company has been an extreme challenge. In our search for one we’ve recognized that this company can’t just be good. It must be great to merit the attention and trust of US investors. Also, unlike companies based in the US, investors can’t simply rely on public filings to make investment decisions. The GeoTeam goes the extra step in China by completing extensive on-the-ground due diligence including time-lapse surveillance to verify the legitimacy of the target company’s business. The tendency of US investors to deeply discount all China RTO’s has created an opportunity to pick up shares in a leading player in China’s booming auto industry at book value when a more reasonable multiple based on historic norms would be at least 2x book. So, while most US investors are focused on Alibaba and other high profile Internet business plays in China, we have followed the path less traveled and uncovered what we view as a gem of an investment with nearly 100% upside.

China Automotive Systems (CAAS) is a leading Chinese producer of automotive power steering systems, serving over 60 automakers including Chrysler North America (CAAS’ largest customer), FAW and Dongfeng Auto Works, two of China’s largest automakers, and both BYD and Zhejiang Geely, China’s largest private automakers. CAAS also serves the China JV’s of GM, Volkswagen, and Citroen. Recently the company signed its first Supplier Onboard Agreement (“SOBA”) with Ford Motors, commencing initial shipments to the world’s fifth largest automaker. We believe this new relationship, while currently modest, underpins CAAS’ growth prospects, validates their quality and service standards, and warrants a re-rating of its equity.

The company also just announced its first ever cash dividend, and in the longer term remains a prime candidate for a management-led buyout. Currently insiders hold 72% of outstanding equity. With zero long-term debt and $111 million in cash, $30 million in available standby credit, the company has ample liquidity to execute a buyout. However, in light of the newly announced cash dividend, we would be surprised by a management-led buyout materializing in the short term. We would be just as happy to see CAAS use its ample liquidity to pay future annual cash dividends rather than to go private at a low valuation at this point.

Having listed in the US via a reverse takeover in 2003, CAAS’ equity has been severely discounted due to ‘guilt by association’ following the many scandals exposed among dozens of other Chinese RTOs. Haven taken a close look, CAAS clearly doesn’t fit the mold and this discount is unwarranted. Recently trading at only 1.0x book value, with zero debt and an unlevered ROE of 12.6%, we estimate fair value at US$16 per share, presenting nearly 100% upside from recent market prices.

Domestic Supplier Emerges as a Global Competitor

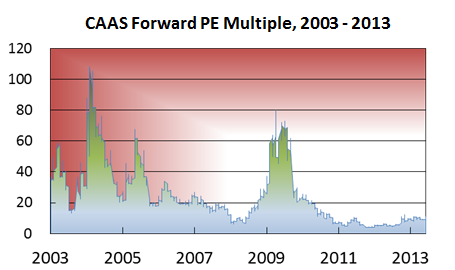

According to industry sources, Ford Motors signed its first SOBA with CAAS in late March, for initial supply of power steering systems (“PSS”) for Ford’s aftermarket service in China. While volumes to this new customer will likely only reach a token 30-60k units this year, perhaps representing less than 1% of 2014 sales, the development suggests an equity re-rating as the relationship grows. Historically, CAAS shares experienced dramatic multiple expansion on the heels of significant new customer/order announcements. An announcement from the company further updating this new business should prompt shareholders to price in sales growth with this valued customer, and could hasten a return to CAAS’s historical average PE multiple of about 20x, versus the recent 8.3x.

Similar announcements in the past have led to dramatic price advances. On November 29, 2004 after CAAS announced it had been named an exclusive supplier for certain steering pumps for the SAIC-GM-Wuling JV, CAAS shares jumped over 110% in that one day. CAAS subsequently sustained a PE multiple above 20x for most of the ensuing four years.

Table 1: CAAS Forward PE

Source: Company reports, our estimates.

Announcements on November 11, 2008 and on January 22, 2010 of first purchase order and initial shipments to Chrysler North America likely also contributed to an explosive run in CAAS’ shares from sub $2.5 to about $25 from late 2008 to early 2010. Of course, macro-economic developments over that period played no small part in the equity price rally at that time. Still, it would be difficult to separate these two effects.

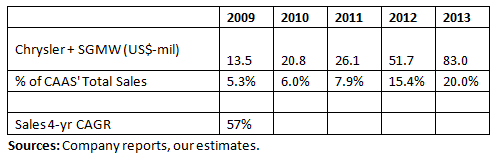

On May 2, 2013 CAAS announced another significant multi-year order for rack-and-pinion PSS from SAIC-GM-Wuling (“SGMW”) – an order that has driven 200% year over year revenue growth from that customer in 2013, making it CAAS’ second largest customer last year. In the intervening year CAAS’ shares have rallied 59%. From 2009 to 2013 CAAS’ total sales to Chrysler and GM grew at a compound annual growth rate (“CAGR”) of 57% and grew from 5.3% to 20% of CAAS’ total sales. With Ford, the world’s fifth largest automaker, added to this mix we would expect these three large customers to become CAAS’ three largest customers in just a few years. CAAS could formally announce initial order/shipments to Ford at any time. As with Chrysler and the SGMW JV, this likely foreshadows more significant inroads with this important customer, and should result in comparable multiple expansion.

Table 2: Chrysler and GM Largest Customer Sales Trend

More broadly, CAAS is rapidly transitioning from primarily supplying domestic automakers to becoming a global competitor with quality and service standards sufficient to capture a large share of business with the world’s leading automakers.

Quality is Essential

PSS is not a component that automakers outsource on a strict cost-reduction basis because an off-spec component in a PSS may pose direct safety issues with the operation of a vehicle. The cost of such safety issues in the form of recall and liability outweigh any conceivable cost saving available from outsourcing primarily on the basis of cost. Case in point: General Motors is currently in the process of recalling some 1.3 million vehicles in North America due to flawed design of a PSS used in several vehicle models. The company faces untold liability relating to losses linked to the flaws and immeasurable cost to its reputation. That Chrysler and the SGMW are both aggressively ramping supply from CAAS for both North America and Chinese markets is a strong affirmation of CAAS’ production quality and service standards, and represents opportunity for continued market share gains with these two customers and other large international automakers. The earnings of a supplier with such an endorsement are more reliable and valuable than a supplier tied solely to China’s domestic auto industry, and warrants a re-rating.

First Ever Cash Dividend, Going Private Transaction Still Possible

On May 28, 2014 CAAS announced it would pay its first cash dividend this year, at US$0.18 per share. That amounts to a payout ratio of almost 20% of current year estimated earnings. Flush with cash amid rising earnings, we expect the dividend is likely to be paid annually and should grow proportionately with earnings.

CAAS remains a compelling candidate for a go-private / MBO transaction, in our view. However, in light of the new dividend, a go-private transaction is not likely to happen in the short-term. As dozens of prior Chinese MBO’s suggest, the utility of maintaining a US listing has largely expired. One benefit of CAAS’ listing in the US in 2003 was an opportunity to better facilitate new relationships with prospective strategic partners and customers. At that time CAAS had not yet secured its first global customer and was still focused on securing advanced technology. Much has changed in the ensuing eleven years. Already, the company is launching production of newly developed Electronic Power Steering (“EPS”) systems, bolstered by an R&D spend that has grown eight-fold since 2009. Moreover, the company has established itself as a key supplier to its first global customer, Chrysler, and is already engaged at some level with others.

The company has zero long-term debt, ample liquidity and access to credit to enable a buyout. Unencumbered cash on hand totals about $70 million, and the company maintains a $30 million standby credit facility at only 2.24% per annum. To buy the outstanding public equity at a modest 1.5x book value would currently only take about $98 million, which could be reasonably covered by available cash and a modest amount of debt.

Going private would also save shareholders a significant amount of expenses related to maintaining the company’s US listing. CAAS reported $2.4 million in ‘listing related’ expenses in 2013, including the legal, auditing, and accounting costs associated with maintaining a public listing, representing over 6% of pre-tax income. Six percent of pre-tax income is a steep price to pay for a maintaining a listing when shares trade near book value.

CAAS has always been closely held. Insiders currently hold about 72% of the equity, including 63.6% of the equity controlled by Chairman and Founder Hanlin Chen and his wife. Since listing via RTO in 2003 there have not been meaningful sales outside of the extreme 2009-2010 share price rally, suggesting a strong interest in retaining majority control.

In 2012 two members of management bought a modest amount of shares, and the company itself bought back $1.0 million of its own stock when it was trading at a steep discount of 0.67x book value.

RTO Discount Unwarranted

- The company has been listed in the US for ten years through all manner of market conditions – plenty of time to assess the business and management.

- Listing overseas served a clear business purpose.

- Three years of on-the-ground due diligence has provided firsthand confirmation that this is a real business, and business is humming.

Few equity groups have been more thoroughly shunned since 2010 than Chinese reverse-takeovers (RTOs), and for good reason. The outrageous nature and ubiquity of fraud among these companies has given rise to a justified level of disgust – and a guilty-until-proven-innocent stance from investors. CAAS is a shining exception, in our view, presenting a real and consistently growing business with new catalysts spurring earnings growth that is unduly discounted amid the detritus of Chinese RTOs.

From the beginning CAAS did not, and does not, resemble the fly-by-night aspects of the fraudulent ventures that later came to market in the US. In 2003, listing in the US made eminent sense for CAAS, based as it was in the relatively isolated central Chinese city of Jingzhou, west of Wuhan. China’s automotive industry was on the cusp of exploding, growing at a feverish pace to become the world’s largest automobile market. Global manufactures including Volkswagen, General Motors, and Ford were scrambling to build supply chains in the country. They brought along their suppliers, pushing them to partner with local manufacturers to best couple western technology and practices with local opportunities for cost savings. Delphi, TRW, and other components suppliers followed their largest customers to China. In that environment CAAS was competing for attention from these new potential customers and from potential western partners with access to technology and customer relationships.

The wave of fraud accusations and de-listings began in mid-2010 and lasted through late 2011 before the pace began to taper off. As the credibility of US-listed small Chinese companies were called into question, and investors fled the group, CAAS took the initiative in December 2010 to upgrade its smaller auditor to Pricewaterhouse Coopers Zhong Tian CPAs (“PwC”). There were no accusations whatsoever of anything untoward occurring with either CAAS’ accounting or reporting at the time. Still, CAAS’ share price had fallen almost 40% during 2010 as revelations of fraud sunk companies like Rino International (RINO) and Puda Coal (PUDA).

One notable blemish on CAAS’ record as a public company came shortly after it upgraded to PwC for its 2010 audit. The company with its auditor discovered improper accounting for embedded derivatives related to CAAS’ 2008 $35 million convertible bond offering, along with other accounting errors relating to accumulated depreciation, deferred tax assets, and accrued payrolls. The necessary amendments were material to prior financial reports. On March 17, 2011 the company announced it would need to restate financial statements for 2008 and 2009, and that its 10-K for 2010 would be delayed. Three months later the company had submitted all of its revised financials, and reported record sales and earnings for the year 2010.

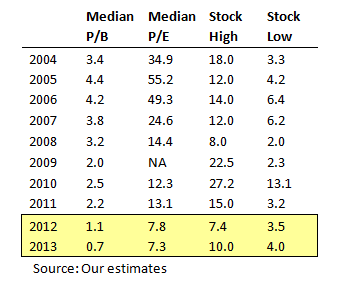

CAAS shares fell throughout 2011 as fraud accusations continued to roll out against other Chinese companies like Deer Consumer Products (DEER), Sino-Forest (TRE), and China MediaExpress Holdings (CCME). By late 2011 CAAS shares traded at only 0.6x book value, 4.7x that year’s earnings.

CAAS shares continued to trade well below book value for much of 2012, when late in the year the company announced its first share buyback program, eventually buying back 217,283 shares or about 0.8% of shares outstanding at the time, at an average price of about $4.60 or 0.67x book value.

Obligatory shareholder lawsuits were filed against the company after it had announced the need to restate. In June 2013 a number of the claims were dismissed, and later that August a petition for class action of claims was denied. In April 2014 CAAS settled the remaining claims for an immaterial sum.

Table 3: CAAS’ RTO Discount

On the Ground Due Diligence Affirms CAAS’ Operations

We have observed CAAS’ operations from time to time over the past three years, and witnessed a consistently busy business as reported in its SEC files. Over a more than 40-day period we conducted time-lapse video surveillance of traffic at CAAS’ primary Jingzhou factories, which account for over 80% of the company’s sales and profits. At both Jingzhou locations we observed a steady flow of goods shipping in and out of the facilities, consistent with what we expected based on CAAS’ multiple customers’ just-in-time fulfillment requirements. Shipping volumes appeared large enough to support the revenues disclosed in the financial statements.

The company’s Jingzhou factories are located at two sites, referred to here as Campus 1 and Campus 2. Campus 1 includes the following subsidiaries (ownership verified in SAIC filings):

- Hubei Henglong Automotive System Group Co., Ltd. (“Henglong Group”)

- Jingzhou Henglong Automotive Parts Co., Ltd. (“Henglong Parts”)

- Jingzhou Henglong Auto Mobile Technology (Testing) Center (“Henglong Testing”)

|

|

| Main Entrance of Campus 1 | Satellite Map of Campus 1 |

The busiest of the three entrances to Campus 1, the Henglong Parts entrance, is shown below, in a sample photo taken from the time-lapse camera on April 10, 2014 at 6:49am, with an overlaid close-up shot of the entrance taken during an earlier site visit:

In just the first 14 days of filming, we recorded over 600 trucks enter the Honglong Parts factory. A sample time-lapse video of the Henglong Parts entrance traffic on April 7, 2014 is available here.

The following is a sample photo of the main entrance to Campus 1, taken from the time-lapse camera on April 7, 2014 at 7:46am:

The main entrance to Campus 1 appears to mainly be used for employee traffic to and from the Henglong office tower (not visible). Also clearly visible in the background are large trucks being loaded with CAAS’ product during the day. A sample time-lapse video of the main entrance traffic on April 19, 2014 is available here.

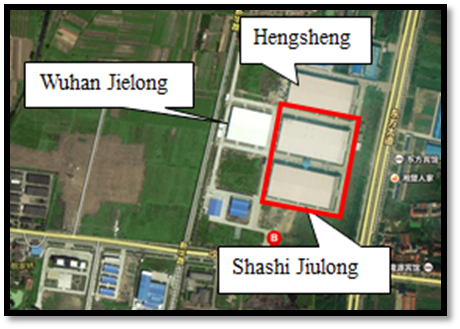

Campus 2 includes the following subsidiaries (ownership verified in SAIC filings):

- Hengsheng Business Unit of Hubei Henglong Automotive Systems Group Co., Ltd. (“Hengsheng”)

- Shashi Jiulong Power Steering Gears Co., Ltd. (“Shashi Jiulong”)

- Wuhan Jielong Electric Power Steering Co., Ltd. (“Wuhan Jielong”)

|

|

| Main Entrance of Campus 2 | Satellite Map of Campus 2 |

|

|

| Hengsheng’s Logo | Shashi Jiulong’s Logo |

The following is a sample photo of the main entrance to Campus 2, taken from the time-lapse camera on April 17, 2014 at 10:39am:

Similar to Campus 1, the main entrance to Campus 2 is primarily used by employees. A sample time-lapse video of the main entrance traffic on May 18, 2014 is available here.

The following is a sample photo of the Hengsheng entrance to Campus 2, taken from the time-lapse camera on April 8, 2014 at 2:23pm:

The Hengsheng entrance has numerous trucks entering and exiting the facility throughout the day. A sample time-lapse video of the Hengsheng entrance traffic on May 8, 2014 is available here.

Separately, we also visited CAAS’ Anhui subsidiary Wuhu Henglong Automobile Steering Co., Ltd (“Wuhu Henglong”) accounting for about 5% of CAAS total 2013 sales. This 77%-held unit is a JV with China’s SAIC Chery producing PSS for that customer. We confirmed the ownership in SAIC filings.

|

|

| Entrance to Wuhu Henglong | Satellite Map of Wuhu Henglong |

|

|

| Wuhu Henglong Facility 1 | Wuhu Henglong Facility 2 |

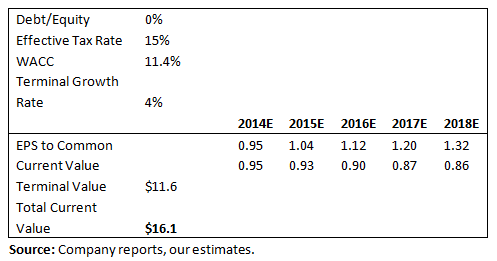

Valuation

We estimate CAAS’ current value at around $16 per share, nearly double recent market prices, according to our discounted cash flow (DCF) estimate. At $16 CAAS would trade at about 17x estimated 2014 earnings per share, still below its historical average PE multiple of 20x.

CAAS should grow revenues an average of about 10% over the next several years as it ramps production for several very large customers including Chrysler, GM, Ford and others, while also capturing additional market share as it continues to roll out new EPS product. We forecast earnings to grow at a more modest 8% due to continued expansion of R&D investment expense.

Table 4: DCF Model Summary

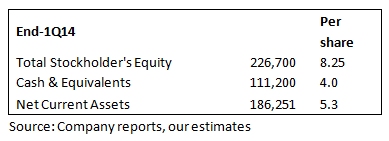

CAAS’ Book Value Provides a Floor

CAAS has been growing book value at a 23% CAGR over the past five years, a pace likely to continue at a moderating pace through at least 2017-2018. Book value is a reasonable floor for CAAS equity given the highly liquid nature of its balance sheet and zero long-term debt.

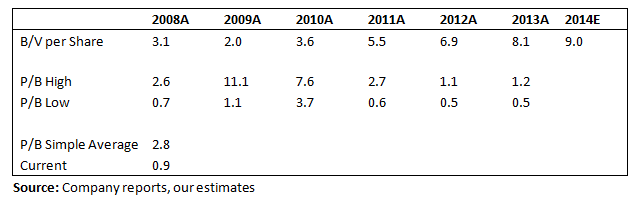

Table 5: Book Value

Recently CAAS has traded near our year-end 2014 estimated book value of $9 per share. Since 2008 the shares have traded at an average P/B of 2.0x, excluding 2009 peak levels associated with a convertible bond that has since been closed out. Lows of around 0.5x were reached amid the depth of the 2007-08 financial crisis, and then again upon the onset of the scandals with other small to mid-sized Chinese firms listed in the US.

Table 6: P/B History (12-month forward BV)

Risks and Competition

China’s broader economy could continue to weaken and shifts in government policy could weigh on near term prospects for China’s automotive industry. We protect ourselves from these types of risks by investing in companies like CAAS that we believe are poised to perform in both strong and weak macro environments. In fact we believe that a weak macro environment provides CAAS further leverage to capture share from both domestic and international competitors.

CAAS enjoys significant scale and cost advantages relative to its domestic competitors. The Chairman of one such competitor, together with other sources, affirmed CAAS’ cost and technology leadership among Chinese PSS suppliers. A weaker macro environment only pressures automakers to further reduce component costs by consolidating their supply chains, underpinning CAAS ongoing market share gains. That CAAS can ship PSS from Jingzhou to Michigan at lower cost than the company’s North American competitors is further testament to its cost competitiveness on a global scale. A weak global macro environment only serves to further drive business to this low cost supplier.

CAAS also faces execution risks in its effort to develop and penetrate the market for advanced electronic power steering systems . Demand is growing for EPS systems given the added fuel efficiency and improved handling they offer. EPS systems are an opportunity for CAAS, which has grown its R&D spend at a 52% CAGR since 2009, growing from US$2.6 to US$20.9 million in 2013. This effort is a clear differentiator for the company, but it may be too early to declare the effort a success. While the company has said it is working with several customers to develop new EPS systems, EPS sales remain a small albeit growing percentage of the company’s total. In time, continued market share gains will become dependent on the success of this effort. Still, the clear R&D commitment and early traction give us confidence that CAAS’ EPS initiative will ultimately pay off.

Finally, while we’ve made the case for CAAS’ ample liquidity to buy back shares, pay a dividend, or pursue a go-private transaction, we don’t have perfect insight into the aims and intentions of CAAS leadership, namely Chairman Chen. We can simply say that the conditions are in place for such continued positive developments that warrant a market price closer to our estimated fair value of $16 for CAAS shares.

Conclusion

Having conducted due diligence on dozens of small Chinese U.S. listed companies, it is rare to find one that both passes our test and offers a highly attractive valuation. CAAS is an undisputed market leader with validated quality and service standards. First orders from Ford underpin future growth, competitiveness, and warrant a higher valuation. CAAS has announced its first ever cash dividend and longer term remains a prime candidate for a management-led buyout. Recently trading at around 1.0x book value, with zero long-term debt, and a durable ROE of 12.6%, we believe CAAS now deserves a higher valuation of $16 per share, nearly double recent levels.